dima_zel

The stock market has had a very volatile and tumultuous 2022 thus far, plunging into bear market territory on a couple different occasions before bouncing back thanks to growing evidence that inflation may be peaking this summer.

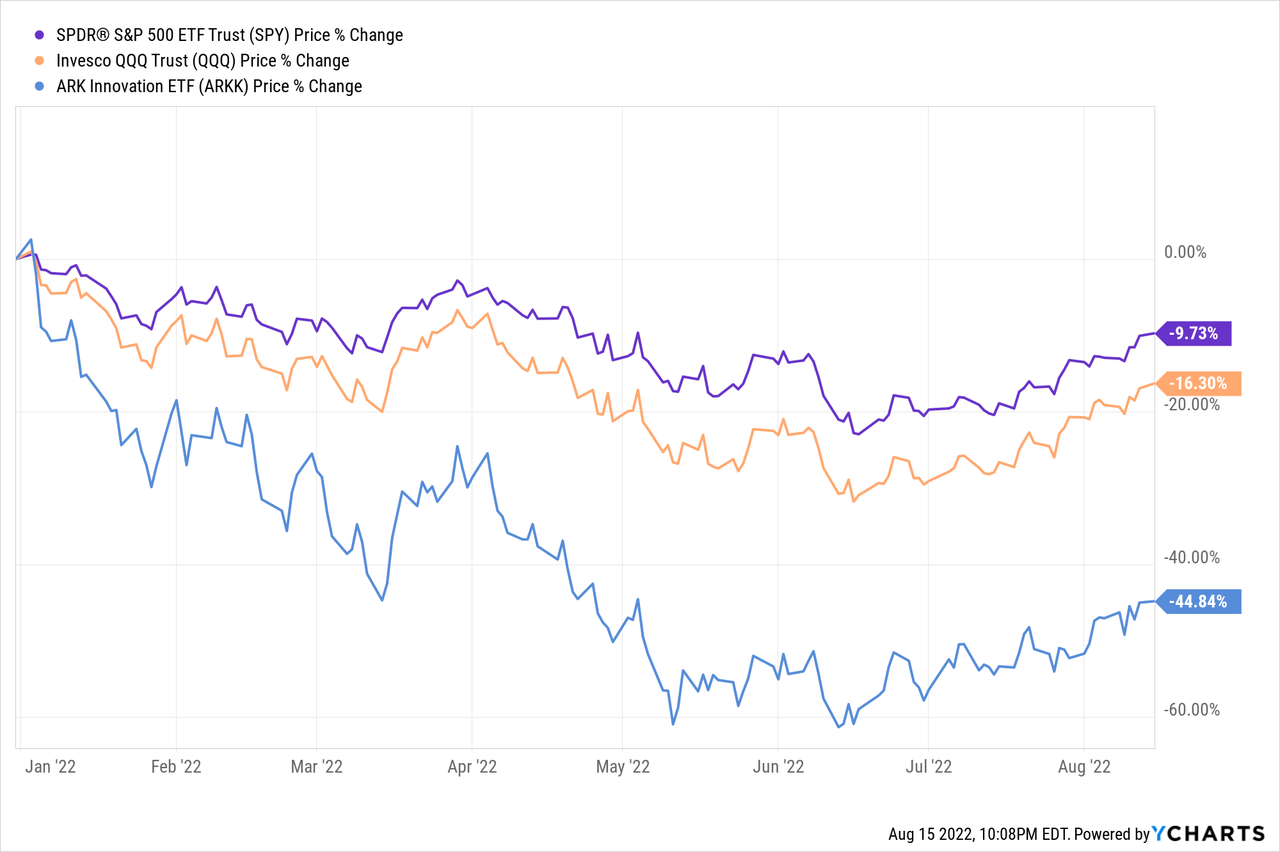

While the S&P 500 (SPY), Nasdaq (QQQ), and innovative technology (ARKK) have all recovered nicely over the past month, ARKK and QQQ remain down substantially year-to-date and even the SPY is down by ~10% in 2022:

