bluecinema

“There is nothing more deceptive than an obvious fact.”― Arthur Conan Doyle

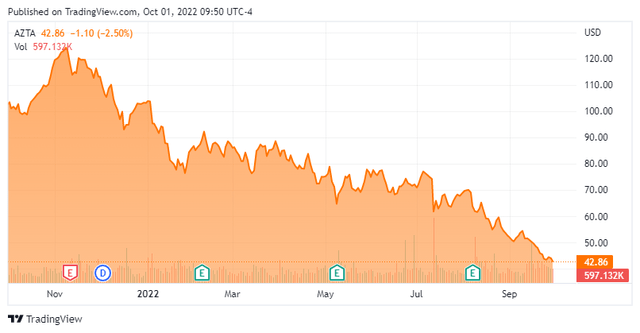

Today, we put Azenta, Inc. (NASDAQ:AZTA) in the spotlight for the first time. The stock has lost nearly 60% of its value over the past year. Azenta recently made a significant acquisition and has seen some insider buying in August in the shares. Signs that a rebound is potentially on the horizon? An analysis follows below.

Company Overview

This life sciences and services company is based just outside of Boston. It provides products to clients such as automated cold sample management systems for compound and biological sample storage; equipment for sample preparation and handling; consumables; and instruments that help customers in managing samples throughout their research discovery and development workflows. The company also provides services to clients including comprehensive sample management programs, integrated cold chain solutions, informatics, and sample-based laboratory services to advance scientific research and support drug development. The stock currently trades right around $43.00 a share and sports a market capitalization of just under $3.3 billion. The company’s fiscal year starts on October 1st.

Roughly two-thirds of the company’s sales comes from pharma/biotech. One quarter comes from academic and the remainder is from hospitals, distributors, diagnostics companies, government and others. The company has a large cash hoard it is using to make strategic acquisitions.

