Sundry Photography/iStock Editorial via Getty Images

In this article, I argue that Tapestry’s (NYSE:TPR) Coach rebranding is successful, as evidenced by increasing positive product reviews on social media, its customers age distribution statistics, current online sales and traffic performance in China and the United States. Given Coach’s current market value, this is a buying opportunity.

Tapestry’s Overview

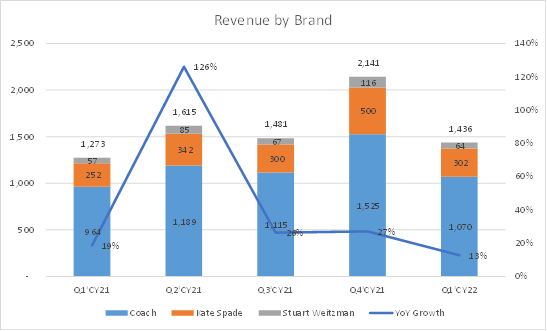

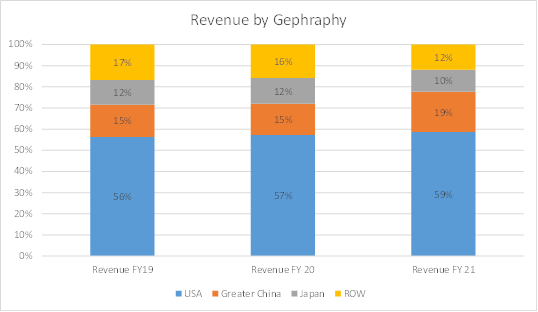

The parent business of Coach, Kate Spade, and Stuart Weitzman is Tapestry. Approximately 75% of income is generated by Coach, 25% by Kate Spade and Stuart Weitzman. China’s sales are growing the fastest, accounting for 19% of overall revenue, up three percentage points from 2019.

Figure 1: Disaggregation of Revenue

Disaggregation of Revenue (Company Disclosures ) Coach’s Annual Report

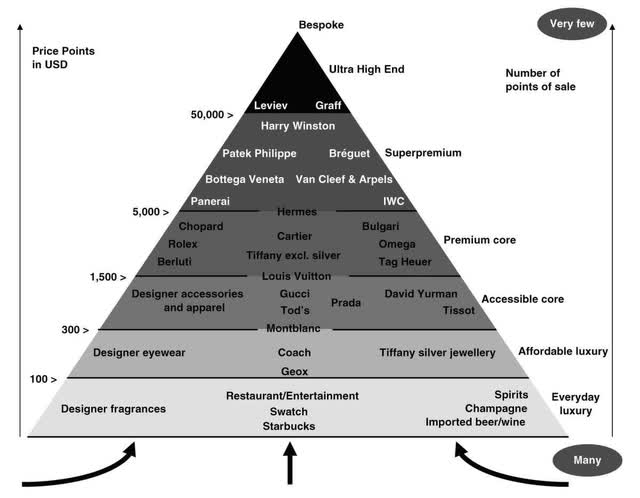

Coach products are positioned in the affordable luxury segment, which benefits from rising global prosperity, and social tendency of pursuing fashion and beauty. Recently, Coach also benefits from the 25% price hike in premium luxury bags. The price increase was primarily driven by strong demand for luxury goods these days. Premium brands such as LVMH (OTCPK:LVMHF), Chanel & Hermes must confer luxury status, by catering to a small number of wealthy individuals, whereas inexpensive luxury brands are not required to do so.

Coach’s competitive position is strong in the cheap luxury market, where there are currently only a few competitors. In the most recent earnings call, the CEO stated, “The strong performance and deliberate actions to decrease promotional activity and strategically raise prices resulted in nearly 20% global handbag AUR(Average Unit Retail Price) growth“, indicating that Coach captured the opportunity to go upscale. Note that this ~20% growth does not include the price increase in August this year, which is about 7% to 8%.

