Jeff Schear

Economic downturns do not affect every company the same way. This is exactly why investors should not jump to conclusions purely based on macroeconomic data. RH (NYSE:RH) is and has always been a company that I love. Over the last five years, the company has done a tremendous job in acquiring market share in the home furnishing industry through its differentiated, unique, luxury products. With a massive European expansion knocking on RH’s doors, there seemed to be little doubt about the company’s ability to grow. That was until global economic growth started slowing and the Fed embarked on a journey to aggressively curb inflation through restrictive monetary policy measures. In this article, I will discuss the challenges looming on the horizon for RH and why I believe the company will see light at the end of the tunnel, which is why we continue to hold RH stock at Leads From Gurus.

How will the home furnishing industry behave in a recession?

I don’t want to assume that we are headed for a recession, nor do I want to ignore the weakness in global economic activity today. RH is a luxury furniture retailer, I know, but its fortunes depend on the outlook for the home furnishing market.

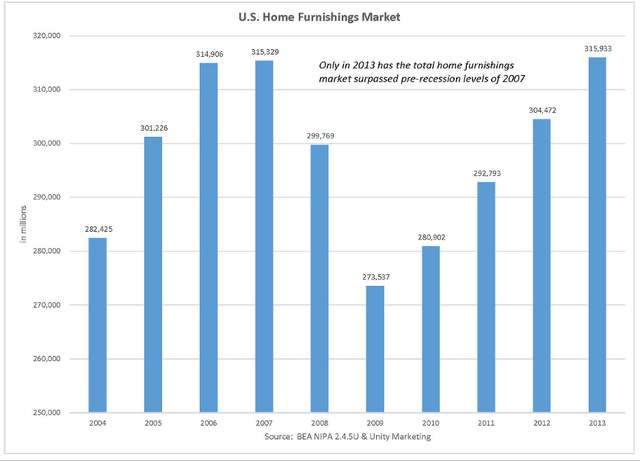

Back in 2008 when questionable lending practices in the housing market led to a global financial crisis, the home furnishing industry in the U.S. collapsed. The Home Depot, Inc. (HD) closed 34 Expo stores across the country and slashed its workforce by nearly 5,000, Williams-Sonoma, Inc. (WSM) was forced to layoff 1,400 employees, and a slew of companies including Wickes Furniture, Levitz, Sofa Express, Dormia, The Bombay Company, and RoomSource filed for bankruptcy. As illustrated below, it took the home furnishing industry more than six years to recover from the blow dealt by the financial crisis.

Exhibit 1: U.S. home furnishing market revenue by year

Unity Marketing

Source: Unity Marketing

The global financial crisis cannot be compared with other recessionary periods as the crisis itself was brought upon by the failure of the housing industry. The home furnishing market, therefore, was bound to collapse back in 2008. Having said that, there are a few reasons for us to believe that the housing market will slowdown materially this time around as well.

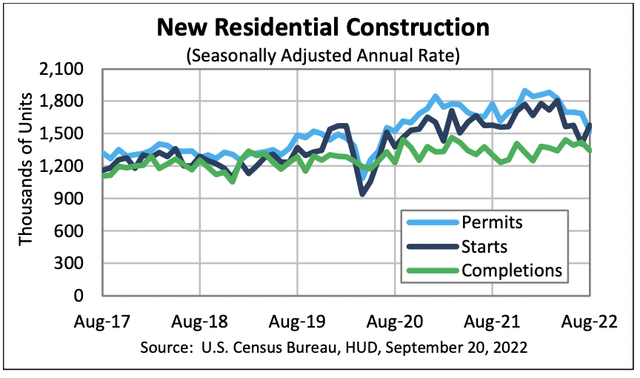

- Residential construction is already slowing down (see exhibit 2) and this spells trouble for the home furnishing market as the industry thrives when a higher number of new homes are delivered. Building permits authorized for privately-owned housing units declined 10% in August compared to July and 14.4% compared to August 2021.

