Justin Sullivan

Fears of a dividend cut drove AT&T Inc. (NYSE:T) to 10-year lows in October, but the stock has since recovered strongly, surging 32% higher amid improving investor sentiment. Fear has primarily been generated this year as a result of AT&T’s declining free cash flow forecast, which AT&T justified by citing rising consumer financial pressure. Because customers require more time to pay their phone bills, AT&T cut its free cash flow forecast for 2022 by $2 billion, causing investors to panic.

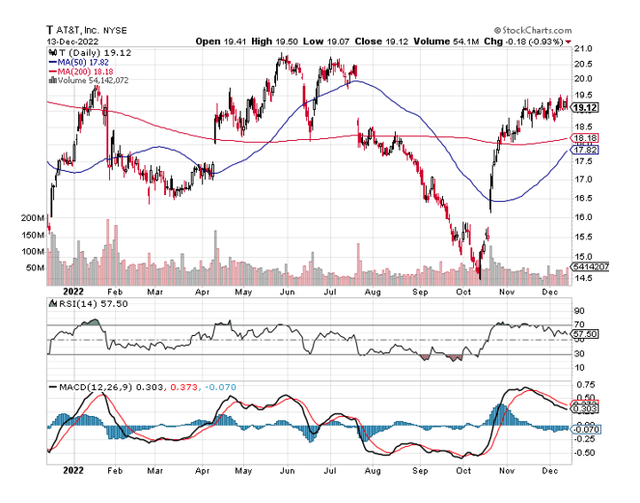

AT&T’s rally has stalled in recent weeks, and the stock has yet to close its yawning July gap, putting the company at risk of entering a consolidation period. I am prepared to buy AT&T at the price points mentioned in this article.

Inflation Remains A Challenge For AT&T And Its Customer Base

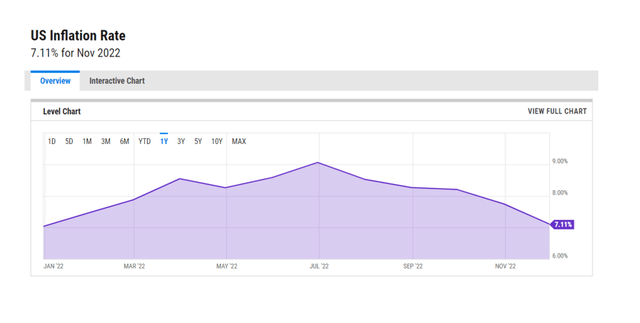

In July, AT&T reduced its free cash flow forecast by $2 billion to a new anchor point of $14 billion due to bill collection issues related to the company’s customer base. AT&T did not revise its third-quarter forecast, implying that the company remains on track to generate $14 billion in free cash flow for the full year, despite inflation remaining near 40-year highs. Inflation in the United States fell to 7.1% in November, from 9.1% in June, but this is only a minor relief for consumers, many of whom are still deciding whether to pay their grocery bill or their phone bill.

Moving forward, inflation will continue to be a significant challenge for many Americans, and by extension for AT&T, which may see a rise in defaults in 2023 if inflation proves to be more resilient than expected.

Having said that, concerns about AT&T’s inadequacy of free cash flow subsided in October when the market recognized that AT&T did not lower its free cash flow forecast a second time.

Technical Analysis And Potential Buy Points

The rebound that has occurred since October has begun to fade, and AT&T has been unable to close the yawning price gap that was created by the July selloff, at which time the telecommunications company revised its free cash flow forecast and cautiously prepared the market for a potentially worsening of its cash collection issues.

AT&T’s stock dropped off a cliff in July, dropping from $20.80 to $14.46 in three months. The stock has recently recovered to $19, but AT&T has not closed the gap, which is a negative technical indicator. While AT&T is no longer overbought, the stock has been trading sideways in no- man’s land for nearly a month. The fact that AT&T failed to close the gap strongly suggests that the stock is due for a correction.

I no longer own AT&T after selling it for a decent profit last month, but I am prepared to throw cash at the stock if it enters a consolidation period, which I anticipate will occur after a 32% upwards retracement with no intermediate correction.

The first level I’m keeping an eye on is the 200-day moving average line, which is around $18.18. If the stock falls below $18 (meaning it has fallen below its 200-day moving average), I will place my first buy order, investing roughly one-third of my total investment amount. At $18, there is also a support level, which if broken would indicate short-term bearish stock momentum.

The second level I’m keeping an eye on is the $16.50 support level. A drop below this level would almost certainly represent a more bearish reaction to the break of the 200-day (and 50-day) moving averages, at which point I would deploy the remaining two-thirds of my investment.

200 Day Moving Average (StockCharts)

AT&T Could Become Cheaper

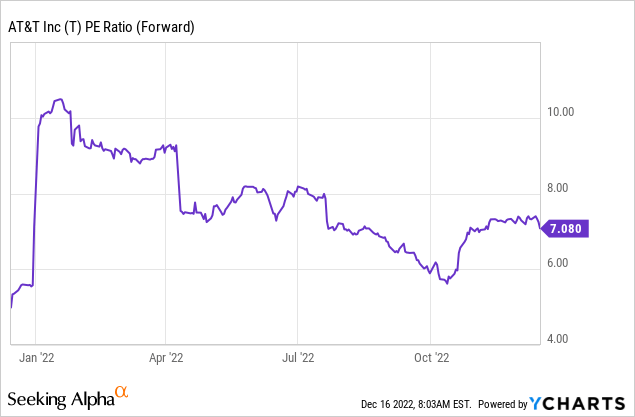

Based on expected earnings of $2.56 per share in 2023, AT&T has a forward earnings multiple of 7.1x. While AT&T does not appear to be overpriced in my opinion, I believe investors should wait for a pullback to the critical technical levels discussed above before deploying capital.

Why AT&T Could See A Lower/Higher Valuation

Inflation may prove to be AT&T’s nemesis. As previously stated, the telecommunications company reduced its free cash flow forecast because inflation is so pervasive that customers must effectively choose which bills to prioritize.

Consumer prices rose 7.1% in November and have moderated slightly since peaking in June, but they remain extremely high, implying that consumers will continue to struggle with payments in the future.

A low-ball free cash flow forecast or a rebound in the rate of inflation could cause AT&T’s stock price to fall.

My Conclusion

AT&T has seen a nice upward retracement since October, but the recovery has recently fizzled out, and the market lacked the strength to force a gap close, which would have been required to complete a full retracement.

AT&T did not revise its free cash flow forecast for 2022 in the third quarter, but the company still faces an uncertain near-term outlook as rampant inflation may cause more customers to fall behind on their payments.

I am eager to reinvest capital in AT&T, but only at a lower stock price. I believe investors should keep an eye out for the levels $18.18 and $16.50.

Be the first to comment