August Company Presentation

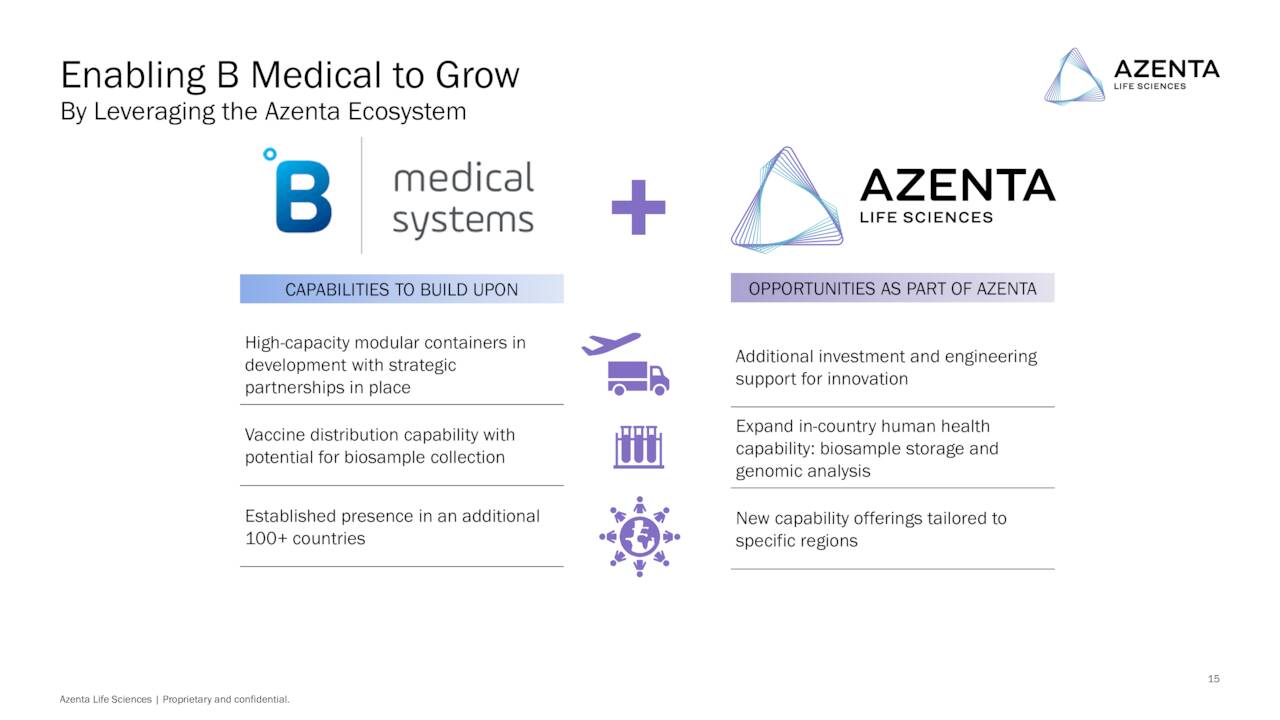

On June 8th, Azenta spent 80 million Euros to acquire Germany based Barkey Holding. This company specializes in automated thawing of plasma, blood and stem cells and has more recently gone into cell and gene therapy applications. Two months later Azenta made a much larger purchase. The company acquired B Medical Systems, a Luxembourg-based vaccine cold chain provider, for ~€410M in cash as well as €50 million in potential earn outs.

August Company Presentation

This deal advances Azenta’s cold chain capabilities by adding differentiated solutions for reliable transport of temperature-sensitive specimens. The purchase is projected to be accretive to earnings by FY2024 and will close this quarter.

August Company Presentation

Third Quarter Results:

August Company Presentation

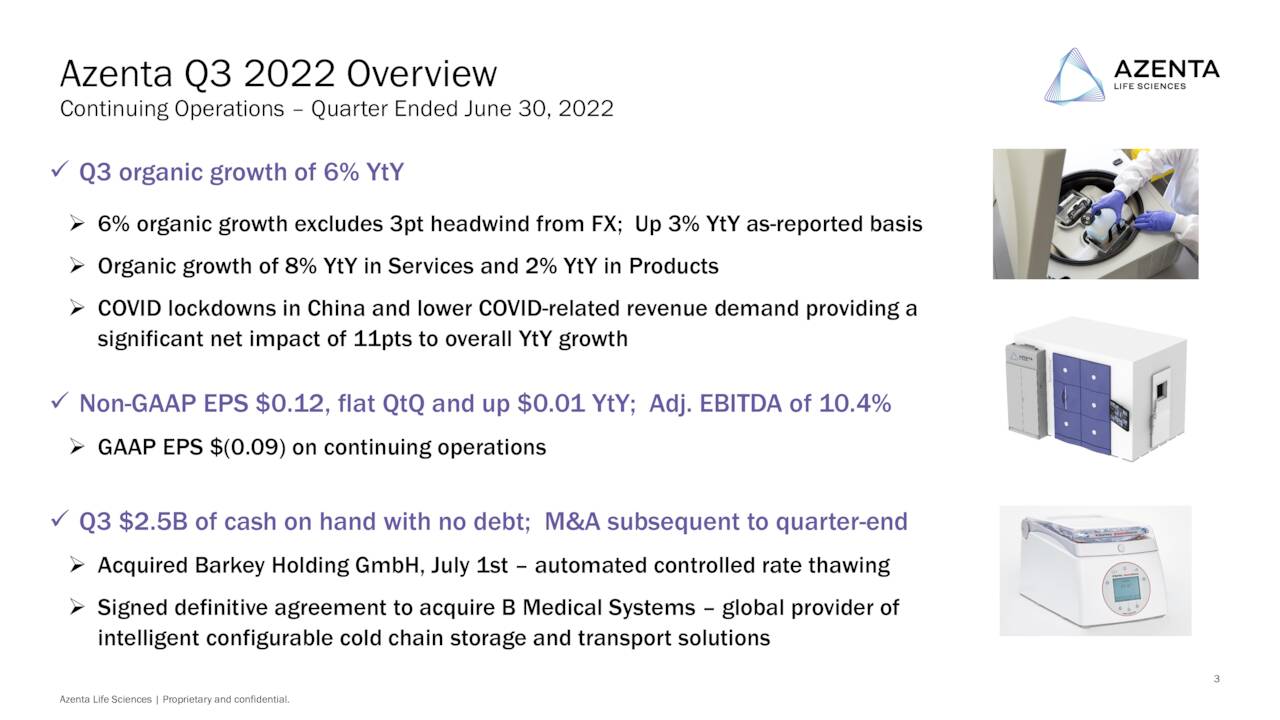

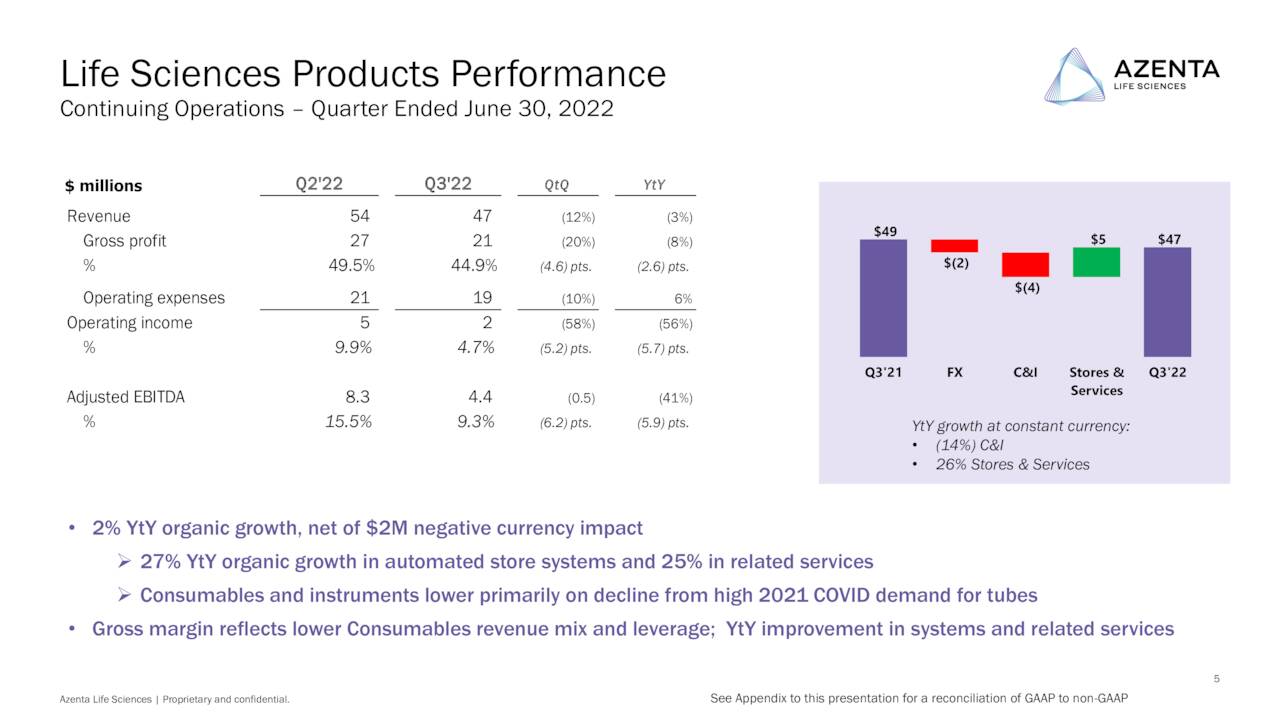

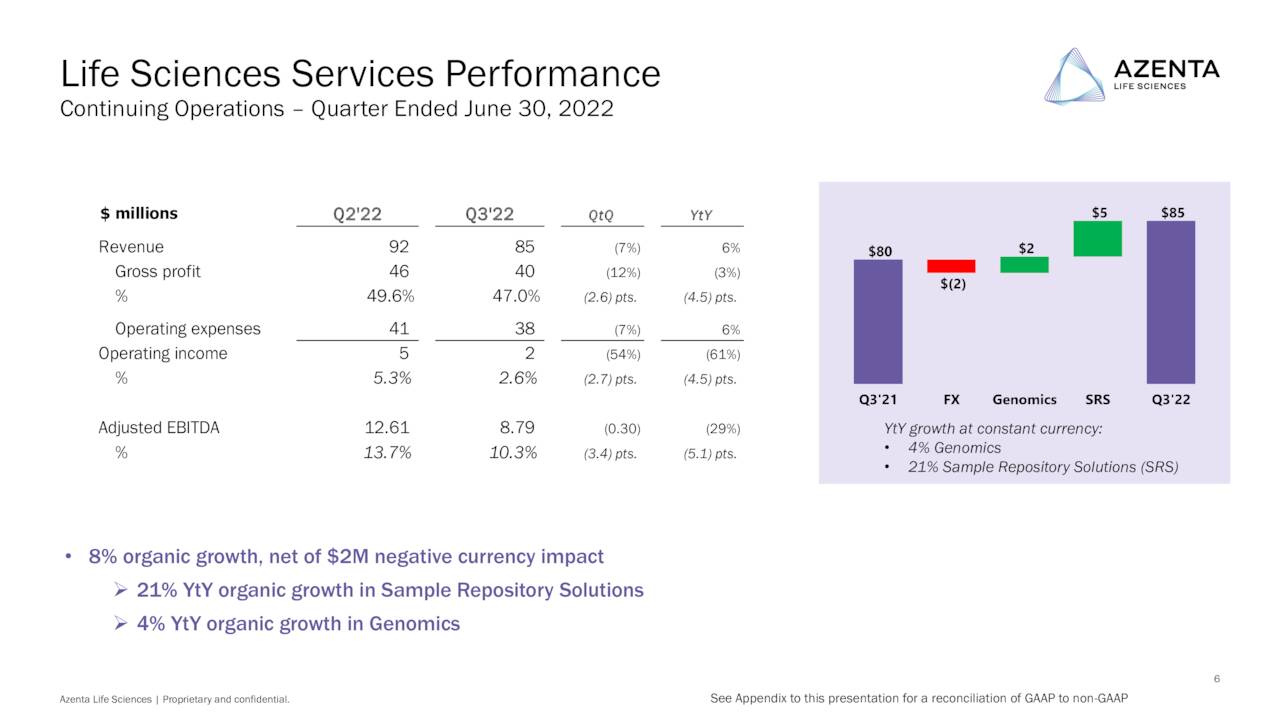

On August 9th, the company posted third quarter results. The company posted non-GAAP earnings of 12 cents a share. Revenues rose three percent to $133 million. Organic growth in services was up eight percent in Services and two percent in Products. Results were hurt by currency headwinds which took three percent out of sales.

August Company Presentation

An even bigger hit (11%) was due to the continuing COVID situation. This is providing considerable headwinds from the company’s Chinese genomics customers, particularly academic institutions, which were closed for an extended period of time. The company also saw a $9 million drop in their consumables and instruments revenue, which was $3 million more than previous guidance.

August Company Presentation

Analyst Commentary & Balance Sheet

Since third quarter results came out, five analyst firms including Needham and Stifel Nicolaus have reissued Buy ratings on AZTA. Two with downward price target revisions. Price targets proffered range from $68 to $109 a share.

