ryasick

Introduction

High-yield investing is the cornerstone of a lot of long-term dividend strategies. There are many reasons why investors decide to buy high-yield investments. The biggest reason is income for retired and soon-to-be-retired investors. I prefer dividend growth investing over high-yield investing. However, due to tax reasons, I, too, am required to maintain a few higher-yield positions. In this article, we’ll discuss the 18th-highest-yielding S&P 500 stock. The International Paper Company (NYSE:IP) yields 5%, has a boring but solid business model providing for steady dividends, and a valuation that could come with significant upside in the 2-3 years ahead.

However, its volatility-adjusted performance is abysmal. The company recently cut its dividend, while management is annoying investors by engaging in buybacks instead of maintaining the dividend.

In this article, I’ll give you my view on things as we assess whether the IP yield is worth buying.

Slow Growth, Underperformance, And Headwinds

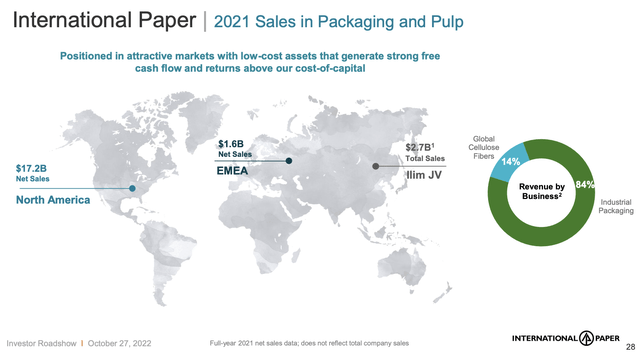

Incorporated in 1941, International Paper has become a leading global producer of renewable fiber-based packaging and pulp products. The company has operations in North America, Latin America, Europe, and North Africa.

As of December 31, 2021, the company operated 24 pulp and packaging mills, 163 converting and packaging plants, 16 recycling plants, and three bag facilities.

On October 1, 2021, the company completed the spin-off of its Printing Papers business: the Sylvamo Corporation (SLVM).

International Paper is a highly mature business operating in an industry that is beyond peak growth. Roughly 85% of total sales are generated in the industrial packaging segment.

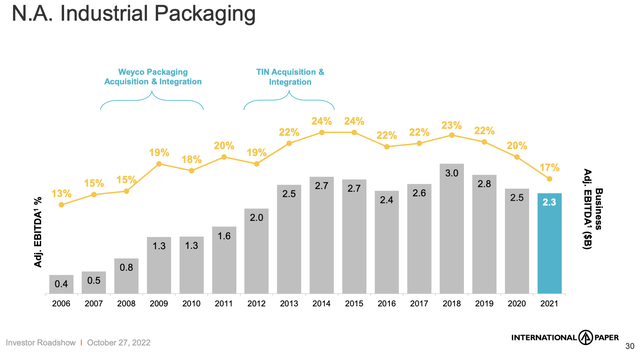

This segment peaked in 2018. The growth rate peaked at least five years before that.

While secular tailwinds like e-commerce and the push for more sustainable packaging (paper over plastics) are good news, we’re dealing with a company whose main focus is on making the most of its current assets and business.

In other words, enhancing margins and improving free cash flow.

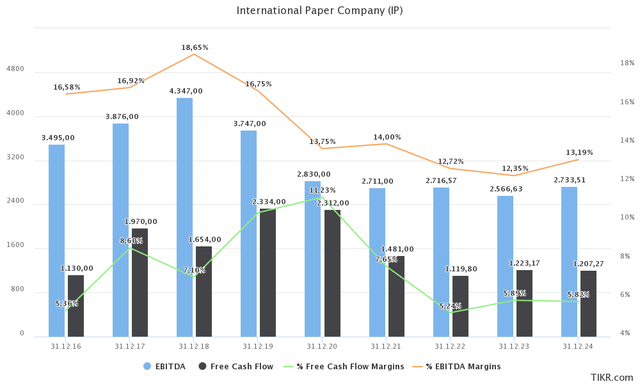

In 2023, the company is expected to generate $1.2 billion in free cash flow. EBITDA is expected to come in at $2.6 billion. Both are expected to grow very slowly in the future. Growth is mainly coming from better product/customer alignment, improving the cost structure, and benefiting from growth in specialty products.

