bombermoon

Buy a fairly priced well balanced electricity producer and get the energy transformation potential upside for free. The need for an increase in energy security, the general reduction of external dependencies, and the goal of reducing climate change make it an interesting portfolio hold.

My opinion about RWE Aktiengesellschaft (OTCPK:RWEOY) has remained the same. I believe it to be a great company producing an essential commodity with an ever-growing demand, having the advantage of being part of the solution to the ongoing energy crisis embedded in Europe’s biggest economy – Germany. Complemented by the new (green) hydrogen movement that has the potential to replace natural gas in heavy industries and (hopefully) replace fossil fuels in heavy vehicles like container ships and commercial airplanes.

Furthermore, this is one of the most capable energy producers to power the shift with the strongest balance sheet to invest in new capacity. The emphasis is always on disciplined capital allocation, going for profitable and reasonable growth.

This is an earnings follow-up and an addition to my previous article.

9M 2022 Results Update

RWE’s overall picture for the first nine months of 2022 was in line with what was expected. Financial results are still being inflated by very high electricity prices as shown, among others, by the massive increase in their “supply and trading” segment with a YoY EBITDA increase of roughly 56%.

The discussion and ending questions were mostly centered around possible price caps and/or windfall taxes to affect the company soon. I believe that there aren’t any laws already in effect, but chances are that we should expect changes soon. This can no doubt be a constraint in the near future.

US Acquisition: ConEdison

The company appears to continue its selected acquisition approach with the recent North American acquisition of the large US solar (and more) utility player, ConEdison.

ConEdison Stats (ConEdison Website)

This move increases RWE’s focus on a key future market and enables a continued balanced portfolio approach of high-quality geographies. After the addition, it will become the second US solar player and the fourth solar and wind player with 7.2GW of operating capacity. ConEdison also will add 7GW of additional pipeline.

The purchase price disclosed to be based around a $6.8Bi enterprise value for a business already expected to produce around $600M of EBITDA, which translates to what appears to be a reasonable EV/EBITDA of 11.33.

Concerning the funding of the operation, it seems to be done through mandatory convertible bonds, sold to the Qatar Investment Authority, which I assume will increase net debt at first and then dilute shareholders once it reached the conversion date. Despite disliking the issuance of (the more expensive) equity to fund acquisitions, I believe this could be positive for the company, and would like to know more about the funding. To my knowledge, there are no disclosure of conversion price, coupon payments, and dates.

LNG Infrastructure

RWE has been a part of helping the German government successfully shift from Russian piped natural gas toward LNG. The company is executing infrastructure projects in the northern part of Germany, not only regarding LNG terminals but also green ammonia to allow for the use of green hydrogen.

This move will help to establish a stable and (hopefully) a more diverse supply chain for their flexible power generation gas-fired plants and more.

The outcome related to returns and profitability of these operations is still uncertain, although management assures that these projects will be adequately remunerated. This should have a minor impact overall, even though I’m expecting it to have a minor positive impact overall.

Portfolio Updates

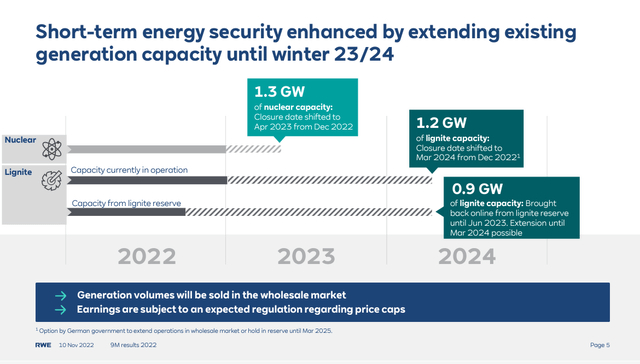

Due to the current macro developments and the need for energy security in Germany, there have been delays regarding the green transformation. Lignite and nuclear power plants had their closure extended toward 2023 and 2024, but with limited prices and consequently, limited returns are to be expected.

Fossil Fuel Extension (RWE Earnings Presentation)

They have struck an agreement with the German government to close down lignite power generation plants by 2030, with total capacity from this type currently sitting at a whooping 7.3 GW. If we add back the hard coal and nuclear production capacities, which should stop soon, we’re looking at 10.9 GW of capacities to be replaced by green sustainable alternatives complemented with what they call “flexible power generation.”

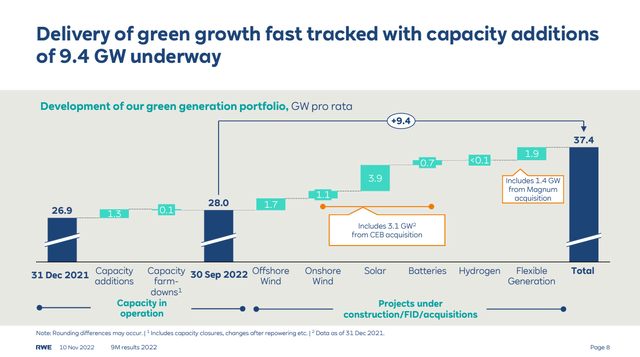

These green sustainable alternatives are well underway to the 2030 goal, 37.4 GW of projects are already in operation or ongoing.

