Andrii Dodonov

Investment thesis

Sumitomo Mitsui Financial Group (NYSE:SMFG) has faced significant headwinds in the last 12 months with Russian exposure and market manipulation at its investment banking arm Nikko Securities. However, with its core business performing in a stable manner, we believe the prospective dividend yield of 6.2% is attractive. We reiterate our buy rating on the shares.

Quick primer

Sumitomo Mitsui Financial Group is a Japanese commercial and retail bank with a primarily conservative domestic focus. Its ‘megabank’ peers are Mitsubishi UFJ Financial Group (MUFG) and Mizuho Financial Group (MFG). Its investment banking division is called SMBC Nikko Securities.

On September 28th, 2022 the Japanese FSA issued its fourth administrative action against SMBC Nikko Securities, following the Securities and Exchange Surveillance Commission’s announcement of its recommendation for administrative action against the company. The FSA is considering a partial business suspension order and is also considering administrative action against the parent company, Sumitomo Mitsui Financial Group. Negative issues cited include a “sales-first corporate culture,” and “little awareness of legal compliance”.

The watchdog criticized the company for “undermining the fairness of the market”, and has filed criminal charges against SMBC Nikko Securities for allegedly manipulating the stock prices of Koito Manufacturing (OTCPK:KOTMY), Mos Food Service (8153), and other companies in connection with block offer trading. The Tokyo District Public Prosecutors Office has charged the company’s former vice president and other executives with violating the Financial Instruments and Exchange Law (market manipulation) by illegally buying shares.

We want to update our view from our buy rating from August 2021, which was based on expectations of improving shareholder returns given SMFG’s well-capitalized balance sheet.

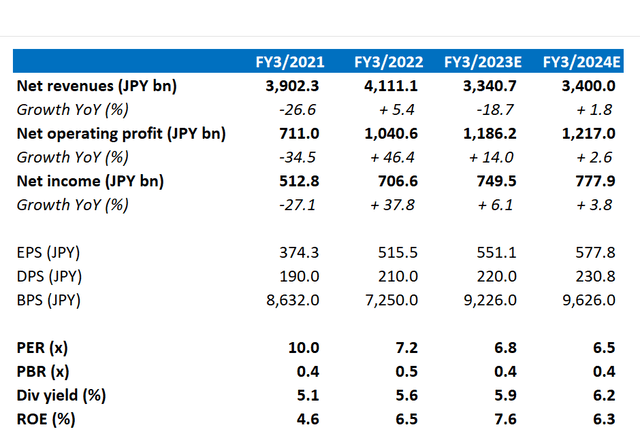

Key financials including consensus estimates

Key financials including consensus estimates (Refinitiv, company)

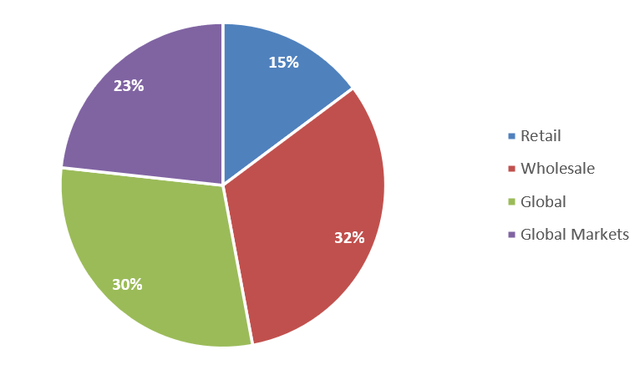

Net business profit split per business unit (FY3/2022)

Net business profit split per business unit (FY3/2022) (Company)

Our objectives

We want to update our view from our buy rating from August 2021, which was based on expectations of improving shareholder returns given SMFG’s well-capitalized balance sheet. The shares have corrected 20% – is it time to add or to sell?

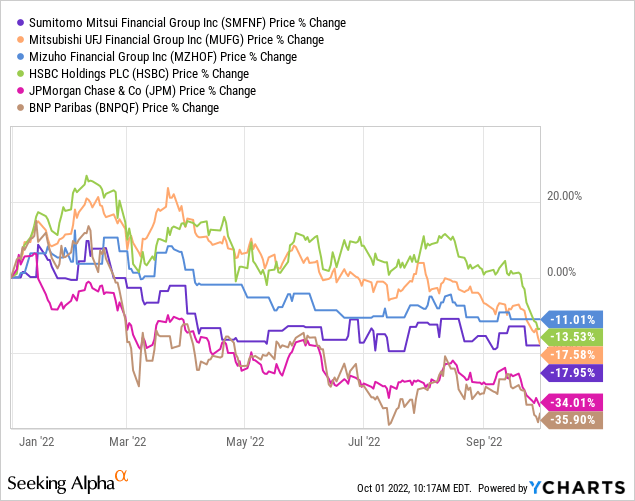

The picture (ignoring Nikko Securities)

Japanese banks have outperformed their global peers YTD in CY2022, the primary reasons being 1) the limited contribution from global market activities (such as investment banking) 2) their relatively over-capitalized balance sheets and 3) conservative management that resulted in predictable credit costs. In essence, Japanese banks are stable and undynamic businesses, and even when under a cloud with negative reputational issues as per SMFG, the shares do not dramatically underperform their peers (chart below shares relative performance YTD).

