Note: We have used Barrick to represent Barrick Gold throughout the article and any other reference to the word “Gold” is a reference to the commodity. This is necessary to point out as Barrick has GOLD as its stock symbol.

It is easy to write bullish articles. We certainly do it. All one needs to do is pick up the latest presentation by management and reiterate the awesome case. Every company comes across as the best thing since sliced bread by that logic. That is not what we are going to do today. We are going to make a case here as to why under no circumstances should you ever invest in Barrick Gold (NYSE:GOLD), at least anywhere close to the current price. We are going to do it examining the past and telling you why it matters for the future.

Why invest in Gold companies at all?

Investors who jump into this world of mining do so for two main reasons. One is that they want to leverage the price of Gold. After all if Gold goes up, then mining companies would get leverage out of that with their costs staying fixed. The other reason investors grab on to mining companies is that they don’t trust ETFs which hold Gold. The internet is full of cuckoo ideas that no Gold exists inside ETFs, and ultimately when needed most, your ETFs will default. Investors buying into that theory feel that mining companies represent a safer option.

What can Barrick do for you?

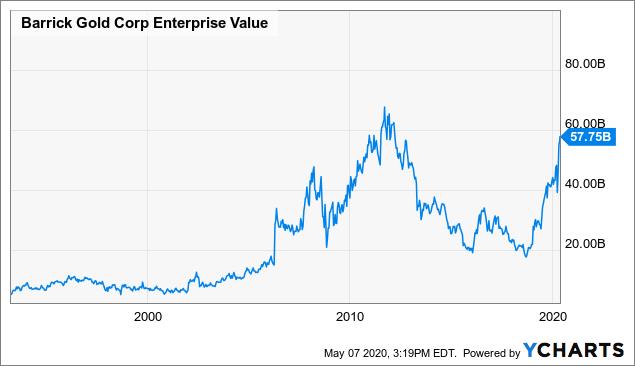

While the past is not necessarily prologue, looking at Barrick’s performance over the last two decades, one thing should hit you right in the face. It has not leveraged the price of Gold.

In fact it has not even kept up with the price of Gold. Over the time frame we pulled this chart, from right near Gold’s historic bottom, Barrick managed to stay almost exactly flat. Barrick’s dividends though did manage to give you a rather pitiful 25.21% return or about 1% a year compounded. But that is a lot of stress for a 1% return and one that trails Gold’s 8% plus compounded return. Of course the past returns by themselves don’t tell you anything. The “why” is what matter. What is that “why”? There are four reasons for this and they are deeply interconnected.

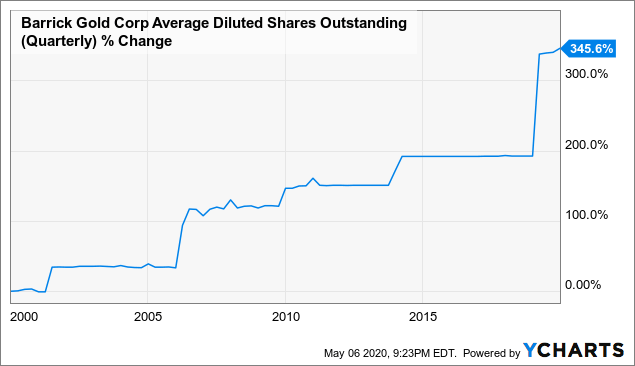

Barrick loves issuing shares

Below is the diluted average share count for Barrick and you can see the nice step ladder moves up. 350% odd increase in shares outstanding significantly increases the difficulty in producing even modest returns.

Data by YCharts

Data by YCharts

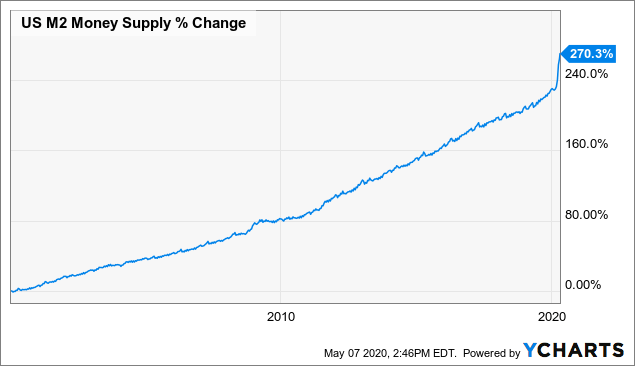

Even if you ignore the Randgold merger dilution, the share count has tripled. One thing investors should always do with Gold companies is run their share count versus the US money supply. We stress this as most Gold companies handily “outperform”, to use the term in its most hilarious manner.

