Tanes Ngamsom/iStock via Getty Images

We recently analyzed Grupo Aeroportuario del Sureste (ASR), which is our favorite airport group due to its exposure to travel to Cancun, which has been growing very quickly, and has proven more resilient than business travel destinations.

Today we thought we would cover another airport operator we like, Grupo Aeroportuario del Pacífico (NYSE:PAC). While Cancun is the crown-jewel for ASR, Guadalajara is the most important airport for PAC, followed by Los Cabos, Tijuana, Puerto Vallarta, Montego Bay, and other smaller airports mostly in Mexico’s Pacific coast.

Financials

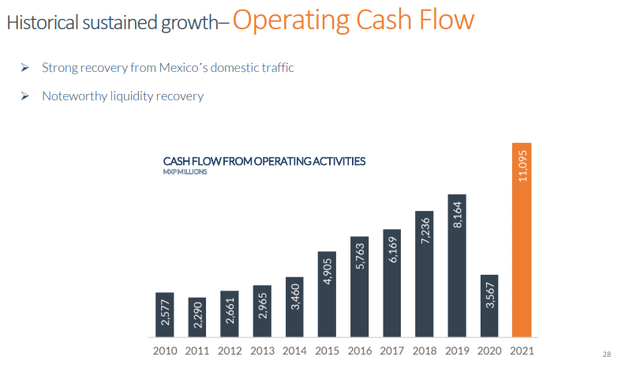

Airports were among the businesses most impacted by Covid, and that is reflected in the financials for the company. Recovery, however, was spectacular, and PAC started exceeding 2019 results in 2021. For example, net income for 2021 was more than 10% higher than that of 2019. Thanks to efficiency measures and overall passenger traffic recovery, especially domestic traffic, operating cash flow recovered even more as can be seen below.

