aerogondo/iStock via Getty Images

Recently, I wrote a cautious article on National CineMedia Inc. (NCMI), commenting that the company had too much debt and movie box office may be in a ‘new normal’. A company related to NCMI is The Marcus Corporation (NYSE:MCS), owners of the fourth largest chain of movie theatres in the U.S.

While MCS’ hotel & resort segment has returned to pre-COVID operating levels, I fear the theatre business may be permanently impaired due to consumers’ changing movie-viewing habits. Consumers in general now have high quality home theatre systems and a broad assortment of streaming options that may permanently cannibalize theatre attendance. While Marcus Corporation may have underappreciated real estate assets, the company will have difficulty surfacing value in a challenging operating environment.

Company Overview

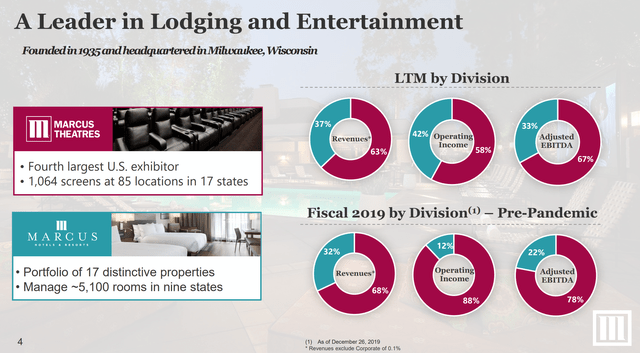

The Marcus Corporation operates in two industries: lodging through Marcus Hotels & Resorts, and entertainment through Marcus Theatres. Marcus Theatres is fourth largest theatre chain in the U.S. with over 1,000 screens in 85 locations. Marcus Hotels & Resorts own and/or operate 17 hotels and resorts.

Historically, pre-COVID, about 2/3 of the company’s revenues and almost 90% of the operating income were derived from the theatre business. In the last twelve months to Q2/2022, the operating income mix is more balanced, as profitability in the entertainment segment has decreased markedly post-COVID.

Figure 1 – MCS Business Mix (MCS Investor Presentation)

Marcus Theatres Have Made Large Investments

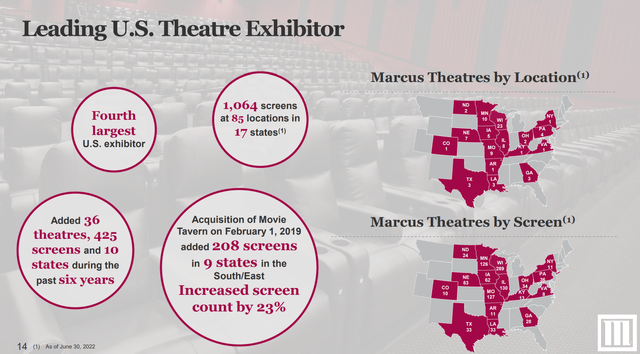

As mentioned above, Marcus Theatres is the 4th largest exhibitor in the U.S, operating 1,064 screens in 85 locations. In the past decade, MCS had been one of the most aggressive acquirors/renovators in the space, having acquired 36 theatres and 425 screens in the past 6 years alone (Figure 2).

Figure 2 – Marcus Theatres Overview (MCS Investor Presentation)

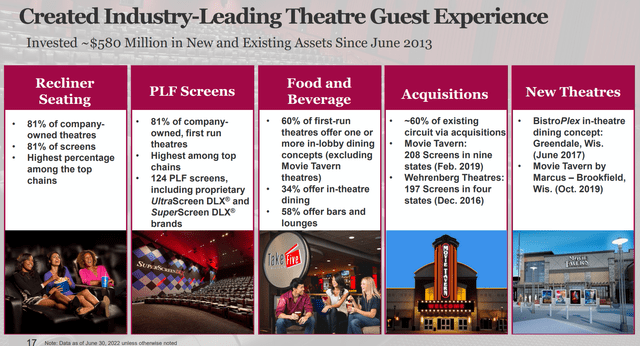

In addition to acquisitions, Marcus Theatres have also spent close to $600 million renovating and building new theatres (Figure 3).