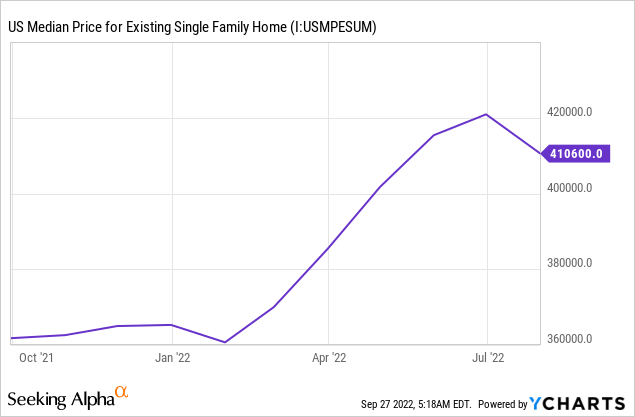

- In August, home prices were down approximately 6% compared to June, and this marks the largest 2-month drop in home prices since the financial crisis (see exhibit 3). This is another indication of how demand for houses is finally cooling down.

- The Fed’s efforts to fight inflation with higher interest rates have so far yielded disappointing results and inflation remains elevated. Policymakers, therefore, are likely to be more aggressive in the coming quarters. Higher mortgage rates will further dampen the demand in the housing market, which should result in low demand for furniture as well.