Grupo Aeroportuario del Pacífico Investor Presentation

Growth

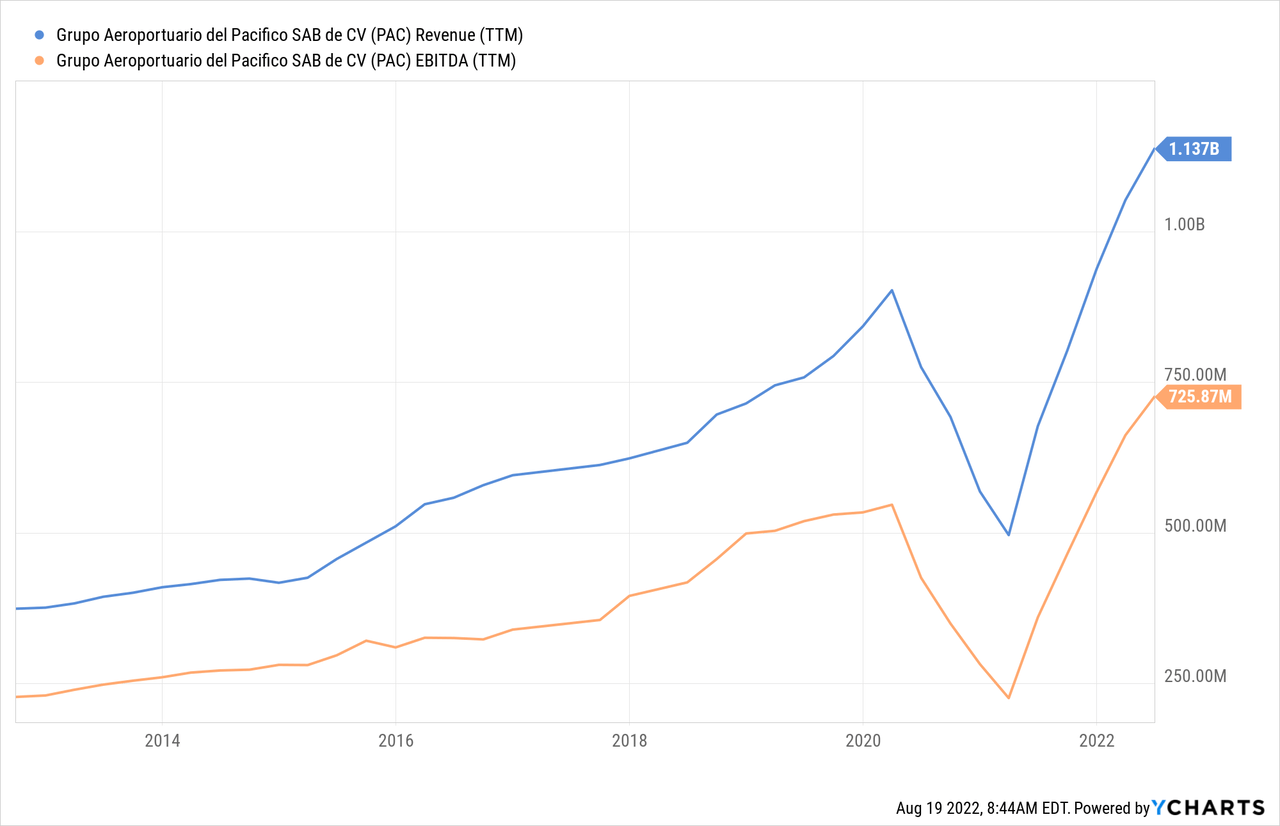

Revenue and EBITDA shown below give a good idea of the growth PAC is capable of achieving. For example, EBITDA has basically tripled in the last ten years, but the company is not standing still, it has several growth projects which should allow it to continue growing at a rapid pace for several more years.

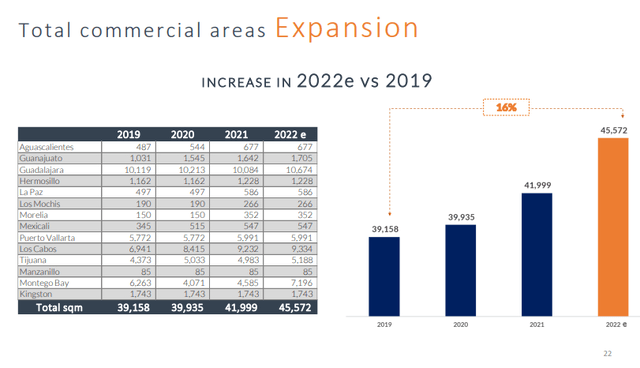

PAC is expanding commercial areas (think restaurants and stores at the airports), with an estimated increase of ~16% for 2022 compared to 2019. The company is also expanding car parking capacity in Guadalajara and Tijuana.

Grupo Aeroportuario del Pacífico Investor Presentation

Additionally, PAC is constructing a second runway and second terminal at Guadalajara airport. There will also be a new terminal building in Puerto Vallarta, and a Terminal expansion in Los Cabos. And these are just some of the main growth projects the company is developing.

Grupo Aeroportuario del Pacífico Investor Presentation

Balance Sheet

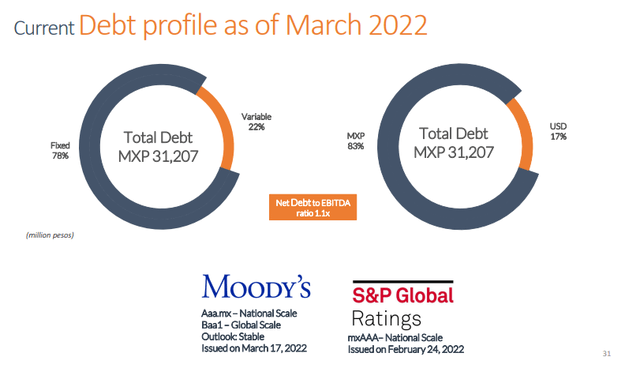

PAC has an investment grade balance sheet with low leverage. As of March 2022 its Net debt to EBITDA ratio stood at ~1.1x, well below the company’s financial target of below 3.0x leverage. Most of the debt is fixed-rate and in Mexican pesos.

Grupo Aeroportuario del Pacífico Investor Presentation

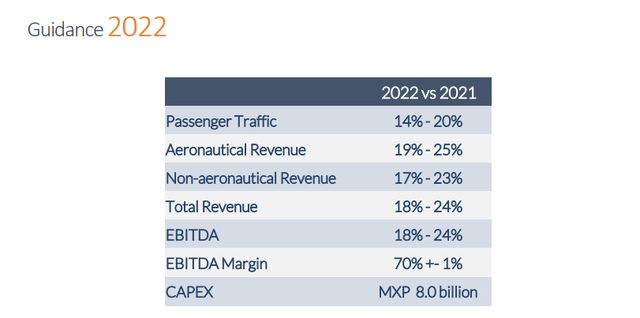

Guidance

The company guided for significant growth in 2022 vs. 2021, with passenger traffic expected to increase between 14% and 20%. EBITDA is expected to increase even more, in the range of 18% to 24%.

