Johnny Greig/DigitalVision via Getty Images

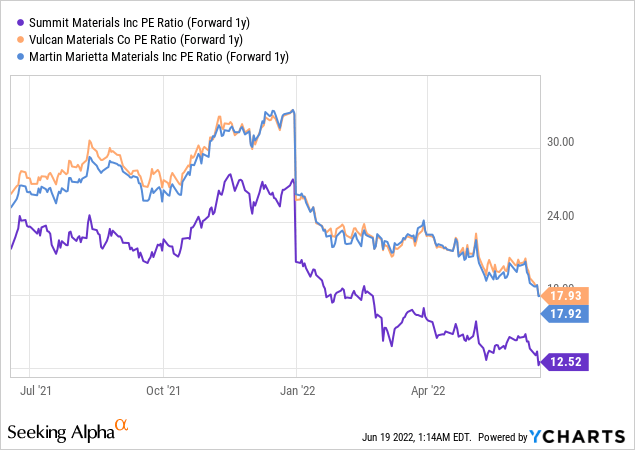

Summit Materials (NYSE:SUM), a leading North American materials-based company, looks to have already made meaningful progress just a year into its medium-term strategy, allowing for a more aggressive capital allocation approach going forward. With the medium-term EBITDA margin bridge also better-defined at its recent investor day event, further execution toward achieving its margin and ROIC targets should drive a more sustained share price outperformance in the upcoming months. Shares are currently priced at an attractive valuation discount to peers Martin Marietta (MLM) and Vulcan Materials (VMC), while relative to its medium-term targets, SUM offers an attractive 10+% FCF yield.

Outlining the Path to 30% EBITDA Margin and 10% ROIC

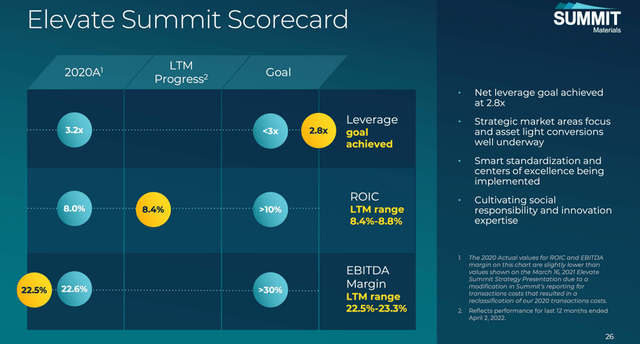

Over the medium-term, SUM is targeting 10% ROIC and 30% EBITDA margins – a considerable improvement from the c. 9% ROIC and c. 23% EBITDA achieved in fiscal 2021. While these numbers look ambitious at first glance, I think SUM could get there if the company successfully takes pricing to offset inflation pressures. Per management, the outlook embeds a high-single-digit % inflation this year followed by a moderation toward mid-single-digits % in fiscal 2023. Partially offsetting this will be several price increases across its product lines (50-450bps margin benefit) along with market growth, greenfield contribution, and portfolio optimization (125-275bps margin benefit). In addition, M&A, sustainability efforts, innovation, and other growth initiatives are projected to add c. 220bps of margin benefit.

Source: Summit Materials Investor Day Presentation Slides

I view the medium-term EBITDA bridge as promising – should SUM grow its top-line in the mid-single-digits % over the next three years and sustain c. 30% EBITDA margins, this would entail c. $775 million of EBITDA (+50% growth from fiscal 2022 levels). Following its recent divestitures, I think the margin target is very achievable as well – the SUM product mix has improved considerably, and a 75% EBITDA contribution target from materials looks well within reach (vs. c. 63% in fiscal 2020 and c. 68% in fiscal 2021). And while the company has lowered near-term guidance to $500-530 million (down from $529-557 million) to reflect the Hinkle divestiture, this still implies an impressive mid- to high-single-digit % growth scenario on a like-for-like basis. Further improvements in the product mix and margin profile should drive the valuation closer toward MLM and VMC in the upcoming years.

Staying Resilient Through the Demand Cycles

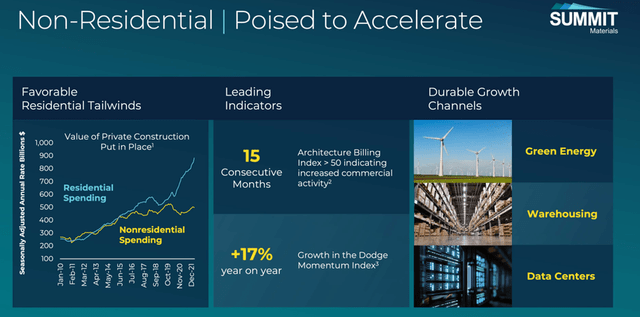

Interestingly, SUM management has yet to see any demand weakness in distribution centers, even alluding to this area as a source of strength – in stark contrast with Amazon’s (AMZN) recently announced plans to cut warehouse capital expenditures. Even if concerns about slowing warehouse construction prove warranted, I would note the diversity of SUM’s non-residential exposure, which includes areas primed for a post-pandemic rebound (e.g., hospitality and leisure). Looking ahead, non-residential demand is also picking up steam, driven by the last few years of residential growth and a flow-through in IIJA (“Infrastructure Investment and Jobs Act”) funding. As such, SUM could reap the benefits of a commercial demand upcycle, especially with the initial wave of public projects expected to be repair and replacement type work (areas where SUM is focused on). Supporting this view is the continued broad-based demand strength across SUM’s more rural and exurban regions, along with its key end markets.