Figure 3 – Marcus Theatres have been leaders in capital expenditures (MCS Investor Presentation)

But With New Normal In Attendance…

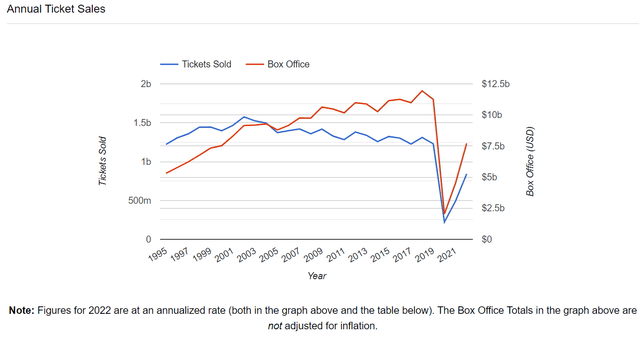

Unfortunately, it appears increasingly likely that the Marcus Theatres’ capital expenditures and acquisitions were spent in vain, as attendance and box office remains far below pre-pandemic levels. Total tickets sold in 2022 are annualizing at 840 million, approximately 68% of 2019’s levels, while the box office is annualizing at $7.5 billion, 69% of 2019’s total box office (Figure 4).

Figure 4 – Box office and tickets sold annualizing at 68-69% of 2019 levels (the-numbers.com)

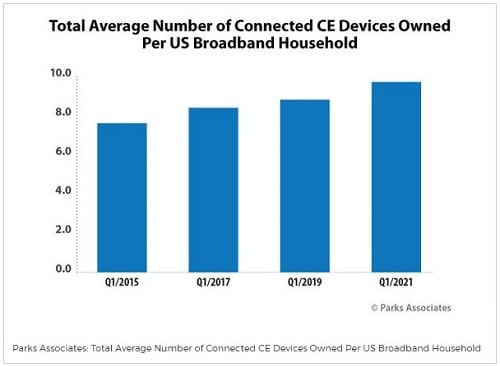

What are the causes for the continued shortfall in movie attendance, despite the lifting of the pandemic restrictions? First, many households used the COVID pandemic (and government stimulus cheques) to upgrade their home theatre systems (Figure 5). With an upgraded home theatre system, many non-blockbuster films can now be enjoyed in the comfort of one’s home without any major difference in picture or sound quality.

Figure 5 – Households upgraded their home theatres during COVID (Park Associates via electronics360.globalspec.com)

Second, in recent years, the movie business has altered its business practices, shortening the theatrical release window and launching simultaneous streaming releases. For major studios like Disney and Warner Bros., this made strategic sense as they are trying to attract customers to their associated streaming platforms like Disney+ and HBO Max. However, for exhibitors like Marcus Theatres, this cannibalizes movie attendance, as customers can enjoy blockbuster films on a $10 / month streaming service mere months after their theatrical release.

Finally, for a certain percentage of the population who are immuno-compromised (frail, young, and elderly), going to the movies is no longer feasible due to the ongoing circulation of COVID-19 variants.

Speaking from personal experience, while I would still go to the movies to see a blockbuster film like Top Gun: Maverick or Minions: The Rise of Gru with my young kids, I have become much more selective and the frequency of my theatre visits have gone down noticeably. Whereas pre-pandemic, I would go to the movies about once a month, nowadays, it is once every few months and only for blockbuster movies.

In fact, as a die-hard Marvel Cinematic Universe (“MCU”) fan, the latest Thor: Love And Thunder was one of the few MCU films I did not see in theatres due to its poor reviews and the fact that it was going to be available on Disney+ shortly after its theatrical run.