SMFG’s Q1 FY3/2023 results highlighted a surprisingly robust performance albeit from a low base YoY, with ordinary profit growth of 64% YoY (slide 5). Growth was driven by the following factors.

Retail operations saw the most growth in capturing payment commissions, driven by Japan’s belated but materializing cashless market for both acquiring and issuer businesses. As consumers and merchants adopt credit and debit cards, e-money, and QR code settlement, this has become a new earnings driver in what has been a predominantly cash-driven market.

Wholesale operations saw steading improvements YoY across the board, but with the fluctuations in FX markets, money transfer fees were notably strong. The loan book grew 14% YoY as appetite for credit recovered, and asset quality saw continued improvements with falling credit costs and non-performing loans falling to 0.92% QoQ from 1.08% in FY3/2022.

SMFG took a JPY100bn/USD0.7bn hit on Russian exposure in FY3/2022, and we take the view that there will be some more losses to absorb during FY3/2023. However, company disclosure states that additional impairment for the aircraft leasing business is USD0.46m, and further credit costs, as well as expropriation expenses for the local subsidiary, may occur; we believe these will be total significantly lower YoY, with some upside if insurance claims come through for the aviation business. With expectations of a gradual recovery, SMFG has increased its exposure in aviation with the acquisition of Goshawk, which is expected to contribute accretive earnings for the medium to long term.

Recent trading shows that SMFG is operating on a stable and sustainable basis, although Global Markets is visibly weak which contributed 25% of total net business profit in FY3/2022 – we look at this next.

Implications over Nikko Securities going forwards

After major insider trading cases, Japan’s regulator is making an example of Nikko Securities, SMFG’s brokerage arm. On a practical basis, this is negative for the business as it will disallow participation in lucrative investment banking activities such as IPOs and other equity offerings as key book runners, as well as underwriting corporate bond issuances. Consequently, Nikko saw net operating revenues fall nearly 40% YoY in Q1 FY3/2023.

Despite this negative development, from a share price perspective, we feel that this episode has been priced in. There will be continued scrutiny by the regulator, but we expect SMFG will respond in an appropriate manner by making sure it becomes compliant and showing improvements and changes within its organization. On a positive note, global markets are not the key earnings contributor at the bank, versus peers such as Mizuho and other investment banks such as Nomura (NMR) and Daiwa (OTCPK:DSEEY).

Unless further negative issues are uncovered at the bank, we believe that Nikko Securities poses a relatively low risk to the shares now. In anything, this investment banking arm is set to become more conservative than before. A lack of dynamism may be seen as negative, but considering Nikko Securities is effectively a relatively new operation set up in 2009 (as Citigroup bought the original high-quality brokerage, and SMFG broke ranks with a partnership with Daiwa), its history is relatively short and was acting in an improper manner in order to catch up with its established domestic peers – the risk profile is set to fall which is a positive.

Valuation

On consensus forecasts (see Key financials table above), the prospective dividend yield is 6.2%, on an ROE of 6.3%. We believe that the negative events that influenced share price performance in the last 12 months are no longer a long-term concern. On this basis, we believe the dividend yield on offer is attractive.

With a relatively robust start to FY3/2023, we believe the dividend guidance of JPY220 is not under threat. The share buyback program of JPY100bn/USD0.7bn that was planned for FY3/2022 is yet to start – we expect this in H1 FY3/2024 once macro conditions begin to stabilize.

Key risks

Upside risk comes from announcing an accelerated share buyback program, re-starting the initial program from FY3/2022 as well as an additional one. If the company maintains its policy of a 40% dividend payout ratio, any upside to FY3/2023 earnings guidance could mean a notable dividend hike YoY.

Downside risk comes from Russia – although we believe the losses booked in FY3/2022 are sufficient, there is an overhang related to further credit costs and delayed timing over insurance compensation for the aviation business. Any significant increase in credit costs from its overseas loan book could pose problems for its core commercial banking business.

Conclusion

SMFG has faced significant headwinds in the last 12 months with Russian exposure and market manipulation at its investment banking arm Nikko Securities. We believe these issues have already been priced in, and on a long-term basis do not pose a major risk to the bank. With a stable dividend yield of 6.2% on offer, we believe the shares remain a buy.

Be the first to comment