luismmolina/iStock via Getty Images

Adaptimmune Therapeutics (NASDAQ:ADAP) was a big winner a couple of years ago following impressive data from the company’s Phase I ADP-A2M4 “afami-cel” trial. The ticker jumped from around $1 per share to roughly $13 per share in about 6 months, and I was able to book some respectable profits. I had decided to jump into the ticker, based on the company’s intriguing SPEAR T cell therapies and the company’s relatively cheap valuation at that time. Now, the share price has receded back to the $1 area despite the company moving closer to submitting a BLA for afami-cel for synovial sarcoma and myxoid/round cell liposarcoma “MRCLS” in Q4 this year and a potential commercial launch in 2023. I believe the market has provided another opportunity to establish a position at a cheap valuation and ahead of some potent catalysts that could trigger a considerable move in the share price.

I intend to provide some background on Adaptimmune Therapeutics. In addition, I discuss some of ADAP’s downside risks that investors should be aware of. Finally, I discuss my game plan for my miniature ADAP position and how I plan to amass a considerable position ahead of a potential PDUFA date.

Background On Adaptimmune Therapeutics

Adaptimmune Therapeutics is a cell therapy company using their TCR-engineered T cells to take on various tumor types. The company’s Specific Peptide Enhanced Affinity Receptor “SPEAR” T-cell platform allows the modification of T-cells to locate and terminate cancer in numerous solid tumor types that otherwise would have gone undetected.

Biotech companies have been investing in the research and development of immunotherapies that are operative with T cells due to their ability to mark and eradicate cancerous cells. T cells are able to identify cancer cells using their TCRs, by identifying distinctive cancer-testis antigens, or CTAs. So, it is possible to modify naïve T cells to express that antigen-specific TCR by way of isolating a TCR that can pick up a distinct CTA from a specific tumor. Thus, forging a modded T cell that can now engage that particular tumor or cancer type because it now has the TCR to match the antigen.

Adaptimmune’s TCR-engineered T cells pipeline has several pre-clinical and clinical-stage programs, including MAGE-A4 and AFP.

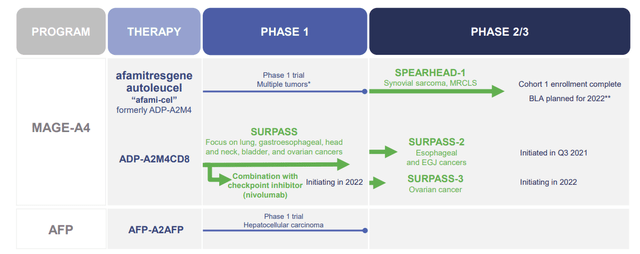

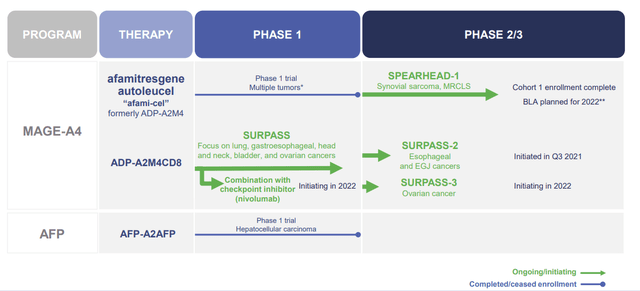

Adaptimmune Pipeline (Adaptimmune Therapeutics)

Their leading program is MAGE-A4 which contains afami-cel, a TCR-engineered T cell that targets the MAGE-A4 CTA and is being tried in multiple tumors. The leading indications are synovial sarcoma and MRCLS. Synovial sarcoma and MRCLS are uncommon cancers, with less than 2K patients in the United States each year. Sadly, the management for these cancers hasn’t really progressed in decades and is essentially simply chemotherapy and radiation treatments. Therefore, a new therapy would be a huge opportunity and could have a dramatic impact on how we treat these patients.

So far, afami-cel has produced impressive data, with a 41% overall response rate “ORR” in synovial sarcoma and 10% for MRCLS. The median progression-free survival “mPFS” was 58 weeks compared to 12 weeks in non-responders. Adaptimmune announced that they saw responses in different subgroups (age, gender, number of prior lines of therapy, tumor burden, and MAGE-A4 expression level) What is more, patients who have experienced 2 or fewer lines of therapy had a response rate of 49% whereas patients who received 3 or more had a response rate of 24%. So, it looks as if a large variety of synovial sarcoma and MRCLS patients could benefit from afami-cel, however, getting treated in earlier lines of therapy yields better results.

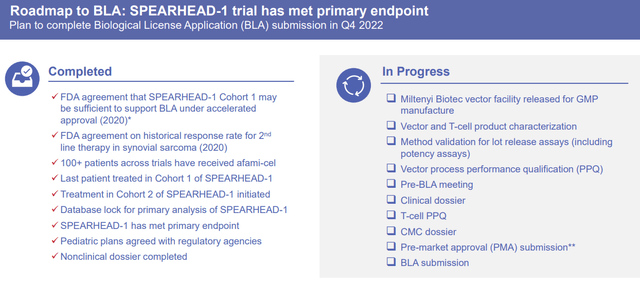

This pivotal trial hit its primary endpoint for efficacy and a favorable benefit-to-risk profile of afami-cel. The company reported “mainly low-grade cytokine release syndrome and tolerable/reversible hematologic toxicities.” The company expects to submit the BLA before year-end.

Adaptimmune Therapeutics Roadmap to BLA (Adaptimmune Therapeutics)

The company’s other MAGE-A4 therapy is ADP-A2M4CD8, which is being tested in a Phase II SURPASS-2 study on gastroesophageal and SURPASS-3 ovarian cancer.

Adaptimmune Therapeutics Autologous Clinical Pipeline (Adaptimmune Therapeutics)

ADP-A2M4CD8 is a next-gen product that is attempting to transition CD4+ T cells into CD8+ T cells while maintaining CD4+ abilities, thus, theoretically improving their cytotoxicity against cancer cells.

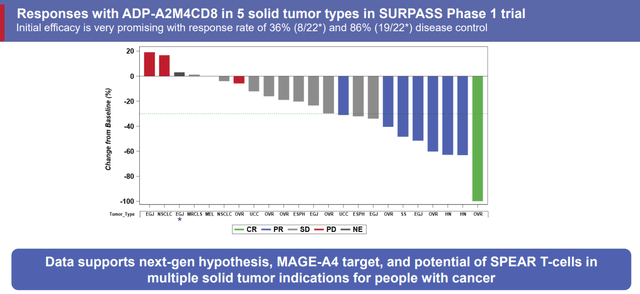

ADP-A2M4CD8 Responses (Adaptimmune Therapeutics)

Preliminary data showed a 36% response rate and 86% disease control. Adaptimmune saw some strong responses and the responses seem to be durable as well.

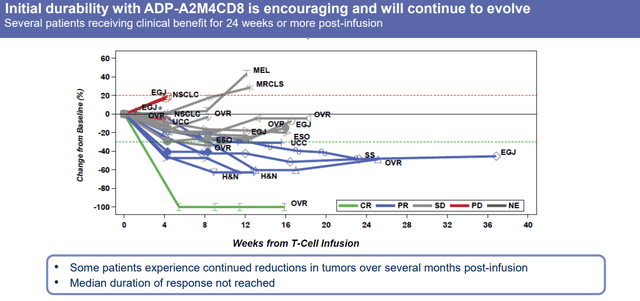

ADP-A2M4CD8 Durability (Adaptimmune Therapeutics)

The other clinical asset is ADP-A2AFP, which is genetically changed T cells that target alpha-fetoprotein “AFP” in tumors. The company is taking aim at hepatocellular carcinoma (liver cancer).

Adaptimmune also has an impressive pre-clinical pipeline filled with both autologous and allogeneic programs. The company is expanding their MAGE-A4 products for IL-7, IL-15, dnTGF-beta, and PDE7 targets. Adaptimmune is looking to cover more patient MHC types with HLA-A1 and HLA-A24 programs. The company looking to push their HLA-independent Targets “HiTs” for GPC3, which could eliminate the need to match the TCR to the patient’s MHC type, thus, expanding the number of eligible patients.