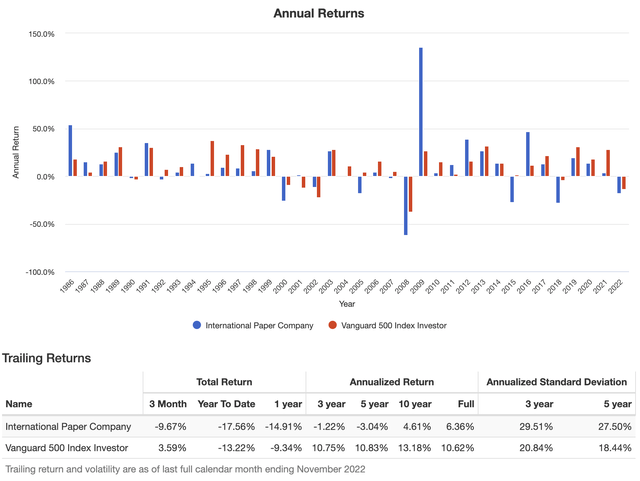

Unfortunately, the company’s mature low-growth business model has led to significant underperformance. Going back to 1986, the company has returned 6.4% per year. That doesn’t seem too bad. Unfortunately, it includes the dividend. IP underperformed the S&P 500 by more than 400 basis points per year. Moreover, the standard deviation since then is 32%, causing the volatility-adjusted performance (Sharpe ratio) to come in at 0.25. That’s a terrible number. Moreover, as the numbers below show, the company has continued to underperform the market, returning just 4.1% per year over the past ten years.

One of the reasons to buy IP is to bet on higher inflation.

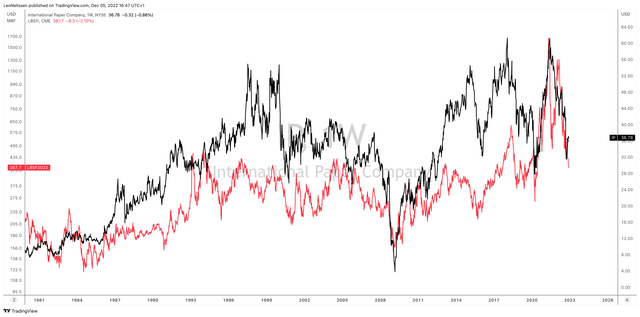

The IP stock price is highly correlated to the price of lumber as the chart below shows. That makes sense, as lumber and paper are correlated commodities. Hence, as low as long-term returns are, IP has been kind to traders who were able to buy and sell more actively (trading instead of investing).

TradingView (Black = IP, Red = Lumber Futures)

Last year, IP was trading above $60. Now, it’s below $40. Over the past ten years, the stock has been through three major cycles.

Now, input costs are down (using lumber prices as a proxy), which persistently high inflation on a consumer level is hurting demand.

Based on feedback from our customers and after observing order patterns across our various channels and end user segments, we believe inflationary pressures weighed heavily on the consumer, resulting in lower demand for goods. This had a large impact on demand for Packaging, as consumer priorities shifted towards nondiscretionary goods and services in the quarter.

Moreover, operations continue to be expensive due to high distribution costs and issues like (more) expensive natural gas.

Sequentially operations in costs was also impacted by significantly higher distribution costs, inflation on materials and services and the non-repeat of favorable onetime items we discussed in the second quarter. It also includes some additional spending on recovery boilers and bark boilers across our mills to make our own energy given the significant increases in natural gas prices.

Additionally, the company is currently being pressured by retailers that are reducing inventory. After the pandemic, most ordered too much. They are now working through their existing inventory. It also doesn’t help that consumer sentiment has imploded. All of this is bad for packaging.

The International Paper Dividend

A mature business model isn’t a bad thing. Many good companies have very mature business models with often slow growth. It doesn’t matter as long as the dividend is decent. After all, that’s why most people buy mature businesses. Otherwise, one may as well buy a fast-growing company.

