industryview/iStock via Getty Images

The byline of my marketplace portfolio is “looking for the next Roku (ROKU)” but the shares of Roku are almost back to where they started, although not without the company not going through a thorough transformation.

And this is ultimately what we’re looking for, companies that are about to be thoroughly transformed, through rapid growth, new products, a step change in secular tailwinds, and the like which ultimately produces a step change in revenue and earnings as well.

This is what Roku has done, although as one can see things can move backward, especially when there is a strong market headwind blowing.

So here are some of the stocks which we think have the best transformational potential.

SOBR Safe

SOBR Safe (SOBR) aim is to revolutionize the alcohol detection market with a simple fingerprint device (see an interview with the CEO) that detects alcohol levels as well as identifies the person in question on the basis of the biometric fingerprint.

The data is uploaded to the cloud for analysis and warning of the organization’s gatekeepers, which can then apply their protocols.

The technology is patent pending and comes in two versions, a fixed device, and a wristband. The solution has a lot of advantages:

- It’s quick and hygienic compared to its main alternative, the breathalizer, opening up a huge amount of use cases.

- It could be able to unlock devices (tourniquets, cars, machines, etc.)

- Automatic data gathering (time stamp, positive/negative, ID) and analysis in the cloud can be used for lowering insurance premiums.

The market opportunity is very large. Alcohol plays a role in nearly half of industrial accidents, on construction sites, and of course in traffic. The latter is the reason why the CSN (the Child Safety Network) endorsed the product (video) and they will help market it. The use for school bus drivers (there are 500K of these in 100K school districts). The company targets three markets:

- Workplace and fleet

- Judiciary and probation

- Rehabilitation, the wristband looks to be especially useful for this segment, they signed a deal with NorthStar Care

The company has already won multiple customers and distribution deals (for a list see our overview article). What got the stock price back down to earth is the lack of revenues in Q3 (just $10K), none of the deals have really started to scale yet, but it’s difficult to imagine these deals were closed just for the fun of it.

Indeed, we have already one happy customer in the form of Nation’s First Secure Halfway House, which is adopting SOBRcheck in a second site installation within 60 days of installing it in their first site.

And then this morning there is further evidence of the company gaining traction as the trial in the oil & gas sector has converted into actual deployments, here is Chief Revenue Officer Michael Watson (our emphasis):

“Consistent with our recent announcement in the Justice space, strong performance across one test site is now translating to formal installation across multiple locations within the same customer,” said Michael Watson. “We believe there is no greater validation of our technology than this ‘land-and-expand’ scenario, where a company evaluates and acclimates to SOBRcheck, and then quickly initiates a cross-organization rollout. We feel that this particular agreement verifies our applicability in oil and gas, and we intend to leverage this use case to grow our industry footprint.”

It’s signs like this that investors should be looking out for, as it proves customers are satisfied with the product and find it useful.

When the existing orders scale (and new ones are won), things can quickly add up as the company uses a SaaS model at $30/M per user so with 30K users which we don’t think is a stretch by any means, the company would have over $10M in ARR (annual recurring revenue) and likely be cash flow positive (cash OpEx is some $2M per quarter but will slowly increase as they hire more salespeople).

There are just 14.5M shares outstanding, but fully diluted it’s close to 30M mostly because of outstanding warrants. However, when these convert they’ll bring in another $15-$16M or so on top of the $10M in cash that the company has.

At $0.89 (when we wrote this) the shares traded basically at the cash level. Now, we realize that the cash will be used in operations and that the balance will decline, but the company has at least until the end of next year to get traction with their device. Given the number of deals they have already signed, this doesn’t seem a tall order.

There have been insider buys. It might not be for all investors, many get nervous from companies without much revenue to speak of, but we think the risk/reward potential is very good here with the shares basically trading at cash, numerous customer and distribution deals and sign of happy customers.

Smith Micro

Smith Micro (SMSI) is in the late stage of proving a platform for the three big US carriers with which they can increase ARPU in the form of white-label software solutions, most prominently SafePath, a family safety solution.

The company bought its two competitors which had contracts with Verizon (VZ) and AT&T (T) and now has the top three carriers as clients.

