Blue Planet Studio/iStock via Getty Images

Editor’s Note: This article is meant to introduce Danil Sereda’s Marketplace service, Beyond The Wall Investing.

Hello everybody! I am pleased to announce the official launch of my Seeking Alpha marketplace service – Beyond the Wall Investing, a special service created for active (and not only) retail investors who want to improve the quality of their investment decisions through a more professional approach to investment analysis.

Introduction Of The Service

The quality of information has always been the key to successful investing in the stock market – this is well understood by professional hedge fund managers who are ready to spend tens of thousands of dollars a year for access to the latest analysis, sell-side equity research reports, terminals, etc. Ordinary retail investors have always been considered closed to such expensive information. But even if we imagine that they have such access – where do they find so much time to read 500+ pages per day as Warren Buffett does?

To solve these 2 problems, my SA fellow Oakoff Investments and I decided to launch this service, whose main goal is to create a strong community of data-oriented investors and give them the opportunity to have the same information as professional market participants!

As with almost everything in our lives, 80% of what is important is contained in only 20% of the whole. Our job is to find that 20% in a huge pile of pages of the latest research to draw our own conclusions. We try to be as selective as possible when creating our newsletters for our premium subscribers so that they do not miss any of the latest stock market insights that are hidden from the general public. And unlike many other newsletter services, we do not just leave you alone with the information – we show you how to implement it by actively managing our model portfolios, which we will discuss in more detail a bit later.

The AI-based technical analysis platform we use is another undisputed competitive advantage. It allows us to test different trading strategies on different timeframes, which greatly increases the likelihood of a successful short-term swing trading, which we do not disregard.

If you want to improve the quality of your investment decisions and get the latest professional information about the market, sign up to Beyond the Wall Investing before October 11 for a full year to lock in your special membership rate for life at $375 per year.

Here’s What You Get When You Sign Up:

We have developed a range of products to help our subscribers find a needle in a haystack:

- “Wall Street Overheard” – a regular newsletter with the latest and most valuable information from banks’ research papers, quarterly letters from hedge fund managers, and insights from independent investment analysts/managers that we talk to and read daily.

- “Wall Street Model Portfolio” – a fundamentally-based model portfolio focused on medium-term positioning (1-3 years). Most medium-term ideas come to us while writing newsletters, but each new addition to the portfolio is carefully researched and published as a standalone article for our exclusive subscribers.

- “Technical Break Model Portfolio” – a portfolio of short-term buy/sell ideas based on technical analysis. We use a wide range of companies for screening and then run them through a special AI-based platform to identify technical setups and patterns that interest us and have proven effective in the past. Below you will see examples of how it works.

- Top priority – you will always know what material we are working on and when. Everything we publish for a wide audience first falls under the paywall for our exclusive subscribers.

- Community Chat – a place where you can discuss the latest market developments in a circle of like-minded people, get new ideas or propose a topic for our next research.

Complementing each other, the products of our service allow our subscribers to receive first-hand professional information and maintain a fundamentally sound and data-driven investment portfolio with a dash of short-term trades to enhance overall returns.