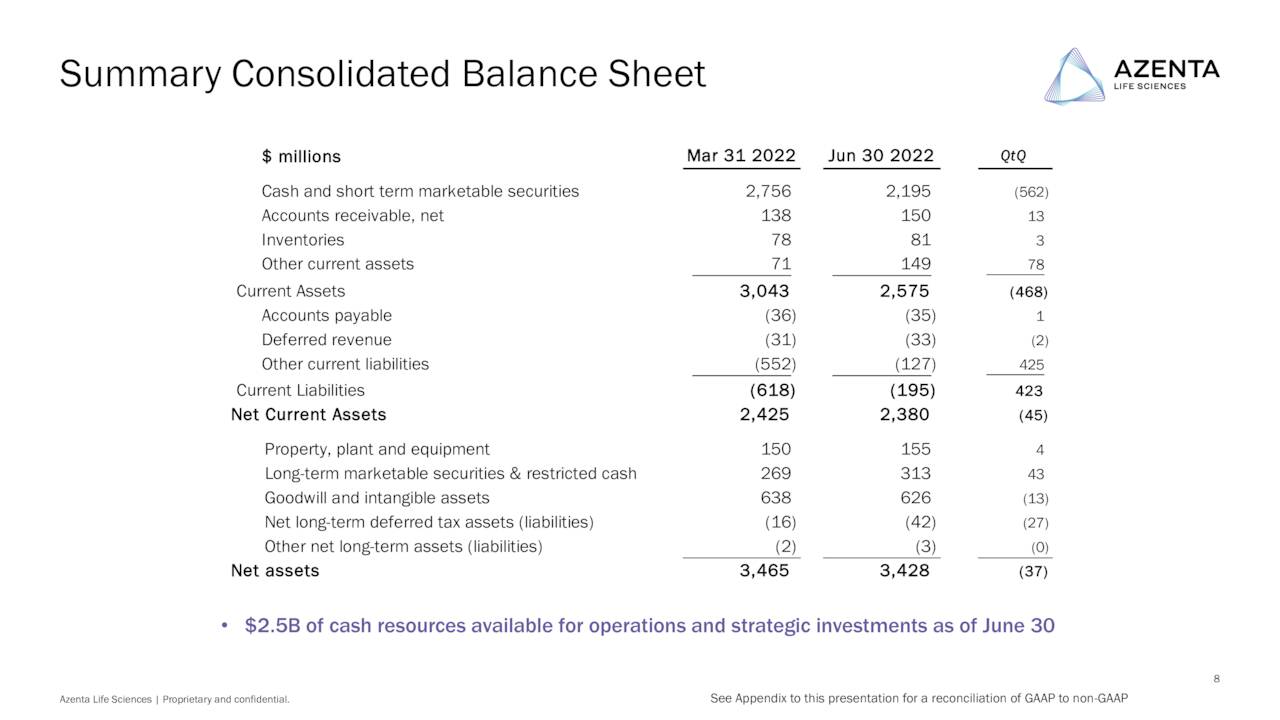

August Company Presentation

The company’s CFO bought approximately $250,000 worth of shares on August 19th. That same day Azenta’s COO added just over $500,000 to his holdings in the equity. Approximately five percent of the outstanding float is currently held short. The company has a pristine balance sheet. Prior to the recent acquisition, Azenta held nearly $2.5 billion in cash and marketable securities on its balance sheet against no long term debt at the end of the third quarter. Factoring in the recent acquisitions, the company’s cash balance is approximately $2 billion.

Verdict

The analyst consensus has Azenta earning just north of 40 cents a share in FY2022 on revenues just north of $550 million. Sales are projected to rise north of 30% in FY2023 to over $730 million and earnings penciled in to improve to approximately 75 cents a share.

The stock looks expensive on the surface at over 55 times next year’s projected profits and 4.5 times forward sales. However, equating for net cash on the balance sheet, the stock is more reasonably valued at 22 times FY2023 estimated EPS and 1.7 times forward sales.

The company has plenty of ammo to continue do additional ‘bolt on‘ strategic acquisitions and at some point, this Covid nonsense will eventually end in China. Therefore, I am aligned with recent insider buying in the view AZTA is worthy of a small ‘watch item‘ holding while the story around the company evolves.

“Never attempt to win by force what can be won by deception.”― Niccolò Machiavelli

Be the first to comment