shapecharge/E+ via Getty Images

A Quick Take On Lightspeed Commerce

Lightspeed Commerce (NYSE:LSPD) reported its FQ2 2023 financial results on November 3, 2022, beating revenue and EPS estimates.

The company provides a platform for omnichannel commerce for businesses worldwide.

Given management’s caution about forward revenue and its inability to make serious progress toward operating breakeven despite its goal to do so, I remain cautious about LSPD.

I’m on Hold for LSPD in the near term.

Lightspeed Commerce Overview

Montreal, Canada,-based Lightspeed was founded in 2005 to develop a commerce platform of various functions for small and medium companies worldwide.

The firm is headed by Jean-Paul Chauvet, who previously held senior roles at Atex Group and Nstein Technologies.

The company’s primary offerings include

-

Point of Sale

-

Menu management

-

Employee management

-

Inventory management

-

Analytics

-

Payment processing

-

Related hardware

The firm acquires customers primarily in the retail, restaurant and golf course industries directly as well as through reseller partners.

Lightspeed Commerce’s Market and Competition

According to a 2018 market research report by Grand View Research, the global restaurant management software market is forecast to reach nearly $7 billion by 2025.

This represents a forecast CAGR of 14.6% from 2019 to 2025.

The main drivers for this expected growth are a growing awareness by restaurant operators of the benefits of increased efficiencies from software systems.

Also, the COVID-19 pandemic will bring forward significant demand for integrated restaurant management systems in order to streamline processes while providing restaurant services in a more omnichannel approach to customers.

Major competitive or other industry participants include:

-

Block (SQ)

-

TouchBistro

-

Clover Network

-

Toast (TOST)

-

Oracle/Micros (ORCL)

-

NCR (NCR)

-

PAR Technology (PAR)

-

Heartland Payment Systems

-

Shift4 Payments (FOUR)

-

Fiserv (FISV)

-

FreedomPay

-

Olo (OLO)

