Wachiwit

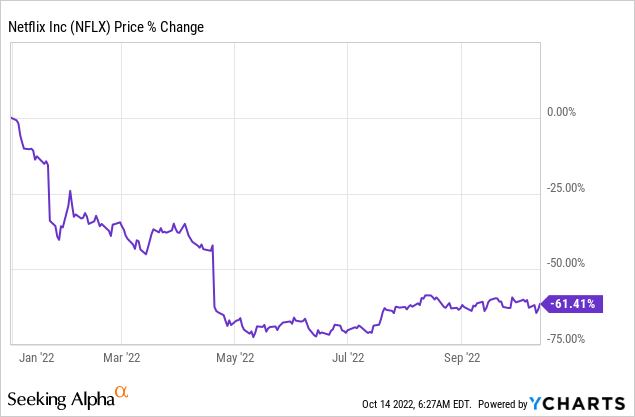

Streaming giant Netflix, Inc. (NASDAQ:NFLX) is going to submit its third-quarter earnings sheet in a few days from now — the scheduled date is October 18, 2022 — and it could be the most important quarter for the entertainment company in recent history. This is because Netflix has bled subscribers in the last two quarters in a major post-pandemic slowdown and the stock has seen a sharp down-turn as a result of it. Although Netflix projected a third-quarter subscriber gain of approximately 1M, growth in paid memberships is set to continue to decelerate. If Netflix loses further momentum in the important U.S./Canada market, I believe the stock may be set for a further revaluation to the downside.

Netflix’s subscriber growth

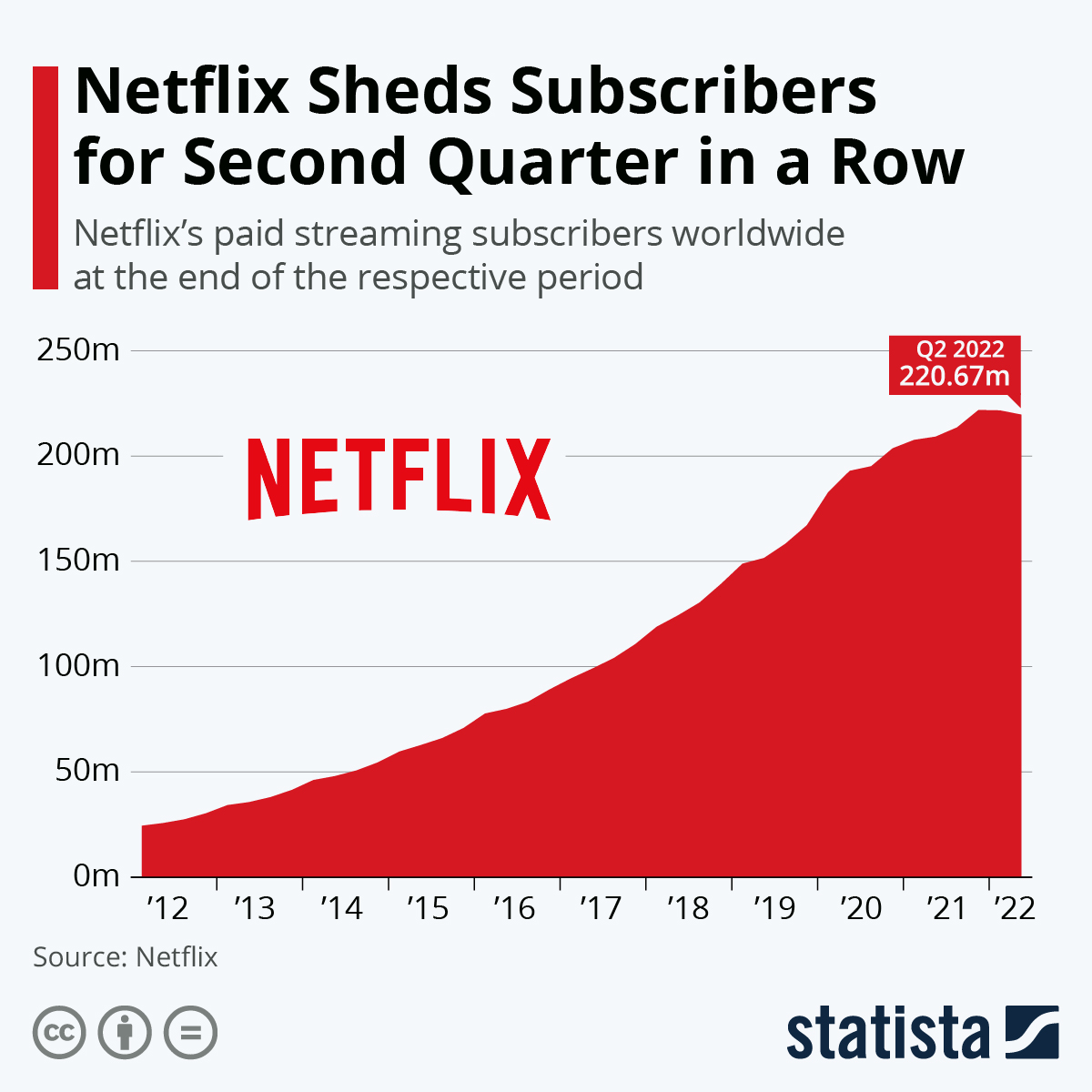

When it comes to Netflix’s subscriber growth, the market has been caught off guard this year. The streaming company lost subscribers twice this year: in Q1’22, and then again in Q2’22, which is when subscriber losses quintupled. In the first-quarter, which is when Netflix expected to add 2.5M subscribers to its streaming platform, the company actually lost 200 thousand subscribers. In the second-quarter, Netflix lost about 1M subscribers, but did much better than its own forecast of a 2M subscriber loss. Netflix ended the second-quarter with 220.7M global users.