Data by YCharts

Data by YCharts

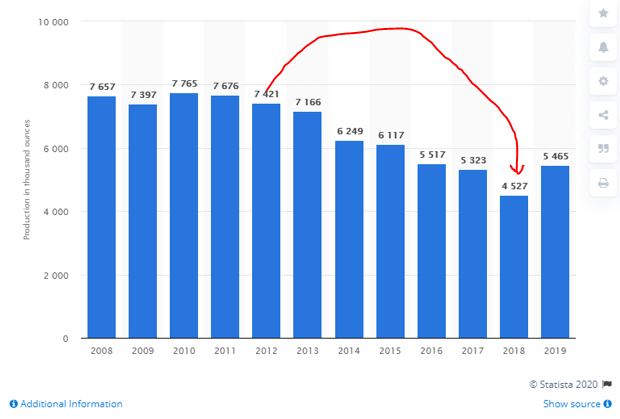

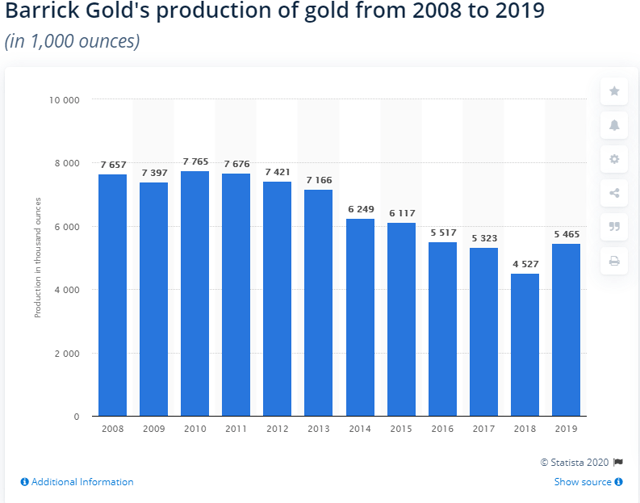

Barrick cannot keep production flat

Below we show Barrick’s Gold production from 2008 to 2019. Between 2008 and 2018 (just before Randgold merger), Barrick’s Gold production dropped 41%.

Source: Statista

So when you triple your share count and your production drops 41%, there is no chance in Hades that you will leverage “the price of Gold.”

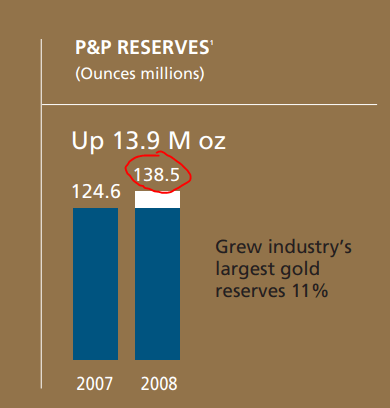

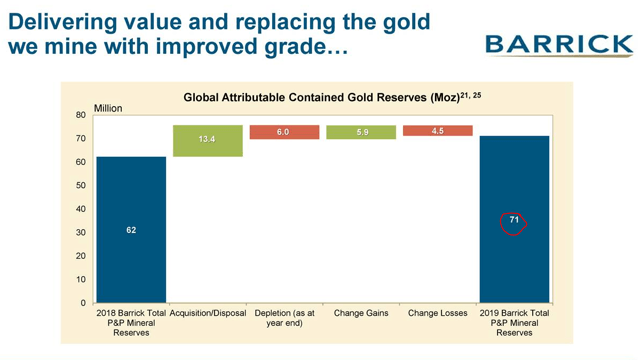

Barrick cannot keep reserves flat

In 2008, Barrick’s proved and probable Gold reserves were at 138.5 million ounces.

Source: Barrick 2008 Annual report

Today, after assimilating Randgold (and making a large acquisition in 2019), we are at almost half those levels.