-

Others

Lightspeed’s Recent Financial Performance

-

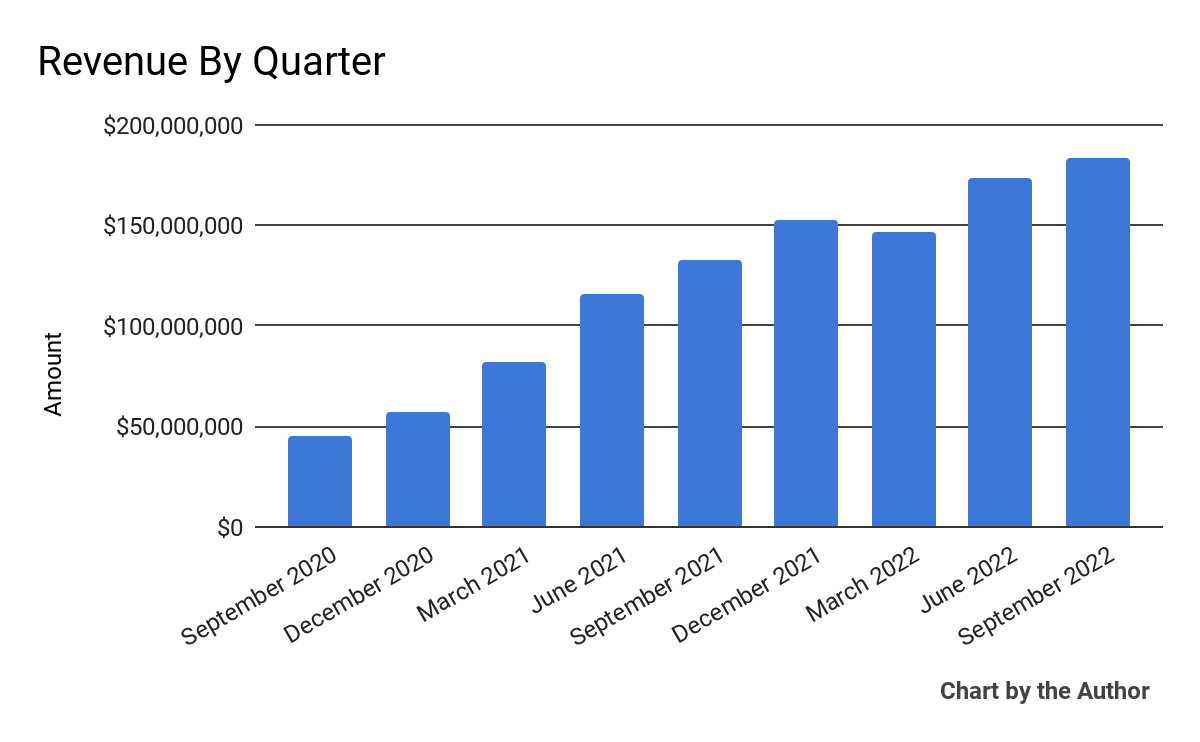

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

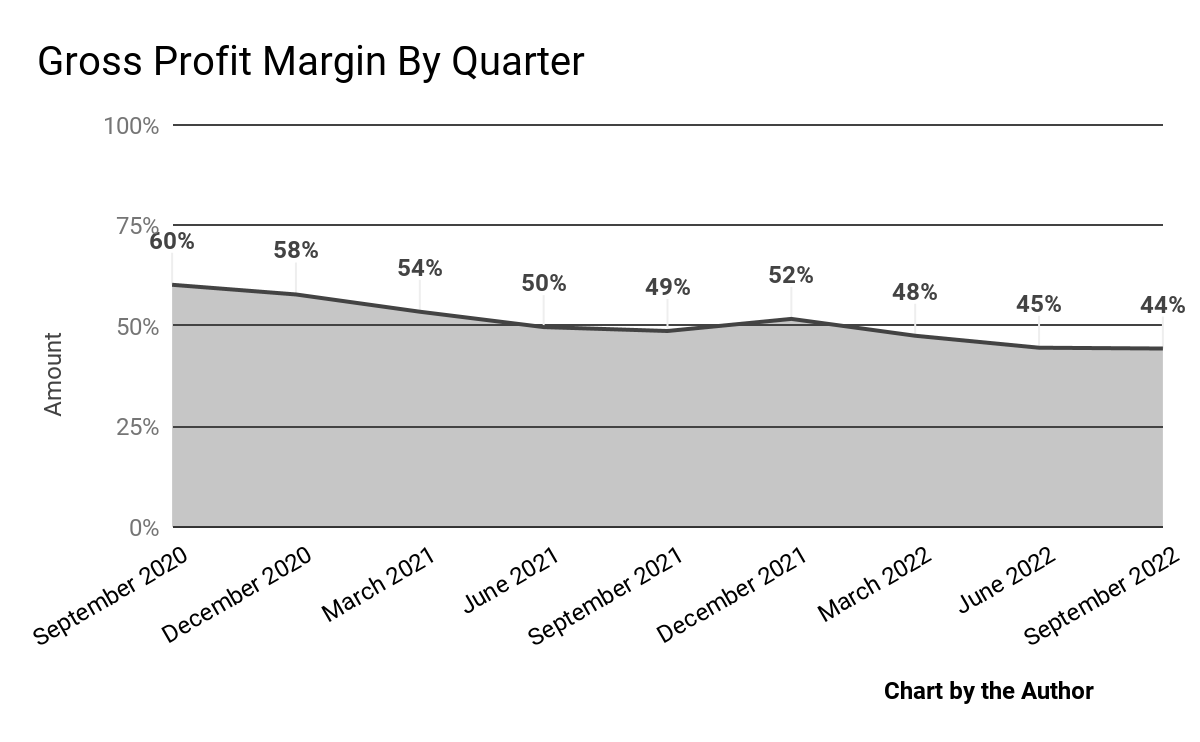

Gross profit margin by quarter has fallen in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