Capacities Waterfall Chart (RWE Earnings Presentation)

Financial Results

EBITDA and Cash Flows

Without surprises here, EBITDA from coal and nuclear have been steadily decreasing as expected while the so-called “core EBITDA”, made by renewable sources, had a massive 108% increase YoY mostly impacted by prices but also by increased capacity and no one-off effects.

The cash flows have been negatively impacted by working capital changes due to the increase in gas prices and inventory levels. This accrual effect should be reverted once inventories are normalized, with the working capital impact being mostly null. Cash is also being positively impacted by the dividends received from their 16.67% stake in E-ON.

Net Debt

Net debt should now start to expand due to the acquisitions and growth capex, so that will naturally leave less room to maneuver in the future. It currently stands at €360M, before accounting for ConEdison’s purchase.

I find their financial assets and liabilities something to take special attention to, there are large movements inside its “economic” net debt reconciliation that could become an issue, heavy liabilities that need to be properly controlled.

On the flip side, they already have their sights over 37.4 GW of their 50 GW 2030 plan, eight years before. Could we see an increase in the 2030 capacity goal or more cash returned to the shareholders? We’ll have to wait and see.

(Near-Term) Outlook

I still consider their growth plan to be on the conservative side when compared to some of the competition with less “capable” balance sheets to support investments. Nonetheless, the outlook for the 2022 full year was maintained at a range of €5.5Bi and €5Bi for full EBITDA and €4.8Bi and €4.3Bi for the core (renewable assets) EBITDA.

They described the high level of uncertainty seen in the industry, especially in their “Supply and Trading” segment. Also, briefly mentioned a lower “hedge ratio” on the sales side and consequently, a higher price risk but didn’t comment if it was a temporary measure. Investors should expect higher volatility.

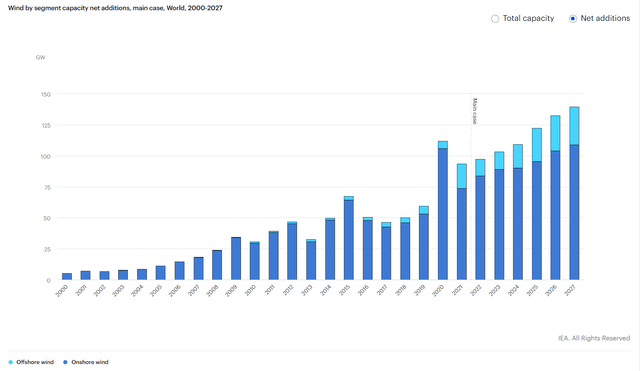

Offshore Future Play

I believe the recent advances in regulation and technology will allow offshore wind generation to improve significantly its levelized cost of electricity (LCOE) to the point where it becomes much more competitive. Since, in my previous article, I mentioned the hydrogen advantages and future possibilities, I feel that this also can be a growth path so much so that we’re now seeing massive offshore projects starting to be announced. The advent and improvements of offshore floating devices, like the Hexicon project, are proving to be instrumental in opening new possibilities in areas where the sea floor was too deep. Just the sheer size and capabilities of the offshore wind turbines are amazing.

RWE is No. 2 in the world when it comes to offshore, the scale and knowledge are an advantage. This is something to look forward to.

Onshore and offshore net additions actual and forecast (IEA.org)

Concerns

- Windfall taxes and similar price caps mechanisms – This can seriously affect the short-term ability to produce the vital resources needed for the heavy investments ahead. The CEO’s interview mentions how this can hurt developments going forward. I believe this to be a topic to closely monitor going forward.

- Margin accounts and financial derivatives – Large price movements of electricity or even gas create the need for extra liquidity due to the margin requirements for derivatives. While I trust RWE to be in control, this can be a problem if the company doesn’t have the required resources to fund those necessities.

- Smaller competition, production everywhere – Due to electricity prices and the need for autonomy, there has been an explosion in smaller individual or corporate producers. Individuals and businesses are ever more capable of, for example, installing their PV solar panels. Despite larger producers like RWE having the scale advantage, this move can reduce future demand going forward.

- Cost inflation and decreasing electricity prices – Electricity prices should now start to recover from all-time highs while cost inflation increases are making solar panels, wind turbines, and batteries more expensive. This can create pressure on their margins for new projects and even unhedged prices.

Bottom Line Conclusion

Windfall taxes, price caps, government instability, and more are all short-term headwinds that don’t affect structural trends highlighted in the intro. The world’s energy transition obligation was only exacerbated by the imposed sanctions over Russian products, governments of the most developed countries need and will push forward legislation and regulation to allow for a more rapid shift towards green energy sources and RWE is at the forefront of this move.

Different risks in the cost of capital for clean energy projects (IEA.org)

As usual, investors and analysts concentrate their attention too much on short-term matters and ignore the bigger picture which is critical to any long-term investors. Importance of being a market leader, in a growing underlying market, having competitive advantages/barriers to enter and with potential hidden assets in the making (hydrogen). These are the reasons why I’m bullish over the energy market, and RWE in specific.

Be the first to comment