sankai

Despite the strong quarter recorded by STMicroelectronics (NYSE:STM), the stock price continues to lose ground. Here at the Lab, we recently published an article covering the latest noisy news involving the company. Indeed, we emphasized how we were not “translating one-off (positive or negative) into real impacts in our estimates“. We confirmed our long-term view on STM, rating the company with a screaming buy. Today, after having analyzed the Q3 results, we are even more positive. At the stock price level, we believe that STM is penalized by the American technology sector decline with disappointing results posted by Alphabet (GOOG) (GOOGL) and Microsoft (MSFT).

Q3 Results

Starting with the bottom, in Q3, STM reported a net income of almost $1.1 billion, up by 131.8% compared to a $474 million recorded last year-end quarter. On a quarterly basis, STM’s net income was also up by +26.8% and we can clearly note that the company is accelerating its profitability trajectory and operating leverage. A very similar trend was also reported in Q2 and also in Q1 with a Mare Evidence Lab publication called: Doubles Profits And Beats Expectations. In detail, top-line sales increased by 35.2% on a yearly basis and by 12.6% on a quarterly basis and achieved a total consideration of $4.3 billion, beating the company’s internal estimates and consensus expectation that was forecasting $4.24 billion and $4.26 billion respectively.

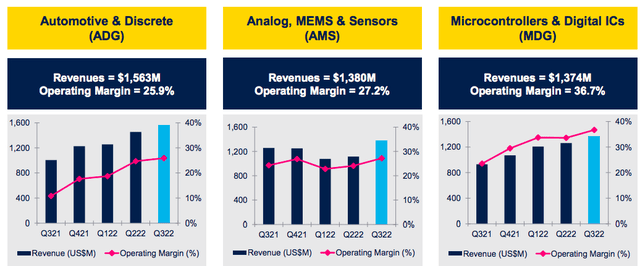

Going down to the P&L, STM’s gross margin improved to 47.6% versus the 41.6% recorded in the same period of 2021, beating analysts’ forecasts of a margin of 47%. The operating margin reached 29.4% thanks to strong cost control at the OPEX level. Looking at the specific division, STM managed to increase profitability in all sectors. Auto & Discrete’s EBIT margin was at 25.8%; Analog, MEMS & Sensors’ EBIT margin stood at 27.2%; and Microcontrollers & Digital IC achieved an EBIT margin of 36.7% margin.

Source: STM Q3 results presentation

Conclusion and Valuation

The company confirmed its revenue and gross margin assumption. Here at the Lab, we are not updating our forecast numbers, providing a turnover of $4.4 billion with a gross margin of 47.3% for the final quarter. STM’s management again reaffirmed the CAPEX guidance and the long-term revenue trajectory to achieve $20 billion in revenue. Despite a weak momentum, the company’s revenue and margins were well above expectations. We expect an upwards revision on the Wall Street forecast. STM’s vertical exposure is better than its closest competitors and provides resilience at the turnover level, which in turn allows for record levels of profitability. We reaffirm our buy rating and our target price of €60 per share.

If you are interested in our latest coverage on European semis, please have a look at our recently published articles:

- FormFactor Vs. Technoprobe: A Clear Winner Part 2

- Infineon Is A Screaming Buy

- STM: Macro Upside

- STM: City’s Global Technology Conference with MICRO upside

Be the first to comment