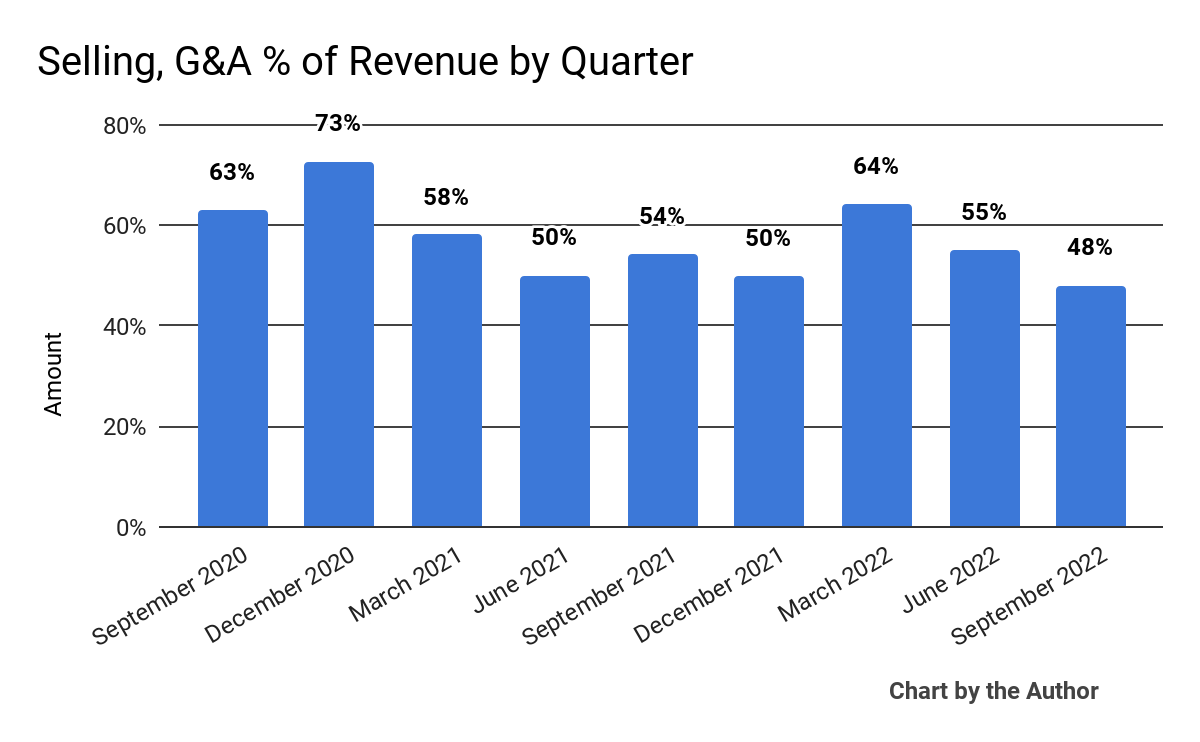

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower more recently:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

