piranka

Between late 2020 and 2021 when Schrodinger (SDGR) traded as high as $110 on the stock markets, Certara (NASDAQ:CERT) followed. Investors bet that health information services companies could grow their way out of losses.

Today in this 2022 bear market, investors are punishing companies that are still losing money. Schrodinger posted a 56-cent loss on a GAAP earnings per share basis despite revenue growing by 23.7% Y/Y. SDGR stock continued its downtrend, closing recently below $16.50.

Conversely, Certara earned 10 cents a share on a non-GAAP basis. Its revenue grew by 14.6% Y/Y to $84.7 million. CERT stock bottomed at $10.60 and closed at $17.72.

Certara reiterated its guidance for the full year. Its stronger fundamental prospects are worth a closer look.

About Certara

Certara supplies biosimulation, technology, and services in the critical drug discovery sector. It had over 2,000 customers in 2021, who looked to Certara for its biosimulation and technology-driven services. The company’s products include Simcyp PBPK Simulator, which predicts drug performance. Customers use Phoenix WinNolin software for PK/PD analysis, toxicokinetics, and non-compartmental analysis.

With Certara’s Integrated Drug Development, clients have a higher probability of succeeding with model-informed drug development.

Third Quarter 2022 Results

In the third quarter, Certara posted revenue growing by 15% to $84.7 million. It swung from a $1.8 million loss last year to a $3.9 million profit. It is worth noting that its non-GAAP net income excluded $6.8 million in equity-based compensation expense and nearly $11 million in amortization of acquisition-related intangible assets. With adjustments, the net income was $16.5 million.

Certara expects full-year adjusted diluted EPS of up to 48 cents:

|

FY 2022 Guidance |

||

|

In millions, except per share data |

||

|

Revenue |

$ |

325 – $335 |

|

Adjusted EBITDA |

$ |

112- $117 |

|

Adjusted diluted earnings per share |

$ |

0.43 – $0.48 |

Data from Certara Q3/2022 Press Release

Opportunity

Certara’s bookings broke out to the upside in Q4/2021 through Q2/2022 at above the $100 million range. It benefited from two of its largest customers pushing out its orders. Fortunately, business picked up during its normally slow summer months of July and August. In addition, Certara’s pipeline grew by 15% since the end of Q3.

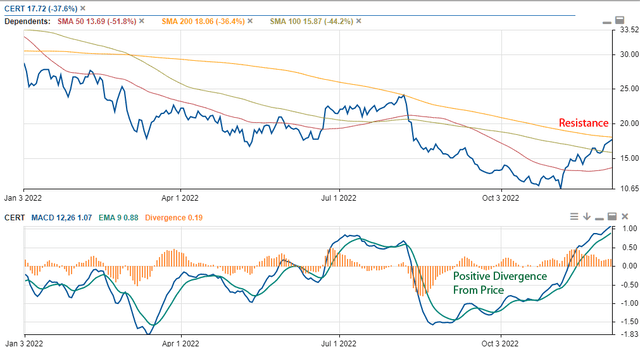

CERT stock adjusted for the strong quarterly results by erasing around half of the stock’s losses since August. Per the chart below, the stock’s moving average convergence divergence slope diverged from the falling stock price before the Q3 report. After rallying from the $10.65 low, could face resistance at the 200-day simple moving average. That suggests the rally may lose momentum near current prices.

Chart from www.Stockrover.com (Stockrover.com)

Should the uptrend pause, investors may consider starting a position if the stock dips to around $15.00.

Positive Catalysts

Certara changed its management and adjusted its operations in the regulatory services segment. This should pay off as the market starts to stabilize. The company has the plan to deliver more from its growing pipeline through 2023. It has a strong 93% renewal rate. In addition, its net retention rate is steady.

Even if the stock does not dip, investors should consider it from here. Activity continues to grow, supported by strong renewal rates.

Risks

Certara’s strong backlog will support its 2023 growth. However, while the book-to-bill is above 1.2 times, it could slow. The macro environment is worsening.

On its conference call, CEO William Feehery said that the company had one delay in trial completion. Its customer is conserving cash, potentially shifting its efforts to other priorities.

To expand its market, the company is seeking growth outside of the U.S. market. It explored business opportunities in China. However, that did not pan out. Fortunately, Certara can achieve biosimulation bookings growth above the mid-teens. It already has a strong demand for its software on the biosimulation side in its current markets.

Stock Score

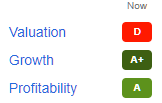

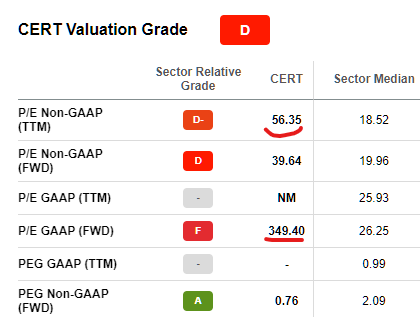

Certara stock has a low score on valuation. However, it scores an A on both growth and profitability:

CERT Stock Grades (seekingalpha Premium)

To earn a better value grade, the price-to-earnings of CERT stock needs to fall. To achieve that, the company needs earnings in 2023 to accelerate.

seekingalpha Premium

Furthermore, Certara’s forward GAAP EPS must expand. That will take its forward P/E GAAP low and improve its sub-grade from an F to perhaps a C or a D.

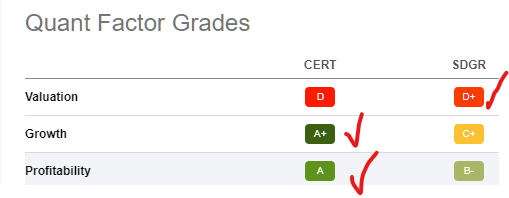

Since I mentioned Schrodinger, a stock I covered previously, it is worth noting that Certara has better scores on growth and profitability. Schrodinger has barely a better valuation score:

Comparison between CERT and SDGR (seekingalpha Premium)

Your Takeaway

Customers are keen to cut clinical costs down. Certara offers unique solutions that will help it reach that goal. As the economic slowdown unfolds, customers will face pressure to reduce their operating costs. Investing in companies like Certara should prove rewarding in 2023.

Be the first to comment