Editor’s note: Seeking Alpha is proud to welcome Fernando Batista Costa as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ferrantraite/E+ via Getty Images

Chase Corporation (NYSE:CCF) is a hidden gem very few retail investors are aware of. With a market cap under $1B and an average volume of 25.38K shares traded over the last 3 months, it is no surprise that virtually no one talks about it in the investing forums, including the YouTube finance space. With gross (37.6%), operating (18.7%) and net (14.3%) margins above its sector average, a return on invested capital (ROIC) of 18% – almost twice as high as the sector average (11%) – and a clean balance sheet, this small cap punches way above its weight class.

What the Company Does

Chase Corporation is a specialty chemicals company that manufactures three types of products: (1) Adhesives, Sealants and Additives, (2) Industrial Tapes, and (3) Corrosion protection and waterproofing. The market for these products is well diversified and includes the aerospace, automotive, electronics, medical, construction, energy, and industrial sectors. The first two segments constitute 41.5% and 43.2% of the company’s revenue, respectively, with the third segment being responsible for the remaining 15.3% of sales. The company operates in North America, Europe and Southeast Asia, but most of the revenue comes from sales in the United States, about 85% according to the company’s latest filings.

What’s to Like

I want to highlight three reasons that make Chase Corporation attractive: (1) rigorous financial discipline, (2) an excellent track record of effective growth, and (3) consistent Free Cash Flow.

Financial Discipline

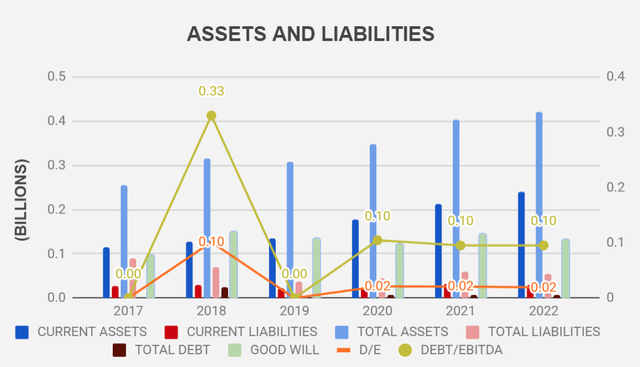

Starting with the balance sheet, Chase Corporation has no debt. It does not get better than that, and rather than an exception, that has been the rule for years as seen in the Figure 1 below. The reason could be lack of investment, but that is not the case. Since there is some good will in the balance sheet, we can infer that the company has made some acquisitions over the years. This means they have been able to make those acquisitions with cash on hand and generated free cash flow (more on that in a bit). With no debt to speak of, any concerns regarding leverage are also non-existent. Boasting a current ratio of 8.03 and an acid-test ratio of 5.86, financial strength is unquestionable. The company’s assets and retained earnings are a bit like a piggy bank that, save for any black swan event worse than COVID-19, should keep growing if the current strategy remains in place.

Back to the acquisitions: How good have these been? To answer this question, we can look the company’s growth.

Figure 1: Chase Corporation Assets and Liabilities (Author)

Revenue and Free Cash Flow Growth

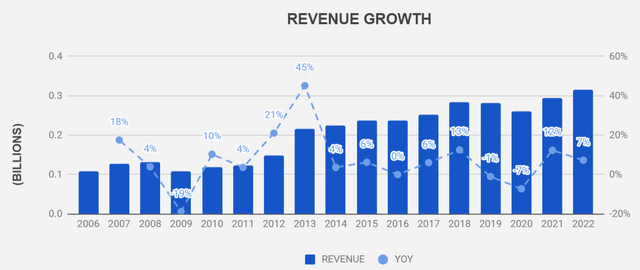

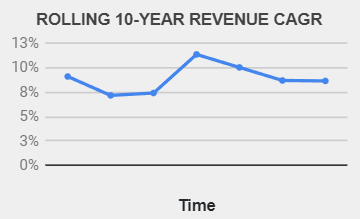

Chase Corporation’s revenue has grown at a clip of about 8.7% per year for the last 10 years, taking the trailing twelve months (TTM) revenue as a starting point. And Figure 2 shows a lower-than-expected cyclicality for the sector Chase operates in. If we account for the fact that 2008 was the year of the great financial crisis, and that in 2020 the pandemic stopped the world in its tracks, revenue has increased almost every single year. A rolling 10-year revenue CAGR as shown in Figure 3 shows that this growth has hovered around the 8% mark, which is reassuring.

