cemagraphics

It’s been about seven months since I wrote another bullish article on Sturm, Ruger & Company, Inc. (NYSE:RGR), and in that time the shares have returned a loss of about 8.6% against a loss of about 3.4% for the S&P 500. I thought I’d review the name yet again to see if it makes sense to buy more or not. I’ll make this determination by looking at the financial history here, and by looking at the valuation. Additionally, the company has just announced a special dividend, and I want to review the impact of that briefly also. A friend of mine who also owns shares expressed apprehension about the size of this dividend, and I want to work out whether his apprehension is well founded or whether he’s clutching his pearls needlessly tightly at the moment. Finally, in the article before last, I recommended selling the January 2023 puts with a strike of $45 for $1.75 each. Given that these will be expiring next month, I thought I’d review that trade again. In fact, I can’t wait to write about that trade.

I know my readers are a busy crowd. They have new frontiers of science to explore, supermodels to date, adventure travel to suffer through, along with countless other fascinating ways to spend their time. I too am busy with a record backlog of cat videos. Given that we’re all busy, I offer a “thesis statement” paragraph for my readers, where I reveal the highlights of my thinking in a pithy, punchy single paragraph. You’re welcome. This “thesis statement” is for people who may want a bit more than the title and bullet points, but who don’t want a full helping of “Doyle mojo.” I remain of the view that Sturm, Ruger is a great business. Revenue and net income in 2022 have been much lower than they were in 2021, but I think that reveals more about 2021 than it does about the current state of affairs. The company is much more profitable today than it has been at nearly any point over the past decade. Additionally, the capital structure remains very solid. After paying the upcoming special dividend, the company will have cash and short-term investments that represent “only” about 203% of total liabilities. This is a company that treats shareholders well, throws its nickels around like manhole covers, and so I remain a fan of the financial history here. Although the shares are no longer as cheap as they were, they remain quite inexpensive in my view. Finally, I did very well on the puts I wrote last February, and this reveals the “win-win” nature of short put options. The problem at the moment is that the premia on offer for reasonable, deep out of the money, strike prices is too thin to make selling puts attractive at the moment. For that reason, I think simply buying shares makes the most sense at the moment.

Financial Snapshot

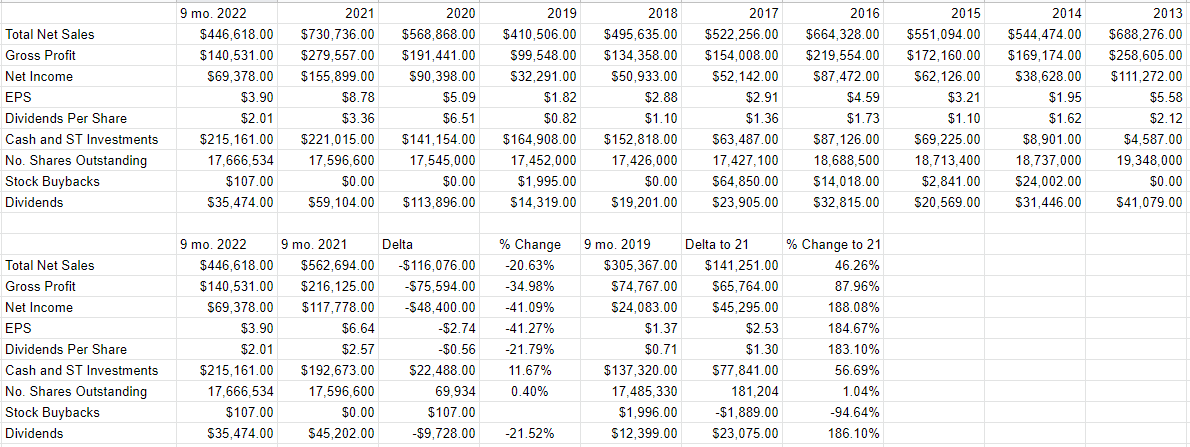

So far, the financial results for 2022 have been less good than the same period in 2021. Specifically, revenue for the first nine months of the year was down by about 21%, and net income was off by a whopping 41% compared to the same period last year. As a result, as of the end of Q3, the dividend had shrunk by just under 21% relative to the same period a year ago. On the bright side, the capital structure is one of the most solid I’ve seen. Specifically, cash and short-term securities dwarf total liabilities, and will continue to do so after the payment of the special dividend (see below).

