Falcor

The Q2 Earnings Season for the Gold Miners Index (GDX) is just around the corner, and the group is heading into its reporting season arguably at its most hated levels since Q1 2020. This is because the Gold Miners Index has suffered a 45% decline from its Q3-20 highs and a ~40% decline since the 2-month anniversary of the Russia/Ukraine War. While many names have slid 40% since April, Orla (NYSE:ORLA) has been punished more severely, down over 50% in the same period. At a P/NAV multiple of ~0.50x, there’s no arguing that the stock is undervalued, but with it being in the unfavorable post-acquisition period, I see more attractive bets elsewhere for now.

Camino Rojo Operations (Company Presentation)

Q1 Production

Orla Mining released its preliminary Q2 results last week, reporting quarterly production of ~25,700 ounces, a 5% beat vs. my estimate of ~24,500 ounces in the period. This was an exceptional performance for a mine that just went into commercial production, given that we often see some teething issues at the start of initial production, like what Victoria Gold (OTCPK:VITFF) experienced in Q3 2020. The solid performance is a testament to the strength of this team, which is led by CEO Jason Simpson, who was the previous Chief Operating Officer of Torex Gold (OTCPK:TORXF) as well as the General Manager of Vale’s (VALE) Labrador Operations (Voisey’s Bay). Let’s take a closer look at the Q2 results below:

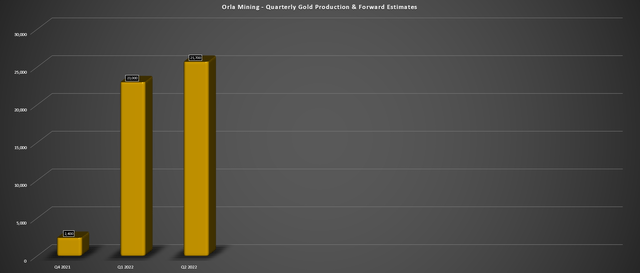

Orla Mining – Quarterly Production (Company Filings, Author’s Chart)

As shown in the chart above, Orla Mining produced ~25,700 ounces of gold in Q2, an 11% increase on a sequential basis. This has placed the company well on track to meet its FY2022 guidance mid-point of 95,000 ounces of gold production, sitting at ~51.3% of guidance heading into H2 2022. Notably, this is despite labor tightness and the spike in cases from Omicron that affected some producers. If we combine this solid operational performance with the fact that Orla was one of the few producers to build Camino Rojo Oxide on time/budget despite considerable headwinds (inflation, COVID-19 exclusions), the company has played itself in rare air (a junior producer that is under-promising and over-delivering).

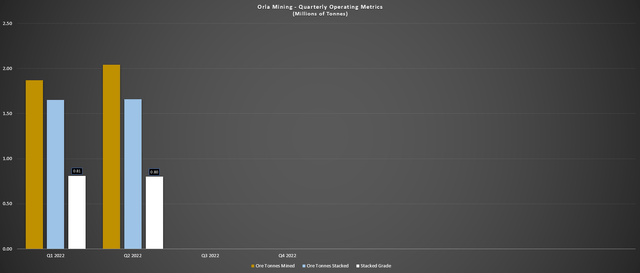

Orla – Quarterly Operating Metrics (Company Filings, Author’s Chart)

Looking at the operating metrics below, investors should be quite encouraged by the results. As shown above, Orla saw a steady improvement in ore mined to ~2.04 million tonnes, it saw an increase in tonnes of ore stacked to ~1.66 million tonnes, and grades were steady at 0.80 grams per tonne of gold. Meanwhile, the company’s processing throughput jumped more than 10% to 18,245 tonnes per day, which is a 1.4% improvement vs. the nameplate capacity of 18,000 tonnes per day.

Given the strong results, Orla is set to generate considerable cash flow this year despite the weakening gold price. This is certainly not the case for other new producers like Pure Gold (OTCPK:LRTNF) and Aurcana (OTCQX:AUNFF), which squandered their opportunity to make hay while the sun was shining after ramping up to production last year. Assuming Orla meets its FY2022 production guidance of 95,000 ounces and enjoys an average realized gold price of $1,810/oz, it will generate revenue of more than $170 million this year and operating cash flow of ~$80 million. However, given how well production is trending to date, we could see a beat on these figures, with annual production likely to come in closer to 100,000 ounces in FY2022.

