ADragan

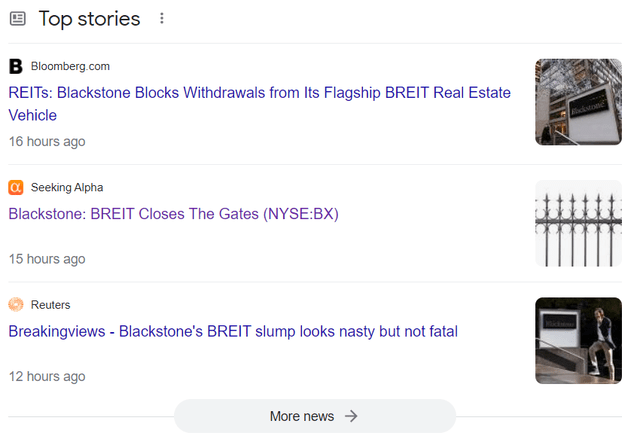

Blackstone (NYSE:BX) made many headlines last week when it announced that it was going to limit the redemptions of its public non-traded REIT, BREIT.

Here are just a few top stories that I found on Google by simply typing the name of the REIT:

These headlines make it seem as if Blackstone and its REIT were facing severe difficulties. Negative and scary headlines get a lot of clicks!

But the reality is actually very different:

Blackstone is doing just fine and so is its REIT.

It is not limiting redemptions because of poor performance. Here are some of the highlights of BREIT’s performance so far this year:

- Its net operating income has grown by 13%

- Its net asset value has continued to rise, despite materially increasing its cap rate assumptions.

- And this has resulted in a 9% net return year-to-date.

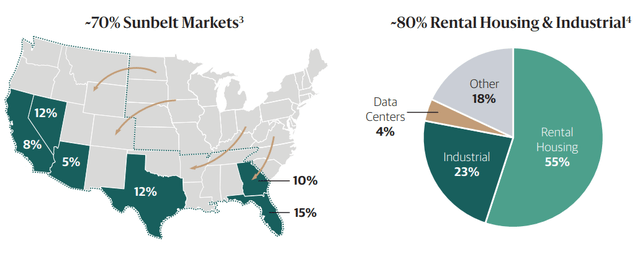

BREIT has performed so exceptionally well in 2022 because it is mainly invested in apartment communities and industrial facilities in strong sunbelt markets where rents are growing rapidly:

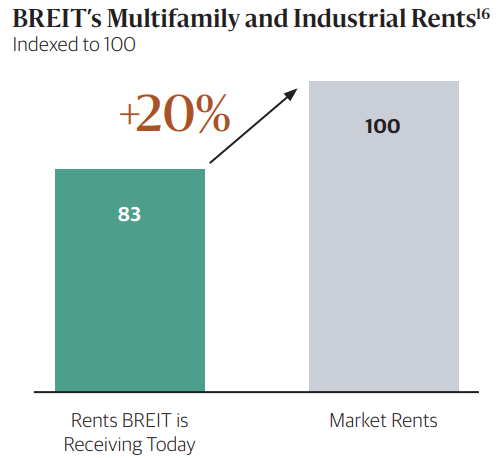

Moreover, they expect the strong rent growth to continue because their current rents remain well below market levels. This provides a bank of future growth as leases expire and rents are hiked:

Blackstone

Their debt is also almost entirely fixed rate for the next 6.5 years and therefore, the positive impact of rising rents should be superior to the negative impact of rising interest expense.

Right now, their rental housing and their industrial portfolio is valued at a 5.4% cap rate, which is quite conservative in my opinion, and I think that any material cap rate expansion from here is very unlikely. Blackstone has actually sold about $2 billion worth of assets at a nearly 10% premium to the carrying value of these assets, which shows that its NAV is quite conservative.

Finally, BREIT has ample liquidity to gradually meet redemptions and a structure to prevent liquidity mismatches. Their immediate liquidity was $9.3 billion before selling the rest of its interest in the MGM Grand and Mandalay Bay to VICI Properties (VICI), which will give it another $1.27 billion. Therefore, BREIT won’t become a forced seller either.

So all in all, we think that the fears are way overblown and this is likely in large part because of all the fear-inducing media headlines.

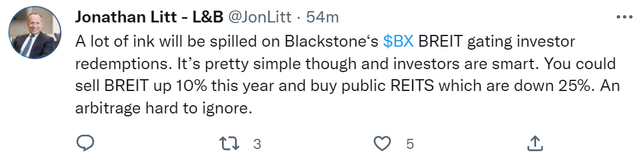

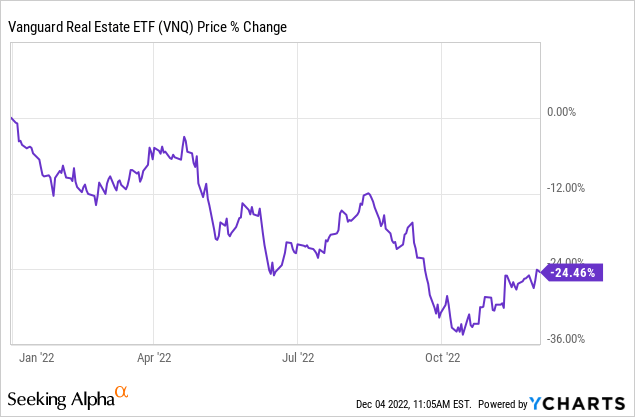

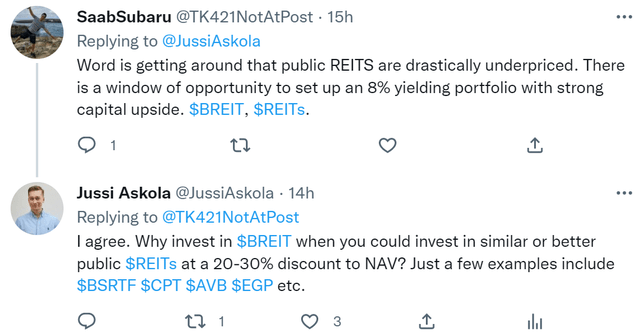

The reason why there are so many withdrawals is not because BREIT is in danger. It is simply because investors realize that public REITs are today a lot cheaper than BREIT and so they are selling it to redeploy in discounted public REITs. Jonathan Litt recently pointed this out in a Tweet:

Jonathan Litt Twitter

There are many similar or even better public REITs that are now priced at a large discount relative to what you would pay for BREIT. Even Blackstone itself noted on a recent public call that public REITs are today more opportunistic than private real estate (or BREIT…):

The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time. – John Gray, Blackstone’s COO

This explains why Blackstone has been buying out public REITs in 2022 instead of buying private properties in many cases.

So you need to ask yourself…

Why would you pay a premium to buy an illiquid, externally-managed REIT like BREIT, when you could buy a liquid, internally-managed REIT like AvalonBay (AVB) or EastGroup Properties (EGP) at a steep discount?

I recently also had a Twitter exchange about this with a BREIT investor:

Many investors are coming to this same conclusion and it is causing them to exit vehicles like BREIT.

Bottom Line

The takeaway is that both Blackstone and BREIT are just fine.

They are not headed for bankruptcy… Instead, capital is just flowing from a less attractive opportunity (BREIT) into better ones (Public REITs).

I think that Blackstone is undervalued today and I would give it a Buy rating following its recent decline, but I would stay away from BREIT because there are better public REITs that offer far better value for your money.

Be the first to comment