AleksandarGeorgiev

Investment Thesis: While Swiss Re could see limited upside in the short to medium-term, favourable movements across the SST ratio and the combined ratio could be a catalyst for upside.

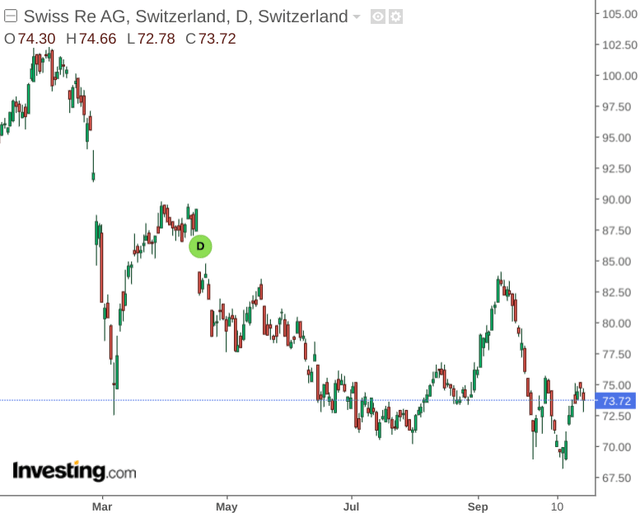

In a previous article back in August, I made the argument that Swiss Re (OTCPK:SSREY) could see low growth in the short to medium-term, owing to low growth in the company’s combined ratio across the Property & Casualty segment, along with a potential increase in excess mortality over the winter months placing pressure on net income growth across the Life & Health segment.

Since August, we can see that while the stock had a brief burst of upside, the stock is trading at similar levels to those seen back in August.

The purpose of this article is to assess what investors may be looking for when assessing Swiss Re’s performance across the nine months 2022 results on October 28, as well as detail other factors that could potentially influence the stock going forward.

Performance

With Hurricane Ian having caused widespread damage across the U.S. states of Florida and South Carolina in the past month – Swiss Re estimates that claims pertaining to the event could total USD 1.3 billion.

As such, the company states that it is unlikely to meet its ROE target of 10% for 2022.

Additionally, the company also explains that as a result of the disaster along with an inflation-driven increase in small to mid-sized claims, it is unlikely that its normalised combined ratio target of less than 94% will be reached this year.

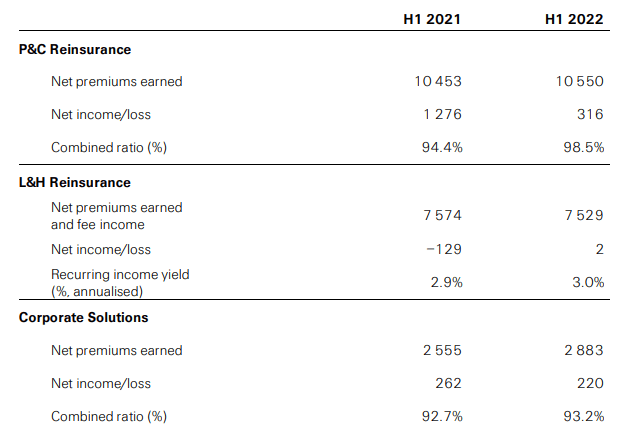

In this regard, I take the view that investors will be expecting that the combined ratio of 98.5% that we saw for the first half of 2022 could remain at similar levels across nine-month results or even see an increase as a result of claims incurred as a result of Hurricane Ian.

Swiss Re Press Release H1 2022

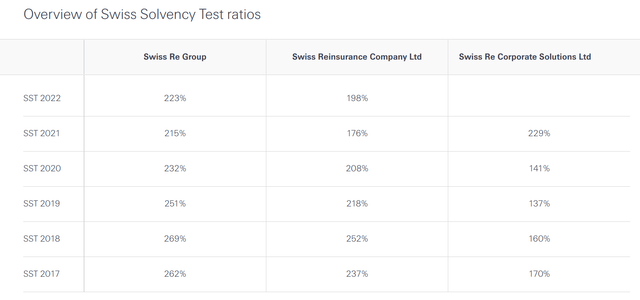

In terms of other segments, the company states that it is still on track to meet its targets across the Life & Health and Corporate segments. Additionally, the company also notes that its Group Swiss Solvency Test (SST) ratio coming in at 274% as of July 2022 – significantly higher than the ratio of 215% for 2021 as a whole.

Swiss Re: Solvency and Ratings

The SST ratio is described by Swiss Re as a proxy of available and required capital based on the economic value of the company’s assets and liabilities. A strengthening ratio in this regard indicates that Swiss Re is in an increasingly stronger position to fund an increase in claims – and I take the view that investors will pay particular attention to this ratio in the upcoming quarterly release to ensure that the company has the capacity to deal with an increase in claim expenses.

Looking Forward

Going forward, I take the view that Swiss Re could see little growth over the short to medium-term given anticipated losses over Hurricane Ian as well as the admission that Swiss Re will not achieve its normalized combined ratio target of less than 94% for this year.

With that being said, growth in the SST ratio this year has been impressive – and I take the view that if Swiss Re can continue to maintain this ratio at similar levels, then the risk of further downside in the stock could be minimized. Given that the impact of catastrophic events such as Hurricane Ian may already be priced into the stock – investors might simply be waiting for the combined ratio across Property & Casualty to eventually approach the 94% target before going long the stock.

From this standpoint, the SST ratio and the combined ratio across Property & Casualty are two ratios that I will be paying particular attention to going forward.

Conclusion

To conclude, I take the view that Swiss Re might see limited upside in the short to medium-term given current events. However, should the SST ratio remain strong, and we see an eventual lowering of the combined ratio (preferably below the 94% target), then this could serve as a catalyst for upside.

Be the first to comment