Figure 2: Chase Corporation Revenue Growth (Author) Figure 3: Chase Corporation Rolling Revenue CAGR (Author)

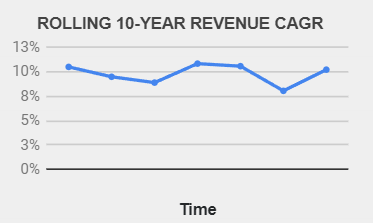

Although 8.7% revenue growth is not in the same league of high growth stocks, for a company in the basic materials sector, it is nothing to scoff at. In fact, that rate is not far off from the growth rate of Starbucks (SBUX), a company many still regard as a growth stock (Figure 4). This orange to apples comparison is really just to highlight that the perception of growth is often linked to the perception one has of a company. One could argue that the rolling 5-revenue CAGR has dropped to about 6%, but I believe the company is on track to keep the 8% growth, given the most recent acquisition is expected to add roughly $80M to the top line.

Figure 4: Starbucks Revenue CAGR (Author)

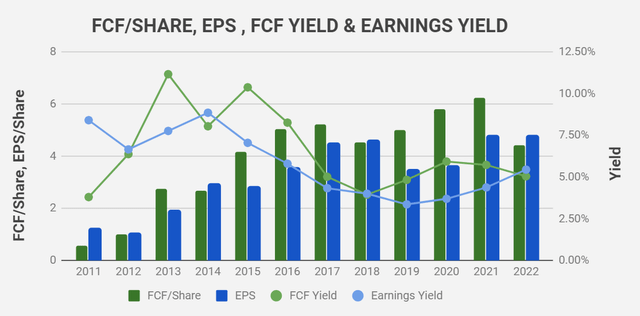

In fact, one of the engines behind Chase Corporation’s growth is accretive acquisitions. This is clearly stated as one of the company’s strategies and they have done it with a high degree of success. As pointed out earlier, acquisitions have not increased the company’s financial leverage because of the strong cash flows it generates. Just like revenue, free cash flow and earnings have grown steadily for the last decade. Free cash flow yield is currently at about 5% (Figure 5), partly due to the current supply chain environment.

Figure5: Chase Corporation’s Free Cash Flow and Earnings (Author)

Among recent acquisitions are HumiSeal in 2016 for $1.16M, Resin Designs in 2017 for $30.2M, Zappa Stewart in 2018 for $73.5M , and ABchimie in 2021 for $22.2M. In the same time period, the company has had no outstanding debts in the balance sheet, and revenue has increased by 31.9%. In July 2022, Chase Corporation has announced yet another acquisition. The company is acquiring NuCera, a specialty polymers manufacturer, for $250M. The acquisition is being financed partially by cash on hand and partially using debt under an existing revolving credit facility. If the historical pattern is to hold, debt should disappear from the balance sheet in a short period of time.

Based on the press release, Chase Corporation expects the deal to increase their leverage to 1.2X trailing twelve months EBITDA, a very benign level by any standard if it were to remain in the balance sheet for a longer period of time. NuCera is expected to provide immediately accretive free cash flow and it will expand Chase Corporation’s end markets to personal care and polymer additives. Another benefit of this acquisition is the expansion of Chase Corporation’s presence in the Asia-Pacific and European and Middle Eastern markets.