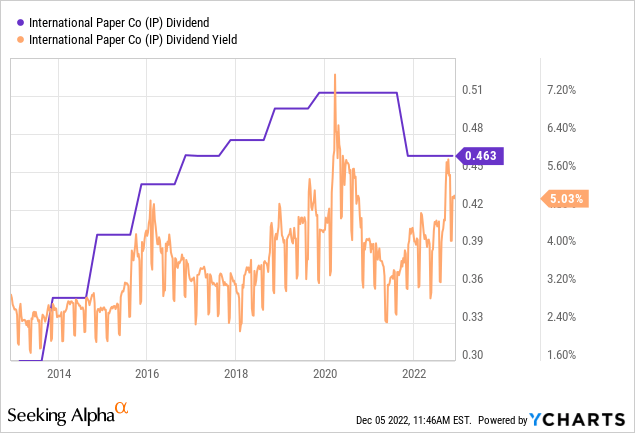

Owners of IP shares currently enjoy a $0.4625 quarterly dividend. That’s $1.85 per year and 5.0% of the current stock price.

This makes IP the 18th-highest-yielding stock in the S&P 500.

Unfortunately, that’s where the fun ends.

The average annual dividend growth rate of the past ten years is 6.2%. Over the past three years, that number is -1%.

As the chart above shows, the company announced a dividend cut on October 12, 2021. The company cut its dividend by 10%. As reported by Seeking Alpha:

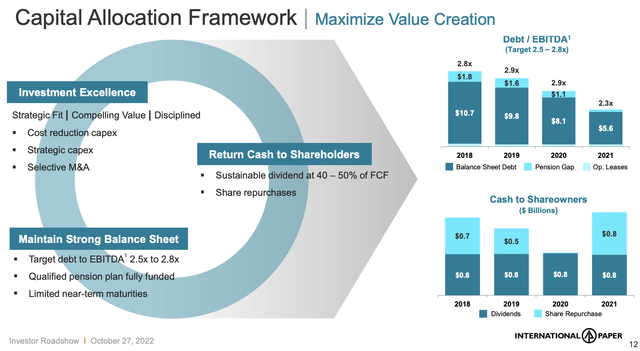

“We are committed to a competitive and sustainable dividend of 40 to 50% of free cash flow. The dividend adjustment we are making is consistent with our dividend policy and is well below the 15 to 20% adjustment we anticipated when we announced the spin-off of our printing papers business late last year,” chairman & CEO Mark Sutton commented.

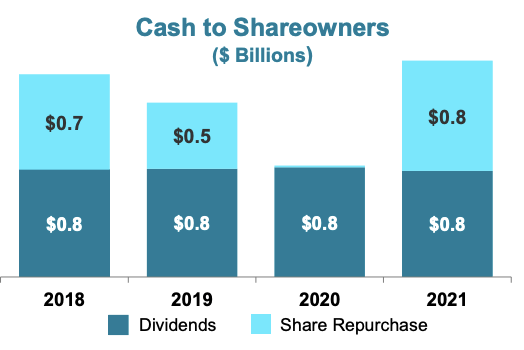

Moreover, the company announced a share repurchase program of $2 billion. That was on top of a remaining buyback authorization of $1.3 billion.

Needless to say, investors hated it. One of the many comments can be seen below:

$2B buyback program for the $22B company with $14B of debt? Are they nuts?

I’m singling this one out because it got a lot of likes as people buy IP shares for the dividend, not the buybacks. Also, I want to elaborate on the debt part of the comment.

First of all, IP buybacks aren’t new. Whenever possible, the company spends excess cash on buybacks. Buybacks are less prone to taxation and it doesn’t come with a dividend commitment. Unless special dividends are part of a dividend policy, most companies prefer to slowly but gradually hike dividends. Even during strong economic times. It gives them more breathing room in case they run into tougher economic times. After all, cutting a dividend is a big deal. No company wants to be forced to do that.

International Paper

This is what the company said in October.

In October, our Board of Directors authorized an additional $1.5 billion of share repurchases, which brings our total authorization to approximately $3.4 billion. Going forward, we are committed to returning cash through maintaining our dividend and through opportunistic share repurchases.

Given the maturity of the company, its business model, and its cyclical behavior, I’m in favor of using special dividends to reward investors. I think share repurchases should be avoided. But that’s just my opinion. Let me know in the comment section what you think the company should be doing!

With that said, the company aims to maintain a 40% to 50% free cash flow payout ratio.