Grupo Aeroportuario del Pacífico Investor Presentation

Valuation

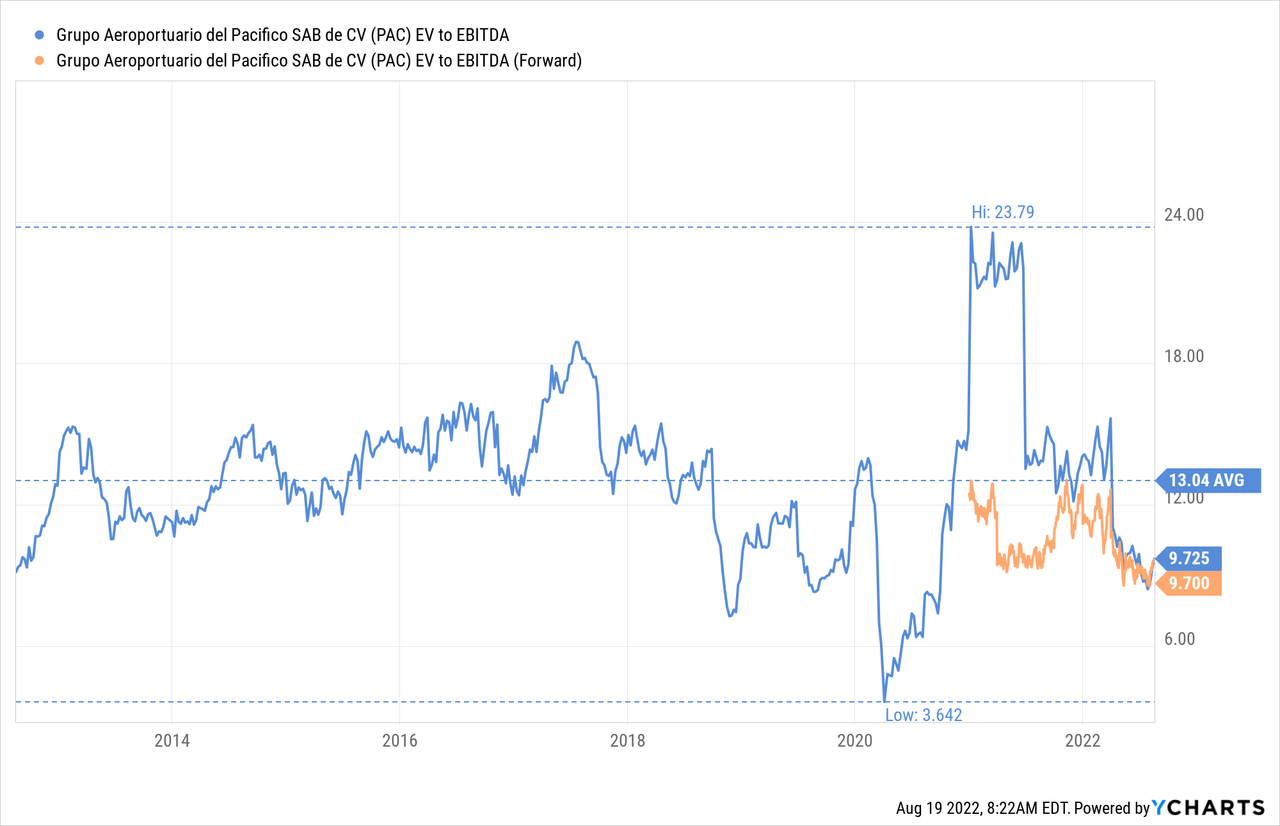

Despite the strong operational recovery after the Covid crisis, the valuation continues to have a significant discount to historical multiples. For example, EV/EBITDA has averaged ~13x over the last ten years, but it currently sits at less than 10x.