Figure 2: Luxury Goods Pyramid

Coach Products Are Becoming More Attractive and Modern

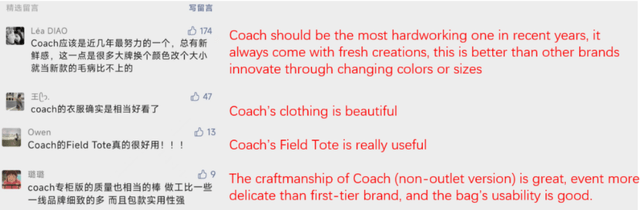

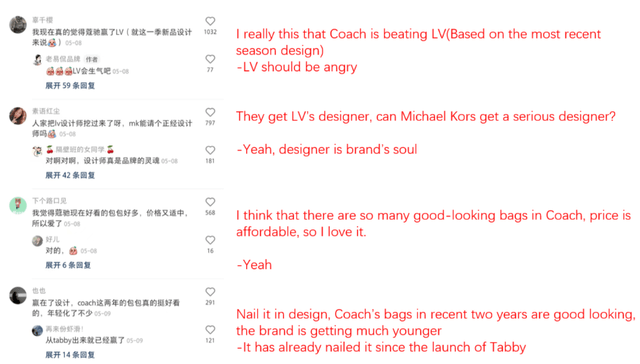

Checking social media websites for product reviews is an efficient method for determining consumer attitude regarding Coach. I examine comments largely on Doyin (the Chinese equivalent of TikTok), Wechat, and Xiaohongshu. I discovered that the majority of Coach reviews are positive. Consumers have praised Coach’s new design initiatives in the past two years. Coach stated, “Over the past two years, we have fostered the growth of our creative team, led by former LV designer Stuart Vevers.” The most frequent feedback is that Coach bags are becoming more attractive and youthful, yet their functionality and price remain satisfactory. Both brand recognition and brand awareness are increasing. The most popular comments are displayed below:

Figure 3: Consumer’s Comments on Wechat and Xiaohongshu

Chris Camillo, a YouTuber, used a similar method, and read thousands of comments on Coach through TikTok to taste the consumer sentiment. In his video, he picked some comments that are representative. Such as:

- “Coach is coming up with some fire.”

- “It’s the cutest thing, they did so well with the revamp”

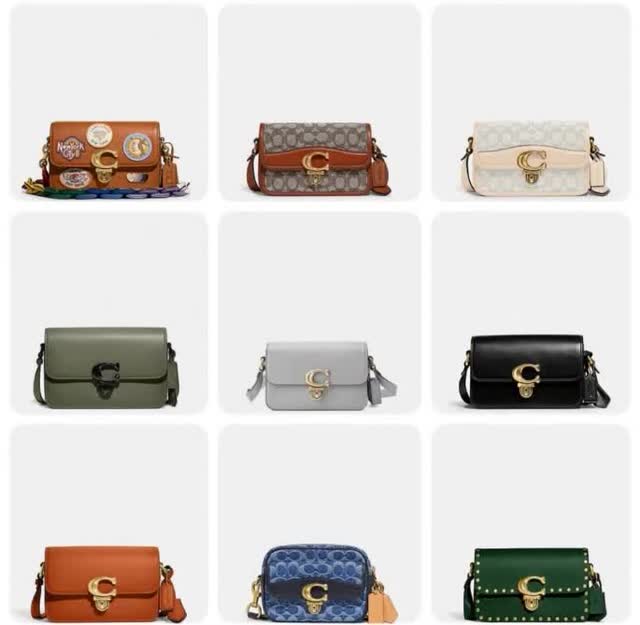

Taking a look at Coach’s design, it is easy to see that it is fashionable and full of variations.

Figure 4: Coach’s Newest Season Tote

Digital Transformation Is Executed Well

Coach said in its earnings call “Digital sales represented one-third of our total business…. we expect digital to reach $2 billion in revenue in this fiscal year with further runway ahead”. Digitalization is one of the profit drivers of Coach. Based on my research, Coach is highly active in utilizing Douyin, Xiaohongshu, and Taobao in China, which are the most powerful e-commerce platforms in China.

