courtneyk

SEGRO (OTCPK:SEGXF), the UK’s largest listed property company, recently released a surprisingly positive Q3 2022 trading update despite the challenging macro backdrop and declining asset valuations. The standout was another positive quarter of rent roll growth at +GBP20m backed by strong occupier demand, as reflected by the performance across new lettings and indexation, as well as additions to the development program.

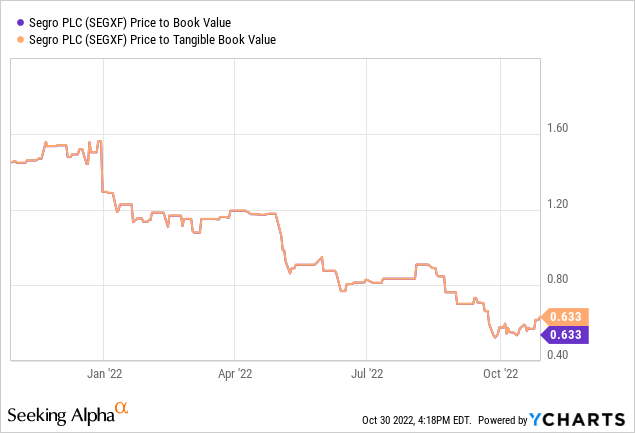

While SEGRO remains exposed to a near-term downturn, the long-term opportunity to compound rental income in the double-digits and unlock value from its development pipeline remains intact, in my view. Plus, a reversion to market rents (which have moved higher in line with rates) should support lease income as more leases roll off in the coming months. With SEGRO stock now trading at a wide 30-40% discount to its book value despite having one of the more resilient balance sheets in the space, I suspect too much pessimism has been priced in here.

A Resilient Operational Update Despite the Worsening Backdrop

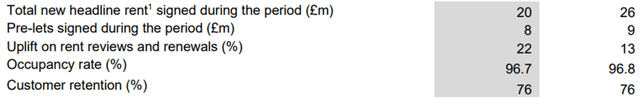

A confluence of strong occupancy and tight supply in the market is supporting SEGRO’s rental growth for now, allowing it to defy the macro weakness once again in Q3. There are signs of weakness emerging, though, with the ~GBP20m of rental income added for the quarter representing a deceleration YoY (recall that Q3 2021 saw rental income growth of +GBP26mn). The quarterly figure also incorporates ~GBP8m of new, unconditional pre-lets and lettings of developments ahead of completion, without which the YoY deceleration would have been steeper. Still, the +GBP76m of rental growth YTD remains well above the prior year’s +GBP64m, keeping the positive momentum in rent roll growth sustained over the last five years intact.

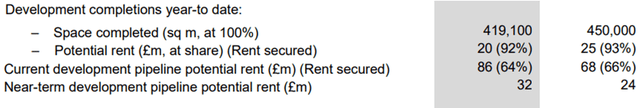

SEGRO also deserves credit for maintaining good development progress, with more new pre-lets signed since H1 2022. As a result, developments under construction as of end-September imply ~GBP86m of headline rent in the pipeline – a step up from the ~GBP68mn last year. How much of that potential can be unlocked is a concern, however, with the anticipated yield on cost of pipeline projects already down ~50bps YoY to 6.3%. Management confirmed as much, citing “increases in interest rates and the volatile macro-economic environment have reduced volumes in the investment markets, causing asset prices to soften in the third quarter”. The ~10% decline in UK industrial capital values (per CBRE’s Index) during the quarter is hardly a positive signal as well, although the overall downside risk is helped by the >60% pre-let composition of the pipeline.

A Relatively Well-Insulated Balance Sheet

With the BoE in the midst of a major rate hike cycle, debt costs are rising – yet, SEGRO only saw its weighted average cost of debt increase to 2.1% in Q3 (from 1.6% in H1 2022). The key to this resilience is the company’s relatively long debt maturities, as well as the high proportion of fixed-rate debt within its capital structure (including hedges). Per disclosures, a ~100 bps increase in the base rate would only increase the cost of debt by ~24 bps. With the company also having no significant debt maturity until 2026, it has ample runway to navigate near-term hikes. Plus, the company’s EUR-denominated debt is also key – it not only keeps the relative cost of capital low but also keeps development activity accretive through a rising rate environment. In essence, SEGRO has one of the most well-insulated balance sheets in the UK against a rate hike cycle and should, thus, continue to benefit from a relatively low cost of capital (WACC) in the coming quarters.

Lower Asset Values Ahead of a Potential Recession

SEGRO’s balance sheet makes it a prime candidate within the sector to navigate a decline in property values going forward. Signs of a downturn are already emerging in the UK EPRA Nareit Index, which has fallen significantly off its cyclical peak in anticipation of a UK recession. Similarly, CBRE data indicates UK industrial capital values have already seen ~10% markdowns in Q3. Expect yields to follow soon – in many cases, they have fallen below the forward terminal risk-free rate and need to be adjusted in line with slowing (or negative) GDP growth estimates. An environment of expanding near-term yields and slower rental value growth estimates will weigh on the UK property sector, but defensive names like SEGRO should command a premium.

To be clear, SEGRO will not be spared. The accelerated asset value declines are the result of the rising funding costs and until inflation gets back under control, further markdowns are very likely from here. So while SEGRO’s insulation against rising rates (relative to its UK peers) should mitigate any funding or solvency risks, its development activity will inevitably slow and so will its growth (note development property and land tend to be more sensitive to fluctuations in end value estimates). In line with this view, I expect the GBP424m of land acquisitions in Q3 to be the last for a while (vs completed disposals of GBP109m), as more conservatism on land acquisitions prevails amid falling asset values.

Weathering the Storm

Coming off a solid Q3 update, SEGRO looks set to outperform on rental growth and capital values through an increasingly uncertain macroeconomic outlook. With rates likely to rise further in the coming months, the company’s relatively resilient balance sheet stands out. For one, the debt maturity profile is well above peers at ~nine years, largely shielding SEGRO from having to raise debt at higher rates. Plus, the debt stack is also mostly fixed, allowing for a below-market weighted average interest rate of <2%. Yes, growth will slow in a recession, but the stock’s underperformance YTD already reflects this view, and the valuation is now at very attractive levels relative to a high-quality book. Given SEGRO’s ability to compound a predictable earnings stream through the cycles remains intact, the risk/reward strikes me as favorable here.

Be the first to comment