Just_Super/iStock via Getty Images

LIDAR Sector Offers A High Risk High Reward Bet On Small-Cap Stock Turnaround

A contrarian investor is an investor who purposely goes against prevailing market trends by selling when others are buying and buying when most other investors are selling. Warren Buffett has his famous quote, “be fearful when others are greedy, and greedy when others are fearful”. This bold style of against the grain investing could be as important as ever with markets pushing downward over 30% year to date in the case of the NASDAQ sending people fleeing stocks for bonds. This bearish sentiment has opened up a number of investment opportunities, particularly in small caps. Of the small caps, one of our favorite sectors is the LIDAR sector offering innovative sensor technology. Out of the Lidar Sector, our best pick is Aeva Technologies (NYSE:AEVA). Aeva Technologies offers a wide array of 4D LIDAR sensors for the automotive as well as industrial segments. The company offers two main products, the Aeries I & Aeries II (Figure 1) LIDAR sensors, both of these options include long-range compact design and industry-leading resolution.

Figure 1. The Aeries II utilizes Aeva’s Frequency Modulated Continuous Wave (FMCW) 4D technology and a unique LiDAR-on-chip silicon photonics design

With the stock trading down 75%+ year to date, we see the potential for as much as 400% returns over the next three to four years if AEVA can exceed analysts’ projections. This is a high-risk investment as cash is a known constraint at the moment with the company not looking to be profitable until the end of 2025 or even possibly 2026. We believe Aeva is one of the best picks within the LIDAR market which was recently assessed as a strong buying opportunity by JPMorgan analyst Samik Chatterjee.

Current Valuation

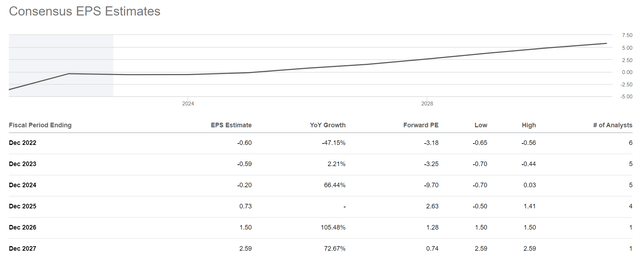

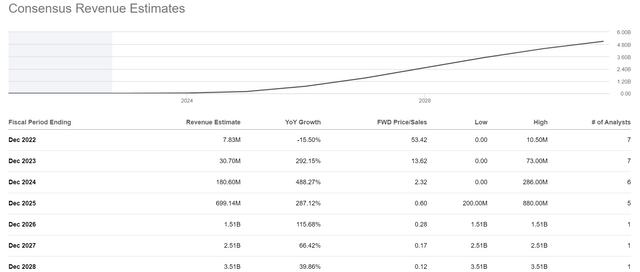

Looking at sector, current valuations for LIDAR stocks are a little tricky as most names are very early into revenue. Therefore, to value these stocks, you must look at the company’s forward projections, when they expect to be profitable, and the cash on hand to get them there. Aeva Tech is projecting revenue of ~$700 million by 2026 and an FWD price to earnings ratio of ~1.3x by that same year, once they break through profitability (Figure 2).

Figure 2. Aeva has a bright future if they can follow through and deliver on analysts expectations over the next 3-5 years