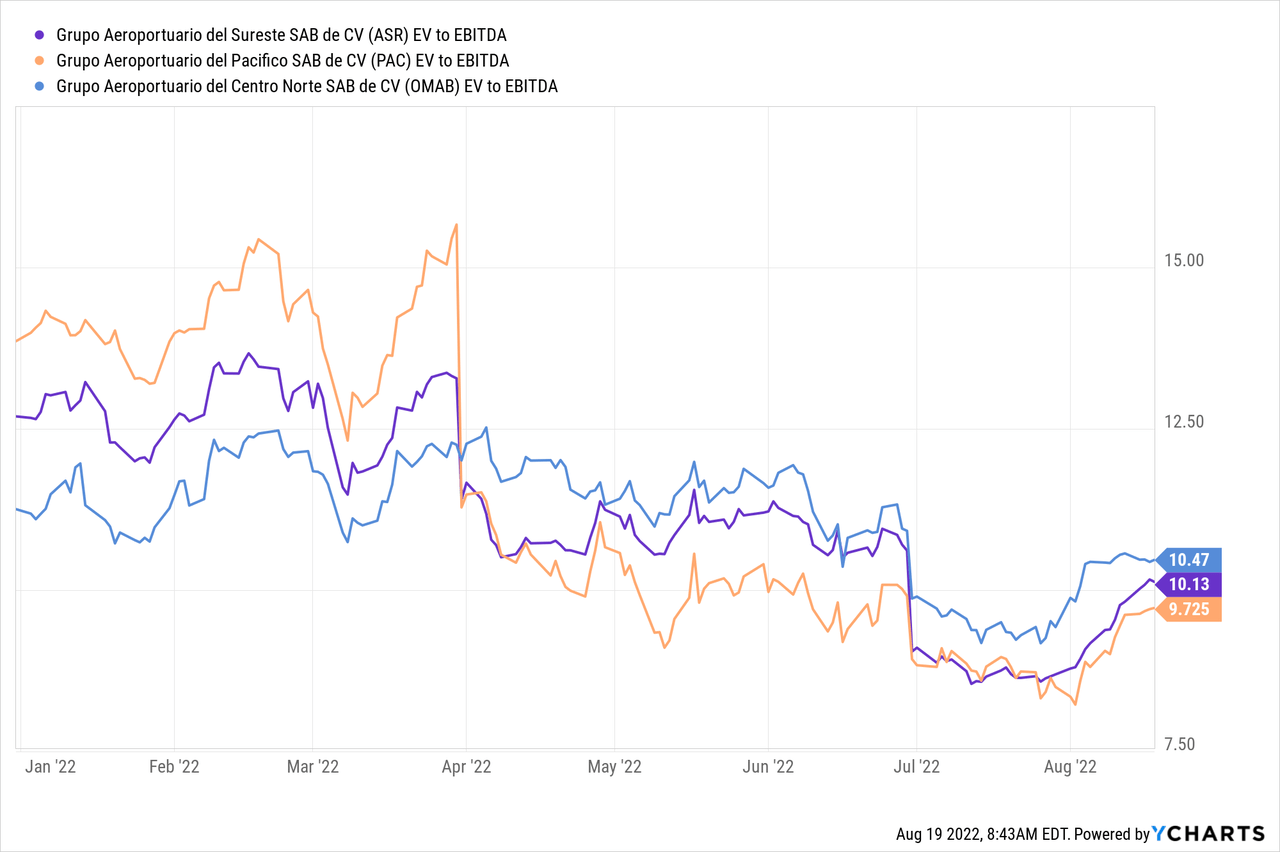

It is not only PAC that trades at a very low valuation, the two other main airport operators in Mexico trade at depressed valuations. Grupo Aeroportuario del Sureste trades at ~10x EV/EBITDA, while Grupo Aeroportuario del Centro Norte (OMAB) trades at ~10.5x, and PAC is the cheapest one on this metric at ~9.7x.

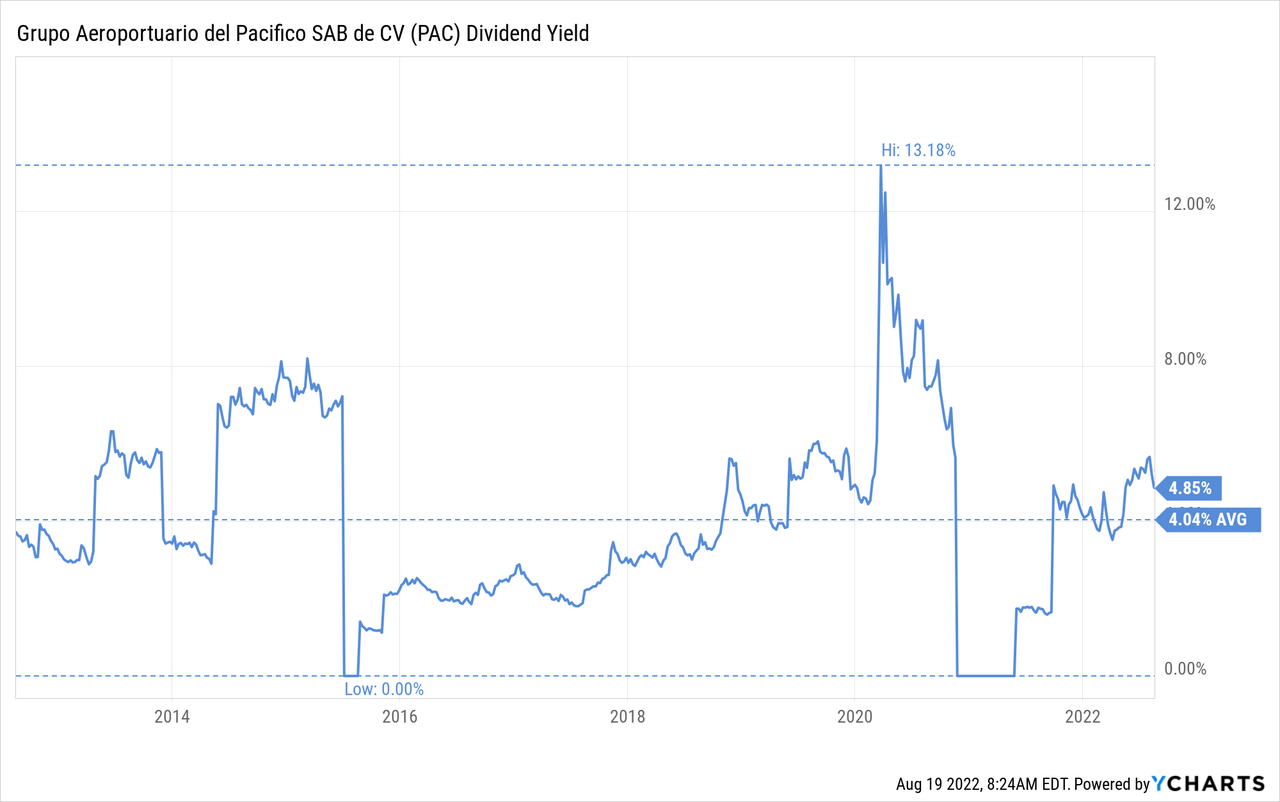

PAC has a policy of paying excess cash above a minimum balance (about two months of OPEX + the debt service) to investors, and as such it currently sports a very attractive dividend yield of close to 5%. While the company suspended the dividend for 2020 for obvious reasons, it has since gone back to rewarding its shareholders with a very attractive dividend.

Risks

There are two important risks to consider with Grupo Aeroportuario del Pacífico. One is potential travel restrictions restarting should Covid get out of control again, or should another pandemic happen. The other is that a large portion of PAC’s revenues (its aeronautical revenues) are regulated, and as such the company has to regularly negotiate with the government, especially as it relates to expansion capex. To a lesser degree there is also the risk of an economic recession, either in Mexico or the US, which would reduce the number of passengers.

Conclusion

While we prefer Grupo Aeroportuario del Sureste due to its exposure to the attractive Cancun airport, Grupo Aeroportuario del Pacífico comes a close second in our preference for airport operators. They are attractive businesses trading at low valuations, and with significant growth potential. One particularly attractive characteristic that PAC has is the high dividend yield, given its policy of returning most excess cash to investors. We think both ASR and PAC are a ‘Buy’ at current prices, and investors should give them serious consideration. As passenger traffic continues to increase and many of the expansion projects start generating revenues, EBITDA should continue posting records.

Be the first to comment