In both 2023 and 2024, the company is expected to do $1.2 billion in free cash flow. This implies a 9.2% free cash flow yield using its $13.0 billion market cap. Note that lower free cash flow (versus 2021) is based on higher strategic investments. Regulatory and maintenance CapEx is close to $500 million. So, if the company were to reduce growth investments, it could pay a higher dividend. Yet, investing in growth makes obviously more sense.

Going back to the payout ratio, 50% of expected free cash flow would imply a 4.8% yield, which means the company’s dividend is scratching the upper bound of the company’s 40-50% payout range. Unless free cash flow improves in a meaningful way, the dividend is unlikely to rise anytime soon.

The International Paper Balance Sheet

Maintaining a strong balance sheet isn’t just important in order to be able to distribute a dividend, but it’s also one of the company’s core strengths.

As of September 30, IP has $5.8 billion in gross debt. Prior to the pandemic, the company had close to $10 billion in gross debt. This year, net debt (gross debt minus cash) is expected to end up at $4.6 billion. That’s 1.8x EBITDA, or well below the company’s own target range. This is very positive for buybacks as the balance sheet is not a priority going forward.

Moreover, the company has barely any maturities until 2035, which buys the company a lot of time in this high-rate environment.

According to the company:

The strong balance sheet gives us options. So we can continue to make organic investments in structural cost reduction and in strategic capacity and capability. In the past we would have probably had to stop some of that, just to manage the balance sheet.

There’s no meaningful debt for the foreseeable future that we need to deal with. So we’ve got a lot of risk off the table. We’re built for this type of environment and we’re built for a strong environment.

The Valuation

It’s not very scientific, but IP has basically moved between $25 and $60 over the past 10 years. The stock moved to the upper bound two times and fell to $30 three times after 2012. As I briefly explained, these are mainly inflationary/disinflationary waves.

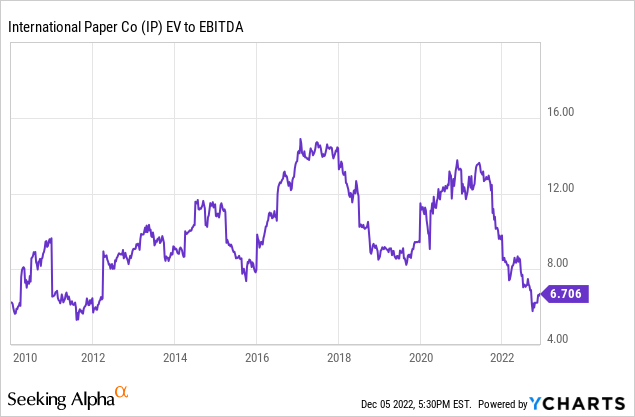

Right now, IP is trading at a forward EV/EBITDA of 6.8x. This is based on its $17.6 billion enterprise value, consisting of its $13.0 billion market cap and $4.6 billion in expected 2023 net debt.

This is actually a highly attractive valuation. Unless business expectations come down in a meaningful way, the company is attractively valued at current prices. The next cycle will more than likely push the stock back to $60. However, it’s hard to tell when that may be. I would not bet against it over the next 24 months, given that I expect the Fed to pivot in 2023.

Now, let’s answer the question I asked in the title.

Takeaway

I’m going with “no”. I do not believe that International Paper is a good high-yield stock. The company has a very mature business. Its yield is high. Its balance sheet is healthy. However, the upside is very limited. Growth is expected to remain very low. Free cash flow expectations hint at almost no dividend growth, while buybacks will be used to distribute excess cash.

This likely means that the long-term volatility-adjusted performance will remain abysmal. Given that the yield is just 5.0% (it’s not *that* high), I believe there are better alternatives on the market.

However, IP is attractively valued. As soon as economic expectations bottom, I believe the stock will soar to at least $60. This indicates a great risk/reward. However, it’s not enough for me to advise this company to investors.

If anything, it’s a good indication that the stock is not a sell. If I were long IP for whatever reason, I would remain long.

Hence, I rate IP a “hold”.

On a side note, we will discuss attractive high-yield investments in the next few weeks. Just to give you alternatives.

(Dis)agree? Let me know in the comments!

Be the first to comment