halbergman/E+ via Getty Images

During difficult economic times, one attractive avenue for investors to consider is acquiring stock in REITs. These tax-advantaged entities, by their very nature of owning real estate that is expected to generate consistent and growing cash flows over time, can offer attractive cash payouts monthly or quarterly, while also providing the stability that helps investors sleep soundly at night. But not every REIT has been treated well during this downturn. One great example of an enterprise that was hurt is LXP Industrial Trust (NYSE:LXP). Admittedly, some of this pain was likely warranted. However, shares are now cheap enough that they are beginning to look fundamentally attractive. Because of this, I have decided to increase my rating on the business from a ‘hold’ to a ‘buy’.

Through the pain can come opportunity

The last time I wrote an article about LXP Industrial Trust was in November of 2021. In that article, I made the case that the company had had a nice run in recent months. Leading up to that point, shares of the company had risen significantly, a move that caused me to become more cautious about the business moving forward. Because of this, I ultimately rated the enterprise a ‘hold’, meaning that I felt its returns would more or less match the broader market moving forward. Back then, I doubt many investors would have imagined the kind of pain that we would be seeing today. However, investors in LXP Industrial Trust have been particularly hard hit. While the S&P 500 has generated a loss of 19.6%, shares of this REIT have resulted in a loss for investors of 30.5%.

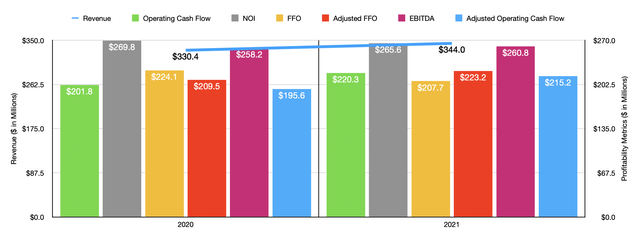

Given this return disparity, it’s natural to think that perhaps the fundamental performance of LXP Industrial Trust has suffered. And to an extent, that is exactly what happened. But before we get into the results experienced so far this year, we should recap what happened in 2021. After all, when I last wrote about the firm, we only had data covering through the first nine months of the company’s 2021 fiscal year. Today, that data extends through the first quarter of 2022. During the 2021 fiscal year, revenue for the company came in at $344 million. That translates to a year-over-year growth rate of 4.1% compared to the $330.4 million generated just one year earlier. This marks the third year in a row in which the company saw a sequential increase in revenue, before which financial performance had been rather volatile.

Just as revenue increased, cash flow followed suit. Operating cash flow for 2021 came in at $220.3 million. That compares favorably to the $201.8 million generated in 2020, and it’s the highest cash flow figure reported by the company since 2017. On an adjusted basis, this metric increased nicely, climbing from $195.6 million to $215.2 million. Net operating income, also known as NOI, actually decreased for the year, dropping from $269.8 million to $265.6 million. Other profitability metrics weakened as well. FFO, or funds from operations, dipped from $224.2 million to $207.7 million, but the adjusted measure of this improved, rising from $209.5 million to $223.2 million. Meanwhile, EBITDA for the company went from $258.2 million in 2020 to $260.8 million last year.

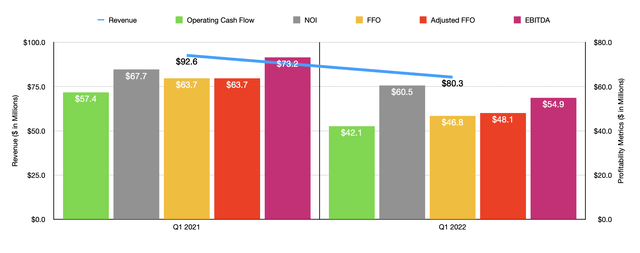

Investors hoping that the 2022 fiscal year might yield further upside are likely sorely disappointed right now. In the first quarter of the year, the only quarter for which data is available, revenue came in at $80.3 million. That’s 13.3% below the $92.6 million generated in the first quarter of 2021. Management did not provide that much in detail about this. But they did say that of the $12.3 million decrease in revenue experienced, $10.9 million was attributed to a decrease in termination income. What this means is that revenue was artificially propped up in the first quarter of 2021 because of certain customers terminating their leases and having to pay for the right to do so.