Source: Barrick Q1-2020 presentation

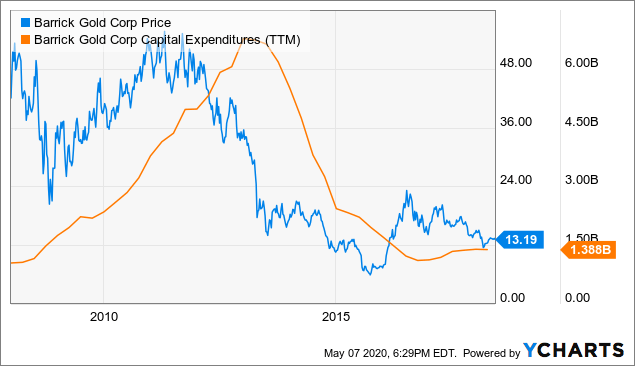

Sure Barrick has sold some pockets and bought a few others, but the reserves per outstanding share are less than 20% what they were in 2008. Does that sound like a recipe for growth? More importantly, Barrick has blown through every dollar of cash flow trying to replace these reserves and has spent an average of $3.0 billion annually trying to do so (2008-2018 numbers below).

Barrick (and no other Gold mining company) should bother with “all-in sustaining costs”

About a decade back, Gold companies started reporting an “all-in sustaining cost” metric. This began in 2012 and was supposed to give investors a true gauge of the costs of mining Gold. So for example, Barrick reported “all-in sustaining costs” as $972 in 2012.

Gold all-in sustaining cash costs for the fourth quarter and full year 2012 of $972 per ounce(1) and $945 per ounce, respectively.

Source: Barrick 2012 annual report

Maybe we understand the word “sustaining” differently, but after six years of reporting sustaining costs of near $1,000 an ounce, Gold production had dropped 38%.

Source: Statista

We reiterate that Barrick has spent far more than what it calls “all-in sustaining costs” and still has not come close to keeping its production flat.

Hope, Faith & Trick

Gold Mining is a capital intensive business, and over any reasonable time frame, depletion is a large hurdle to overcome. When you take into account the serial share dilution, stock options and rising costs, making money is very difficult. We call this the “Hope, Faith & Trick” business. Investors buy on Hope and Faith, but 99 times out of 100 they get Tricked.

While Barrick is not the worst of the group (that honor belongs to this little one), it will in all likelihood not create any value over long periods of time. Certainly buying it today at this valuation is fraught with peril. Today you are paying about $800 for each ounce of “proved” reserve.

Data by YCharts

Data by YCharts

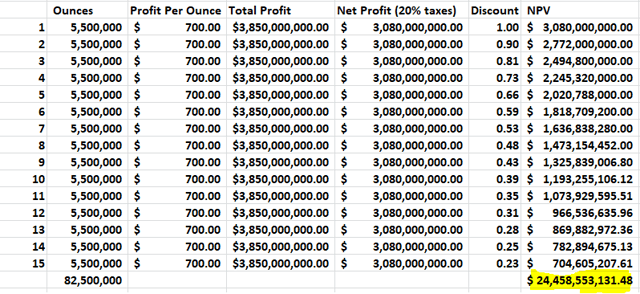

Remember that it costs Barrick about $1,000/oz just to get this stuff out of the ground, so at today’s prices the maximum profit per Gold ounce is around $700. Using a 10% discount rate and assuming that Barrick can keep its production flat for 15 years, we can work out what investors “should” pay for this.

Source: Author’s estimates and calculations

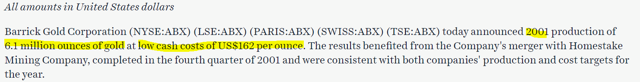

Barrick has about $9 billion of debt, so we would estimate fair equity market value at $15.5 billion, or close to $9/share. Investors might argue that the 10% hurdle rate is too high, or that the price of Gold will rise in the future. They may also accuse us of ignoring the copper reserves. Our rebuttal there is that 10% is an extremely low a discount rate when investing in serial money destroyers like Gold miners. As for the price of Gold rising, we believe that Barrick’s costs will rise at an equal or faster rate than that. In case you have doubts, do have a look at Barrick’s costs in 2001.

Source: Barrick 2001 Annual Report

Copper reserves don’t produce any free cash flow at prices around $2.50/pound, and hence we have left them out. We have also ignored any capital expenditures beyond what Barrick calls the sustaining capex. As the capex chart above shows, Barrick does run through a lot of capex trying to keep production flat, but these would only subtract from the net present value (although extend total reserves). Finally, we have also not taken into account the serial equity dilution and that speaks volumes about our generosity. We start the shares at a Strong Sell with a $10 price target.

If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with 4,400 members. We are looking for more members to join our lively group and get 20% off their first year! Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don’t miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment