funky-data/iStock Unreleased via Getty Images

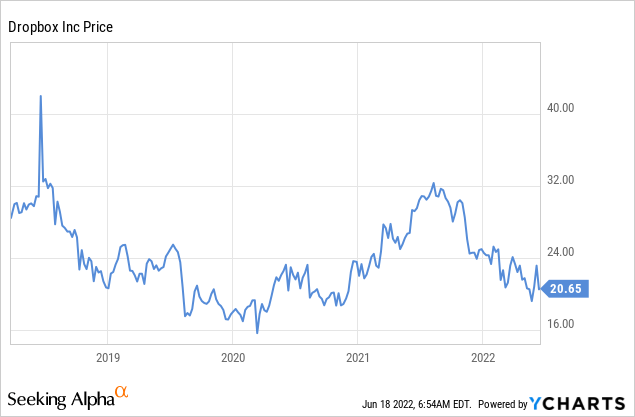

Dropbox (NASDAQ:DBX) IPO’ed in March 2018, going public at $21 per share and opening at $29. It currently trades for ~$20.65 four years later, despite massive improvements to its financials. The reason for this is simple, it went public at a very high valuation, and it has taken four years for its fundamentals to catch on with the actual price.

We’ll see how it has performed on a number of metrics, and while the company has perhaps not delivered as much as it potentially could have delivered, it is a more profitable company compared to the Dropbox at IPO. It also has a few new products that could start contributing very meaningfully to the top line, particularly its e-signature solution HelloSign.

Dropbox Financials

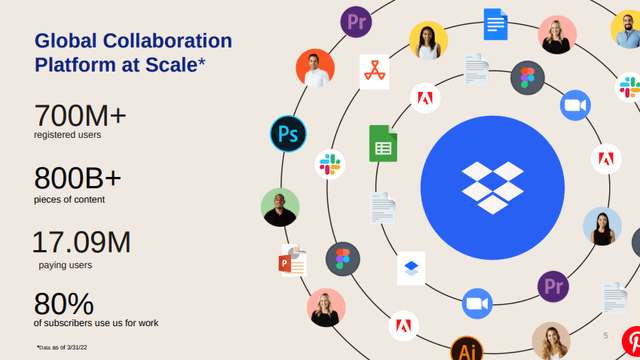

The foundation of the Dropbox business model is the freemium approach, where the service is mostly free, but users can opt in to pay for additional features. Most of Dropbox’s 700 million+ users utilize the service for free, but fortunately for the company, there are ~17 million that have signed up for one of the paying options. Therefore, the number of paying users is a key metric, and it has been trending up. In 2019, there were ~14.3 million, so the company has gained a few million since IPO. The average revenue per paying user has also modestly increased from ~$123 in 2019 to about $133 now. Multiplying the two, we get the annual recurring revenue, which currently stands at a little above $2.2 billion per year.

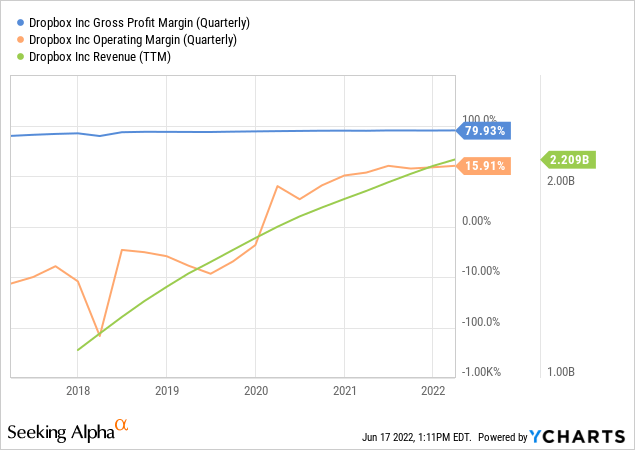

Despite offering the service to most users for free, the company has managed to post very impressive financials, such as >80% Non-GAAP gross margin, >30% Non-GAAP operating margin, and it is targeting $1 billion in free cash flow by 2024. GAAP operating margins are significantly lower, as can be seen below, and as is common with many technology companies, the reason is mostly share-based compensation. On the positive side, the company has displayed very strong operating leverage, and as revenue doubled, operating margins improved in an impressive way. Note that the graph is using a log scale to be able to better appreciate the improvement trend and operating leverage.

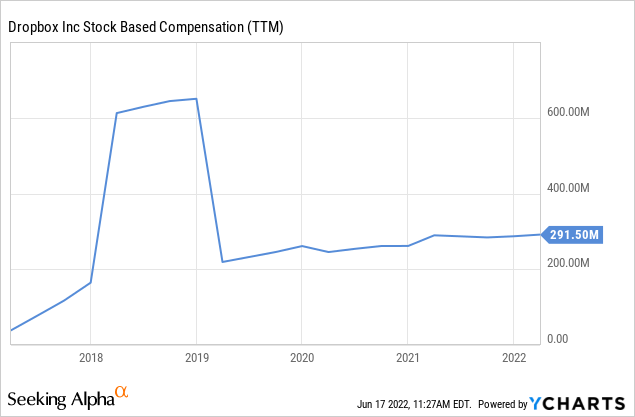

Share-based compensation has moderated a bit since the IPO, but we would argue it remains elevated for a company of its size. We would subtract stock-based compensation from the free cash flow numbers in order to get closer to what we consider real owner earnings.

The company posted $708 million in free cash flow in 2021, subtracting the ~300 million in stock-based compensation we get to an adjusted free cash flow closer to $400 million.

In Q1 2022 the company continued seeing some improvements, even if moderate, to its key financial indicators. Annual recurring revenue now stands at $2.29 billion, average revenue per user increased to $134, and revenue was $562 million for the quarter.

Longer term, the company believes it can further increase gross margin to be between 80-82%, and Non-GAAP operating margin to 30-32%. The company also believes it can generate more than a billion in annual free cash flow, from $708 million in 2021. This is all very impressive, but don’t forget to take into account stock-based compensation, which significantly lowers the Non-GAAP numbers.

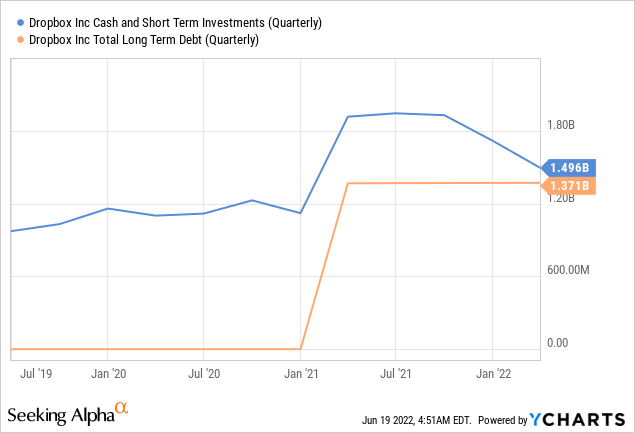

Dropbox Balance sheet

Dropbox has a very strong balance sheet, with more cash than debt. It has total cash and short-term investments of $1,495.6 million against long-term debt of $1,371.2 million. This leaves a net cash position of $124.4 million.

DBX Stock Valuation

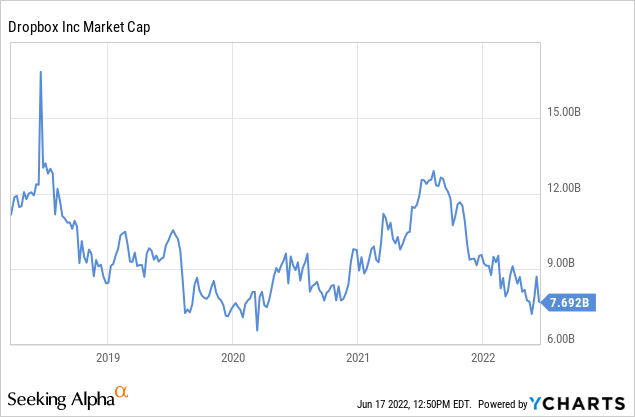

The company is trading with a market cap of ~$7.7 billion. If we take the $708 million in free cash flow and subtract the ~$300 million in stock-based compensation, the company is trading at ~19x adjusted free cash flow. This is not expensive and can be argued to be a reasonable value.

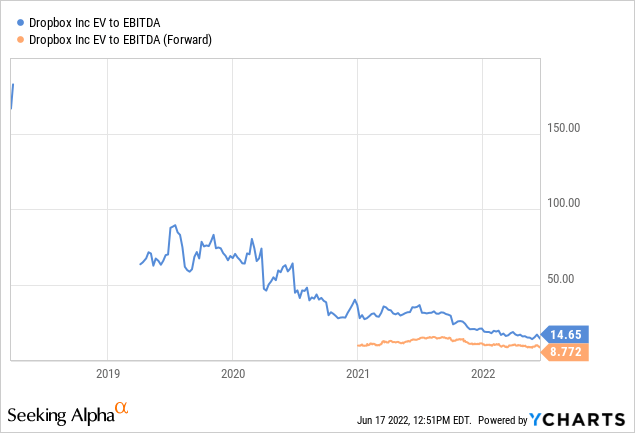

When Dropbox IPO’ed, it did so with an EV/Revenues ratio of ~10x. With the growth of the last four years, and a moderately less expensive share price, that ratio today stands at ~3.3x. EV/EBITDA was not even very meaningful at IPO given the low level of profits the company had, and now shares are trading with a very reasonable ~14x ratio and a ~9x forward EV/EBITDA.

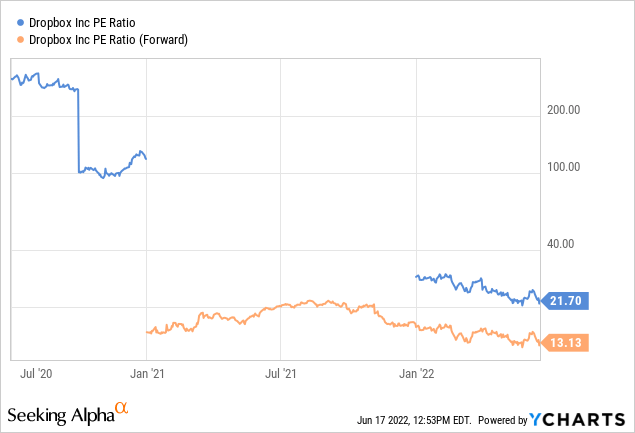

Same thing with the price/earnings ratio, it went from not being meaningful due to the low level of profitability of the company, to a reasonable ~21x, and ~13x for the forward P/E. These are cheap multiples for a technology company still expected to grow, even if growth is not breaking any records. In fact, decelerating growth explains part of the reduced valuation, as growth has moderated to ~10% year over year. Since it went public, growth has averaged ~17%, so the recent 10% is a meaningful deceleration.

Glassdoor Reviews

We get the impression from its Glassdoor reviews that Dropbox is a well-managed company. Usually, 4-star averages are only seen at companies with superior management, so a 4.3 average is quite good. And most employees also say they would recommend the company to a friend, and that they approve of the CEO.

Risks

We see two important risks with Dropbox, one is intensifying competition, with competitors like Microsoft (MSFT) trying to steal some of its customers with OneDrive, and other similar file sharing/synchronizing solutions from other big tech companies. The other risk we see is that the valuation can continue to compress if growth continues slowing down. At this point we view shares as fairly valued, even slightly undervalued, but with a significant downside risk if competitors figure out how to steal more market share from them.

Conclusion

Dropbox is an interesting company that has managed to make its freemium business model a success. When it went public, the valuation was quite elevated, but has since become a lot more reasonable. Part of the valuation reset can be explained by decelerating growth, and we caution investors that shares could fall considerably more should growth continue to decelerate under intensifying competitive pressures from companies like Microsoft with its OneDrive product. At this point, we believe shares have balanced pretty well the positives and negatives, and that the share price should follow more closely in the future the evolving fundamentals of the business.

Be the first to comment