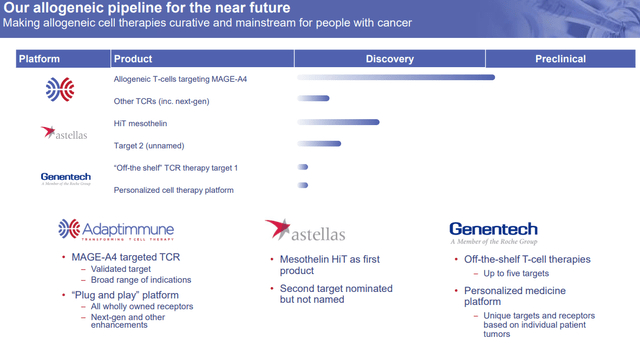

The company’s high-tech programs are allogeneic TCR-engineered T cells, which are “off-the-shelf” products that would not require the apheresis of the patient’s own T cells. This would radically reduce costs and remove a huge portion of the process. In addition to the company’s wholly-owned assets, they also have partnered allogeneic programs with Astellas Pharma (OTCPK:ALPMF) and Roche’s (OTCQX:RHHBY) Genentech.

Adaptimmune Therapeutics Allogeneic Clinical Pipeline (Adaptimmune Therapeutics )

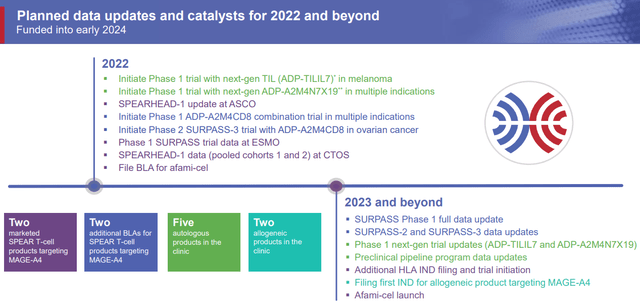

Looking ahead, the company has a long list of upcoming catalysts in 2022 and 2023 that should have a dramatic impact on the share price.

Adaptimmune Therapeutics Upcoming Milestones (Adaptimmune Therapeutics)

Obviously, afami-cel’s BLA filing, PDUFA date, and potential launch will be the most potent catalysts, however, we should get some noteworthy data updates in 2023 that give us some insight into the company’s pipeline programs.

In terms of financials, Adaptimmune finished Q1 with ~$304.2M in cash, cash equivalents, and short-term investments and has ~$26M in debt. Currently, ADAP has a $239.79M market cap, so its enterprise value is -$39.5M. This means ADAP is in the deep value category.

Downside Risks

Like all pre-revenue healthcare companies, the company has a few major downside risks that investors should consider. First and foremost, there is a possibility the FDA does not accept the company’s BLA, or they deny approval. Another issue to consider is the numerous hurdles associated with a commercial launch. Not only will the company have to work on sales and marketing, but they will also have to work with payers to cover a cell therapy that should easily be a six-figure bill. These hurdles could prolong or intensify the company’s cash burn, which would raise the likelihood that the company would have to fundraise with secondary offerings and/or debt.

Another major downside risk comes from competition. Indeed, Adaptimmune appears to have a fairly unique cell therapy, however, it is possible other cell therapies will be able to outperform the company products either in the clinic or on the market. Oncology is evolving fast, and the market is extremely competitive, so it is possible that Adaptimmune will get their products onto the market, but be outclassed by another product or company.

My Conviction

Despite some of the downside risks I stated above, I am very bullish on ADAP at these technical levels and valuation. One cannot deny that Adaptimmune has situated themselves as a trailblazer in the TCR T cell field and is expected to be the first one to market. If all goes well, Adaptimmune will have several therapies on the market in the coming years. Not only will this change the company’s fundamentals, but it could also improve the likelihood of the company being acquired at a premium valuation.

My Plan

As I mentioned in my introduction, I have had previous success with the ADAP under similar circumstances. However, I believe Adaptimmune is in a stronger position both clinically and fundamentally. As a result, I am taking a different approach to accumulating and managing my position this time around. My entry was basically an “I got to have it” buy due to the share price approaching the lows seen in 2019, the potential BLA filing, and the company’s negative enterprise value. Now that I have established a position, my accumulation strategy will be primarily based on market conditions. If the market’s volatility continues, I will stick to buying on dips as long as the company’s EV is still negative. If the market’s volatility subsides, I will look for quality technical setups before adding to my position.

My goal is to accumulate a half-sized position at these current prices and will look to take profits in order to transition my position into a “house money” status ahead of the company’s BLA submission. Once the company has filed the BLA, I will start to look to reapply my profits ahead of the potential PDUFA date and potentially take profits following a possible approval. Long-term, I expect ADAP to have a spot in the Compounding Healthcare “Bio Boom” Portfolio for at least 5 years, in anticipation the company will be first-to-market and/or will be acquired at a premium valuation.

Be the first to comment