Source: Summit Materials Investor Day Presentation Slides

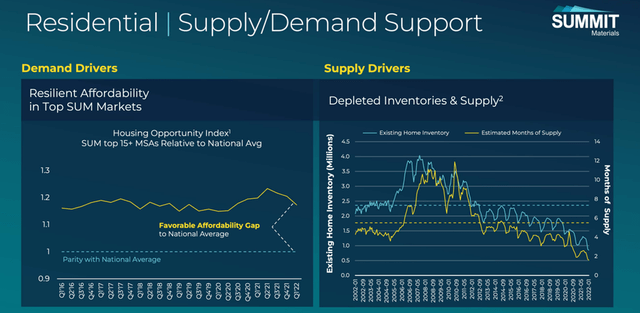

On the flip side, the residential cycle is slowing in light of rising rates. Admittedly, SUM is heavier in residential than peers (c. 32% revenue contribution), and some leading indicators have begun to indicate weakness on a national level. However, the strength in SUM’s more affordable regions, including Houston and Salt Lake City, could provide some relief amid a downturn. Considering SUM’s housing exposure is also skewed toward better affordability and strong in-migration trends, any near-to-medium term residential slowdown scenario could be less pronounced for the company.

Source: Summit Materials Investor Day Presentation Slides

A More Aggressive Capital Allocation Strategy

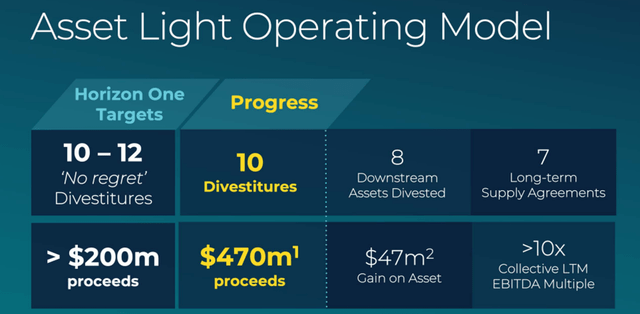

Encouragingly, SUM has completed the first phase of its Elevate plan at a brisk pace. Specifically, the company has generated proceeds of c. $470 million (vs. the $200+ million targeted) from ten divestments at a solid c. 10x trailing EV/EBITDA multiple. The latest divestiture of Hinkle was the largest one yet, netting c. $294 million in proceeds at a c. 10x multiple. The divestiture fits well into SUM’s portfolio optimization strategy – not only did its margins run below the company average for years, but there was also no clear path to margin expansion ahead. Furthermore, Hinkle was a business heavily reliant on asphalt paving and had relatively inconsistent growth despite its large platform. With the company also locking up seven long-term aggregate supply agreements, SUM has updated its FCF guidance to $140-160 million. Coupled with c. $340 million of divestiture proceeds, SUM could see its cash balance reach $850+ million for the year before debt pay down (c. 30% of its market cap).

Source: Summit Materials Investor Day Presentation Slides

SUM will now move into the Horizon 2 phase, which entails a move away from portfolio pruning and towards a more aggressive growth strategy. The company’s growth levers will span organic (attractively positioned greenfield activity) and inorganic efforts (fresh acquisitions). SUM currently has a robust pipeline of approximately sixty potential targets in place, with most of its targets either market leaders or having a clear path to becoming a leading player in the medium term. Also encouraging is that management has clearly defined margin and return targets to ensure post-deal accretion. Successful execution of these new growth initiatives (in contrast to prior portfolio refinement initiatives) could be an attractive catalyst for positive revisions in the upcoming years.

Final Take

Overall, SUM’s investor day event provided lots of positive insights into the company’s progress toward improving its asset base through targeted divestitures and its focus on operational improvements through the cycles. Considering the impressive progress made only fourteen months into its Elevate plan and the significant dry powder available for growth, it makes sense that SUM is now shifting toward a more growth-oriented strategy. With the cash balance set to approach c. $870 million (c. 30% of its market cap), SUM has sufficient balance sheet capacity for M&A and greenfield investments, along with share repurchases (the company has c. $203 million authorized for share repurchases after buying back 1.5 million shares through Q1′ 22). Shares currently trade at a relative valuation discount and, based on its medium-term targets, offer investors an attractive 10+% FCF yield.

Be the first to comment