Sergi Alexander/Getty Images Entertainment

Investment Thesis

BARK (NYSE:BARK) shares have jumped as much as 120% since I last covered the company in June. The company reported better-than-expected profitability results in its first quarter. The business is still losing money, and this investment is highly speculative. But I think that the company’s outlook is moving in the right direction. I still think that BARK shares have considerable upside potential if the company manages to reach profitability.

Progress Towards Profitability

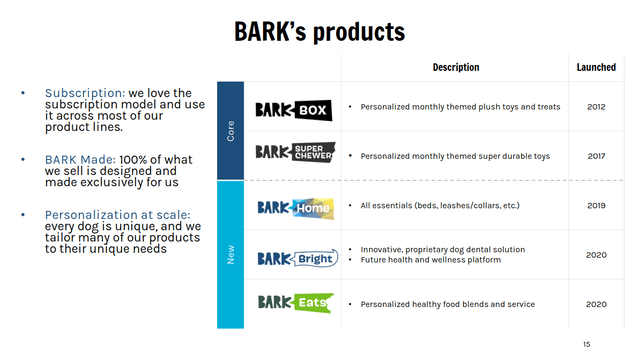

BARK’s business model is straightforward. The company sells its line of branded products to dog owners. Most of its sales are through its direct-to-consumer subscription boxes. This model is simple and consistent. The company has clear profitability drivers. It has to increase the average revenue per customer and reduce customer acquisition costs.

BARK reported a $13 million adjusted EBITDA loss in the last quarter. This beat its previous guidance by $5 million. The company grew its average order value by 7% year over year and 3% quarter over quarter. A lot of this is due to management’s focus on their higher-margin products. Products like BARK Eats and BARK Bright generate more profit for the company.

BARK December 2020 Management Presentation

BARK’s subscription business is reporting strong fundamentals. Management reports that their customer acquisition costs have not increased. However, the company has seen strong growth from newly acquired customers. The average revenue generated by new customers has jumped 10% since last year.

At the same time, management is trying to keep expenses under control. The company’s operating expenses grew by 18% year over year, compared to 12% topline growth. But management has cut operating expenses by 10% over the last two quarters. They discussed the company’s expense growth on their last earnings call.

The year-over-year increase was primarily driven by a 6% increase in subscription shipments in the most recent quarter and increased headcount. Looking ahead, we do not have any plans to materially increase headcount from current levels. We expect the majority of G&A growth this year to be driven by subscription shipment volume and thus we expect our operating margins to improve in fiscal 2023 as compared to fiscal 2022.

I think that this is a solid outlook. The business is continuing to report positive topline growth. BARK’s hiring freeze will let more of the company’s gross profit flow through to the bottom line. Because of this, management expects the company’s EBITDA loss to narrow to $8 million in Q2. This would be a 38% sequential decrease.

Overall, I think that the company’s profitability outlook is quite positive. There is still a long way to go, but all of BARK’s major metrics are moving in the right direction.

The Valuation Is Still Discounted

Even after a 32% bounce off of its lows, I still think that BARK shares are cheap. The company has a price-to-book value of 1.4 times. Its market cap is about $300 million. It has $177 million in cash on its balance sheet, offset by $76 million in debt. This gives the company an enterprise value of just $190 million. This seems low for a company with over $500 million in annual sales and the potential for solid margins.

The company has $158 million in inventory on its books, up 54% since last year. This is over eight months’ worth of inventory. This seems high for a company with this profile. But I don’t think it will be an issue due to BARK’s business model. Management discussed their inventory outlook on their earnings call.

We continue to hedge against potential supply chain disruptions. However, we do not believe that inventory will be a material drag on working capital this year and we expect our inventory to come down from current levels as we leverage the products we have on hand over the next several quarters.

It takes time for us to turn this as we are typically ordering product six months in advance. So we’ll take a couple quarters to see our progress reflected on our balance sheet. But one great thing about our subscription model is that the customer is unaware of the products they will receive in their dogs in trend. In a traditional retailer e-commerce business, the customer selects the exact products they want send to them. In our model, it’s a surprise each month and we can leverage the inventory we have on hand at our discretion.

This inventory model is very efficient. It effectively eliminates the chances that BARK will have to take large markdowns. This should allow the company to maintain its solid margins above 50%.

The company is reducing its cash burn rate. In the last quarter, the company spent $17.4 million on its operations. This cost is down by almost 70% since last year. At the current run rate, the business has enough liquidity to sustain itself for over three years.

It’s difficult to value a company with this much uncertainty. But shares are trading at a forward EV to revenue of 0.34 times, so it appears the market doesn’t think that BARK will be able to reach profitability. I think that there is a good risk to reward that the company will become profitable. Even modest margins would make the company’s shares undervalued in my opinion.

Future Growth Drivers

BARK is continuing to grow its topline even as economic headwinds increase. The company reported 259,000 net new subscribers in the last quarter. I think that BARK can continue to sustainably add subscribers. Spending on pets typically stays consistent through recessions. Sectors such as pet food and healthcare are especially resilient. BARK Bright and BARK Eats are fast-growing offerings in these categories.

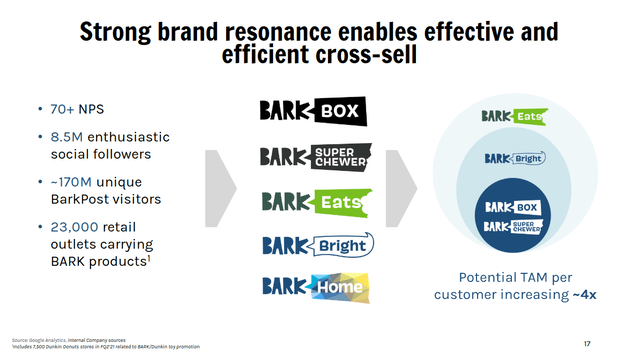

I also think that BARK has good opportunities to sell new products to existing customers. The company generated $10 million from cross-selling in Q1. This is up 42% since last year. Management has been integrating all of BARK’s offerings into a single site. For example, the company started cross-selling BARK Bright products and food toppers to its toy and treat customers in May. This boosted the company’s average order value. It also decreased its customer acquisition costs.

BARK December 2020 Management Presentation

This is where BARK’s data advantage comes into play. The company has a list of almost 2.3 million customers who are currently paying for one of BARK’s services. The business also has basic information on about 10% of the United States’ dog population. This allows the company to be more efficient at advertising and marketing. The business can leverage this information to drive down the cost of customer acquisition, further increasing margins.

Final Verdict

There is still a lot of uncertainty here. But I think that BARK’s outlook is becoming clearer. The business is making strong progress toward profitability. I’m interested in BARK’s next quarterly report. I want to see how the company is handling the current economic headwinds. Overall, my outlook is unchanged. I think that this is a decent speculative buy for deep-value investors with a high-risk tolerance.

Be the first to comment