Statista: Netflix Subscriber Growth

Netflix has guided for the on-boarding of 1M new subscribers in the third-quarter, which would bring the number of global paid memberships to 221.67M. However, even if Netflix succeeded in reversing the exodus of subscribers from its platform, the streaming company still faces a deceleration of its subscriber and revenue growth. Netflix’s 1M (potential) addition of new subscribers in Q3’22 calculates to just 3.8% year-over-year growth. In the year-earlier period, Netflix grew its subscriber base by 4.4M, or 9.4% year-over-year.

The problem with Netflix’s subscriber losses is that paid net additions declined by 2M in FY 2022 in the important U.S./Canada market which is the highest ARM — average revenue per membership — market for Netflix. However, the streaming company is growing especially fast in the Asia-Pacific region, where it reported 2.2M paid net adds in the first six months of FY 2022. The majority of the 1M subscriber additions in the third-quarter will therefore likely also come from the Asia-Pacific region where the value of a subscription is about half of what it is in the U.S./Canada. Simply speaking: Netflix likely continued to lose subscribers in high-ARM regions in Q3’22 and substituted them with subscribers from low-ARM regions.

Negative EPS trend

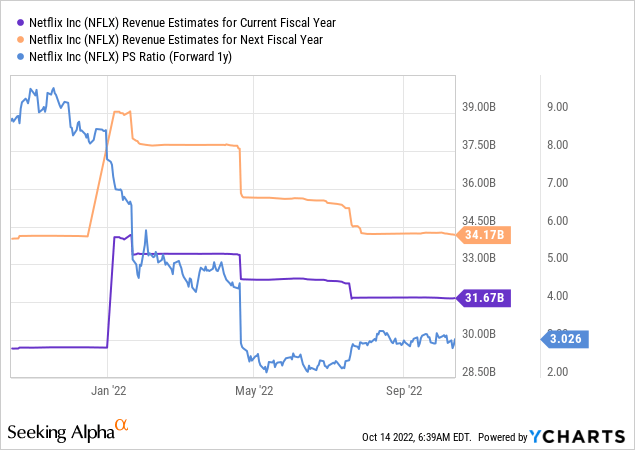

The market appears to believe that Netflix will achieve its Q3’22 subscriber target, but expectations are not high heading into earnings. The expectation is for Netflix to have generated revenues of $7.85B and EPS of $2.17 in the third-quarter, which signal year-over-year growth rates of 5% and (32)%. In the last 90 days, there were 36 downward revisions and just 1 upward revision for Netflix’s FY 2022 revenues, and 29 downward revisions and 5 upward revisions for Netflix’s FY 2022 EPS.

Revenue estimates have trended down for a while, but really started to drop off after the company shocked the market with its massive subscriber miss in Q1’22. Until today, shares of Netflix have not recovered from the selloff. Based off of revenues for FY 2023 ($34.2B), Netflix currently trades at a market-capitalization-to-revenue ratio of 3 X. Given the uncertainty regarding subscriber growth and weakening monetization, I believe investors may be overpaying here and underestimating the downside.

Uncertain times for Netflix

Netflix is plagued by a couple of problems, among them being password-sharing, which Netflix has said is a practice that affects 100M non-paying households. Additionally, inflation continued to surge throughout the third-quarter, potentially resulting in lower retention rates for Netflix as well as other streaming companies. On top of that, Netflix is losing subscribers especially in the lucrative U.S./Canada market, a development I discussed in my last work “Netflix: Uncertain Times.”

Risks with Netflix

The two biggest commercial risks for Netflix going forward are the following: (1) Subscriber growth is likely going to continue to decelerate as the economy slows, inflation keeps weighing on consumer spending and the streaming market becomes an increasingly saturated market as most large media companies now have their own streaming platforms; and (2) Average revenue per membership growth may continue to slow if more subscribers based in the U.S./Canada depart the platform. What change my mind about Netflix is if the company crushed its Q3’22 subscriber projections and gained more subscribers in the US/Canada market.

Final thoughts

Netflix’s Q3’22 is likely going to be a mixed bag, and the shares are not a buy before earnings. I believe despite inflation headwinds, Netflix is going to report third-quarter subscriber additions that will come in just around the company’s 1M projection. However, I also believe that Netflix will continue to see weaker metrics in the lucrative U.S./Canada market with low-ARM regions out-performing Netflix’s domestic market regarding subscriber and average revenue per membership growth. Because of the headwinds in the U.S./Canada business as well as slowing growth and a high valuation based off of revenues, Netflix is a not a buy right now!

Be the first to comment