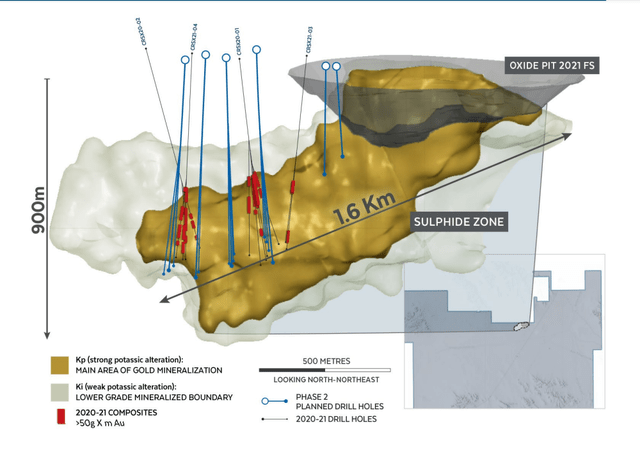

Camino Rojo Sulphide Metallurgy & Gold Standard Acquisition

The other key news in the quarter was Orla’s release of metallurgical results from its massive ~7.0+ million-ounce Camino Rojo Sulphide Project. The Phase 1 program suggests that two geometallurgical zones of the five that were recognized appear amenable to conventional carbon-in-leach [CIL] processing, and there is potential to produce a zinc concentrate and the potential to produce a gold concentrate through selective flotation. In addition, selective flotation may be used to produce a concentrate that can be treated using pressure oxidation.

Camino Rojo Project (Company Presentation)

The main takeaway from this news is that Camino Rojo Sulphide could operate as a stand-alone operation vs. potentially having to rely on Newmont’s Penasquito infrastructure for processing. With this additional information in place to inform cut-off grades, Orla is working towards a Preliminary Economic Assessment on its Sulphide Project, which is planned for year-end. With the potential for an After-Tax NPV (5%) on this project of more than $1.0 billion, the release of the PEA should allow Orla to get some credit for this massive opportunity which now appears to have multiple processing options.

Unfortunately, while the Camino Rojo Sulphide Project PEA had the potential to deliver a re-rating for the stock, the combination of its recent acquisition of Gold Standard Ventures (GSV) and gold price weakness has derailed the stock. This is unfortunate for investors that were looking forward to continued solid operating results for the sector’s newest and one of its lowest-cost producers, which could have helped Orla to command a premium multiple. Worse, Orla could find itself in the penalty box medium term, given that the post-acquisition period for suitors can be treacherous in this sector, regardless of how attractive the acquisition was that was recently completed.

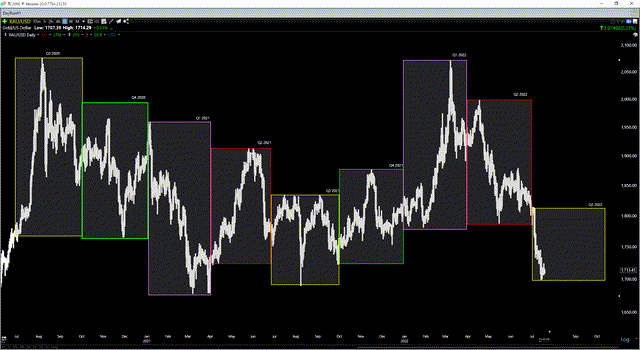

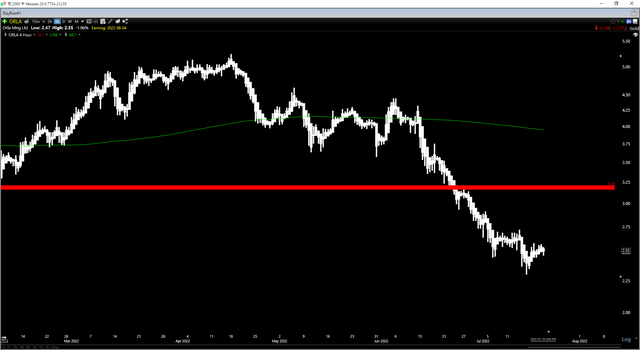

Gold Futures Price (TC2000.com)