With a revenue of $83M, NuCera should increase Chase Corporation’s revenue to about $390M when the deal is complete, which represents a 24% increase relative to the trailing twelve months revenue. It is worth highlighting once again that this comes with no burdening of the company’s balance sheet, perfectly showcasing the excellent track record of achieving growth through acquisitions.

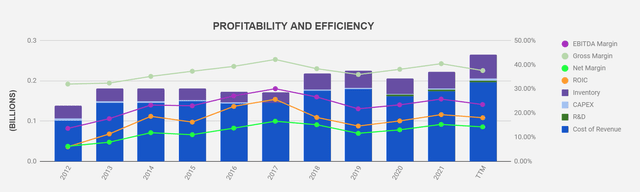

One more metric that shows the company’s ability to create value is the ROIC. Chase’s ROIC for the trailing twelve months is around 17.9% and has remained in the very high teens for years. The weighted average cost of capital (WACC) for the company is around 7%. The difference between the return the company gets from its investments and what it costs to raise capital should give investors strong confidence in the ability of the company to continue shareholder value creation.

Figure 6: Chase Corporation’s Profitability and Efficiency (Author)

Consistent Free Cash Flow

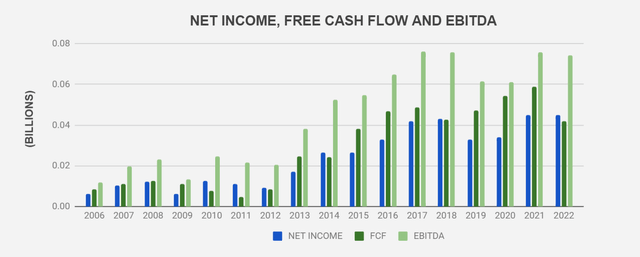

Companies in the industrial and materials sectors tend to be heavily influenced the economic cycles, and one would expect Chase Corporation to follow that pattern. Not wanting to make the case that Chase Corporation is immune to those cycles, looking at the historical data for revenue, EBITDA, net income and free cash flow, one can at the very least conclude the company is fairly resilient. The company has not had negative free cash flows, even during the 2008 financial crisis or, more recently, during the COVID-19 pandemic (Figure 7). In fact, free cash flow, has remained strong during those periods.

Reality is not a mathematical model where growth is arithmetic or geometric, but Chase’s free cash flow would definitely give peaceful sleep as an investor. With no debt to repay, and no share buybacks, this cash is financing the strategic acquisitions whenever the opportunity arises, and what remains of it is piling up in the balance sheet, sort of. Part of it is a sweet little bonus being given to shareholders.

Figure 7: Chase Corporation’s Free Cash Flow and Earnings (Author)

A Little Bonus

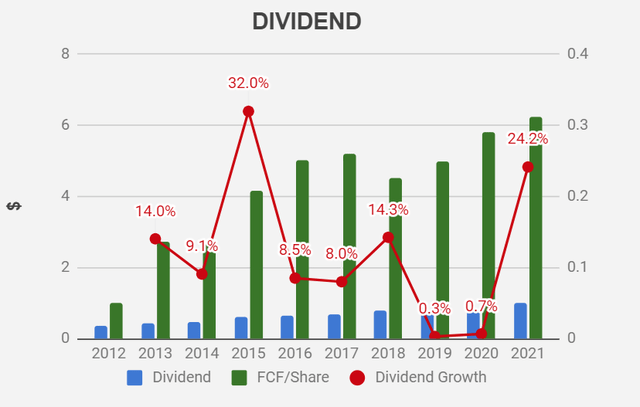

If by now it has not become clear that Chase Corporation is an unknown gem, dividend investors will like to know that the company pays a dividend that has consistently grown over the years (Figure 8). The yield is rather modest at 1.05%, but it has grown at a 9% compounded annual rate for the last 5 years, and is very well covered by free cash flow. If there is one thing dividend investors should not worry about is the ability of the company to cover the dividend since they intentionally target a payout ratio between 15% and 25%.