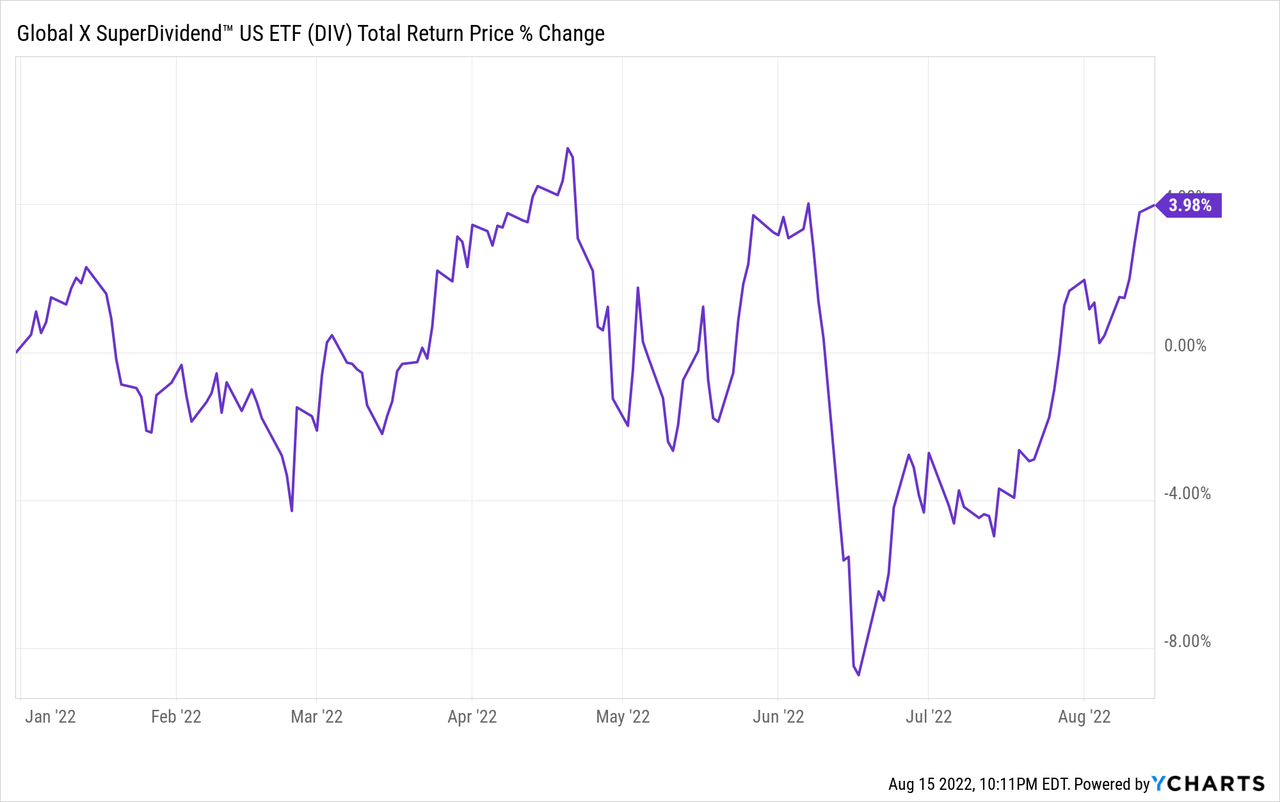

In contrast, the high yield sector (DIV) is actually in the green year-to-date, and our portfolio at High Yield Investor is actually up by double digits so far this year.

The reasons for this include:

1. Tech was grossly overvalued heading into the year, particularly the mega cap tech stocks like Tesla (TSLA), Amazon (AMZN), Meta (META), and Netflix (NFLX) as well as many of the unprofitable tech growth stocks. The massive underperformance year-to-date for mega cap and high growth tech is simply a reversion to the mean and a valuation adjustment by Mr. Market as hype is being increasingly replaced by fundamentals in price setting.

2. Higher interest rates generally punish growth-oriented stocks more than high yielding stocks. This is because higher interest rates result in higher discount rates being applied to discounted cash flow valuation models, which makes future cash flows worth less in the present. Given that the vast majority of the intrinsic value of growth companies comes from cash flows well out into the future while a significant portion of the intrinsic value of high yield companies comes from near-term cash flows, the adjusted valuations generally favor high yield stocks more in a rising interest rate environment.

3. High yielding stocks are often found in defensive inflation-resistant industries like utilities (XLU), REITs (VNQ), and midstream MLPs (MLPA). As a result, they have generally weathered the current economic uncertainty and headwinds better than the rest of the market.

That said, there still remain several compelling opportunities in the high yield space that have not rebounded with the rest of the market and we believe present investors with compelling value right now.

Three High Yielders Set To Soar

While we have a portfolio of over 30 high yield names at High Yield Investor that provide very attractive risk-reward at the moment, three of them that we will discuss in this article are Newmont Corp. (NEM) and Energy Transfer (ET), and Lumen Technologies (LUMN). Here is the basic bull case for each:

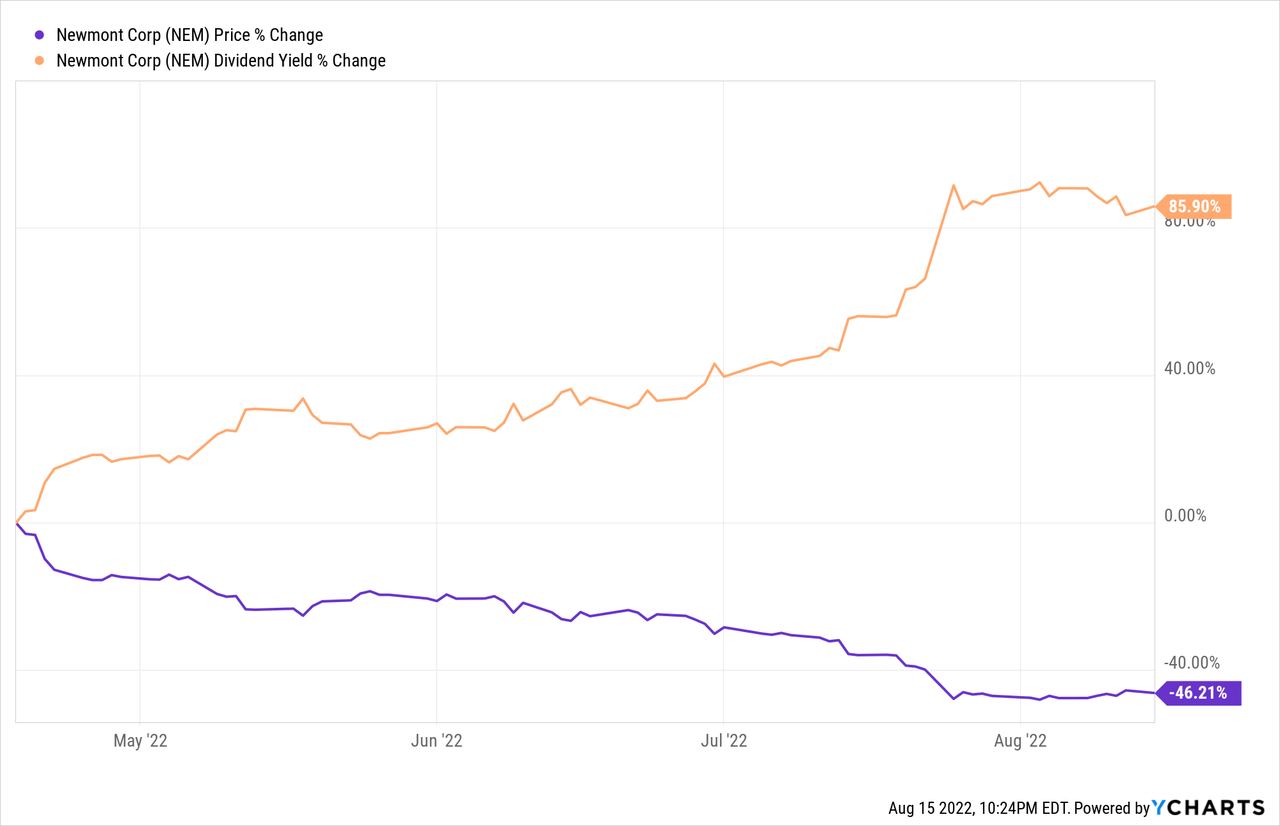

NEM: It is a world-class miner with some of the very best mining assets in the world. While it is known primarily as a gold miner, often lost in the discussion is that it has almost as many gold equivalent ounces of copper and silver as gold in its proven reserves. Given its very strong balance sheet, lengthy production profile, and exploration efforts that will likely enable it to sustain and even grow production for decades to come, it is one of the safest mining investments you can make today.

Now, thanks to one rough quarter due to inflation and a few other unfortunate events, the stock price has cratered, creating a very attractive buying opportunity.

The stock now offers investors significant valuation multiple expansion potential, geopolitical risk and long-term inflation hedging, meaningful exposure to the long-term bullish thesis on copper, and a juicy 4.8% yield while you wait.

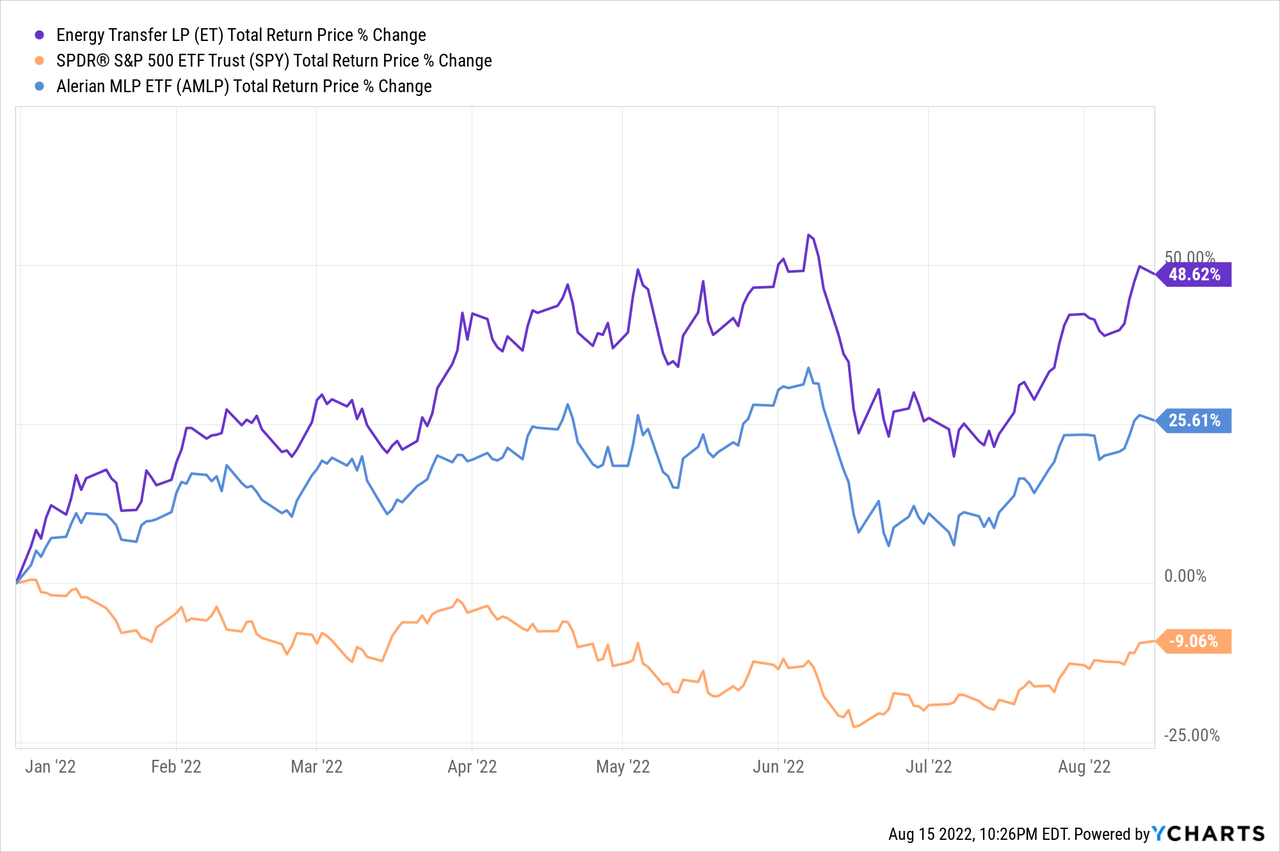

ET: ET has been one of our biggest winners so far this year, crushing not only the broader market but also the midstream sector as a whole:

However, there still remains immense upside and total return potential from here. ET is firing on all cylinders fundamentally, with management reporting that they will achieve their target leverage ratio by year-end, which will open up the door to finally restore the distribution to the pre-2020 cut level of $1.22 per year. On top of that, management is reporting numerous exciting growth opportunities available for the business to deploy its immense amount of retained cash flow.

Moving forward, investors can look forward to a 10.5% yield on cost once the distribution is fully restored to its pre-cut level along with solid growth. On top of that, the valuation multiple remains well below historical and peer averages. Given that the balance sheet is in very strong shape and that the partnerships boasts an attractive combination of cash flow growth and distribution growth potential in the near and medium term, it should warrant a higher multiple. When combined with the stable cash flows inherent to the midstream business model, ET’s high quality and well-diversified asset portfolio, and the bullish macro environment for energy, it is hard to see how an investor will lose with an investment in ET over the next 3-5 years.

