piranka

My Background

Each investor faces a different set of circumstances. Now 35, I have been investing since I was 22 years old. My first investment in individual stocks was made in the heart of the financial crisis back in May of 2009. I purchased 40 shares (80, split-adjusted) of Toronto-Dominion Bank (TD). However, for years before making that purchase I had been researching the best methods available for both wealth creation and preservation.

I don’t believe in taking unnecessary risks and feel the whims of the stock market are too fickle as far as capital gains are concerned to base my aspirations of financial freedom on. Dividend growth investing stands out as it is far more predictable that a healthy company might increase its dividend by 6% than to make any sort of prediction about stock price volatility in the near term.

On this basis and from my initial foray into the markets with TD, I’ve built a portfolio of over 30 cash flowing equities. My goal is ultimately to have a stock market portfolio which provides enough income to cover all of my expenses.

While some feel that it only requires ten companies to achieve ultimate diversification, I believe there is room for a healthy level of redundancy to avoid the hiccups involved with company-specific performance. Regardless, I endeavor to always own the best of breed companies in their respective industries. I can live with slower growth if it means greater security for my invested dollars.

This is a strategy I have researched over time and came to trust because it can work for me both as a young investor and likewise carry me through the decades to come. While it may not turn heads at a dinner party, it has proven its value over the past few hundred years and remains as relevant as ever today in our digital age.

Having noted the above, it is truly a great time to be a dividend growth investor. The companies I own are committed to rewarding shareholders and I love nothing more than to reinvest back into them to further increase the compounding power in my portfolio.

Dividend Summary

Once more, I’ve brought in cash flow from 36 companies. Of those, 25 payments were provided in CAD with another 11 being in USD.

Please note that all Canadian companies are owned in CAD on Canadian exchanges. KO and JNJ are owned in CAD within my portfolio, though they reside on the NYSE; their dividend payments are provided in CAD.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

| Toronto-Dominion Bank (TD:CA) | 178.00 | |

| RioCan Real Estate Investment Trust (REI.UN:CA) | 66.57 | |

| The Coca-Cola Company (KO) | 75.23 | |

| Johnson & Johnson (JNJ) | 94.19 | |

| BCE Inc. (BCE:CA) | 202.40 | |

| Canadian Imperial Bank of Commerce (CM:CA) | 19.92 | 3.11 |

| Corby Spirit and Wine Ltd. (CSW.B:CA) | 12.00 | |

| Bank of Nova Scotia (BNS:CA) | 103.00 | 3.00 |

| TELUS Corporation (T:CA) | 72.80 | 3.42 |

| Rogers Communications Inc. (RCI.B:CA) | 27.50 | |

| Fortis Inc. (FTS:CA) | 96.30 | |

| Canadian Utilities Ltd. (CU:CA) | 104.39 | |

| Canadian National Railway Company (CNR:CA) | 32.96 | |

| Canadian Pacific Railway Limited (CP:CA) | 9.50 | |

| Hydro One Ltd. (H:CA) | 72.70 | |

| Chartwell Retirement Residences (CSH.UN:CA) | 15.30 | |

| Metro Inc. (MRU:CA) | 5.50 | |

| Brookfield Renewable Partners L.P. (BEP.UN:CA) | 119.57 | |

| Brookfield Renewable Corporation (BEPC:CA) | 54.54 | |

| Brookfield Asset Management (BAM.A:CA) | 4.07 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN:CA) | 14.16 | |

| Brookfield Infrastructure Corporation (BIPC:CA) | 7.55 | |

| A&W Revenue Royalties Income Fund (AW.UN:CA) | 18.60 | |

| Enbridge Inc. (ENB:CA) | 21.50 | |

| Saputo Inc. (SAP:CA) | 5.40 |

USD Dividends

| Company | USD Payments ($) |

| Waste Management, Inc. (WM) | 27.53 |

| McDonald’s Corporation (MCD) | 24.64 |

| Yum! Brands (YUM) | 18.90 |

| Yum China (YUMC) | 3.98 |

| PepsiCo, Inc. (PEP) | 9.78 |

| Walmart Inc. (WMT) | 7.14 |

| Visa Inc. (V) | 4.79 |

| AbbVie Inc. (ABBV) | 63.45 |

| Microsoft Corporation (MSFT) | 6.86 |

| Mastercard Incorporated (MA) | 2.92 |

| Apple Inc. (AAPL) | 3.45 |

Dividend Totals

I earned C$1,433.65 and U$173.44, combining for a currency-neutral grand total of $1,607.09. This represents a quarterly record for my portfolio and is 11.12% higher than Q3 2021 where I brought in $1,446.31.

So, I’ve made some healthy progress over the course of the past year in growing my passive income.

Taking the first three quarters of the year together, I’ve brought in the solid sum of $4,694.11:

With my goal being to firmly cross the $6k barrier for the year, I’m well on track.

Market Activity And Q3 Personal Highlights

This was a slow period in terms of stock purchases. I’ve been mostly getting back in the swing of things after moving into my new house in July and taking a two-week European vacation in August.