Things have moved much slower than we hoped for numerous reasons (the pandemic, the Sprint takeover by T-Mobile (TMUS), and the integration and consolidation of acquired platforms and subscribers).

But a huge opportunity lies awaiting the company now that most of the heavy lifting and up-front investment has been made and the company can decrease costs and increase gross and operating margins.

SafePath 7.0 is now a sophisticated platform potentially broadening its high-margin recurring revenue stream with additional products and services (Drive, IoT) and into the home (Safepath Home) where carriers are gearing up an assault on cable company’s turf.

With costs embarking on a downward path and revenues set to increase with a potential market that is 7x that of the 2019 Sprint surge things become interesting in the coming quarters and the company has plenty of international opportunities.

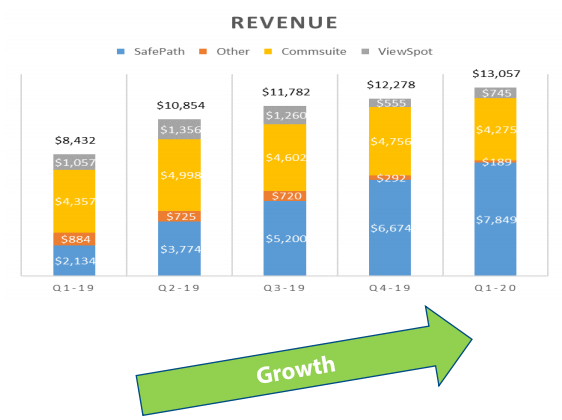

A reminder of what happened at Sprint might be in order as revenues from SafePath increased from $2.1M in Q1/19 to $7.8M in Q1/20 before the growth was cut short by the pandemic and the protracted acquisition of Sprint by T-Mobile:

SMSI IR presentation

The shares spend years in the wilderness ever since, but we think that now the pieces of the puzzle have fallen in place for a resurgence of the stock.

T-Mobile has already moved on a contract on similar terms as the original Sprint revenue-sharing contract (which enables Smith to earn several dollars per installation with the opportunity to earn more on added IoT/Drive/ solutions like the Sprint tracker).

We assume that the other two Tier 1 carriers will also move on a comparable new contract but this isn’t guaranteed and remains a risk as less favorable legacy contracts (that were concluded with Circle Labs and Avast, whose carrier business Smith acquired) are still operative.

We think this risk is low because the companies have a good collaborative relationship with the carriers and Smith has made an extraordinary effort to integrate the best software parts of the Circle Labs and Avast solutions to make SafePath 7.0 a much better solution and another effort to migrate all the subscribers of the legacy solutions on the new platform.

SafePath 7.0 is a much better product than these legacy solutions of Avast and Circle Labs and after these huge integration and migration efforts, a new better contract with both Verizon and AT&T is to be expected.

We think it’s unlikely that Smith would have embarked on these efforts without some assurances from the carriers on this. So we see quite a few upsides as we get a revenue ramp from subscriber additions and contract improvements as at the same time we get margin expansion and operational leverage.

The coming financial improvement does come from a low point and the revenue ramp will be slow at first as initially only T-Mobile is ready for a marketing campaign (with some of the same people that drove the Sprint campaign three years ago).

Next year AT&T and Verizon will follow and gross margin will recover to the 80%-90% territory with OpEx cash cost declining from $13M in Q3/22 to $11M by Q2/23. What gets us excited is not necessarily next year’s financials, but the longer-term potential:

- Just with the 3 Tier 1 US carriers they address a market opportunity that is 7x that of Sprint in 2019 (and keep in mind, that original Sprint ramp was cut short at an early rate).

- SafePath 7.0 is a platform, additional revenue streams can be attached to it through additional solutions like IoT devices, SafePath Drive and SafePath Home.

- There are plenty of international opportunities for Smith to repeat the success in the US.

From a Dawson James research report:

The company estimates it can reach 9 to 15 million accounts by 2025 and we estimate this is a revenue opportunity ranging from $270 million to $900 million annually for Smith.

Even if just half of that materializes we’re talking about $135M in revenues at 90% gross margin with OpEx at $45M a year, which would be well over $1 in earnings per share for a stock that trades in the low 2s.