Figure 8: Chase Corporation’s Dividend (Author)

The Risks

Chase Corporation’s outstanding ability to acquire and seamlessly integrate smaller businesses is also a potential downfall. The company admits that opportunities for organic growth are scarce in the mature industry they operate in and, if for some reason these opportunities don’t arise, or if at some point they botch this approach, the historical trends might very well take an ugly turn. Microsoft’s (MSFT) acquisition of Nokia is one of those ugly deals that come to mind. Mistakes made by companies the size of Microsoft are likely not that consequential, but a bad deal can indeed spell doom for a company.

Chase’s margins are above industry, but because the market is mature, competition may compress them in the future, eroding most of what makes the company an attractive investment. Chase is a sub $1B market cap company whose products compete with some of those made by 3M (MMM), for example, which is over 70 times larger. Talk about David and Goliath. Competition is not restricted to behemoths like 3M. In their own league, they have H.B. Fuller Company (FUL) whose TTM revenue is growing at a faster pace with lower profit margin.

By the company’s own admission, their competitive advantage relies on their reputation of providing high-quality products and in the built-up trust with clients, which is not really an impenetrable moat. The bet in Chase Corporation is one that relies heavily on exemplary past execution and on the belief management has a good compass to keep the journey ahead very enticing.

Fair Value

I believe Chase Corporation is a high quality company that investors should take a look at. The company’s share price has appreciated at a rate of about 19% per year over the last 5 years and I think future returns are still compelling. With little analyst coverage, it is hard to project revenue and earnings into the future, but using recent historical performance as a rough guide, we can estimate a fair price to pay for the company’s stock. The company has grown revenues at 8% per year over the last 10 years.

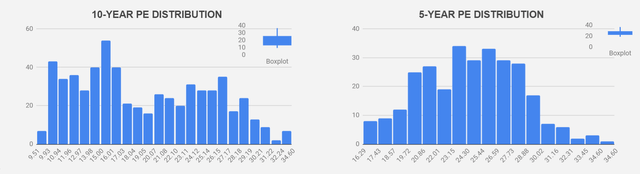

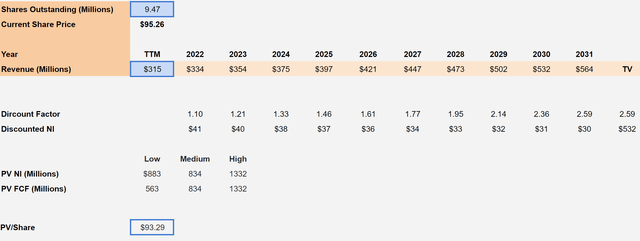

Given the uncertainty about the near term economic environment, let’s haircut that growth to 5% to err on the conservative side. The weighted average for net margin over the last 10 years is 13.6%, and the average P/E ratio over the last 10-year and 5-year periods is 19.2 and 25.4 – the 95% confidence interval for the two periods is (18.68, 19.73) and (25.19, 25,70), respectively. To err on the safe side, I assume an exit multiple of 18 at the end of a 10-year period. These assumptions should give us some downside protection.

Figure 9: Chase Corporation’s PE Distribution (Author)

Putting these assumptions in a simple discounted earnings model, and assuming a required rate of return of 10%, the fair value for Chase Corporation is $93/share (Figure 10). This assumes revenue growth from current trailing twelve months revenue. Knowing that NuCera’s acquisition should add about $80M once the deal closes, the fair value increases to $117/share if we include this revenue in the model (Figure 11). The model does not take net debt in consideration, but since we know the company’s leverage will remain low even after the acquisition of NuCera, it should not make a big difference.

Figure 10: CCF Fair Value (Author)

Figure 11: CCF Fair Value (Author)

Bottom Line

Chase Corporation is a high-quality company that lacks visibility among many investors, likely due to its market capitalization. The company has outstanding financials, a proven track record of consistent growth, and – if management stays the course – the creation of shareholder value is very likely to continue.

Be the first to comment