All the same, I did make a single stock purchase in Q3 with BIPC.

Brookfield Infrastructure Corporation (BIPC)

In an effort to take advantage of the recent price weakness and deploy some idle cash, I increased my position in BIPC by 13 shares. This cost ~C$800 and was sourced from dividends that were sitting in my account just waiting to be selectively redeployed.

Depending on FX fluctuations since the dividends are declared in USD, I should bring in roughly C$6 quarterly in additional cash flow from this purchase.

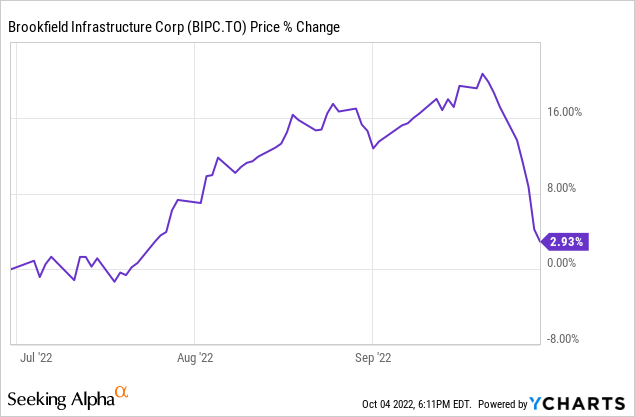

Here’s a chart from BIPC’s Q3 price action:

Based on this recent decline, I am actually considering another cash infusion in the company in the near future.

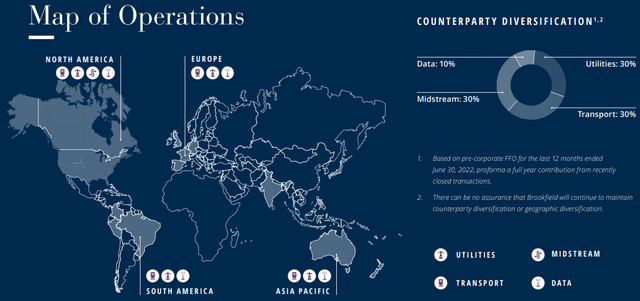

What I love most about BIPC is its steady earnings from a globally diversified infrastructure portfolio. Notably, its operations are spread quite evenly across its four operating segments of Utilities, Midstream, Transport, and Data:

BIPC Q2 2022 Investor Fact Sheet

Source: BIPC Q2 2022 Investor Fact Sheet

These are all areas with plenty of runway for growth in the decades to come.

Aside from BIPC, I’ve been mostly accumulating cash patiently over the past three months.

European Vacation

While the focus of this article has been my portfolio growth, I thought I’d take a moment to highlight a few of the sights I took in through this period as well.

The trip started in Geneva, Switzerland, before moving to Italy where a friend was getting married. On the Italian side, we tracked our way through Milan, Lake Como, Venice, Florence, and finished in Rome.

I hope you enjoy a few of my snapshots below.

Venice

Venice is one a quaint, picturesque city. Going days without seeing an automobile is a strange thing, and was rather enjoyable. There was plenty of walking to do and boating excursions to enjoy.

Here’s a view of a waterway in Venice:

Venice Waterway (Personal Photos)

Here’s an alleyway which was great for riding the gondolas:

Venice Alley (Personal Photos)

Florence

The Tuscan skies and unique architecture in Florence was easily a favorite stop on the journey. There was plenty of art and history to enjoy, including works from the Renaissance artist Donatello.

Here’s a nice panorama atop the hotel:

Rome

You could spend a week in Rome and still feel like you’re scratching the surface. Aside from the usual tourist destinations of the Vatican and Collosseum, there were plenty of catacombs and other ruins to explore.

A favorite from the city was seeing the Roman Aqueducts which were the method of bringing water to the city during the Roman Empire:

Roman Aqueducts (Personal Photos)

Q4 Investing Considerations

The most impactful macro concern I see at the moment is the impact of rising interest rates. Overall, central banks seem to be broadly agreeing on the need to put the clamps on inflation at any cost. This will be one of the most significant major economic headwinds for at least the next twelve months.

What I suspect this will amount to for investors with cash on the sidelines is plenty of opportunities to invest at better valuations. The market has been getting choppy, which is a circumstance that rewards patient investors with a healthy watch list of stocks ready to pounce when prices permit.

Conclusion

Q3 was a record quarter in absolutely every manner. I brought in the most dividends I ever have over this period of time, moved into a new home, and took two weeks off to book.

The beautiful thing is that I have every reason to expect Q4 to bring in even more income. Dividend growth in high quality companies continues to prove a worthwhile strategy that is durable in every sort of market. The bottom line is that top performers keep rewarding shareholders.

Having a stock portfolio built around a foundation of strength allows me plenty of peace to sleep at night. When I was abroad in August, I didn’t think twice about how my portfolio was performing. I simply caught back up on things upon my return home and found more dividends to be selectively reinvested.

Thank you for reading.

Be the first to comment