I don’t want to be myopic in my analysis, though. I don’t think we should be surprised to have learned that 2022 was not as good as 2021, given that sales last year were fully 28.5% higher than they were in 2020, and were about $42.5 million higher than they were in 2013, which was the prior high-water mark for the decade. In other words, 2021 was a banner year, and any comparison with that period should be taken with a gargantuan grain of salt. When we compare the most recent period to the same point in 2019, for example, we see that sales and net income in 2022 were higher by 46.25%, and 188% (!) respectively. The company rewarded shareholders in 2022 by paying out an extra $23 million, which drove standard dividends per share higher by about 183%. In other words, 2022 has been a relatively good year in my view.

Writing once again of the dividend, the company has just announced a special dividend of $5 per share. This will be payable to shareholders of record on December 15, and will be payable on January 5 of 2023. For more information about this dividend, feel free to check out this link.

The market seems to have liked the news as the shares rallied about 10% on the news, and are up nicely as of this morning. My gut tells me that $5 per share is a great deal, so I decided to employ the skills not at all lovingly imparted to me by the good sisters at Holy Spirit School many, many, many decades ago to work out exactly how this will impact the capital structure. Sending $5 per share to all 17,666,534 shares will cost the company just over $88.3 million, which will drop the cash position down to something like $127 million. While this is quite a large drop in percentage terms, the capital structure will remain very strong after the dividend in my view. Specifically, after paying out the dividend, cash and short-term investments will still represent about 203% of total liabilities. This company had a very, very solid capital structure prior to the dividend, and it will have a very solid capital structure after the dividend. For my part, I don’t know if this was necessary, given that the shares were sporting a healthy yield prior to the decision. That written, I’m not gonna say “no” to this dividend.

So, I think the most recent period reveals once again what we should have always remembered when looking at this business. The business cycle exists. If that comes as a shock to you, you may be surprised to learn that water is wet, and that the sun rose in the East again this morning. Sales have risen and fallen over the years, yet the investment has remained very safe in my view for two related reasons. First, management throws their nickels around like manhole covers, with the result that the capital structure remains quite secure. Second, the dividend rises and falls with the health of the business. This means that no one has an incentive to take on debt in order to fund the market’s dividend expectation. This is the way a business should treat its owners, and so I’d be happy to add to my position at the right price.

Sturm, Ruger Financials (Sturm, Ruger investor relations)

The Stock

If you’re one of my regular readers, you know exactly what time it is. It’s time for me to point out, yet again, that “companies” and “stocks” are different things. It’s also time for me to be a total “buzzkill”, as the young people say, because I remind investors that a great, solidly profitable company like this one, can be a terrible investment at the wrong price.

Taking the first point first, the business generates revenue and profits, and the stock is a speculative instrument that gets traded around based on long term expectations about the business. Given that the financial statement valuation of the business is “backward looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two. The tension is highlighted by the fact that the business is about manufacturing firearms, and lawfully selling same. The stock, on the other hand is buffeted by a host of factors, some of which have nothing to do with those activities. One of the things that affects the performance of a given stock, for example, is the crowd’s ever-changing views about the desirability of “stocks” as an asset class. There’s no way to prove this definitively, as it’s an obvious counterfactual, but a reasonable argument could be made to suggest that some portion of the 8.3% loss I’ve suffered on these shares can be blamed on the 3.4% loss in the S&P 500 over the same period. I don’t know if you follow the financial news, but the mood about “stocks” as an asset class has been mixed lately. This attitudinal shift may have resulted in a bit of a reduction in the demand for the shares of robust companies like this one.

So this is why I consider the stock as a thing distinct from the business. The former is often a poor proxy for what’s going on at the company, and I think it’s possible to profitably exploit this disconnect. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. What I want to see in this regard is a stock that the crowd is somewhat pessimistic about that goes on to exceed expectations. When the crowd is pessimistic, the shares are cheap, which is why I try to buy only cheap stocks.