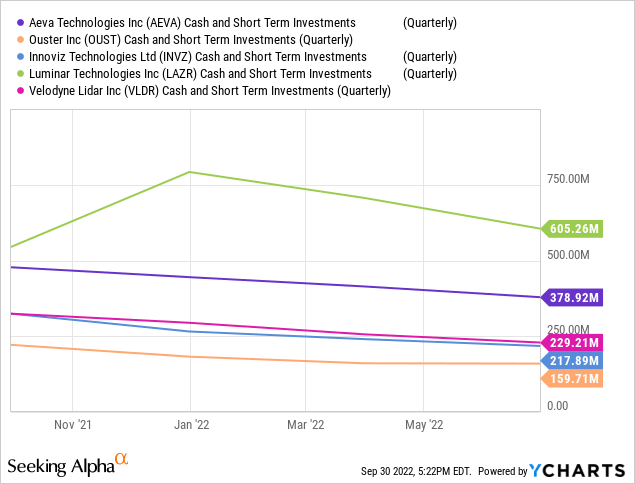

The company currently has around $370 million in cash on hand and is burning through that at nearly $100 million per year. This gives them a runway of a little over three years speaking conservatively, meaning they have cash to get them through to 2025 when they expect to become profitable. This is good news for the company and is not the case for many other LIDAR names. This in our opinion is why Aeva trades at a fairly high market cap for the sector of just around $457 million along with the fact that they have a few big-name partners. For comparison, our second favorite pick in the industry Ouster, Inc. (OUST) trades at just around a $187 million market cap but projects only around $560 million in forward-looking revenue for the same year, and is not expected to be profitable until the following year, end of 2026. Furthermore, Ouster has a cash runway similar to Aeva between three to four years, making them a slightly riskier investment overall (Figure 3).

Figure 3. Aeva’s cash on hand alone nearly meets its market value and should be followed closely as production scales

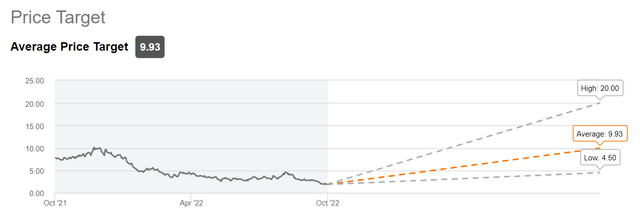

Both names appear deeply discounted at current prices for investors willing to wait out the long haul as you could see as much as 400% upside according to Wall Street price targets. Average price targets put Aeva at nearly $10 per share (Figure 4). Many of these estimates are fairly outdated from when the stock’s price was much higher, but some have still come in recently and with a forward P/E of 1.3x in 2026 if all goes well and the stock does reach $8 a share (~400% higher), by then it would still trade at just a 5-6x Price to earnings, about half that of the market average, fairly conservative in our opinion.

Both Aeva & Ouster are three- to five-year investments for those bold enough to go against the grain of the broader market and take on the risk of a company that could potentially fall to zero, worst-case scenario.

Risks

Looking at investment risks for AEVA, the company has just around $9 million in debt with over $370 million of cash on hand, so debt and cash burn does not look to be a prevailing issue for another 2-4 years. Short interest on the stock stands around 9% and most of the bearish sentiment has come from macroeconomic headwinds. One area to monitor in the medium-term future will be the company’s ability to scale production. Velodyne (VLDR) has struggled with this and Aeva will need to be successful here if they are to deliver to their big customers such as Sick & Plus.

The LIDAR industry has become crowded over the last couple of years. Nearly a dozen major sensor companies have come out of the woodworks making competition fierce. Obviously, because of this, there will be winners and there will be losers. We believe Aeva will be a leader in the industry because of their premier product, large partnerships, and strong cash management they have shown thus far.

Other challenges the sector faces include the ever-present question of is LIDAR a necessary value-adding piece of equipment. Bears have long brought forth the thesis that Radar devices can be used to provide the same data as LIDAR at a fraction of the cost. The fact is LIDAR will continue to grow cheaper and the data it provides will only grow more and more valuable and this has been backed up by mammoth groups such as NASA utilizing the technology in new and innovative ways.

In Conclusion

Overall, Aeva is set up to be a winner in a beaten-down sector. The stock has a number of large partners and if production scales and they are able to deliver the stock could be significantly undervalued in years to come. Below $2, we see over 400% upside potential over the next 4 years if the company can beat the clock and overcome cash concerns. An $8 price target by the time the company is profitable is very conservative at a forward price to share estimated to be sub-1x revenue. It takes a true contrarian investor to have the patience and propensity for risk to stay in the LIDAR sector in the type of environment we have seen the past 9 months. Look towards both AEVA & Ouster for good high-risk high-reward plays on any sign of market turnaround or bounce.

Be the first to comment