jetcityimage

Few, if any, furniture companies are as iconic as La-Z-Boy (NYSE:LZB). With a special emphasis on reclining chairs and an extensive portfolio that includes other residential furniture, La-Z-Boy has carved out for itself a rather nice niche in the furniture space throughout its life. Recently, however, investors have been rather bearish on the firm, pushing shares down even more than what the broader market has seen so far this year. While this may be disappointing to those who have owned the stock during this time, the fact that shares are now trading at rather cheap levels and the fact that fundamental performance for the company is improving suggests that there could be a nice bit of upside for investors moving forward.

An uncomfortable ride

Back in January of this year, I wrote a bullish article discussing whether or not it made sense to consider investing in shares of La-Z-Boy. In that article, I talked about the fact that the company’s operational performance had been inconsistent over the prior few years. Even so, it did demonstrate a favorable trend for investors. Shares of the company were also trading at rather low levels, plus the firm had a significant amount of cash in excess of debt to cushion it during tough times. All of these facts combined to make me somewhat bullish on the company, resulting in a ‘buy’ rating being granted to the firm. Unfortunately, the months since the publication of that article have not been particularly kind to my thesis. While the S&P 500 is down 14.4%, shares of La-Z-Boy have dropped by 23.7%.

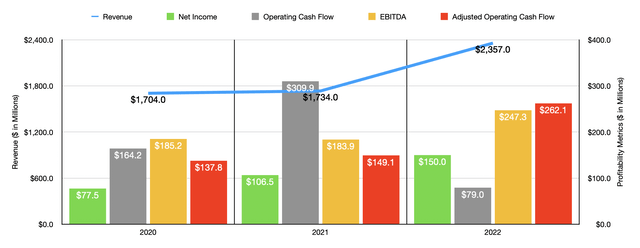

You would think, based on this return disparity, that the financial performance of the enterprise was suffering. But the opposite is true. To see what I mean, I would first like to point out the financial performance of the company generated during its 2022 fiscal year. After all, when I last wrote about the company, we only had data covering through the first half of that year. For 2022, sales came in at $2.36 billion. This represents a 35.9% increase over the $1.73 billion reported just one year earlier. The fact that the company had 53 weeks to operate during the 2022 fiscal year compared to the 52 weeks in most normal years means that the firm did benefit to the tune of $48.9 million. Beyond that, the biggest area of improvement for the company involved its wholesale operations. Revenue there skyrocketed 35.9%, climbing from $1.30 billion to $1.77 billion.

According to management, about half of the sales increase in this segment during the year was driven by higher volume thanks to increased demand following the dark days of the COVID-19 pandemic. For that segment alone, the additional week I already mentioned added $36.6 million to the company’s top line. The remaining increase in revenue during this time, then, was mostly due to increased pricing and surcharge Actions taken by the company because of higher manufacturing and freight costs. Under the retail operations of the company, revenue grew by 31.2%, climbing from $612.9 million to $804.4 million. This was driven in large part by a 28% increase in delivered same-store sales and by acquisitions that collectively added $31.9 million to the company’s top line for the year.

With this rise in revenue came an increase in profitability. Net income rose from $106.5 million to $150 million. But of course, we should pay attention to other profitability metrics as well. Although it is true that operating cash flow for the company fell year over year, dropping from $309.9 million in 2021 to only $79 million the same time this year, we should look at the adjusted figure that strips out changes in working capital. Doing this, the metric would have risen from $149.1 million to $262.1 million. Meanwhile, EBITDA for the company also improved, climbing from $183.9 million to $247.3 million.

