Bennett Raglin

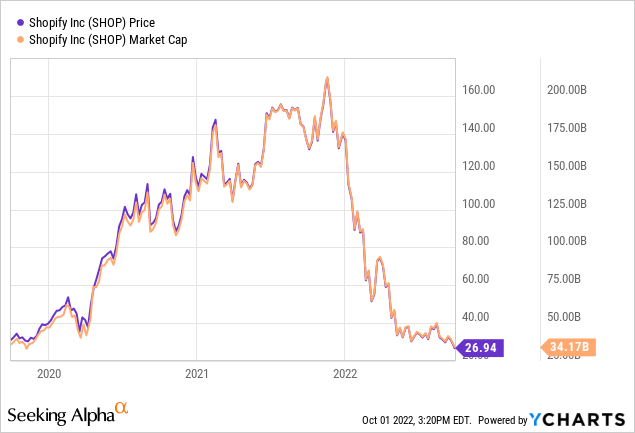

Shopify’s (NYSE:SHOP) shareholders have watched in shock, some in awe, as the common shares of the Ottawa, Ontario-based company collapsed over the last year to reach record lows on the back of a Fed turned hawkish to try and stem inflationary pressures rising to record highs. This has happened against deteriorating macro conditions characterized by falling consumer confidence and an erosion of real disposable incomes. Expectations of hyper post-pandemic e-commerce growth have moderated with Shopify now trading nearly 85% lower than its 52-week high.

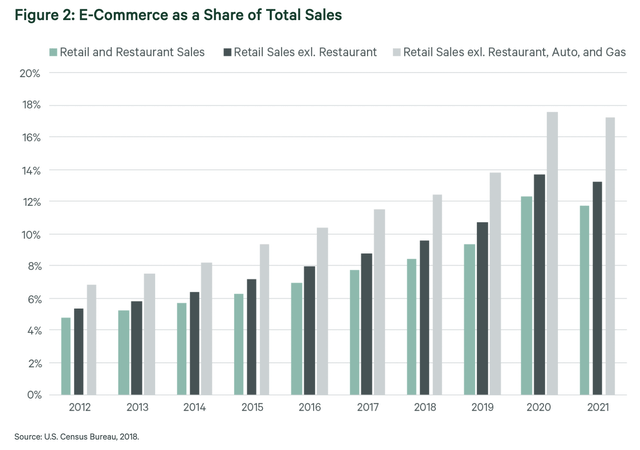

A time capsule back to these previous highs would reveal just how viscous investor euphoria was for e-commerce plays as the pandemic had taken hold. With this came stay-at-home orders that kept people indoors and Shopify’s brick-and-mortar retail outlets shut down. The valuation then was always going to be unsustainable as it was solely built on the immense exuberance surrounding the future post-pandemic world. This was one that would entirely be dominated by e-commerce with Shopify occupying a pivotal role. This allure of a world speeding faster into what was already its inevitable future led to a trading boom in Shopify’s shares as the company stood to benefit from this structural shift in human society. Indeed, since the mainstream adoption of the internet following the onset of the new millennia, e-commerce as a percentage of total retail sales has continually grown and sat below 20% in 2021 but is forecasted to grow to nearly half by the end of the decade.

For the company’s bulls, Shopify still represents the lowest hanging fruit for investors looking to gain exposure to this ongoing structural shift despite the current malaise being faced by the common shares.

Revenue Growth Decelerates With A Previously Astronomical P/S Multiple In The Rearview Mirror

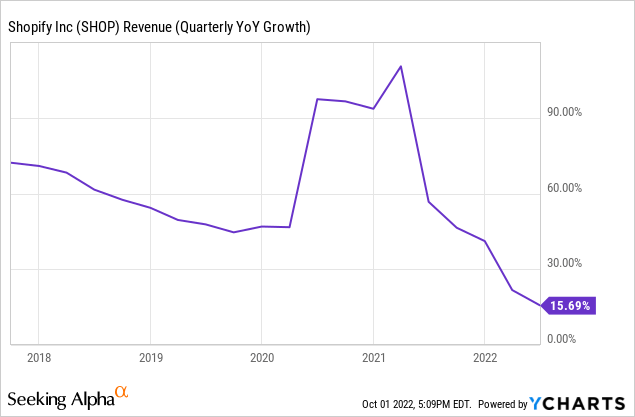

Shopify’s core financials tell two key stories. Firstly, that revenue growth has slowed materially. The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $1.3 billion, up 16% from the year-ago quarter but a miss of $111.8 million on consensus estimates.