Knowing the cause of the revenue decline, it should be no surprise that profitability for the company dropped so far this year. After all, termination income is extremely high margin, so most of the income it attributed to last year’s results flowed to the company’s bottom line then. As a result of all of this, operating cash flow in the latest quarter came in at $42.1 million. That compares to the $57.4 million generated just one year earlier. In its quarterly report, management does not provide a specific breakdown of the components of operating cash flow. Because of this, I cannot provide an adjusted figure for this. Other profitability metrics have also worsened, with NOI dropping from $67.7 million to $60.5 million, FFO declining from $63.7 million to $46.8 million, and adjusted FFO dropping from $63.7 million to $48.1 million. Meanwhile, EBITDA also plunged, dropping from $73.2 million to $54.9 million.

Unfortunately, management has not provided any significant guidance covering the current fiscal year. The only thing they said is that adjusted FFO should be between $0.64 and $0.68 per share. At the midpoint, this implies adjusted FFO of $189.2 million. If we assume that other profitability metrics follow a similar trajectory, then FFO should be $176 million. Adjusted operating cash flow should be around $182.4 million, while NOI should come in at around $225.1 million. Finally, EBITDA for the company should total roughly $221.1 million for the year.

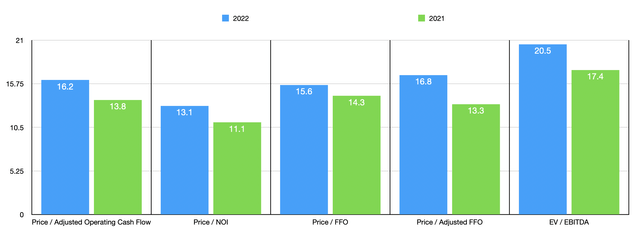

Using these estimates, we can easily value the business. On a price-to-adjusted operating cash flow basis, the company is trading at a multiple of 16.2. This compares to the 13.8 reading we get if we rely on 2021 results. The price to NOI multiple, meanwhile, should climb from 11.1 using last year’s results to 13.1 this year. The price to FFO multiple should also increase, inching up from 14.3 to 15.6. On an adjusted basis, this metric should grow from 13.3 to 16.8. And finally, the EV to EBITDA multiple for the firm should increase from 17.4 To 20.5. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 6.3 to a high of 40. In this case, compared to our 2022 estimates, three of the companies were cheaper than LXP Industrial Trust. Meanwhile, using the EV to EBITDA approach, the range was from 17 to 31.2. In this case, two of the five companies were cheaper than our prospect.

| Company | Price/Operating | EV/EBITDA |

| LXP Industrial Trust | 13.8 | 17.4 |

| Innovative Industrial Properties (IIPR) | 13.9 | 17.5 |

| Terreno Realty Corporation (TRNO) | 30.2 | 29.3 |

| Industrial Logistics Properties Trust (ILPT) | 6.3 | 31.2 |

| Plymouth Industrial REIT (PLYM) | 10.3 | 21.2 |

| INDUS Realty Trust (INDT) | 40.0 | 17.0 |

One other thing I would like to touch on is that management is making some interesting moves. For starters, recently, the company acquired 1.24 million shares of stock on the market for a combined $16.6 million. Compared to the size of the company as a whole, this is not all that large. However, any sort of share buyback program should prove beneficial for shareholders. In addition to this, the company also, in January of this year, announced that it received a letter from Land & Buildings Investment Management, LLC, which offered to acquire the enterprise for $16 per share in cash. At that time, that translated to a premium of 11% compared to the company’s prior closing share price. Fast-forward to today, and the premium has increased to 53.6% as shares of the company have fallen significantly. The company also, following the announcement of the receipt of this letter, initiated a process whereby it examined strategic alternatives for the company’s assets. But in early April of this year, management said that the board of trustees dedicated to that process determined that the entity would be best serving its investors by remaining an independent company and executing its current growth strategy while completing the final stages of its portfolio transformation that has seen the company go from having 16% of its assets dedicated to the warehouse and distribution category of properties in 2015 to 98% by the end of the latest quarter.

Takeaway

Based on the data provided, I understand why some investors might be wary about LXP Industrial Trust at this time. The company has not had the greatest operating history and recent financial performance, on the bottom line, has been negatively impacted because of artificially high-performance last year. Shares are not exactly cheap, but they are far from expensive. This is especially true when you consider how strong the cash flows the entity generates are. Add on top of this the interest of outside parties in potentially acquiring the enterprise, and I do believe that now could be a decent time to consider buying into the firm.

Be the first to comment