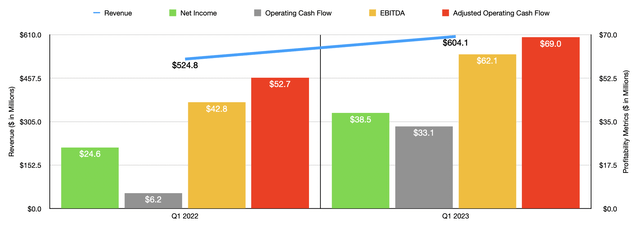

Growth for the company has so far continued into the 2023 fiscal year. During the first quarter of the year, sales for the company totaled $604.1 million. That’s 15.1% above the $524.8 million reported for the first quarter of 2022. Wholesale revenue grew by 12.3% during this time, driven primarily by the realization of pricing and surcharge actions taken in response to higher costs. Favorable product mix also helped on this front to an unspecified degree. Under the company’s retail operations, revenue spiked 29.8%. This, management said, was driven by multiple factors. Retail store acquisitions throughout the 2022 and 2023 fiscal years added $12.2 million to the company’s top line. The company also benefited from a 25% rise in delivered same-store sales. It’s also important to note, however, that written same-store sales in the first quarter of the year dropped by 15% year over year. This, management said, was driven by industry-wide seasonal trends and the softening of demand driven by economic uncertainty and consumer sentiment. This could be a leading indicator that the company could face some weakness moving forward.

On the bottom line, results also came in strong. During the first quarter of 2023, net income of $38.5 million dwarfed the $24.6 million reported the same time last year. Operating cash flow surged from $6.2 million to $33.1 million. If we adjust for changes in working capital, the increase would have been from $52.7 million to $69 million. And finally, EBITDA for the company also improved, rising from $42.8 million to $62.1 million.

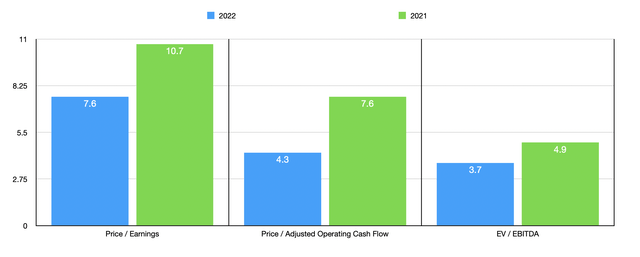

Truth be told, we don’t really know what to expect moving forward. The only guidance management gave was that revenue in the second quarter of this year should be higher year over year by between 2% and 5%. Even though it’s great to see continued growth, this does mark a significant decline in growth compared to what the company has seen over the past few quarters. Due to this uncertainty, I do think it would be a better idea to value the company based on data from 2022 and from 2021 instead of projecting out what results might be for 2023. Using the data from 2022, the company is trading at a price-to-earnings multiple of 7.6. The price to adjusted operating cash flow multiple is lower at 4.3, while the EV to EBITDA multiple should be 3.7. Using the data from 2021 instead, these multiples would be 10.7, 7.6, and 4.9, respectively. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 0.8 to a high of 38.8. In this case, two of the five companies were cheaper than La-Z-Boy. Using the price to operating cash flow approach, the range was between 8 and 23, with our prospect being the cheapest of the group. And finally, using the EV to EBITDA approach, the range is between 3.5 and 171.5. In this scenario, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| La-Z-Boy | 7.6 | 4.3 | 3.7 |

| Ethan Allen Interiors (ETD) | 6.4 | 8.0 | 3.5 |

| Tempur Sealy International (TPX) | 11.0 | 14.2 | 8.9 |

| Dorel Industries (OTCPK:DIIBF) | 0.8 | 12.8 | 171.5 |

| The Lovesac Company (LOVE) | 9.0 | 23.0 | 7.4 |

| Mohawk Industries (MHK) | 38.8 | 10.2 | 8.4 |

Takeaway

What we see from looking at all of this data is that investors should be braced for some volatility moving forward. So far, however, financial performance remains robust and shares are trading at incredibly attractive levels even if we rely on data from the 2022 fiscal year. This is true on both an absolute basis and relative to similar firms. Add on top of this the fact that the company has cash of $241.44 million and no debt on hand, and I do believe that it still warrants a solid ‘buy’ rating at this time.

Be the first to comment