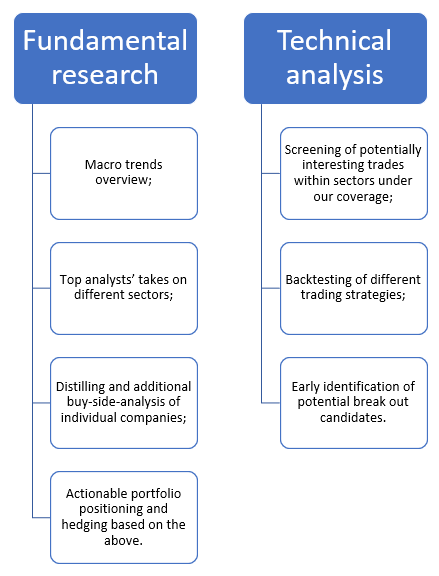

Author’s work

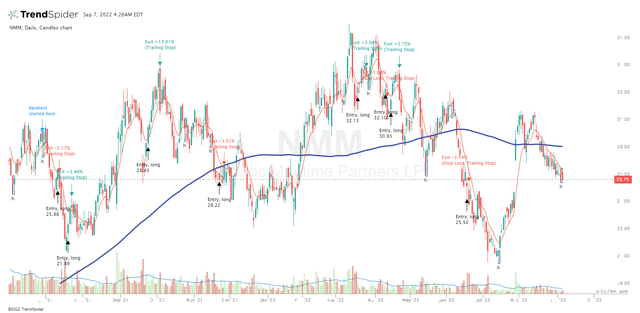

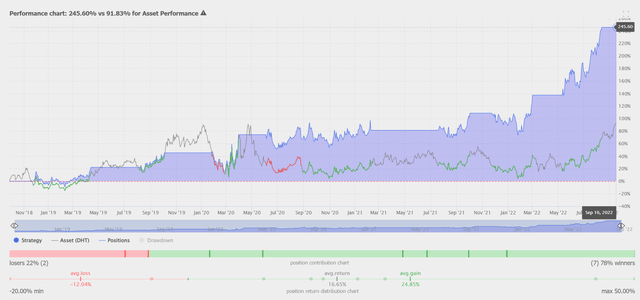

We have a special AI-based platform in our arsenal that allows us to study the price action of various stocks and identify the most effective trading strategies during backtesting. For example, here you can see the performance of the MACD strategy, which we improved by adding additional criteria, using DHT Holdings, Inc. (DHT) stock as a testing example – the developed strategy with a lower drawdown outperformed the underlying asset by more than 2x over the last 4 years (or 1000 daily candles):

TrendSpider, DHT (daily) TrendSpider, DHT (daily), backtesting results

Here is an example of how this approach works in real life.

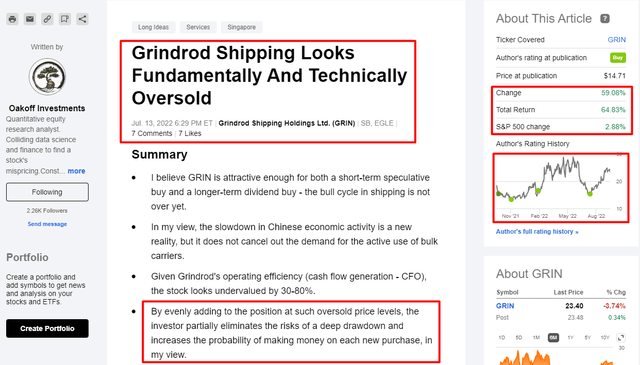

The co-author of Beyond the Wall Investing, Oakoff Investments, published an article on July 13 about Grindrod Shipping Holdings (GRIN) in which he used a strategy based on RSI oversold levels. Based on backtesting, he then successfully managed to predict a local bottom in GRIN’s stock:

Oakoff’s take on GRIN’s technicals

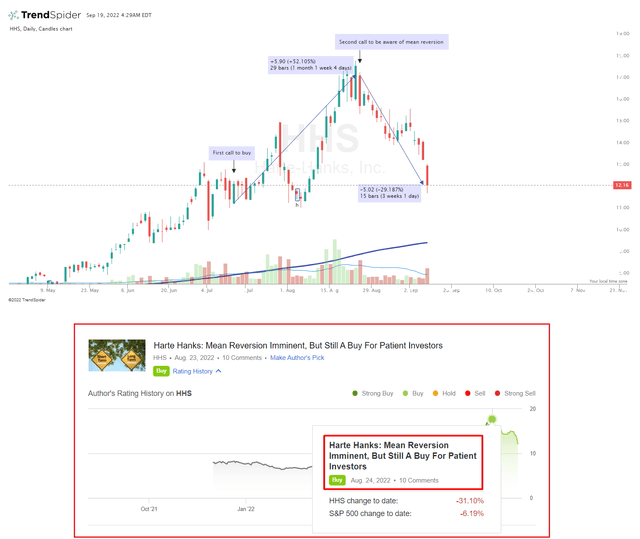

Another example of how our approach works in practice is Danil’s recent buy recommendation on Harte Hanks (HHS) stock.

