DenisTangneyJr/iStock via Getty Images

California Resources Corporation (NYSE:CRC) has had some pretty recent and arguably situation-changing news on the regulatory side. Late in the session, California has pushed through Senate Bill 1137 and Senate Bill 905. The former makes radical changes to how and where oil and gas wells can be developed in the state, with the latter also making significant restrictions to how carbon capture projects might be framed in the state. While there is no doubt that California Resources remains cheap on a multiple basis, recent action is a reminder of the challenges that the company faces as the largest non-governmental owner of mineral acreage in California.

Senate Bill 1137

California oil production peaked in the middle of the 1980s and has been in steady decline since, with daily production now averaging a little more than 330,000 barrels per day. That’s not nothing however, and given the transport and logistics costs involved in getting imports into California from domestic fields or overseas, local producers do have an advantage if they can navigate the regulatory environment. Recently, there has been a vocal call by constituents for some sort of formal regulations on restricting new drilling activity. This might be surprising to some, but technically in California under prior state law you could drill an oil well nearly anywhere absent any local zoning laws and successful navigation of permitting. That runs counter to other states like Colorado that have formalized setback rules that mandated new oil and gas wells be a certain distance away from structures like schools, daycare centers, or neighborhoods.

I don’t personally find setback rules to be terribly meaningful when it comes to environmental protection, but do acknowledge the public does not like the idea of oil and gas developments in their backyard. It was no surprise to see that last year, the California Energy Management Division put out draft regulation that would establish a setback of 3,200 feet – dwarfing Colorado and its 2,000-foot legislation – the furthest setback in the country. While 2,000 feet might not seem like much, recall that the Colorado legislation (SB 181) sparked fears that it would be so punishing that it would render many prospective wells unviable. The Colorado Association of Mineral Owners (“CAMRO”), while obviously an industry group, pegged potential losses at $180B based on discounted cash flow analysis and models of where future drilling would have taken place in Colorado absent the regulations.

Colorado regulation only applied to drilling new wells. Old wells were grandfathered in, and in fact are allowed to be “reworked”, meaning that operators can redrill existing wells and putting in newer infrastructure to extract more oil and gas. Operators tend to be happy with reworks as they can get high returns on investment – particularly on very old wells that utilize new technology – and generally the broader public should be theoretically supportive as it often means the well is structurally improved with new equipment which is less leak prone, cutting latent emissions and reducing spill risk.

Late in this year’s regulatory session, SB 1137 passed the California Legislature. What is important here is that SB 1137 codifies the 3,200-foot setback, but also means that commencing January 2023, it also applies to workovers. For companies like California Resources, workovers have been a big factor in minimizing decline rates. Following the Senate vote, California Resources did file an 8-K that detailed the impact to its net present value of its proved reserves, preliminarily stating that its proven undeveloped reserves (“PUD”) would be reduced by less than a quarter and the value of its total reserves by half that. The baseline for the company’s assessment is an undisclosed amount estimated on July 1st 2022, using a price deck of $105.00 per barrel crude oil and $5.00 per mmbtu natural gas.

California Resources primarily operates within the San Joaquin Basin and the Los Angeles Basin. The former is mostly rural, the latter urban. It’s pretty safe to assume setback rules are going to primarily apply in the Los Angeles Basin, and that means that more than two thirds of its stated reserves in the Los Angeles Basin have been rendered unviable. This is a big deal, as these projects have had incredibly high return on investment and also yield 99.0% oil; California Resources wells in the San Joaquin Basin typically only see 50.0% oil cuts. Going forward in 2023, decline rates in its otherwise stable Los Angeles Basin asset are going to accelerate and it is going to have to direct further capital to its San Joaquin assets for new drilling where breakevens are higher – particularly in this high inflationary environment.

Senate Bill 905

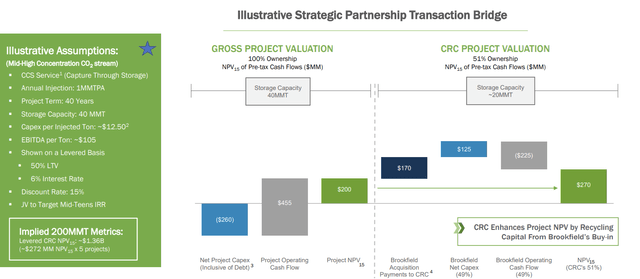

Management has tried its best to pivot the story of the company into green / renewable projects. Its Carbon TerraVault Project which will capture, transport, and sequester carbon recently picked up Brookfield as a joint venture partner. Brookfield brings $500mm in capital and significant experience in these kinds of projects. As shown below, management has pitched this as a potential billion dollar project that would create significant value for assets that were otherwise not generating economic value for California Resources.

CCTV Project (California Resources)

Senate Bill 905 does not impact Carbon TerraVault in a meaningful way, but it was not their only carbon capture project. Separately, the company was evaluating the feasibility of a carbon capture system to be located at the Elk Hills power plant, otherwise known as CalCapture. Under Senate Bill 905, carbon capture, sequestration, and storage projects are no longer able to be used alongside enhanced oil recovery – in other words, getting economic benefits from carbon dioxide flooding that was used to capture hydrocarbons. This was precisely what the plan was at CalCapture: retrofitting its natural gas power plant with capture equipment to take in carbon generated from power production, using that carbon for carbon dioxide flooding in its projects.

There are other sources of project revenue for CalCapture, namely low carbon fuel standards (“LCFS”) credits, cap and trade, and directly from the federal government as part of the Inflation Reduction Act that enhanced 45Q payments. The project could still go through, albeit with weaker economics than many expected otherwise. It’s a mild net negative in my opinion, although SB 905 does show continued California support for carbon capture – even if it does have strings.

Takeaways

Senate Bill 1137 took out $500 – 700mm in equity value on its own given its impact to reserves. Further, California Resources is already one of the highest cost producers domestically: operating costs were in the mid $30.00 per barrel range even before factoring in the cost of maintenance capital. Including that, breakevens are in the low $50.00 per barrel range, and that will inch higher from here given the loss of low cost Los Angeles Basin development opportunities.

Given all of this, expect the focus to shift once again to carbon capture and embedded real estate value. Kimmeridge, a major private equity player, is building a stake here. Despite having significant focus on oil and gas, this is rumored to be more about the value of the real estate California Resources owns in Huntington Beach. Remediation costs would be high, but at some point the headaches of dealing with oil and gas in many urban areas in California just get outweighed by the land value. This would inevitably yield big money even after those costs given how expensive California land remains.

Long story short, lots of moving pieces here – many of which are just a headache to deal with and fraught with uncertainty. Recent regulatory changes and permitting issues show just how the story can change overnight. Kimmeridge and other activist involvement could force immediate value, but otherwise I think it’s tough to be an enthusiastic bull. I’m on the sidelines.

Be the first to comment