wsfurlan/E+ via Getty Images

Recommendation

I recommend buying Leslie’s (NASDAQ:LESL). LESL is a heavyweight in an industry that is currently experiencing a paradigm shift, and has positioned itself for this shift through a large network of services in pool and spa care.

Business

LESL is a direct-to-consumer brand in the American pool and spa care world. It offers certified installation and repair services, both important in the maintenance of pools and spas. Alongside this, LESL offers a wide array of professional-grade products, exclusively possessed by the brand to its massive customer base of residential, professional and commercial customers.

Large and growing industry

The aftermarket pool and spa care market, which LESL is a part of, is one of the most stable, reliable, and defendable consumer markets.

More than 14 million pools and spas are in use in the United States, and this number has grown dramatically over the past few decades, providing strong evidence for the industry’s resilience. There will always be a need to perform routine maintenance on a pool or spa, regardless of when it was installed. It is estimated that the annual cost of upkeep for an in-ground pool is at least $24,000. The figures cited in LESL’s S-1 suggest that the average lifespan of today’s in-ground residential products has increased from 19 to 22 years. As the base of customers increases and the lifetime of products extends, I believe the aftermarket for both components and maintenance services is only going to grow.

The COVID-19 pandemic has contributed to this seismic shift in demand, as it has modified and accelerated secular trends in consumer behavior. Consumers are, on an increasing scale, adopting healthier lifestyles because they have been sensitized to a higher consciousness of sanitation and safety. Another trend in consumer behavior is their tendency to migrate to lower-density communities and spend more time indoors. LESL reaps the profit from the growth in demand, however, it could equally generate effective growth in its pool usage and maintenance needs from its customer base without depending on its new pool construction services.

Leader in the industry

For the past 57 years, LESL has built its reputation on meeting the needs of pool owners so that they can spend less time maintaining and more time unwinding. I believe LESL is unique in that it sells its products directly to consumers and operates stores and websites all over the United States. Its digital mobility is made possible by its all-encompassing digital platform, which features specialized e-commerce websites for each product, a transactional mobile app, and an online marketplace for businesses catering to the wants and needs of industry consumers. For perspective, LESL controls close to 15% of all aftermarket product spending in the residential sector. Its digital sales are five times as high as those of the next largest digital competitor, and its physical network is larger than the combined networks of its three largest competitors (source: S-1).

LESL has also set up the largest and most widely spread pool and spa care network in the country. Its facilities are placed in strategic, market-driven locations in the most populated parts of the country, especially in the Sunbelt.

By adopting digital methods, LESL has strengthened its position as a market leader. As the world becomes more and more digitally focused, consumers are demanding digitally enabled “smart” home options. Because of this, LESL has been hard at work creating an architecture for an integrated digital platform of proprietary websites catering to the needs of customers. I believe strategic investments in digitalization have put LESL in a position to serve customers via its cross-channel capabilities, allowing the company to capitalize on rising online demand while boosting overall network profitability.

The investments have clearly taken off and yielded great results. According to the S-1, LESL has a Voice of Customer [VoC] score of about 75% based on periodic surveys of consumer, showing that customers have a lot of love for the brand.

Strong direct relationships with key players in the ecosystem

Unlike most big brands, LESL prioritizes a direct relationship with pool and spa owners, including the professionals who serve them. It has a file of more than 10 million consumers on its integrated platform. By deploying its team of highly trained pool and spa experts, LESL is able to offer cutting-edge expert advice and product recommendations, ensuring a lasting relationship with customers. The all-inclusive nature of its services makes it nigh impossible for consumers to leave the ecosystem, contributing in no small measure to the Customer Retention Rate.

A loyalty membership program was also introduced by the company to further cement the relationship with its over 3 million customers. This is fantastic because it helps businesses keep tabs on things like customer preferences, order frequency, and pool profiles, which in turn improves the quality of recommendations and promotions, allows them to better predict the size of demand, and provides valuable data for calculating customer lifetime value. The effectiveness of LESL is demonstrated by the fact that loyalty members spend twice as much with LESL annually as non-loyalty members do.

Wide varieties of offerings

Over 80% of the products sold by LESL are required on a regular basis and are therefore considered non-discretionary purchases. By providing these items, LESL is able to forge lasting connections with its customers, keep tight reins on its supply chain, and reap healthy profits. I also think that LESL’s customers like it more because its own brands and specially made products are better than those of its competitors.

The LESL strategy is smart because it combines a wide range of products with different kinds of in-store and on-site services. For instance, they were the first to offer free in-store water testing and prescriptions for pool or spa water, a move that has resulted in increased foot traffic and customer loyalty.

Attractive growth profile and unit economics

LESL has exhibited 57 years of straight growth, which proves its ability to continually deliver solid financial outcomes. This expansion can be seen in all of the company’s operations, from installing residential pools to managing commercial spas. LESL’s success stems from the company’s skill at retaining and acquiring new customers. It has also been able to sustain its profit economics because of its size, vertical integration, and excellent operations. In addition, it is able to create substantial cash flow thanks to its low maintenance capital intensity, which provides for adaptability in capital allocation and the promotion of long-term shareholder value.

Valuation & model

LESL is a stable growth company. I believe LESL should continue to capture market share from smaller players as it further solidifies its position in the industry.

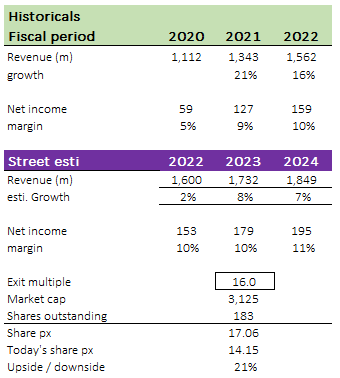

For FY22, I used management’s guidance since we are already coming to the end of the period. Moving forward, I expect LESL to continue growing at a stable rate as before, and its margin to slowly step up over time as it scales off its fixed cost base (i.e., incremental margins kick in). To sense-check my projections, my estimates are more or less in line with the street.

LESL currently trades at 16x forward earnings, which is rather fair in my opinion as that is where the S&P 500 trades at on average. This is especially given that LESL is a company in a rather mature industry.

With all my assumptions, I believe LESL should be worth $17 in FY23, which would yield investors a 1-year return of 21%.

Author’s own calculations

Risks

Competition

There’s a lot of rivalry in every field, and the pool and spa business is no exception. Original equipment manufacturers, regional merchants, and local merchants are examples of these competitors. Also, the lack of proprietary technologies or other entry obstacles mean that competition will only increase over time. Brick-and-mortar and internet stores could become strong rivals if they hone in on the sector at large and shake things up. This could have a huge influence on the company.

Recession

Despite LESL’s impressive expansion over the past few decades, the company’s future success ultimately rests on how consumers behave. It’s possible that in difficult economic times, fewer people may be looking to purchase pools, spas, or accessories for either. Potential factors include the expansion in the number of families who are eligible for a pool, the rising price of pool installation, and consumers’ willingness to spend more on luxuries. If the economy is struggling, consumers will put off maintenance and replacement purchases.

Summary

To conclude, I believe LESL is undervalued. The aftermarket pool and spa care industry is a stable and reliable market, with over 14 million pools and spas in use in the US. Leslie’s has established itself as a leader in the industry, with a digital platform and a large network of physical stores across the US. It also has strong relationships with key players in the ecosystem. The investments in digitalization have put Leslie’s in a position to serve customers via its cross-channel capabilities.

Be the first to comment