elinedesignservices

Any time the Fed is top of mind for the market, the same phenomenon seems to occur in which good economic news causes the market to sell off.

On Friday 7/8/22 a strong jobs report came out and the market opened with a sharp sell-off.

Why?

Because a strong jobs report gives the Fed ammunition to be more hawkish. So while a stronger economy is unequivocally good for earnings of the overall market, it sells down because of raised expectations for interest rates.

This can be rather confusing. It may seem as though the market is wrong or overly reactionary, but allow me to show why good news can be both good news overall AND rationally cause market prices to drop.

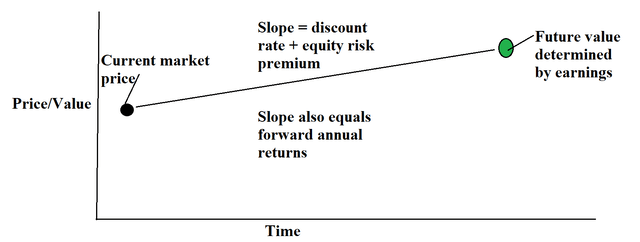

I like to think of the discount rate as the slope of forward returns. The higher the discount rate, the greater the slope. Earnings determine the long run value of each stock and thereby the market as a whole. To visualize this consider 2 data points: the long run value and today’s market price. If you draw a straight line connecting them, the slope of that line should be the discount rate plus the equity risk premium which equals the expected rate of return of the market.

2nd Market Capital

With market price being the most accessible data point since we can see it live it is easy to think of it as the barometer of success.

I think that is wrong.

The future value is the true barometer of success. It is just a much harder figure to pin down. There is no data point we can look at to see future value. It is essentially the culmination of future earnings at an indeterminate point in the future.

I encourage thinking of the market in this fashion because it makes news much more clear to interpret.

Using this framework, when the very strong jobs report came out on 7/8/22 we know that it increases future value. More jobs means more economic activity which means more earnings.

So why did the market react with a drop in price?

Well, market price is the dependent variable. The independent variable is the future value and then market price is estimated by the market by applying the slope.

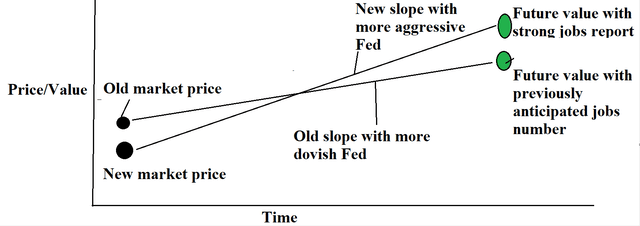

Since the strong jobs report facilitates more hawkish Fed policy, it functionally increased the slope via the Fed hikes which will increase the discount rate. So applying the above reasoning the graph now looks like this.

2nd Market Capital

Essentially the new data point changed 2 things.

- It increased the future value of the market because overall earnings will be higher

- It increased the required rate of return (the slope)

So even though the future value of the market is higher, the current value of the market could rationally drop because market participants are now demanding a 9% annual return instead of previously demanding an 8% annual return.

This makes the price drop potentially rational even though the news is quite clearly good news.

As a long-term investor, all I really care about is that future value number. If the price drops a bit and then I get a higher annual return to still get to that future value number that is fine.

Fed action should be watched but not feared

I think in seeing the Fed have such a powerful and immediate impact on market price when they act, it gives the impression that they are impacting long run returns. The economy is big and complex so I’m sure there are some ways in which changes to the Fed Funds rate really does impact long-term returns, but that is not the goal nor is it the primary effect.

The main parameter that changes when the fed hikes or cuts is the discount rate. The Fed directly influences the slope in the graphs above. When the Fed hikes the slope steepens. If the future value is the same, that necessarily means current market price has to be lower to provide investors a higher rate of return to get to that future value.

Similarly, when the Fed cuts, the slope is reduced so market prices rise such that a lower rate of return will get to that future value.

For anyone with a long investment horizon these changes in market price don’t really affect them. It is just a pulling forward of returns when the Fed cuts and a pushing back of returns when the Fed hikes.

2022 has been a year of banking future returns

Heading into 2022, the market was very expensive. Multiples were high, so the market price was close to future value. In other words, the slope was shallow.

The zero interest rate environment meant equity investors only demanded a 5-7% return, so market prices rose to a level that would deliver such a return given expected future earnings.

Today, expected future earnings are largely unchanged and yet the market has dropped 20% or so depending on the sector. That future value remains intact.

The slope is just steeper.

Returns have been pushed back. In exchange for the drop in market prices, investors now get to enjoy a base return rate of the market that is much higher. With where multiples are today, I would estimate forward annual returns for the market of 8-10%.

Invest more when the market is cheap

We all know to invest more when the market is down. It is much harder to have the equanimity to actually do it.

It is much easier when you visualize the market in the fashion described above. In understanding that today’s market price is just the market’s calculation of slope and future earnings, it becomes easier to see when the market is opportunistic.

The best time to invest is when future earnings are strong, multiples are low and stock prices are low. This is precisely the environment that creates a great rate of return on invested capital.

Be the first to comment