Filipp Borshch

Overview

In my opinion, there is a significant undervaluation of NuScale (NYSE:SMR). I believe the expected growth of SMR over the next decade will be supported by strong tailwinds. That said, risks are present for SMR at the moment because they are not making any money, but their track record of excellent execution gives confidence that they will be able to hit their targets.

Business description

Through proprietary and innovative SMR technology, SMR is redefining nuclear power. It ensures safe, scalable, cost-effective, and reliable carbon-free power. There are only 2 key features to note about SMR. First is its core technology, the NuScale Power Module [NPM], which can generate 77 MWe and is premised on well-established nuclear technology principles. The second is its flagship power plant, named VOYGR. VOYGR is a plant design that can be expanded to fit up to 12 NPMs, for a total gross output of 924 Mwe.

SMR only believes in a safe and highly reliable power plant, which is where NPM comes into play. It is suitable to be sited close to wherever electricity or process heat is required. SMR expects the first VOYGR power plant to be operational in 2029.

Note: The term [SMR] refers to Small Modular Reactors throughout the report, unless it is referring to NuScale.

Investments thesis

Dramatic shift towards net-zero carbon emissions

According to the International Energy Agency, global power consumption will continue to increase in the future. This means that SMR capacity would be the pathway to global net-zero carbon emissions. The energy and power markets have been transformed by replacing fossil fuels with carbon-free sources. Various external factors have ensured the use of decarbonized electricity in multiple sectors, such as transportation and building. However, most global capacity additions to replace the existing carbon-intensive power generation are expected to begin in the carbon-free age.

There are three key components to drive the adoption of carbon-free life in the current times.

- Technological advancement will continue to influence the world’s energy mix, even in the future. According to SMR prospectus, studies have concluded that solar photovoltaic capacity has grown 37% annually since 2000 and accounts for 10% of the global power generation capacity. The main reason behind this incline is the decline in the prices of PV modules. There is a great possibility that SMRs and other carbon-free generations will catalyze similar adoption trends in the coming years.

- There are also various economic and reliability drivers behind carbon-free power generation technologies. The push to deploy carbon-free generation has shifted its focus to renewables like wind and solar, which now have levelized electricity costs competitive with many conventional forms of power. Intermittency and land use constraints are some of the reasons why renewables alone can’t power regional power grids. Baseload generation is necessary to address these problems. Management has concluded that, in these circumstances, nuclear power, and especially SMRs, is the only practical carbon-free baseload power solution that can keep up with the worldwide demand for carbon-free generation.

- ESG investing has become increasingly popular among institutional investors and is the right way to invest. This form of investment helps reduce carbon emissions in the environment and eliminates some structures that currently contribute detrimentally to climate change. According to the Global Sustainable Investment Alliance study, which was carried out in 2020, approximately 36% of global assets under management are “sustainable investments,” considering ESG factors. Many large companies have responded by investing in greener forms of energy that don’t produce as much carbon as they once did, such as renewables or nuclear power.

In order to meet international climate objectives, 16,000 gigawatts of carbon-free generation capacity will be needed by 2040, based on SMR’s prospectus. These additions result from the increase in projected power use and the replacement of existing generation sources. The most common replacements are coal, natural gas, and oil. Although essential to meeting climate goals, renewables, such as solar and wind, have their fair share of constraints. These include issues with land use and how the grid system works, as well as power that goes out and comes back on.

According to the U.S. Energy Information Administration, the average 2020 capacity factor for nuclear power plants was 92.4%. In comparison, for solar power, it was 24.2%, and for wind power, it was 35.3% (all figures drawn from SMR prospectus). Long-term storage, geothermal energy, natural gas, coal with carbon capture, and nuclear power are all examples of flexible and dispatchable sources that will be essential in many parts of the world. Among these options, SMRs stand out as an attractive choice because of their long-term viability, competitive costs, carbon-free emissions, and dependability.

Support from government

In December 2021, President Biden passed an executive order that required all government electricity to be 100% carbon pollution-free by 2030. At least 50% of this energy has to come from dispatchable sources, which can be utilized 24 hours a day. The order also requests that all federally-owned buildings be emissions-free by 2045 and that federal agencies start using zero-emission vehicles within the same time period. Additionally, the U.S. Infrastructure Investment and Jobs Act of 2021 includes $65 billion for power and grid investments. This includes investments in grid reliability, resilience, and clean energy technologies like carbon capture, hydrogen, and advanced nuclear power.

