primipil/iStock via Getty Images

Investor Sentiment, Default Risk and Stock Returns

Academic research, including the 2012 studies “ The Short of It: Investor Sentiment and Anomalies” and “ Global, Local, and Contagious Investor Sentiment,” and the 2020 study “ Investor Sentiment: Predicting the Overvalued Stock Market,” has found that investor sentiment—the general mood investors exhibit toward a particular market or asset—can be an important determinant of investment performance. The reason sentiment plays a role is that investors who exhibit relatively high sentiment tend to be overconfident and engage in excessive trading, resulting in subpar investment performance because they are trading on “noise” and emotions. Such activity can lead to mispricing and “limits to arbitrage” (impediments to short selling), which play a significant role in limiting the ability of economically rational traders to exploit overpricing, allowing mispricing to persist. However, eventually, any mispricing would be corrected when the fundamentals are revealed, making investor sentiment a contrarian predictor of stock market returns.

Research, including the 2006 study “ Investor Sentiment and the Cross-Section of Stock Returns,” has found that sentiment exerts stronger effects on difficult-to-value and hard-to-arbitrage stocks. And the 2011 study “ Investor Sentiment and the Mean-Variance Relation” found that the market is less rational during high-sentiment periods due to higher participation by noise traders in such periods.

Examples of times when investor sentiment ran high are the 1968-69 electronics bubble, the biotech bubble of the early 1980s, and the dot-com bubble of the late 1990s. Sentiment fell sharply, however, after the 1961 crash of growth stocks, in the mid-1970s during the oil embargo, and in the crash of 2008.

Jong Hwa Lee, Taeyoon Sung and Sung Won Seo contribute to the behavioral finance literature with their study “ Investor Sentiment, Credit Rating, and Stock Returns,” published in the July 2022 issue of the International Review of Finance, in which they sought to explain the distress anomaly—the well-documented negative relation between distress risk and stock returns. They hypothesized that because retail investors lack experience and information when compared with institutional investors, they commonly neglect the sources that determine the value of firms and bankruptcy risk, leading them to invest solely due to positive expectations. The positive sentiment-driven behaviors of retail investors induce a stock to become highly priced despite the firm’s credit risk, leading to low future stock returns. This is in line with research finding that individual investors pursue lottery-like stocks that have low returns on average but sometimes skyrocket. Similarly, high-credit-risk stocks have low chance of recovery and sometimes provide extremely high returns after the recovery. Retail investors speculate with these types of stocks, leading to their prices being overvalued, explaining lower future returns for riskier stocks. On the other hand, institutional investors adjust their aversion to lottery-like stocks by sentiment level.

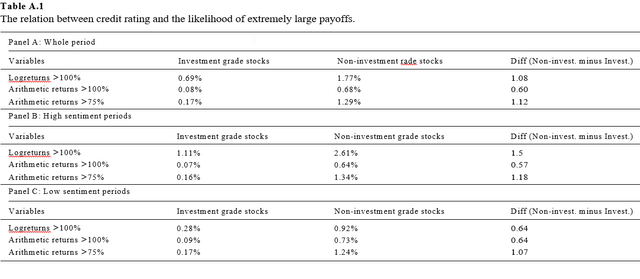

The Relationship Between Credit Rating and the Likelihood of Large Payoffs (July 2022 issue of the International Review of Finance)

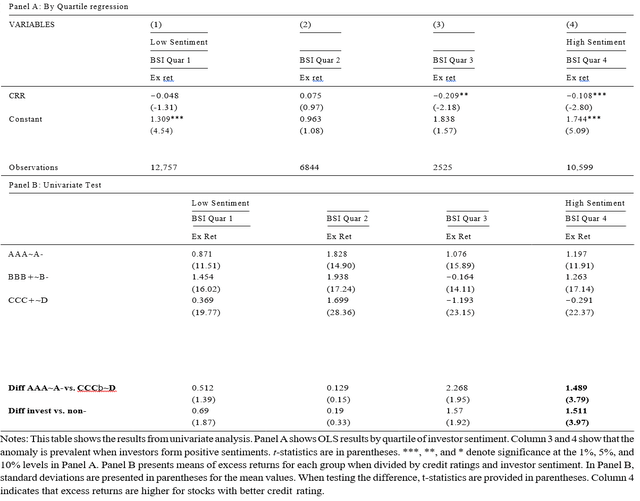

The authors’ data sample was from South Korea and covered the period January 2001-August 2015. They noted that South Korea provided the advantages of having separate data on the stock trading of foreign institutional investors, domestic institutional investors and individual retail investors, and that retail investors accounted for more than one-third of the market capitalization of the South Korean market. Their corporate credit ratings were from the National Information and Credit Evaluation (NICE Investor Service), the Moody’s-affiliated Korea Investor Service, and Korea Ratings. To be conservative with the ratings, they chose to use the lowest rating of the three. To measure retail investor sentiment, they constructed a buy-sell imbalance (BSI) indicator for individual stocks that measured retail investor sentiment. A positive BSI indicated that the stock was bought more than it was sold by retail investors, signaling positive sentiment formation. They then related the latest sentiment data available—the sentiment measurement of the last day of the month—to future excess returns and used the sum of the last two (five) days of purchase and sales data as robustness checks. They also controlled for the Carhart four factors (beta, size, value and momentum). Following is a summary of their findings:

Affirming the distress risk anomaly, the credit risk rating (CRR) was negatively associated with future excess returns (the equity risk premium). The relation that credit risk was negatively associated with excess returns was more pronounced when individual investors had positive sentiment — investor sentiment helped explain the association between credit risk and excess returns. Individual investors were dominantly active with non-investment-grade stocks — foreign and domestic institutional investors were net buyers on average for investment-grade stocks, while individual investors were not. Excess stock returns for speculative stocks were lower (0.5 percent per month) than those for stable ones (1.2 percent per month), but their volatility was much higher.

Credit risk, Excess Returns and Investor Sentiment (July 2022 issue of the International Review of Finance)

Their findings were robust to various tests, including controlling for factor exposures and different measures of sentiment.

Their findings led Lee, Sung and Seo to conclude: “Retail investor sentiment, i.e., the buy–sell imbalance, contributes to the negative relationship between credit risk and future excess returns. Stocks with positive retail investor sentiments tend to yield lower future returns as credit risk increases. The role of investor sentiment remains significant in terms of various robustness checks. In addition, the influence of sentiment has persisted even after the recent regulatory reforms that supposedly have helped protect retail investors after the global financial crisis. Lastly, even after including foreign and institutional investors’ measures, the influence of individual investor sentiment persisted.”

Investor Takeaways

The research makes clear that investor sentiment—the propensity of individuals to trade on noise and emotions rather than facts—represents investors’ beliefs about future cash flows that the prevailing fundamentals cannot explain. Such activity can lead to mispricing. Eventually, any mispricing would be expected to be corrected when the fundamentals are revealed, making investor sentiment a contrarian predictor of stock market returns. Thus, the takeaway for investors is to avoid being a noise trader. Don’t trade on sentiment and don’t buy investments that are the financial equivalent of lottery tickets. Most of all, have a well-developed, written investment plan. Develop the discipline to stick to it, rebalancing when needed and harvesting losses as opportunities present themselves.

Larry Swedroe, is the chief research officer of Buckingham Wealth Partners.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively known as Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined, or confirmed the adequacy of this article. LSR-22-376

Be the first to comment