Year-over-year revenue growth rates have been on a constant decline since the first quarter of 2021 when the comps to the lockdown era started to kick in. Shopify’s revenue growth has now reached its lowest level since the company went public back in 2015. Whilst Shopify faced headwinds during the quarter from a strong US dollar, its core revenue metric deteriorated. Monthly recurring revenue grew by only 13% from the year-ago quarter to reach $107.2 million whilst gross merchandise volume grew to reach $46.9 billion. This was an 11% increase from the year-ago quarter. Growth continued to be driven by new merchants joining the platform and greater adoption of the company’s point of sale Pro hardware.

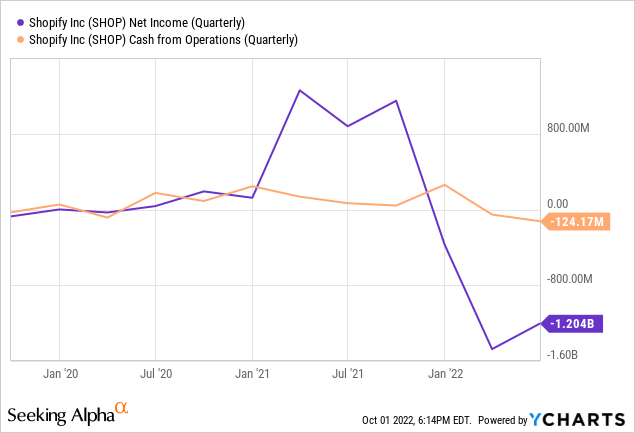

The second story is that of entrenched unprofitability. The company realized net losses of $1.2 billion during the quarter. This was a significant deterioration from net income of $880 million in the year-ago quarter. However, both of these quarters were significantly impacted by unrealized movements in equity and other investments held.

Whilst a significant amount of net loss could be attributed to non-cash items, cash burn from operations still came in at $124 million. This was a material increase from positive cash from operations of $66.4 million in the year-ago quarter. Essentially, this quarter marked the second consecutive quarter of negative cash burn and reversed what had been seven back-to-back quarters of positive operating cash flows. This reversion back to its pre-pandemic mean is terrible news in a market that has increasingly shown it is not afraid to heavily discount high-growth but unprofitable companies. Shopify is currently low growth and unprofitable.

The company’s institutional backers continue to have faith in the company with Cathie Wood’s ARK Innovation ETF (ARKK) purchasing 1,326,295 shares as recently as July. Shopify is now the sixteenth largest position in ARK’s largest fund. Even the Saudi Arabian sovereign wealth fund has ramped up its take by 10x to 1.25 million shares. Hence, even against what has been a marked slowdown, a decent level of institutional faith still remains. Shopify was the ultimate pandemic stock and could see 2020 levels of demand return at a certain point in the future. But the short to medium-term outlook for the company is bleak.

Maybe It could become the next Apple? Maybe Nike? Shopify

The wholesale discounting of fundamental security analysis that was prevalent during the pandemic years would see Shopify’s P/S ratio rise to stratospheric levels with ultra bulls describing the company as the Apple of e-commerce as its market cap marched triumphantly towards a quarter of a trillion.

Investors should express caution over buying into an unprofitable company in a competitive space. And whilst Shopify is at the vanguard of the transition of retail to e-commerce, the pace of the shift was heavily overestimated on the back of the unique conditions during the pandemic. The story of Shopify’s certain domination of the e-commerce world has crumbled into pain, obscurity, and capital destruction with the company’s pandemic era gain all but wiped out. Further, whilst the current price to forward sales multiple of 6.24x is a huge departure from its previous peak, it is still 155% higher than its sector average. Is this collapse a generational buy? No. But an opportunity might very well open up as the macro context deteriorates even more.

Be the first to comment