SurgePays

SurgePays (SURG) has two main business lines. It runs software in some 8K convenience stores that service underbanked communities in the US with third-party products like payments and top-up prepaid cards and the like.

Then they run a mobile broadband business on AT&T and T-Mobile networks as an MVNO (mobile virtual network operator).

This mobile broadband business greatly benefits from the ACP (Affordable Connectivity Plan), which provides $30M per month subsidies (and $100 for a tablet) for qualified users, of which there are some 40M+.

The mobile broadband is already in the hockey stick development, raking in subscribers from 30K at the start of the year to 220K now and a projected 500K subscribers by the end of 2023.

If they pull that off it produces a revenue run rate at the end of next year of $180M, a gross profit in the order of $90M+, and an operating profit of around $75M (or $4+ per share), and that is just for their mobile business.

It will also start to produce considerable amounts of cash with which it can expand the number of neighborhood shops in its network and add products and services to the ones it sells through these shops geared for the underbanked segment.

There is a substantial short position, supposedly because drug addicts collect the tablets to sell them for drugs, but:

- ACP only pays if the device is being used.

- ACP only allows one sign-up per qualifying household and subsidizes the device for any household only once.

- The company owns and operates a sophisticated CRM platform, which (Q2CC): “houses customer information, is integrated with underlying wireless carriers, manages the plans and metering, the customer service, compliance, billing and is connected to the FCC’s database clearing house.”

- Has hired a third-party compliance bureau (Paricus).

- The company’s new subscriber drive is ensuring new subscribers are aware of the fact that they can put the sim card in their phones, thereby reducing attrition to 7%-9%, according to management.

So we’re not too worried here, especially as there are good reasons to expect an acceleration in subscriber growth:

- The company recently embarked on a non-dilutive $25M financing based on the receivables from the ACP program. This removes the main bottleneck as it enables the company to buy many more tablets. (The financing also has the benefit of enabling the company to buy the tablets in bulk, reducing the cost to $75-$78 instead of $90).

-

The company has enabled its 8K network of convenience shops to sign up subscribers in the stores (rather than the outside tent drives it’s using now).

As we argued in greater detail earlier, attaching their Shockwave CRM software to the software in the shops could work wonders. Much of the US will be too cold for open-air subscriber drives that are common in this segment and with their shop network SurgePays has an important advantage over the competition.

With 8K connected shops already and 75% of visitors on SNAP (food stamps) which automatically qualifies them for the ACP as well, if they sign up just 2 new subscribers per week per shop, this adds up really fast.

What’s more, while they sell mostly low-margin third-party products through their shop network, here is the first high-margin own product that will make it much more attractive for additional shops to join the network, cementing the company’s unique position in servicing the underbanked.

They have hired a specialist manager to drive new shops to the network, so this is a win-win situation. It’s a free proposition for prospective subscribers and very little effort and easy money for shops.

This is why we expect an acceleration in the number of subscribers (we think they could reach 500K well before the end of 2023), as well as an acceleration in the number of shops joining the network.

The financing also has the benefit of enabling the company to buy the tablets in bulk, reducing the cost to $75-$78 instead of $90.

The only real risk we see is changes to the ACP, which runs out of funding somewhere in 2024. But this was passed with bipartisan support and internet access enables disadvantaged people to search for jobs, and engage in e-learning and telehealth programs, the importance of these became clear during the pandemic.

There were quite a few insider buys this year and insider holdings are very substantial.

Fully diluted there are 17.8M shares (including the 5.7M warrants which are already in the money) so at $7, the market cap is $125M, which is about 1x this year’s sales.

We think that by enlisting their networks of shops to drive subscriber rates and the $25M financing removing the tablet bottleneck, subscription is going to seriously accelerate.

We think that the 500K subscriber target for the end of next year will be possible already by midyear, but let’s assume it isn’t and stick to the original EY target of 500K. That produces an ARR of $180M at 50%+ gross margin with OpEx at $3M a quarter (and not increasing), which would produce an EPS of $4.2 with the stock at $7. Difficult to argue the shares are expensive.

Be the first to comment