LUMN: While we are rather nonplussed by LUMN’s business and management, the value proposition here is highly compelling and the potential to unlock it for shareholders via asset sales is quite promising. We also see an increasingly viable path for LUMN to return to top-line growth in the next year or two, especially after closing their asset sales. For example, highlights from its Q2 FY2022 results included:

- Revenue declines continued to decelerate as, when adjusting for foreign exchange impacts and one-time hits to revenue (the loss of CAF II Support from the year-ago quarter), revenue declined by 3.4% year-over-year.

- The business and wholesale sub businesses actually saw sequential growth from Q1 while the enterprise business saw a slight sequential decline and mass markets saw the steepest decline of 6.2% sequentially. However, this decline was largely due to the loss of CAF II so it is a bit overstated when looking at trends that are likely to carry over to future quarters. Overall, the sequential revenue decline was 1.4%, implying that the company is nearing growth, especially once the divestures of non-core non-growth businesses are completed.

- The enterprise channel also saw its revenue declines decelerate across all three of its channels, with international and GAM declining by only 0.3% sequentially, mid-market enterprise declining by 1.6% sequentially, and large enterprise actually growing by 0.8% sequentially.

- The quantum fiber business also continued to ramp with the company adding an additional 45,000 quantum fiber enabled locations and 26,000 new subscribers in Q2.

- Adjusted EBITDA and adjusted EBITDA margin excluding CAF II continued to decline sequentially, albeit at a decelerating pace.

- Free cash flow was still robust at $668 million, providing coverage for the dividend and management was able to reiterate its 2022 financial outlook of between $2 and $2.2 billion. At an $11.6 billion market cap, that implies a very attractive 17.2%-19.0% free cash flow yield.

Something important to keep an eye on is how the evolving macroeconomic landscape will impact LUMN’s performance. Management seemed to set the stage for disappointing performance in the second half of the year by stating:

As we look toward the second half of the year, we see the same macroeconomic pressures as everyone else. We are actively managing through supply chain constraints, which have caused some installation delays, but our strong relationships with our suppliers are proving invaluable in a challenging environment. We are also not immune to the inflation impacting all industries, and we did see increased pressure in the second quarter.

That said, we believe the critical nature of our service offerings make them more durable as our customers grapple with what the current economic uncertainty means for their businesses. Customers are certainly being more thoughtful in buying decisions, but we are not seeing any meaningful change in customer cancellations. Those of you who have followed us know, we often see opportunities to win new business with new technologies during economic downturns. Fundamentally, we believe these risks are temporary in nature and do not impact our long-term strategy or opportunity.

Inflation-driven cost increases, particularly labor costs, put pressure on our full year EBITDA guidance. However, we are amplifying our cost management strategies to offset this impact and are maintaining our full year EBITDA guidance based on our current expectations for performance in the second half of the year.

Notably nothing was said on the earnings call about potential further asset sales in contrast to the Q1 earnings call where this was discussed repeatedly by management and the analysts on the earnings call. This implies to us that something has likely changed here. Either management has explored sales and has decided nothing is imminently attractive, or, more likely in our view, management is on the cusp of closing another deal. Regardless, LUMN currently offers a 9% dividend yield to investors while we wait for management to deliver additional value accretive asset sales and/or restore the top line to growth. The cheap valuation and high dividend yield make the downside risk somewhat limited, so we believe the risk-reward is highly asymmetric to longs, though we also believe the stock is risky enough that investors may want to keep position sizes smaller.

Investor Takeaway

The market is recovering at the moment after an abysmal start to the year thanks to data suggesting that inflation is peaking and the labor market is remaining strong. If these two trends continue to hold, it is very possible that we may be able to skirt through the current murky waters with little to no further Federal Reserve rate hikes and only a mild recession and/or stagflationary period instead of a severe and more prolonged recession brought on by continued aggressive interest rate hikes.

Regardless of which way the wind blows, we believe that by investing in a diversified basket of deeply undervalued high yielders like the three discussed in this article, investors can position their portfolios to weather geopolitical and inflationary storms (with high quality miners like NEM), generate strong cash flows in just about any climate (with well diversified investment grade midstream businesses like ET), and see significant upside unlocked in a recovering economy and/or via a special situation asset sale (with deep value stories like LUMN’s). Our portfolio at High Yield Investor is filled with stocks like these and believe they will continue to drive our outperformance for years to come.

Be the first to comment