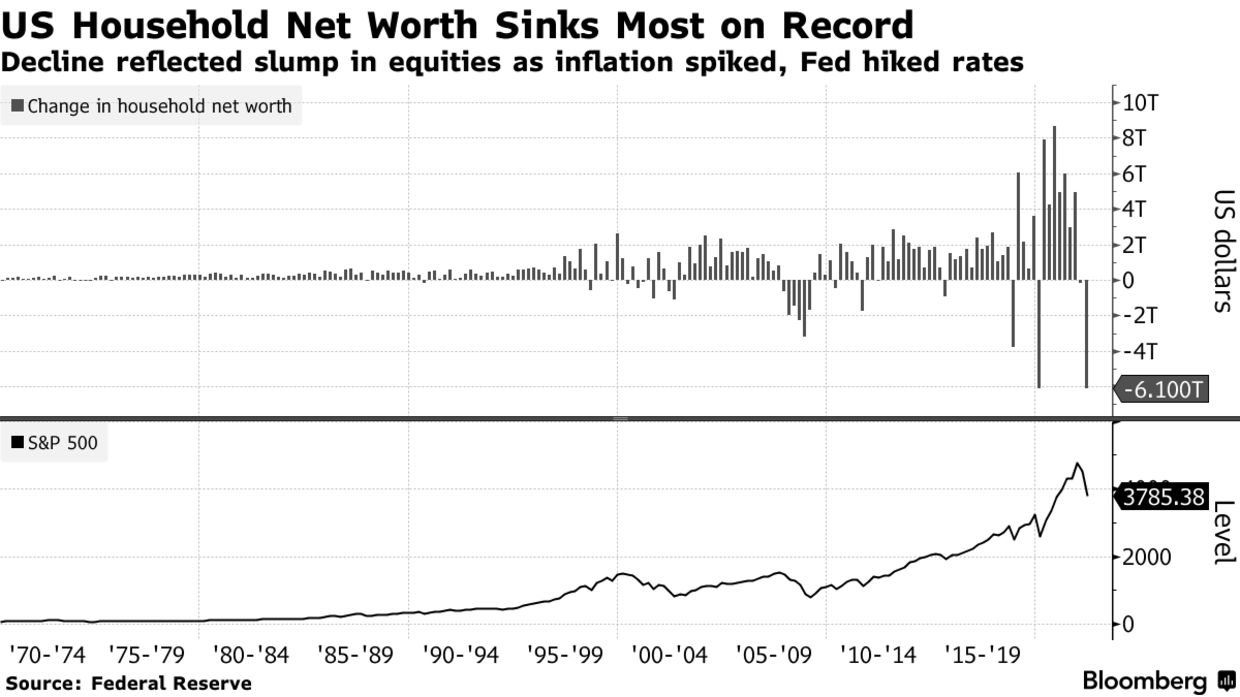

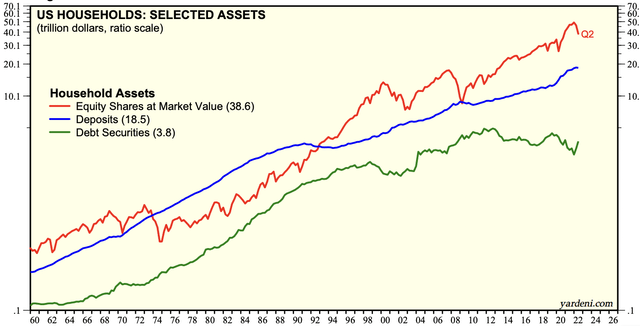

- U.S. household wealth plummeted by a record $6.1 trillion in the second quarter (see exhibit 4). As illustrated in exhibit 5, equities account for a major portion of household wealth, and with equity markets in turbulence due to macroeconomic and geopolitical developments, it would be fair to assume that household wealth will struggle to show any improvements in the short run. This is an early warning sign of a slowdown in housing market activity.

Exhibit 2: New residential construction data

U.S. Census Bureau

Source: U.S. Census Bureau

Exhibit 3: Median sales price for existing single-family homes

Exhibit 4: Changes in U.S. household wealth

Bloomberg

Source: Bloomberg

Exhibit 5: U.S. household wealth by selected asset classes

Yardeni Research

Source: Yardeni Research

Although the luxury market is believed to show resilience to economic downturns, when it comes to the luxury home furnishing market, I believe there are some fundamental differences. An affluent individual not cutting down his spending on luxury fashion items worth a few thousand dollars during a recession is fundamentally different from an affluent individual wanting to invest in properties during a recession. For this reason, I expect the luxury home furnishing market to show notable weakness in the short run.

There is light at the end of the tunnel

RH is thinking long-term, which is admirable as company executives often are forced to take decisions with short-term profitability in mind. RH CEO Gary Friedman continues to steer the company in the right direction to create long-term value for shareholders, which is evident from his comments on the company’s strategy to tackle short-term woes. Commenting on the actions of competitors and RH’s strategy in a letter to shareholders, Mr. Friedman wrote:

There continues to be widespread discounting across our industry, and while there may be short-term risks of market share loss as a result of our choice not to promote, we believe there is certain long-term risk of brand erosion and model destruction once you begin down that path.

RH will not discount its products for the sake of meeting short-term revenue goals, and this is encouraging given that the company has to maintain its brand image as a high-end luxury retailer to enjoy a high return on invested capital in the long run.

The international expansion plans of the company have been met with many challenges over the last 12 months, and the company was forced to push the opening of RH England to the Spring of 2023. The opening of RH Palo Alto has also been pushed to Q1 2023 from Q4 2022. Although there are delays, I believe this international expansion will take the company to the next phase of growth once macroeconomic conditions turn supportive. Although RH does not face direct competition from luxury retailers in the United States, the competitive landscape in Europe is likely to be more difficult to navigate, which is something I am keeping an eye on as RH expands into Europe.

There are early signs that suggest RH will enjoy durable competitive advantages in the future. RH Members Program, which is priced at $175/year, has already attracted more than 400,000 members and these members account for the lion’s share of RH sales. Members get a discount of 25% on all full-priced items, 20% off on discounted items, and complimentary services with RH Interior Design. The massive success of the loyalty program since its launch in 2016 is a testament to the brand loyalty shown by customers.

Takeaway

As a shareholder of RH, I am not encouraged by what the short-term future holds for the company. However, as a long-term-oriented investor, I do not find any reason to believe that a decline in housing market activity in the coming quarters will permanently deteriorate the company’s earnings potential. At a forward P/E of less than 10, RH is not richly valued to begin with, which is another reason why I feel comfortable holding RH despite the challenges that are looming on the horizon.

Be the first to comment