…Theatre Economics Are Now Barely Breakeven

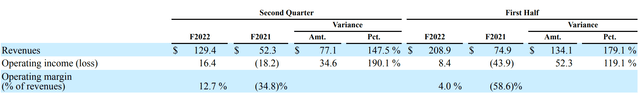

For exhibitors like Marcus Theatres, this new normal in attendance means that the theatre business is barely breakeven, with a 4% operating margin in H1/2022 (Figure 6).

Figure 6 – Marcus Theatres H1/2022 operating performance (MCS Q2/2022 10Q Report)

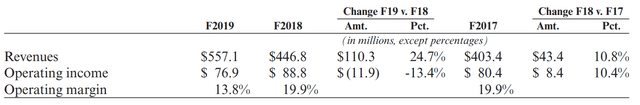

For comparison, in 2017 to 2019, the operating margin in the theatre business was 14 – 20%.

Figure 7 – Marcus Theatres historical operating performance (MCS 2019 10K Report)

Hotels On The Mend…

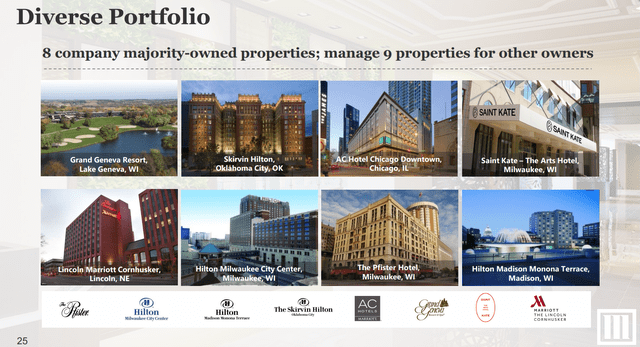

Marcus Hotels & Resorts majority own 8 luxury hotels and manages 9 other properties under the same banner. Altogether, Marcus Hotels & Resorts manage 5,100 rooms and over 200 event and meeting rooms.

Figure 8 – Marcus Hotels & Resort properties (MCS Investor Presentation)

For Marcus Corporation, the hotels business has returned to normal, with comparable revenues in Q2/2022 reaching 99% of 2019 levels (Figure 9).

Figure 9 – Marcus Hotels & Resorts back to 2019 levels (MCS Investor Presentation)

…But Were Never That Profitable To Begin With

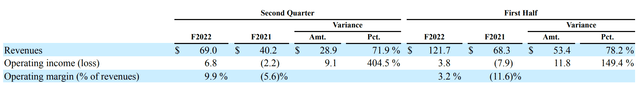

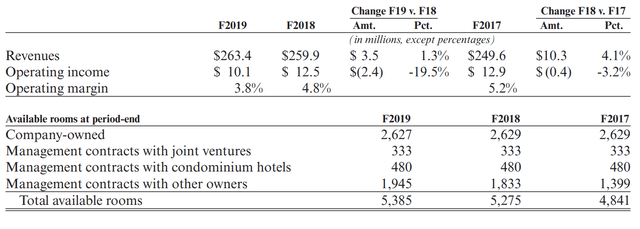

However, despite the YoY improvements, the hotel business had never been a big earner for MCS. It’s H1/2022 operating margin of 3.2% is roughly comparable to 2019 operating margin of 3.8% (Figure 10 and 11 respectively).

Figure 10 – Marcus Hotels & Resort H1/2022 operating performance (MCS Q2/2022 10Q Report) Figure 11 – Marcus Hotels & Resorts historical operating performance (MCS 2019 10K Report)

Financials

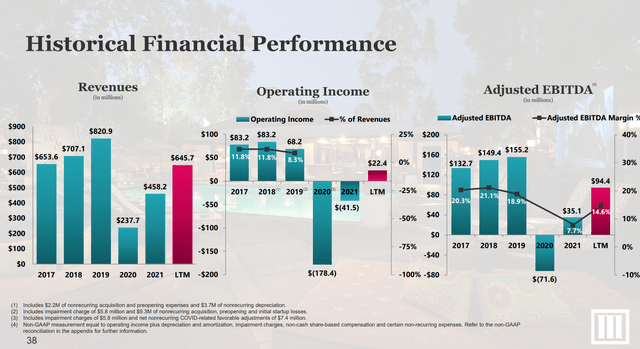

Overall, LTM corporate operating margin of 3.5% ($22 million in operating income on $646 million in revenue) is far below the historical range of 8-12% pre-COVID (Figure 12), primarily due to the decline in the theatre business.

Figure 12 – Despite recovery, MCS operating margins still far below historical ranges (MCS Investor Presentation)

With the theatre business facing structural headwinds, it is hard to envision operating profits returning to pre-COVID levels.

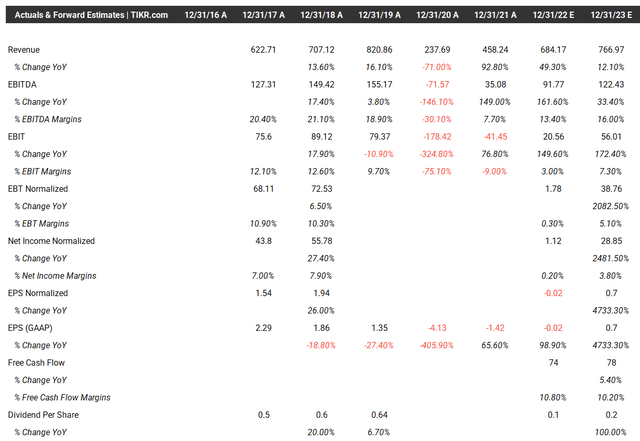

Analyst Estimates May Be Too Aggressive On The Theatre Business

Wall Street analysts currently expect the Marcus Corporation to return to profitability in 2023 with revenues of $767 million and $0.70 in EPS (Figure 13). $767 million in total revenues would be 93% of 2019 revenues. Given hotel revenues are already 99% of 2019 levels, that means theatre revenues are expected to be ~$504 million or 90% of 2019 levels ($767 million corporate revenue estimate less 2019 hotel revenue of $263 million).

Figure 13 – MCS analyst estimates (tikr.com)

We know LTM theatre revenues for Marcus Theatres are only $405 million, or 73% of 2019 levels (H1/2022 revenue of $209 million plus 2021 revenue of $271 million less H1/2021 revenue of $75 million). This percentage is similar to the industry box office, which has only recovered to 69% of 2019 levels. Hence for MCS to achieve 2023 analyst estimates, movie box office will have to get back to 85-90% of 2019 levels. Given the structural headwinds mentioned in this article, I believe analyst estimates for the theatre business may not be achievable.

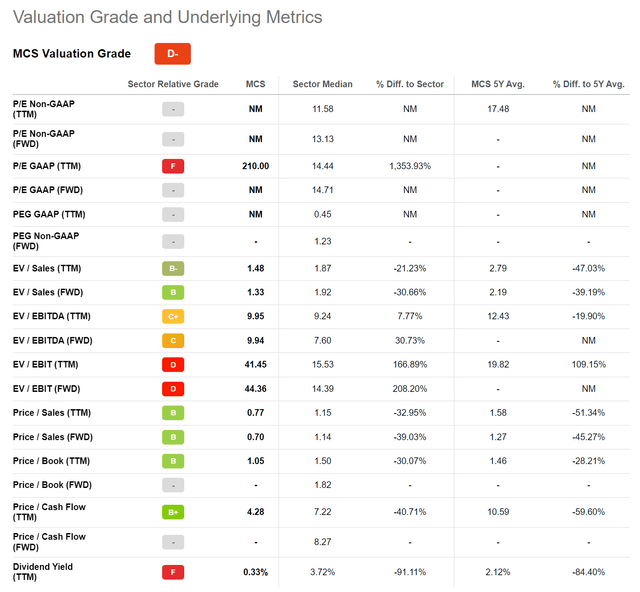

Valuation Is Expensive

Assuming analysts are correct and MCS can deliver $0.70 in EPS in 2023, the stock is still trading at 20.0x Fwd P/E, significantly above the consumer discretionary peer median of 13.1x. On Fwd EV/EBITDA, MCS is trading at 10.0x, also a significant premium to peers at 7.6x.

Figure 14 – MCS valuation (Seeking Alpha)

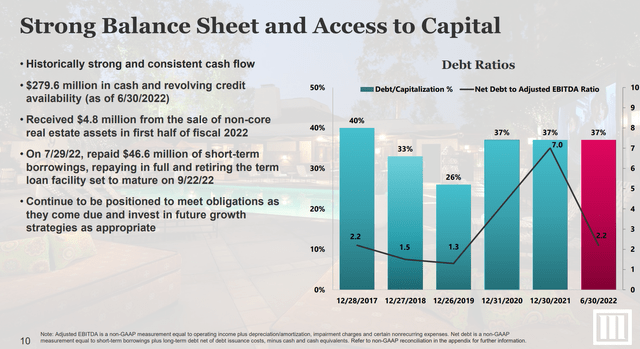

MCS Has A Strong Balance Sheet Backstopped By Real Estate Assets

On the positive side, unlike other heavily indebted movie exhibitor chains like Cineworld (OTCPK:CNNWQ), the Marcus Corporation has a relatively strong balance sheet and is not at risk of an imminent bankruptcy (author’s note, Cineworld filed for bankruptcy in early September), with Net Debt to LTM Adjusted EBITDA of only 2.2x (Figure 15).

Figure 15 – MCS has a relatively strong balance sheet (MCS Investor Presentation)

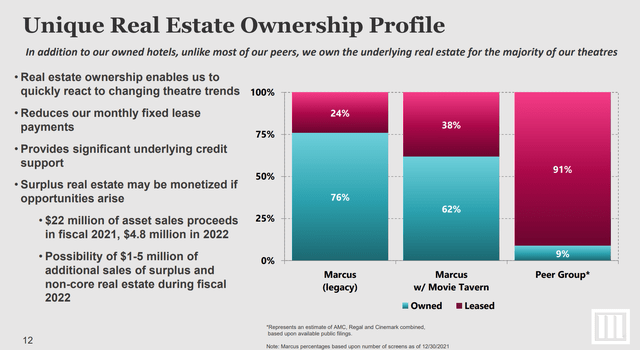

Furthermore, 62% of its MCS’s theatre real estate is owned and MCS also owns 8 hotel properties.

Figure 16 – MCS owns a lot of real estate (MCS Investor Presentation)

Significant Asset Value Present But Hard To Surface

Although Marcus Corp’s businesses are not very attractive operationally, trading at 20.0x 2023 P/E, there are significant value in the company’s real estate assets. For example, fellow Seeking Alpha author Nick Bodnar wrote a well researched article on MCS arguing it was trading significantly below the fair value of its real estate holdings.

However, one of the core assumptions in Mr. Bodnar’s article is a comparable transaction table used to triangulate a $850k value per theatre screen. The caveat is that these historical transactions are mostly based on pre-COVID industry trends. If we use more recent transactions, the resulting ‘asset value’ could be much lower. For example, in Q2/2022, AMC acquired 80 screens for $17.8 million, or $220k per screen.

Furthermore, with the recent bankruptcy of Cineworld and other exhibitors heavily indebted, who would have the wherewithal to acquire Marcus Theatres and surface the asset value for MCS shareholders?

Conclusion

In summary, I would stay away from shares of Marcus Corporation. While the hotel & resort segment has recovered to pre-COVID operating levels, I fear the theatre business may be permanently impaired due to changing movie-viewing preferences. Consumers in general now have high quality home theatre systems and a broad assortment of streaming options (Disney+, Netflix, HBO Plus, just to name a few) that may permanently cannibalize movie attendance. While Marcus Corporation may have underappreciated real estate assets, the company will have difficulty surfacing that value in a challenging operating environment.

Be the first to comment