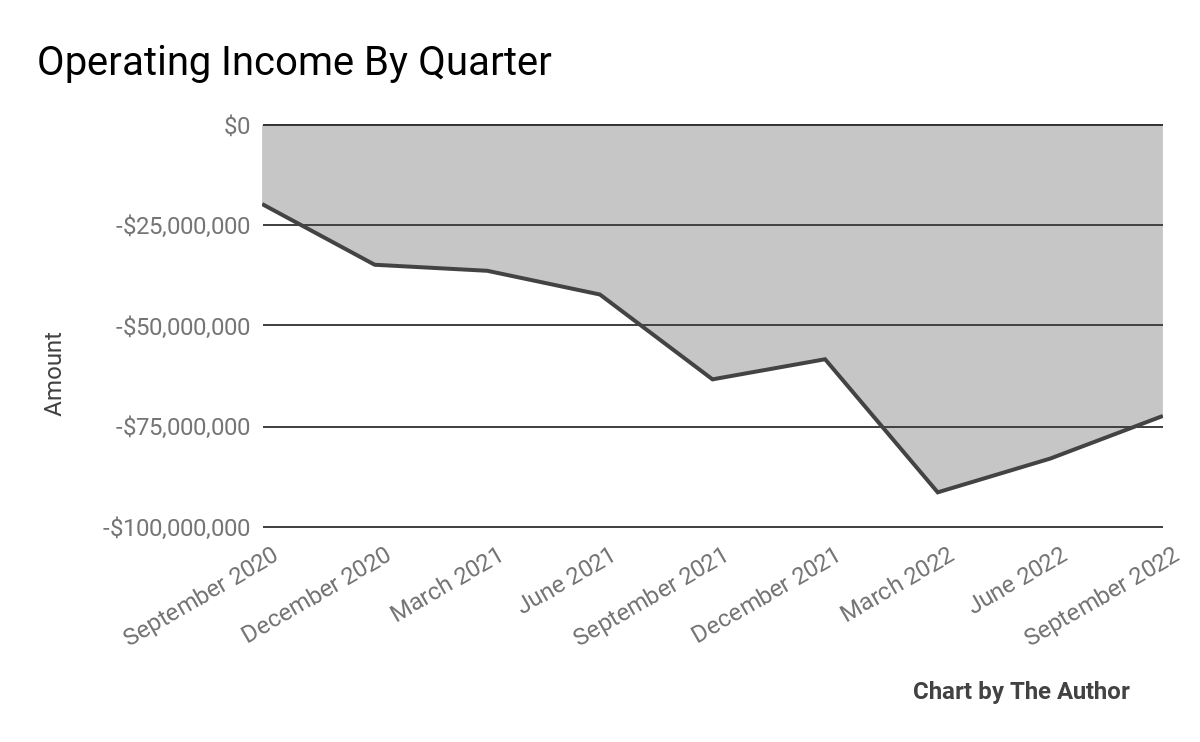

Operating losses by quarter have worsened in 2021 and 2022:

9 Quarter Operating Income (Seeking Alpha)

-

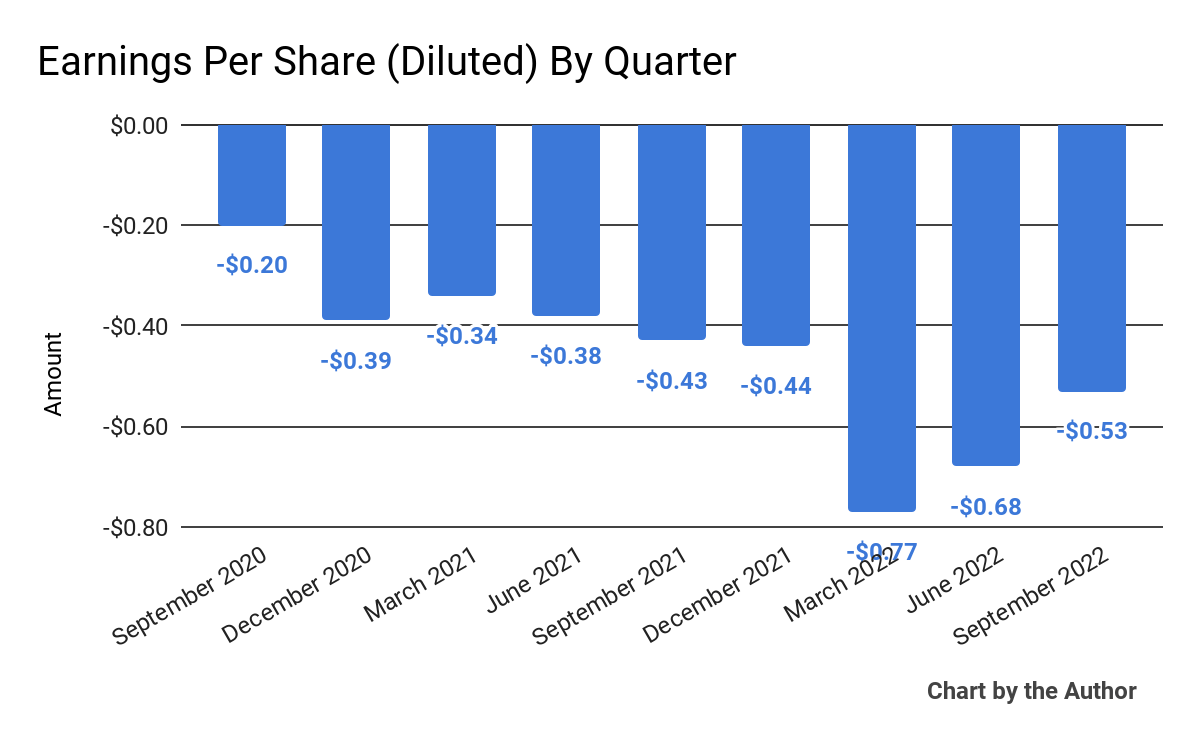

Earnings per share (Diluted) have also trended substantially negative in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

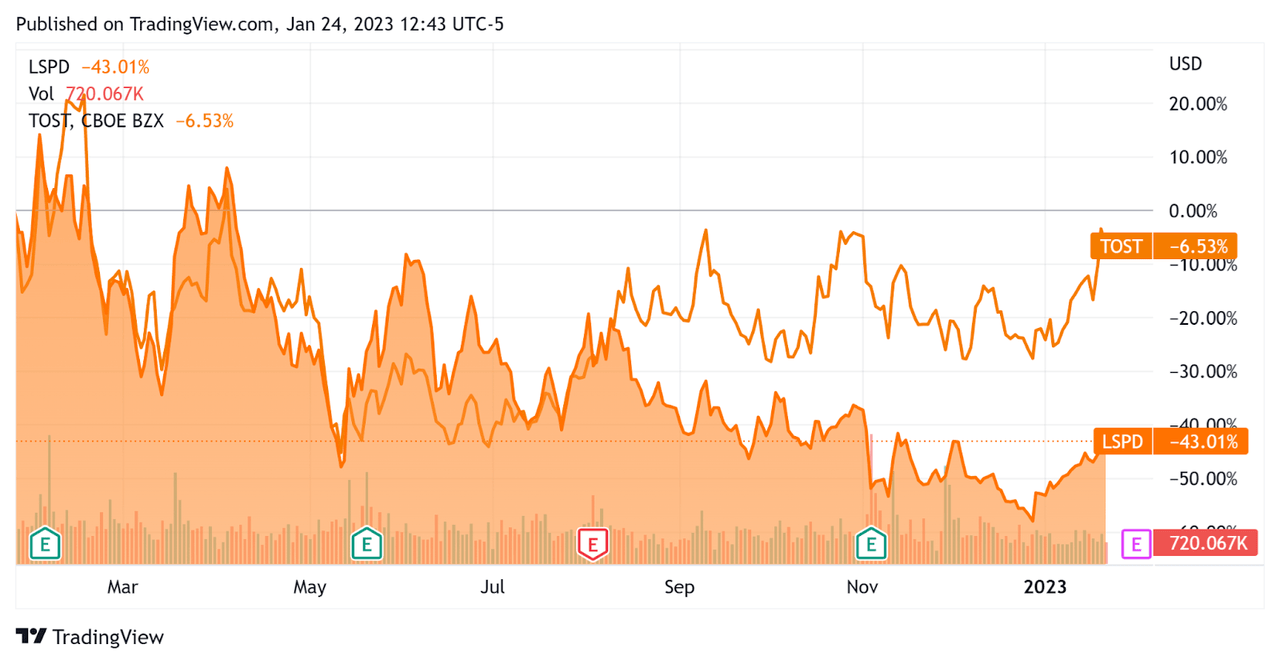

In the past 12 months, LSPD’s stock price has fallen 43% vs. that of Toast’s drop of around 6.5%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Lightspeed

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.5 |

|

Revenue Growth Rate |

68.8% |

|

Net Income Margin |

-54.9% |

|

GAAP EBITDA % |

-35.4% |

|

Market Capitalization |

$2,493,547,260 |

|

Enterprise Value |

$1,635,778,050 |

|

Operating Cash Flow |

-$116,851,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.42 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Toast; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Toast |