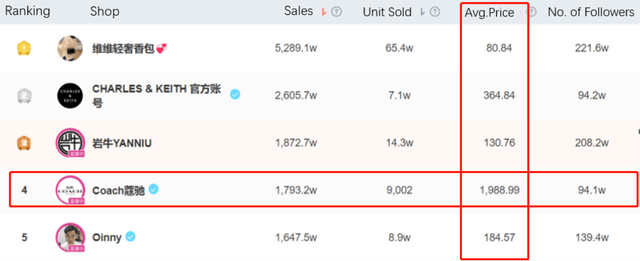

According to the data on Chan’Mama, Coach ranks fourth among the top 10 handbag, luggage, and leather goods retailers on Douyin(Chinese TikTok), while Michael Kors ranks twenty-first. Among the top 20 retailers, Coach is the only one with an average sales price of over Rmb 500, at Rmb 1,898 ($300), demonstrating high brand equity in the affordable luxury market in China.

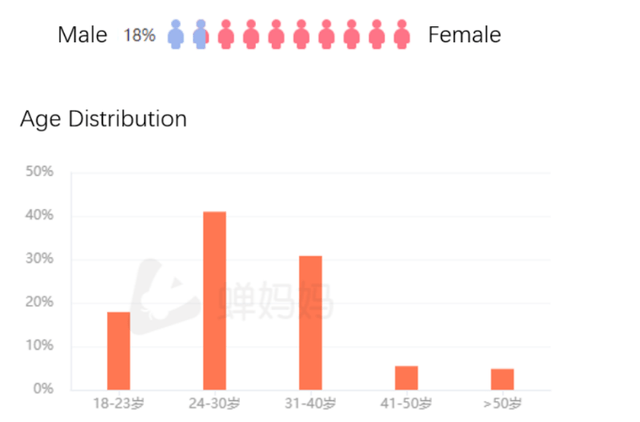

Table 1: Coach’s Sales Ranking in Douyin Store

When reading customer reviews, it is usual to come across comments about the brand becoming younger. I’ve read an intriguing comment stating, “I used to believe Coach bags were for women over 40 or 50, but that’s no longer the case.” Over half of the buyers on the Coach Douyin online store are under 30 years of age, which contradicts the classic idea of Coach clients. Men still make up a relatively small fraction of the store’s clientele. Coach stated that it is aggressively preparing men’s items and aims to reach $1 billion in men’s product sales within the next several years.

Figure 5: Age Distribution of Coach’s Douyin Shoppers

Web Traffic Data Is Steadily Growing

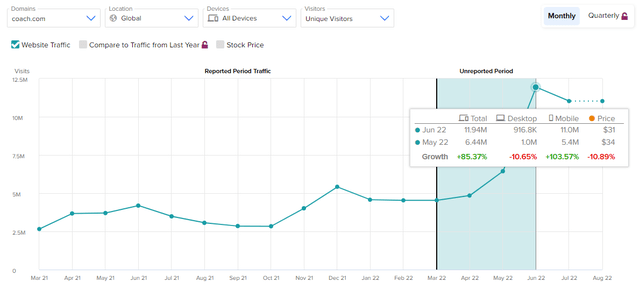

According to TipRanks, the overall number of unique visitors on Coach on Mobile (tracked globally) increased ~100% year-over-year.

Figure 6: Coach’s Web Traffic

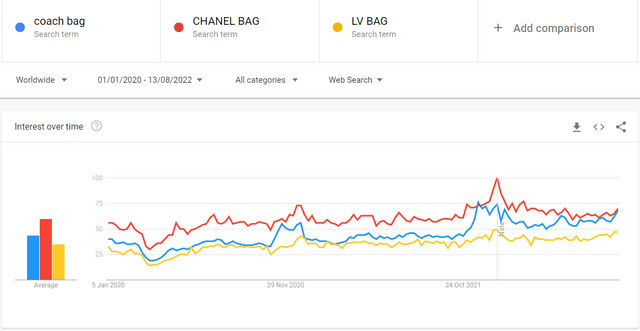

Over the past two years, Google trend data indicates that Coach bag popularity has increased the greatest compared to LV, Chanel, and LV bag. From this, we also observe a progressive increase in people’s interest in fashion and luxury.