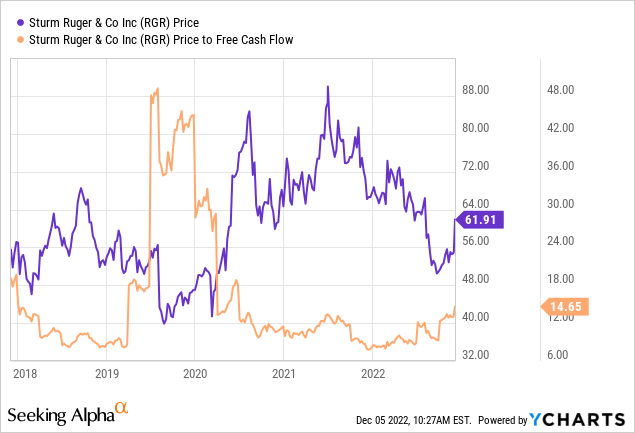

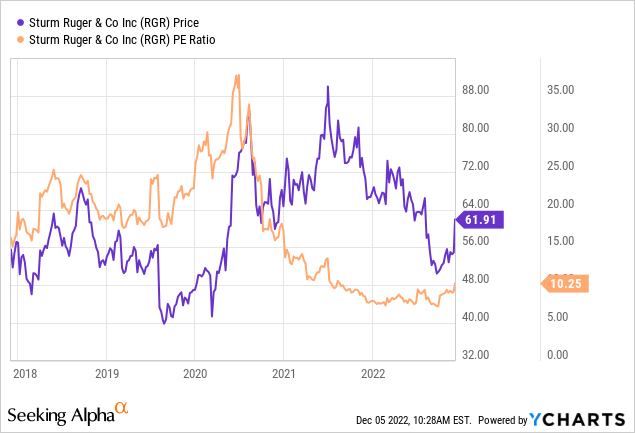

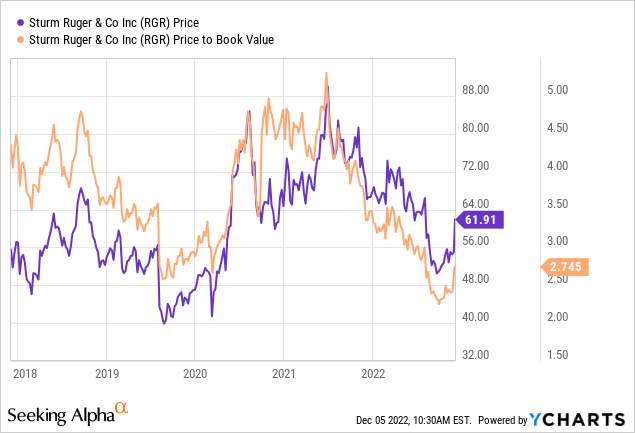

In my previous piece, in case you’ve forgotten, I got excited about this company because the shares were trading at about 8.6 times free cash flow, and a PE of ~7.9 times and were changing hands at 3.4 times book value. Fast forward to the present and we see that the shares are about 70% more expensive on a price to free cash basis, 30% more expensive on a PE basis, but 19% cheaper on a price to book basis per the following:

Source: YCharts

Source: YCharts

Source: YCharts

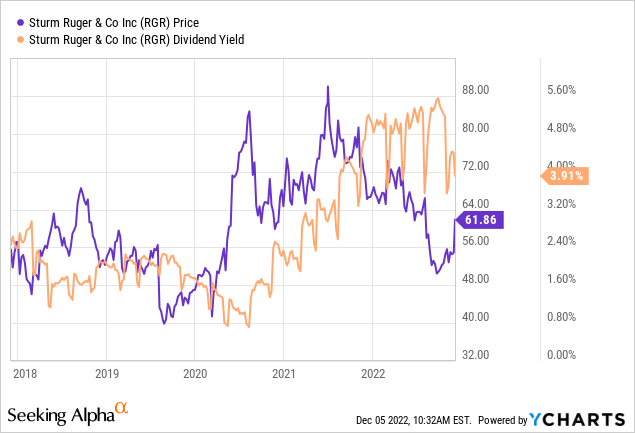

At the same time, it’s fair to say that the (very sustainable) dividend yield is relatively high by historical standards, per the following:

Source: YCharts

Given the above, I think the shares remain reasonably priced by historical standards, though they’re not the “screaming buy” they were previously.

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future. Applying this approach to Sturm, Ruger at the moment suggests the market is assuming that this company will grow earnings at a rate of only ~1.25% in perpetuity. I consider that to be a pretty pessimistic forecast for any company, even one who’s volatility is as high as this one.

Given all of the above, I’ll be adding to my position here. The shares are not as attractively priced as they were, but they’re still attractively priced. The company will have a very strong capital structure, even after the upcoming very generous dividend. If you’re just joining this party, I would recommend buying some Sturm, Ruger. The dividend is particularly secure here because no one is going to drive this company into debt in order to pay a dividend. I like that level of financial prudence.

Options Update

As I wrote above, way back in February, I sold some Ruger puts with a strike of $45 for $1.75 each. These last traded hands at $0.40, and are currently bid at $0, suggesting that the trade has worked out rather well. This reveals, yet again, the power of selling deep out of the money put options. Either the shares drop to the attractive strike price, or they remain above it, and the investor pockets the premium as it seems I’m about to do in this circumstance.

While I normally like to repeat success, I think there’s more value in the shares than the puts at the moment. For instance, the July 2023 puts are currently only bid at $0.10. If the stock drops nicely in price, I’ll review this idea, but for now I think it just makes more sense to buy shares.

Be the first to comment