Lightspeed Commerce Inc. |

Variance |

|

Enterprise Value / Sales |

4.3 |

2.5 |

-42.2% |

|

Revenue Growth Rate |

72.4% |

68.8% |

-5.0% |

|

Net Income Margin |

-7.0% |

-54.9% |

681.2% |

|

Operating Cash Flow |

-$168,000,000 |

-$116,851,000 |

30.4% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

LSPD’s most recent GAAP Rule of 40 calculation was 33.4% as of FQ2 2023, so the firm is in need of some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

68.8% |

|

GAAP EBITDA % |

-35.4% |

|

Total |

33.4% |

(Source – Seeking Alpha)

Commentary On Lightspeed Commerce

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted its efforts in upselling customers on software and payments and produced ‘success in our target market of complex SMBs, especially among higher GTC customers.’

However, leadership noted that the macro environment has negatively impacted its business, although the twin challenges of inflationary effects on its customers combined with staff shortages making it more difficult for them to serve customers provides a strong use case for adopting LSPD’s solutions.

The company also seeks to simplify its offerings to its Retail and Restaurant systems and to drive the adoption of its payments services to the greatest degree possible.

As to its financial results, total revenue rose 37.9% year-over-year on an as-reported basis. The firm suffered foreign exchange headwinds due to the strong US dollar, although more recently, the dollar has been weakening, so this effect may wane.

Management did not disclose any specific company retention rate metrics but indicated that it is focusing on larger and more complex customers since they produce less churn over time.

The firm’s Rule of 40 results have been fair, with a strong revenue growth result offset by a significant operating loss contributing to a sub-par figure for this metric.

Operating losses remain heavy, although management has indicated a goal to achieve profitability.

For the balance sheet, the company ended the quarter with $862.6 million in cash and equivalents and no long-term debt.

Over the trailing twelve months, free cash used was $129.2 million, of which capital expenditures accounted for $12.3 million. The company paid a very elevated $145.5 million in stock-based compensation.

Looking ahead, for the full fiscal year 2023, management expects revenue to be $735 million at the midpoint of the range, reduced from previous guidance due to ‘a heightened level of caution.’

Adjusted EBITDA loss was unchanged at $37.5 million at the midpoint, although this figure does not include the company’s hefty stock-based compensation figures.

Regarding valuation, the market is valuing LSPD at an EV/Sales multiple of around 2.5x.