On July 14, he wrote an article, pointing out the potential for continued growth in HHS’s quotes based on its fundamental profile and strong momentum. At the time, HHS appeared to be an interesting turnaround story based on an analysis of its operating metrics and existing undervaluation. In a little over a month, HHS rose by >50%, and at its local peak he published his second article warning investors of the impending mean reversion, but still great future for the long run. After that, HHS fell >31% in just 3 weeks:

TrendSpider, Seeking Alpha, author’s notes

In this way, we not only provide our subscribers with insights right from Wall Street that would cost many times more with other services, but we also provide actionable recommendations based on what we read and see every day, which adds even more value!

About The Authors

Danil Sereda, Founder

Danil Sereda

As a chief investment analyst in a small family office registered in Singapore, I am responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments. The specifics of my job allow me to eat bank reports for breakfast, washed down with hot Americano.

BS in Finance. During the heyday of the IPO market, I developed an AI model in the R statistical language that returned 24% more than the overall IPO market in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

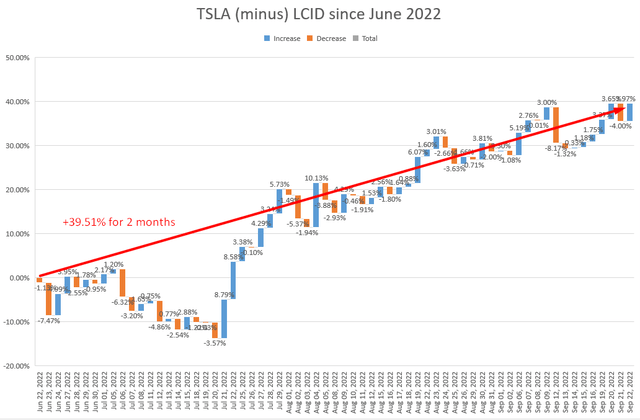

I also can’t get past pair-trade ideas. One of the most recent of these ideas can be found in my profile – it involves buying Tesla (TSLA) stock and correspondingly shorting Lucid Auto (LCID) stock. The efficiency of that idea speaks for itself:

Author’s calculations, based on Investing.com

Oakoff Investments, Co-Contributor

Oakoff Investments

I am a quantitative analyst with >5 years of personal portfolio management experience (an average annualized return of ~26%). Lately, I have been interested in geopolitical and macroeconomic shifts that could impact the future performance of certain sectors and companies.

BS in Logistics. As a result, I usually cover logistics-related stocks on Seeking Alpha. However, I also have experience analyzing materials and metals companies. I am especially proud of my recommendation at the end of August 2021 to buy several midstream companies in order to cope with the inflationary wave that was just beginning at that time. You can see the efficiency of that recommendation below:

| Company Name | Total return since publication | Recommended allocation |

| Antero Midstream Corp. (AR) | 189.10% | 21.43% |

| Enable Midstream Corp. (ENBL) -> (ET) | 34.86% | 7.14% |

| DT Midstream, Inc. (DTM) | 36.34% | 10.71% |

| EnLink Midstream, LLC (ENLC) | 96.41% | 3.57% |

| Hess Midstream LP (HESM) | 20.73% | 25% |

| Phillips 66 Partners LP (PSXP) -> (PSX) | 30.31% | 14.29% |

| Western Midstream Partners, LP (WES) | 47.64% | 17.86% |

| The total return of the portfolio since August 21 = | 68.37% | |

Source: Author’s calculations based on SA

Getting Started

We bet you will not find anything comparable for such a low subscription fee. Access to insights from the latest IB reports and the AI platform for backtesting alone costs many times that – and we are willing to separate the wheat from the chaff for our community on a regular basis.

You can sign up for the service now and try all the features without paying anything for 14 days. You can quickly cancel your membership if you find that the service does not suit you, and there will be no fees involved. Moreover, if you stay, you can use the service for a lifetime at the special launch price (20% discount), which will not change in the future.

If you have any questions about this service, do not hesitate to send us a message through Seeking Alpha or leave them in the comments section below.

Let us uncover the most interesting opportunities hiding in the bowels of the stock market together!

If you’re reading this via Seeking Alpha’s mobile app, to try this service right now, go to seekingalpha.com and enter “Beyond the Wall Investing” in the site search to visit the Marketplace Service checkout page.

Be the first to comment