Funtap

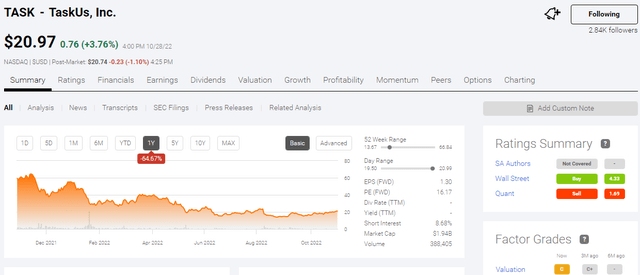

It is my task to write about under-the-radar companies. Go long TaskUs, Inc. (NASDAQ:TASK). This business outsourcing company’s stock is now trading significantly below its 52-week high of $66.84. The $45.84 decrease in its price has made TASK a value buy. TaskUs is now an affordable growth stock. Its TTM revenue CAGR is 59.78%. The 3-year revenue CAGR is 44.10%.

We should ignore that Sell rating that Seeking Alpha Quant has for TASK. This BPO company only had its IPO in June 2021. AI or human quantitative analysts require extensive data to scrutinize. The most important thing now is that TASK trades at just 16.17x forward P/E valuation. A high-growth 44.10% CAGR revenue company that trades below 20x forward P/E is a rare investing opportunity.

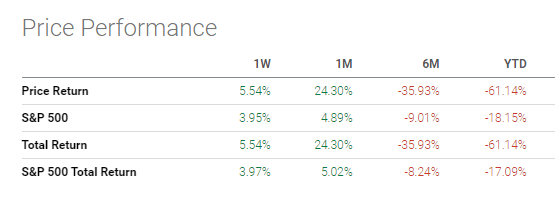

Momentum-wise, TASK has an emerging rebound story. The +24.30% one-month price performance soundly beats S&P 500’s 4.89%.

Seeking Alpha

Management Guidance Is Not Always Accurate, Trust Statistical Patterns

This recent reversal of investor sentiment is comprehensible. TaskUs is financially healthy that it has a plan to do a $100 million share buyback. I suspect that this intention to buy back Class A shares is why management/owners guided for below consensus for FY 2022.

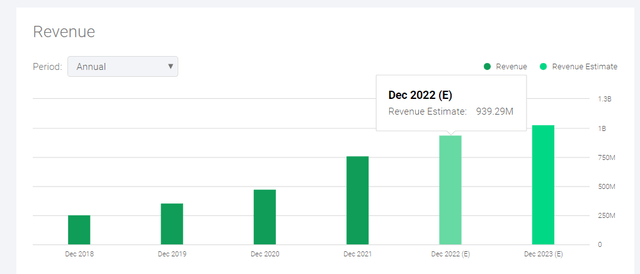

The 3-year revenue CAGR of 44% convinced me that TaskUs could outperform the projected revenue numbers below. The projected F2022 revenue is only $939.29 million. This does not respect the statistical pattern and forward trend of that 3-year CAGR achievement. Multiply F2021 revenue of $760.7 million by 1.4, and we get greater than $1 billion for F2022.

Statistical probability has no intention to do any share buybacks. It does not get paid to make conservative, self-serving forward sales guidance. Going forward, a good Q3 earnings beat could again push TASK beyond $25.

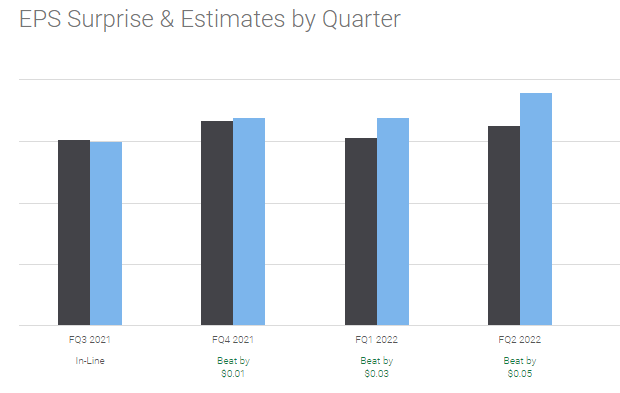

The statistical chart below is prima facie evidence that TaskUs has been beating estimates since its IPO. Three consecutive quarters of earnings surprises validate my supposition that TASK might do Q3 and Q4 earnings beat.

Seeking Alpha

Let Us Not Be Pessimistic

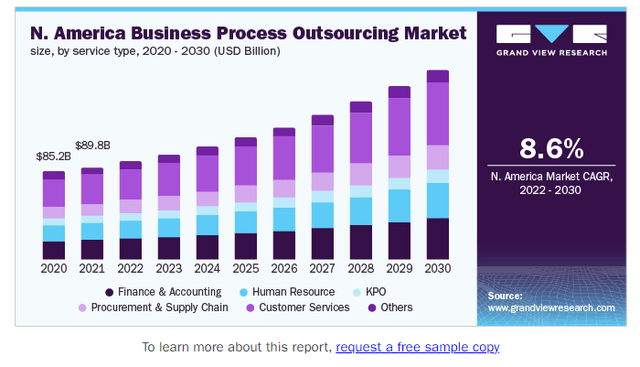

I am optimistic about TaskUs Inc.’s capability to surprise us all. The decades-old global $245.9 billion BPO industry is still growing at 9.1% CAGR. TASK’s has a diversified international presence. It has BPO operations in the United States, Europe, India, Philippines, Mexico, Malaysia, Colombia, and Taiwan. This brilliant geographical distribution of its revenue streams is why TASK will persist as a high-growth stock.

The decision to operate BPO units in the high-salary United States is pretty understandable. The chart below explains why the United States remains an important growth driver for TaskUs Inc.

The cheaper wages of the Philippines, India, Mexico, and Colombia could eventually improve the low margins of TaskUs Inc. The low TTM 5.48% net income margin of TASK is probably why its reign above $50 price level was short-lived.

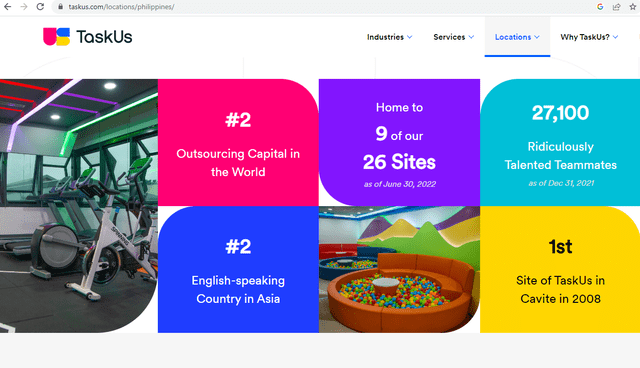

I still reside in the Philippines. My buy thesis for TASK is because it employs 27,100 Filipino employees. TaskUs, Inc. has been operating in my country since 2008. Due to the much bigger population of India, the Philippines is only the no. 2 English-speaking country in Asia. As of June 30, 2022, TaskUs has 45k employees in the world. The Philippines, therefore, likely is the biggest workforce for TaskUs. This is great. We Filipinos are very industrious and loyal.

You should go long TASK because management & owners are generous to their employees. This game-changer attitude toward employees is probably why more than 27k of my Filipino brethren decided to work for TaskUs, Inc. TaskUs is not even among the top 20 biggest BPO companies in the world.

Giving equity to managers/leaders (and one-time cash bonuses to employees) after the successful 2021 IPO is why you should go long TASK. There were only around 30k employees on June 30, 2021. The IPO proceeds were spent wisely. It hired 15k more employees. This substantial number of additional workers is fueling that 59.78% TTM revenue CAGR. It is also the reason why I expect TaskUs to wrap up F2022 with more than $1 billion in revenue.

The BPO business is a numbers game. The more employees you have, the faster you can grow your sales/revenue. The faster you can grow your topline, the better chance that you could improve your bottom-line. The faster its managers can grow sales and net income, the faster TASK can rebound to over $30.

Technical Indicators Are Favorable

My fearless buy recommendation for TASK is thanks to its bullish EMA averages. The EMA chart below has been on the upside trend since early October. It is a very bullish indicator when TASK’s 5-day EMA of 20.21 is higher than its 13-day, 20-day, and 50-day averages.

My other favorite market emotional indicator is RSI. In spite of the huge 1-month +24% run, TASK’s RSI score is only 64.17. It hasn’t breached the oversold score of 70. Better go long TASK before its RSI goes 70 or higher. Technical indicators are good metrics to measure the general investing public’s emotional direction. EMA and RSI are easy to understand. Both are bullish for TASK.

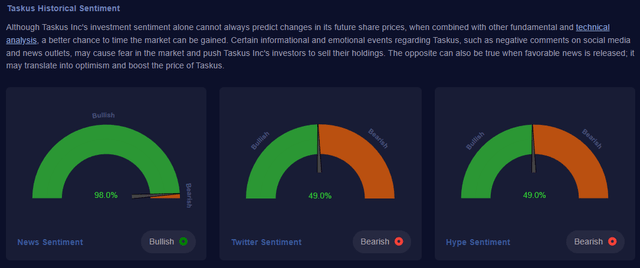

Since investing is subject to platforms like Seeking Alpha and Twitter, I’m proud to say the propaganda grade for TaskUs Inc. is not that bad.

Motek Moyen’s Contributor Account at Macroaxis.com

Is TASK Safe?

Investing in TaskUs is 100% safe. It is a 13-year-old company that only had its IPO last year. The original two founders are still at the helm. The generous equity given to top and low management personnel is strong incentive for salaried team members to work their butt off.

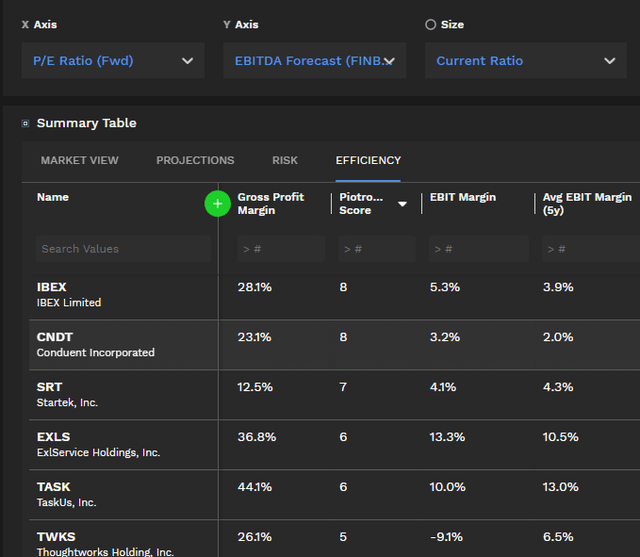

TASK touts an Altman Z-score of 6.61. Any company that has a Z-score of 4 or higher is already not going to go bankrupt anytime soon. In terms of efficiency vs. value factor, I am happy to report that TaskUs boasts a Piotroski F-score of 6, near the perfect score of 9. Compare the efficiency stats of TASK to its BPO/outsourced business peers below. TaskUs has better efficiency.

Motek Moyen’s Finbox.io VIP Account

My Verdict

The much lower valuation ratios of TaskUs, Inc, should inspire us to go long its stock. The very high 44% 3-year CAGR is another compelling reason to invest in this company.

The big increase in number of employees after its June 2021 IPO means the cash raised is being spent on expanding its manpower size. The decent Z-score and F-score of TaskUs makes it a solid investment. TaskUs can wrap up 2022 with more than $1 billion sales based on its historical revenue performance.

Seeking Alpha readers who know me since 2013 know that I love companies who sell Artificial Intelligence services/solutions/products. My buy rating for TASK is because it has matured beyond its traditional BPO business model. TaskUs offers outsourced AI and data collection/annotation/evaluation services. An AI-expanding company that is profitable and has a forward P/E less than 20x, should be attractive to value and growth-focused investors.

The wordings say TaskUs will provide the best quality human intelligence to power AI and ML. It means they have a horde of Filipino and Indian programmers making Python, R, or Julia on-site or cloud-based AI and ML software for rent.

Hiring more affordable Filipinos, Latinos and Indians while reducing its BPO presence in expensive labor markets like the U.S. and Europe might improve that low 5.48% net income margin. I can fake an American accent, even though I never worked for a BPO before. The Philippines now has superfast fiber and 5G internet services. Fire the Americans and Europeans and hire American accent capable Filipinos/Indians/Latinos.

Be the first to comment