Mongkol Onnuan

The First Trust NASDAQ Technology Dividend Index ETF (NASDAQ:TDIV) gives investors exposure to high yielding technology and telecommunication stocks.

While the concept of high yielding technology stocks is interesting, in practice, I find TDIV’s returns and yield both underperforming peer funds.

Fund Overview

The First Trust NASDAQ Technology Dividend Index ETF gives investors exposure to high yielding technology stocks and charges a 0.50% expense ratio.

Strategy

The TDIV ETF tracks the Nasdaq Technology Dividend Index (“Index”). To qualify for the index, a security must be listed on the Nasdaq, NYSE, or NYSE Amex stock exchanges and be classified as a technology or telecommunications company, according to the Industry Classification Benchmark (“ICB”).

The index also requires companies to have a minimum market cap of $500 million and have paid a regular dividend within the past 12 months with a yield of at least 0.5%. The dividend must not have been cut within the past 12 months.

The index uses a ‘modified dividend value weighting’ methodology where size and dividend rate is rewarded. The dividend value is calculated by multiplying the dividends paid per share in the last twelve months by the number of shares outstanding. Technology companies are given a collective weight of 80% and telecommunications companies are given 20% weight in the index.

Portfolio Holdings

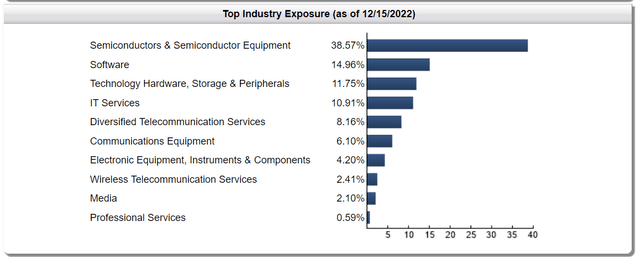

Figure 1 shows the TDIV ETF’s industry allocation. As designed, the fund is heavily concentrated in technology and telecommunication companies.

Figure 1 – TDIV industry allocation (ftportfolios.com)

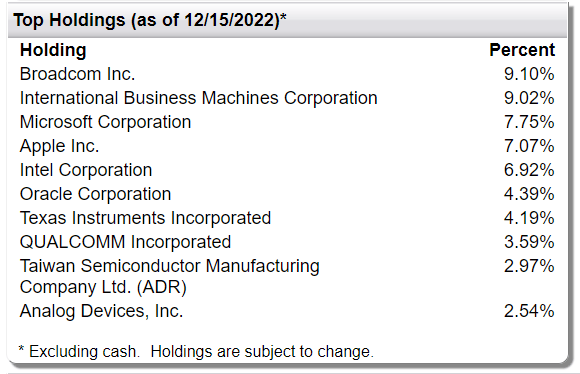

The fund’s top 10 holdings are shown in Figure 2 and comprise 57.6% of the fund’s assets.

Figure 2 – TDIV top 10 positions (ftportfolios.com)

Returns

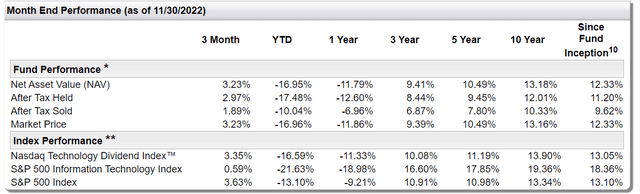

The TDIV fund has had strong long-term returns with 3/5/10Yr average annual returns of 9.4%/10.5%/13.2% respectively to November 30, 2022. However, due to the 2022 bear market, short term returns have been poor with YTD returns of -17.0% (Figure 3).

Figure 3 – TDIV returns (ftportfolios.com)

Distribution & Yield

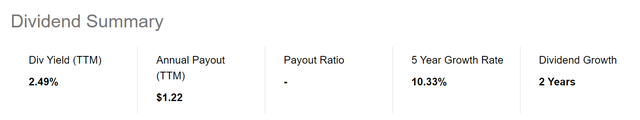

TDIV has a trailing 12-month distribution of $1.22 / share or 2.5% current yield (Figure 4). The distribution is paid quarterly.

Figure 4 – TDIV distribution (ftportfolios.com)

TDIV vs. Peer Funds

TDIV is conceptually intriguing, as it attempts to combine high growth technology investing with dividend investing, which is more Value / GARP oriented. But how does it compare against other high yielding ETFs?

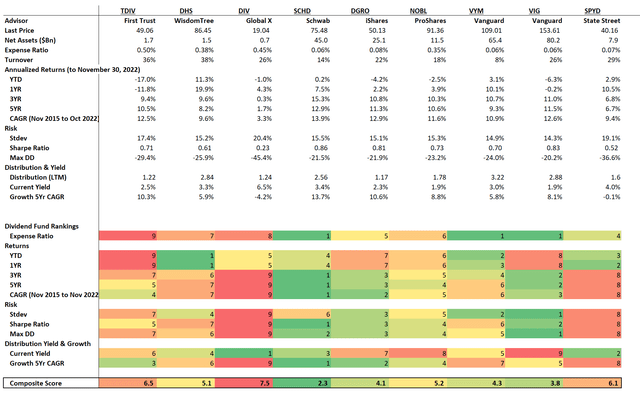

Readers should note that I am personally invested in the Schwab U.S. Dividend Equity ETF (SCHD), hence I like to compare dividend funds against the SCHD (Figure 5).

Figure 5 – TDIV vs. peer funds (Author created with returns and risk metrics from Portfolio Visualizer and distribution and fund details from Seeking Alpha)

Looking at TDIV versus the peer group, we can see that it scores pretty poorly. First, it is the most expensive fund with a 0.50% expense ratio vs. SCHD’s 0.06%.

In terms of returns, TDIV has some of the worst short-term returns, and mediocre long-term returns.

The fund is also more volatile, with volatility of 17.4% vs the peer group ~15%.

Finally, the dividend yield is also mediocre, at 2.5%.

Conclusion

The TDIV ETF gives investors exposure to high yielding technology and telecommunication stocks. Conceptually, the idea behind TDIV is interesting as it combines high growth technology stocks with dividend investing which is more of a Value or GARP-style of investing. However, comparing TDIV against peer dividend funds like the SCHD, I find it neither outperforms in returns nor yield. I would avoid TDIV.

Be the first to comment