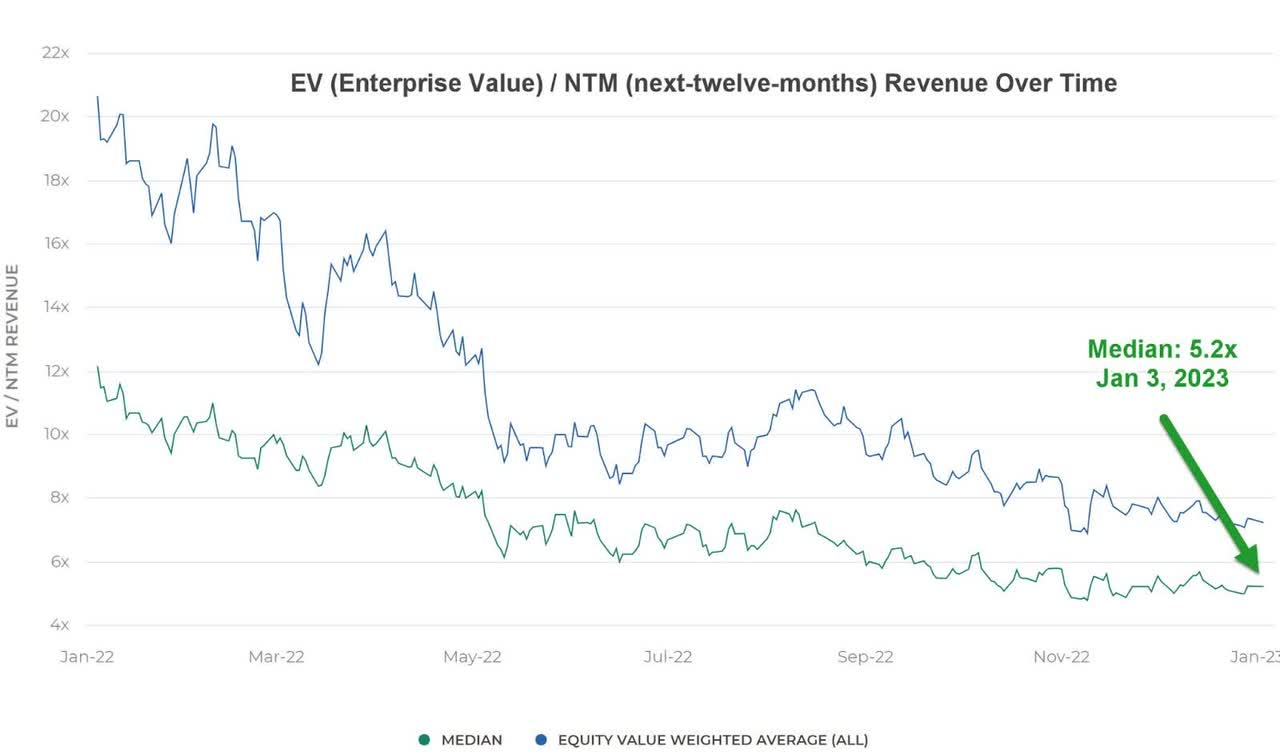

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 5.2x on January 3, 2023, as the chart shows here:

Enterprise Value Next Twelve Months Revenue Multiple (Meritech Capital)

So, by comparison, LSPD is currently valued by the market at a significant discount to the broader Meritech Capital Index, at least as of January 3, 2023.

The primary risk to the company’s outlook is a macroeconomic slowdown, which may produce slower sales cycles and reduce its revenue growth trajectory.

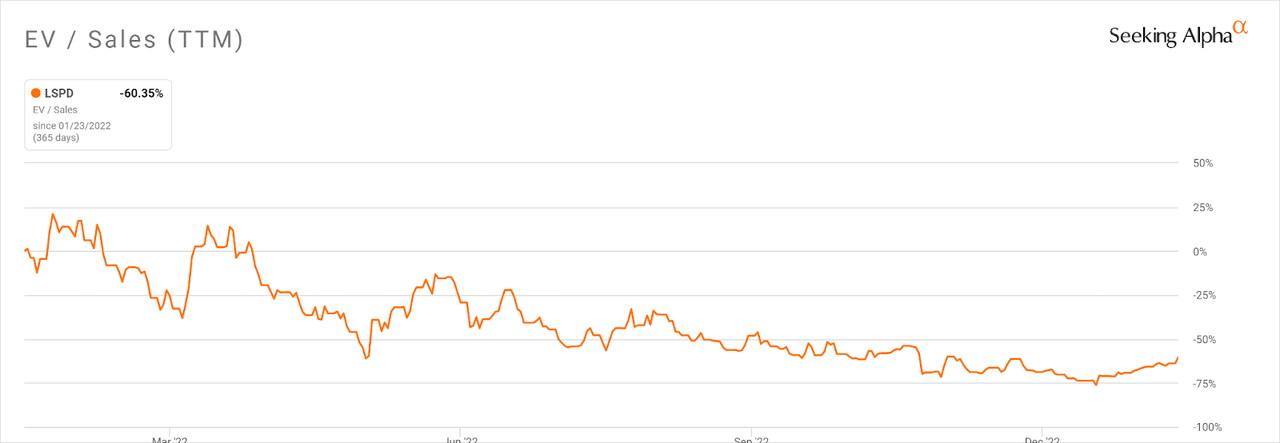

Notably, LSPD’s EV/Sales multiple [TTM] has compressed by a very high 60.4% in the past twelve months, as the Seeking Alpha chart shows here:

Enterprise Value / Sales Multiple (Seeking Alpha)

A potential upside catalyst to the stock could include a software downturn due in part to China’s reopening after dropping its Zero-COVID policies in recent weeks.

But given management’s caution about forward revenue and its inability to make serious progress toward operating breakeven despite its goal to do so, I remain cautious about LSPD.

I’m on Hold for LSPD in the near term.

Be the first to comment