LilliDay/E+ via Getty Images

NY Fed: Very low recession probability

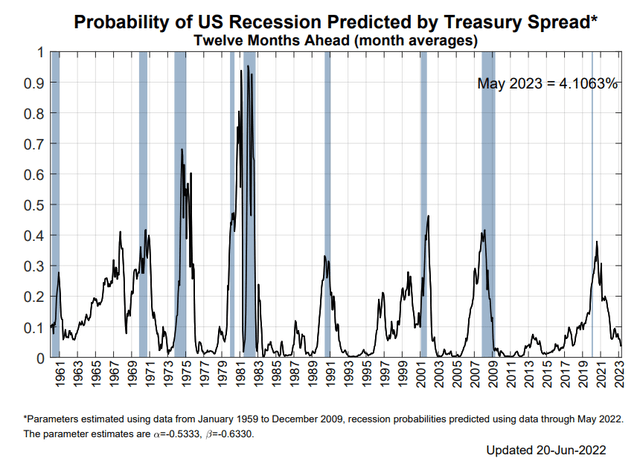

The New York Fed just released its’ updated U.S. recession probability for the next 12 months, or specifically until May 2023, and it’s 4.10%, which is a very low number. In other words, don’t expect an imminent recession over the next 12 months.

Here is the historical chart with the recession prediction probability. Note, the probability over 30% historically results in a recession.

NY Fed: US recession prediction model

First, let’s explain the model that the NY Fed uses to predict the U.S. recession. The NY Fed uses the statistical methodology called probit or logit to predict the probability of a recession using the yield curve spread as the sole predictor.

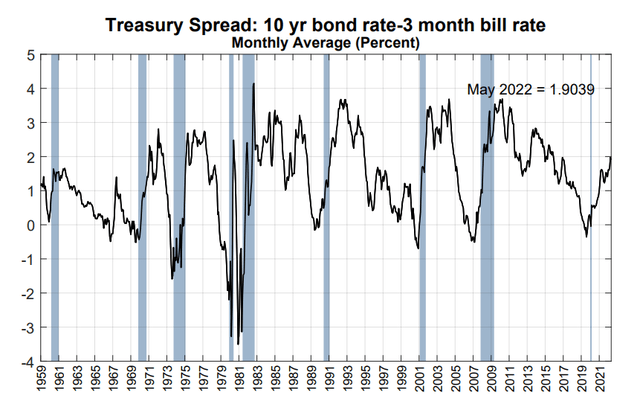

Specifically, the Fed uses the difference between the 10Y Treasury Bond yield and the 3-Month Treasury Bill yield as the independent predictor variable, and codes the actual recession 12 months ahead as a binary dependent variable: 1 = recession and 0= no recession.

The NY Fed probit/logit model finds that an inverted yield curve (10y-3mo) accurately predicts the recession 12 months ahead. Specifically, the NY Fed states:

“the yield curve has predicted essentially every U.S. recession since 1950 with only one “false” signal, which preceded the credit crunch and slowdown in production in 1967.”

Here is the 10Y-3mo yield curve spread chart provided by the NY Fed where the shaded area indicates the recession:

NY Fed further states that (emphasis added):

“…However, since 1960, a yield curve inversion (as measured by the difference between ten-year and three-month Treasury rates) has preceded every recession on record. In fact, in terms of monthly averages, the ten-year rate was at least 12 basis points below the three-month rate before every recession in that period. In contrast, very low positive levels of the spread have been observed without a subsequent recession. Specifically, there were two episodes in the 1990s in which the term spread attained very low positive levels (42 and 12 basis points respectively), but did not invert. In both of those cases, economic activity continued unabated after the troughs or low points for the spread.”

In other words, NY Fed suggest that the 10Y-3mo curve has to be inverted to predict a recession, on average by 12bpt. A very narrow or flat 10y-3mo spread does not predict a recession.

How this contradicts with the popular Wall Street model?

The financial media has been overwhelmed lately with the calls for the next recession, and for the valid reason. Specifically, Wall Street economists also use the probit/logit model to predict the recession, however, they use the spread between the 10Y Treasury Bond yield and the 2Y Treasury Bond yield as the sole predictor variable.

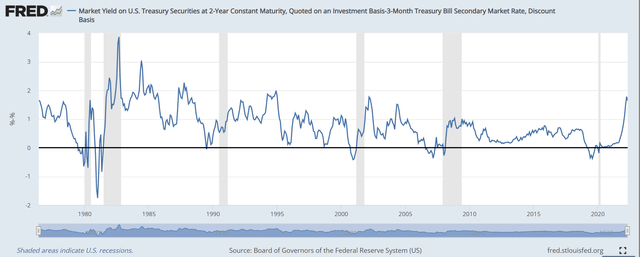

Note, the 10Y-2Y spread has already briefly inverted in March, and also reinverted briefly just a few weeks ago. Currently, it’s barely positive at 0.11%. Thus, naturally, it you plug-in the 10Y-2Y spread into the probit/logit model, you will get a much higher recession probability. This contradicts the Fed’s model prediction.

So, what spread to use to predict the recession? The NY Fed acknowledges the issue and states (emphasis added):

“…most term spreads are highly correlated and provide similar information about the real economy, so the particular choices with regard to maturity amount mainly to fine tuning and not to reversal of results. The caveat is that a benchmark that works for one spread may not work for another. For instance, the ten-year minus two-year spread may invert earlier than the ten-year minus three-month spread, which tends to be larger.”

Wall Street prefers to use the 10Y-2Y spread because it provides the advanced warning signs. However, at the same time, the 10Y-2Y spread is more speculative, more volatile, and thus prone to providing the false positives.

Specifically, the 3-Month Bill yield is based on the actual or an imminent Federal Funds rate. The 2-Year Treasury Bond yield is based on the expected average Federal Funds rate (monetary policy) over the next 2 years. Thus, during the periods when the Fed is expected to aggressively hike, the 2Y-3mo spread will be very high, and thus, provide the contrasting recession prediction in the probit/logit model, compared to the 10Y-3mo model.

Here is the current chart showing the 2Y-3mo spread. It’s historically at the high level just below 2%, as in the mid-1990’s and mid-1980s – where both of these cases produced the false recession signs.

Implications for investors

The question of interest to all stock market investors is whether we will have a recession, and thus, a much deeper recessionary bear market.

In my recent article, I state that the probability of an imminent recession is low, and thus I don’t expect (what I define as) the Phase 2 (recessionary) selloff in S&P500 (SPY) (SPX) (SP500). Clear, this assessment is based on the NY Fed’s model (which I also update weekly).

With that said, the market expects the Fed to hike to 3.43% by the end of 2022 (based on Federal Funds futures). If this prediction comes true, the yield on the 3-Month bill will be around 3.5%.

Currently, the yield on 10-Year Treasury Bond is 3.04%, and if it stays in this area 3-3.3%, the 10Y-3mo will be inverted by the end of the year. Thus, the recession in late 2023 will become very likely – based on the NY Fed model.

So, I can argue that the probability in an imminent recession is low, but the recession is coming, probably in late 2023 or early 2024, if the Fed executes the currently expected monetary policy tightening.

However, this a speculative assessment and there is a big IF. The Fed has also indicated the willingness to pause in September if it gets “a few months of positive inflation data.” Thus, the Fed could pause at 2.25-2.75% range, and if the 10Y yield stays above 2.75%, we could avoid a recession and have a soft landing.

Thus, my recommendation is still neutral on stocks (QQQ) (IWM) until we get more clarity on inflation and the Fed policy. The good news is that commodity prices have started falling (CL1:COM) – this will likely help to ease the headline CPI inflation and allow the Fed to pause. Thus, my bias is bullish.

Be the first to comment