Figure 7: Coach’s Google Trend, in comparison with Chanel and LV

Luxury Brands Are Recording New Record High Profitability

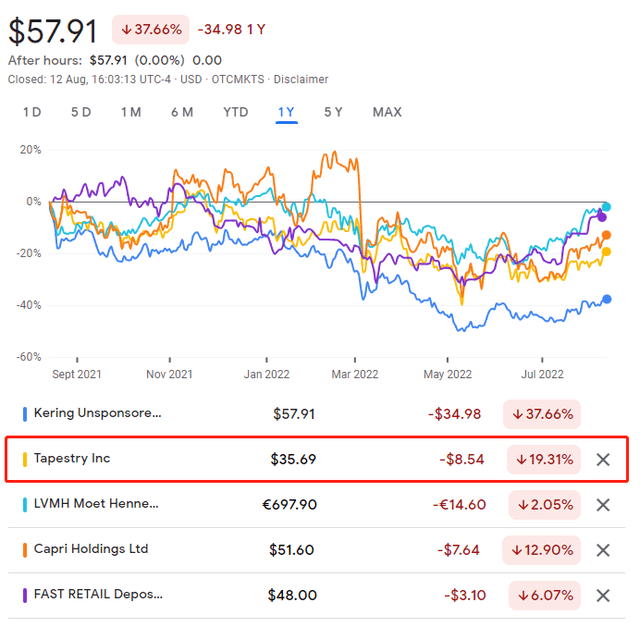

The industry trend is the most influential influence on the stock price, and there is still significant relevance among stocks in the same sector. Based on the comparison of stock prices provided below, TPR’s stock movement follows the sector trend in general.

Figure 8: Stock Movement Comparison

Source: Google Finance

LVMH also posted good earnings last week, with revenue from its flagship brand LV increasing by 31% in the first half of the year compared to the same period in 2021. Despite the inflation, it appears that everyone from luxury automobile manufacturers to handbag designers is experiencing robust demand. Despite the inflation, it seems like everyone from high-end automakers or handbag designers is seeing strong demand. “Brands like Louis Vuitton, Christian Dior, Fendi, and Celine achieving “new record highs for profitability” in the first half of the year, the company said. This taught us that the demand for luxury products is highly rigid, unaffected by economic trends, and driven mostly by the social trend of people’s demand for luxury and beauty.

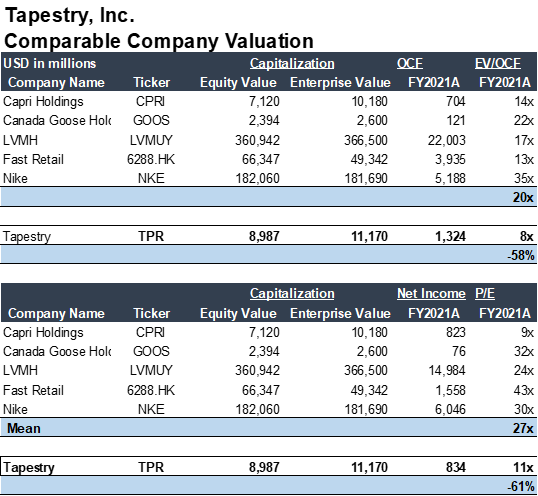

Undervalued by ~60%

Profitability and cash flow creation are solid aspects of Coach’s financials. Its FCF margin is 13%, and its EBITDA margin is 20%, which is greater than its direct competitor CPRI’s FCF margin of 8.5% and EBITDA margin of 18%, as well as greater than Nike’s FCF margin of 9.5% and EBITDA margin of 16.5%.

In addition, its EV/OCF ratio is the lowest among comparable companies (NKE, OTCPK:LVMUY, CPRI, GOOS, Fast Retail). Its EV/OCF ratio is 8x, which is 58% less than its comparable firms, and its P/E ratio is 11x, which is 60% less than its comparable companies.

Table 2: Tapestry’s Valuation

StockAnalysis.com

Final Thoughts

Tapestry’s current low valuation suggests a concern regarding its growth ceiling. However, in my opinion, there is still a great deal of space for revenue growth due to Coach’s improvement in product design, its transition to digital sales channels, its penetration among younger clients, its expansion in the men’s business, etc. The redesign of Coach may have just begun and might continue for two to three years. Beyond, the category of women’s bag is in high demand, in line with the social trend of people’s growing interest in beauty. Some investors don’t like Coach’s huge share repurchase and dividend payment as a strategy of cash deployment (~$1.9b in FY2022), because it limits the growth of ROI, while I see the share repurchase as a downside protection, which is critical component when investor want to build a relatively involatile portfolio. Thus, Tapestry is currently my top-recommended consumer stock buy.

Be the first to comment