Valuation

For the first time since early 2020, Orla has shed its premium valuation, resulting from extreme pessimism in the gold sector and share dilution related to the acquisition of Gold Standard Ventures. As discussed in a previous update, I see this as a smart move for Orla, and the stock now trades at less than 0.50x P/NAV, a very reasonable valuation for a growth story even if it’s operating out of a Tier-2 jurisdiction (Mexico). This is especially true given that the Gold Standard acquisition gives Orla jurisdictional diversification (Nevada, Mexico, Panama), complementing what was otherwise a less favorable jurisdiction profile ahead of the announced acquisition.

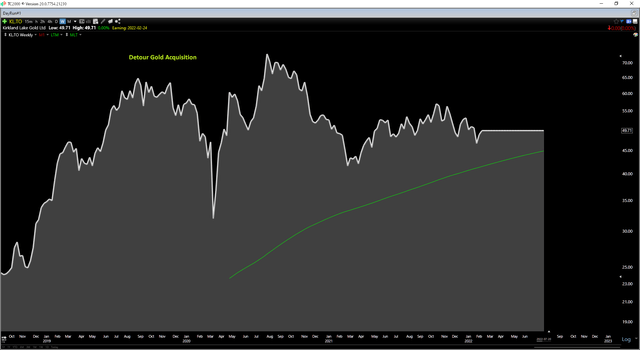

Kirkland Lake Acquires Detour Gold (TC2000.com)

However, following M&A deals, we often see the suitor punished unfairly, with the suitor having to absorb the share dilution but getting next to zero credit for the assets it acquired. This is what we saw in the case of Kirkland Lake Gold acquiring Detour, with Kirkland Lake seeing its P/NAV multiple nearly halved over the next year despite acquiring what could be one of the world’s largest and most profitable gold mines at a discount to NAV. Even if we adjust for the COVID-19 Crash, which exacerbated KL’s correction, the stock still fell over 30% from its highs and was unable to get up off the mat for over a year, underperforming its peers like Newmont (NEM) that didn’t do any major M&A deals.

For this reason, while Orla Mining is stretched to the downside from a validation standpoint, it’s hard to rule out its valuation getting sillier, given that we’ve seen very strange moves post M&A historically. Hence, while the stock is dirt-cheap, I wouldn’t rule out a drop to 0.40x P/NAV. In addition, I would expect the stock to be more of a trading vehicle over the next year, meaning that it makes sense to buy only on very steep drops and take profits into sharp rallies. Based on this outlook, I think there are more attractive ways to play the sector, with the period of underperformance often lasting over a year post-acquisition regardless of how good the deal ended up being. Fortuna (FSM) has been an extreme example, which has now slid 65% from its acquisition of Roxgold.

Technical Picture

Moving to the technical picture, Orla broke a major support level at US$3.50 that dated back to Q1 2021, and major support levels, once broken, often become new resistance levels. Given the loss of this major support level, the next support level for the stock doesn’t come in until C$2.60 [US$2.00]. This doesn’t mean that the stock has to drop to this level, and with sentiment in the sector the worst it’s been since Q1 2020, it’s possible that Orla might find a bottom at current levels. However, I don’t see any reason to rush in and buy the stock here above US$2.55, given that it has major resistance overhead at US$3.20 following its support break, potentially capping the upside for the stock.

Summary

Orla continues to put together solid operating performance, and its development portfolio is stronger than ever, with three very attractive projects in its pipeline, assuming votes go in its favor in the GSV deal. However, the post-acquisition period for stocks in this sector can be brutal. This suggests that while Orla is quite undervalued, it’s likely to be a sector performer at best over the next year. For this reason, I would not be in a rush to buy the stock unless it dips below US$2.20 per share, and I would view any rallies above US$3.30 before October as profit-taking opportunities.

Be the first to comment