In addition, over 190 countries, including the European Union, have signed the Paris Agreement. This treaty seeks to limit the global rise in temperature to below 2°C. 130 countries, including China and the U.S., which are the biggest CO2 emitters in the world, have set a goal of zero net emissions by 2050.

Nuclear is the only viable carbon-free baseload power

Nuclear power is the only carbon-free baseload power available to meet global electricity needs year-round and meet decarbonization targets. There are many alternative energy sources to choose from. Traditional baseload technologies, such as coal and gas, emit a lot of CO2. Renewables such as wind and solar power are intermittent, making them a risk to depend on for baseload power. Batteries have not scaled well enough to make renewables a viable source of baseload power. SMR’s VOYGR provides highly reliable, cost-effective, and clean power to electric grids. It’s the perfect solution to meet our current and future energy needs.

Patents and certifications reduce investment risk

The essential components of SMR technology are safeguarded by the 443 issued patents and the 196 pending patents. The 496 individuals who make up SMR’s staff are among the company’s greatest assets. There are 37 Ph.Ds. and 168 Master’s degrees among them, all in the sciences and engineering. In my opinion, SMR’s intellectual property rights and highly skilled workforce are the company’s most valuable assets.

SMR is the first and only SMR to receive standard design approval [SDA] from the United States Nuclear Regulatory Commission [NRC], despite the fact that China and Russia currently dominate the SMR market. With the NRC’s stamp of approval, SMR can confidently tell its clients that their plant layouts are safe and sound. For SMR, it took 41 months to get through the SDA’s application, review, and finalization processes. For a nuclear reactor company, this was the quickest approval ever. However, no other SMR or advanced reactor company has submitted an application to the NRC for SMR design approval. The management thinks this gives the company an edge over its SMR rivals, as does the relatively short time it takes to get design approval from regulatory bodies.

Forecast

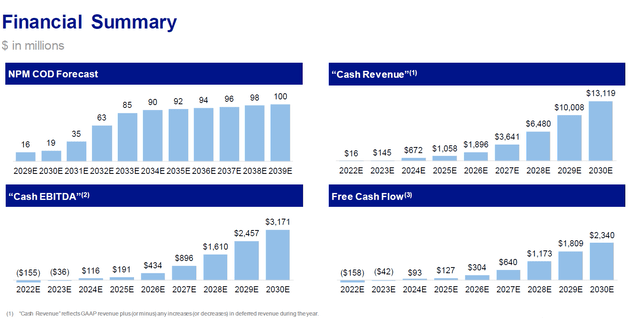

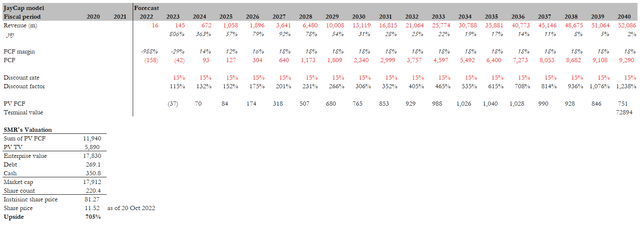

The primary objective of my model is to reveal the sizeable gain that would result if SMR achieved management’s long-term guidance. Since it is an 18-year DCF model, the model is highly sensitive to changes in growth rates and margins. My model consists of a two-part process. Management guidance (see snapshot below) informs the first phase (FY23-FY30), while a model of declining growth (to 2% in FY40) represents SMR’s maturation. Since the SMR business model is still new and I would need a higher rate of return as an investor to justify investing in it, my model is based on a very high discount rate of 15%.

If these projections hold, SMR’s share price of $11.52 could be as much as seven times higher.

Investor Presentation April 2022

Red flags

No binding contracts at the moment

Before SMR can start deploying its NPM, it must first reach a binding agreement with Utah Associated Municipal Power Systems [UAMPS] for its scope of supply, and UAMPS must be in an active contract with Fluor. Failure to reach a legally binding agreement could have serious consequences.

Competition from China and Russia

There are renowned competitors in China and Russia that currently operate commercial SMRs in those countries, even though their SMR designs have not been approved by the NRC or other jurisdictions outside their native countries. They will gain a competitive advantage if they can either get approval for their Standard Design or if they can demonstrate the value and benefits of their SMRs to their potential customers.

Conclusion

When compared to its current share price, SMR has the potential to increase by a factor of seven. Investors must believe the SMR’s technology will cause a seismic shift in the market and be widely adopted, resulting in a dramatic increase in revenue. Underlying this is my conviction that nuclear power represents the only sustainable long-term approach to lowering carbon emissions, and that there are positive trends in the industry that point in this direction.

Be the first to comment