peshkov

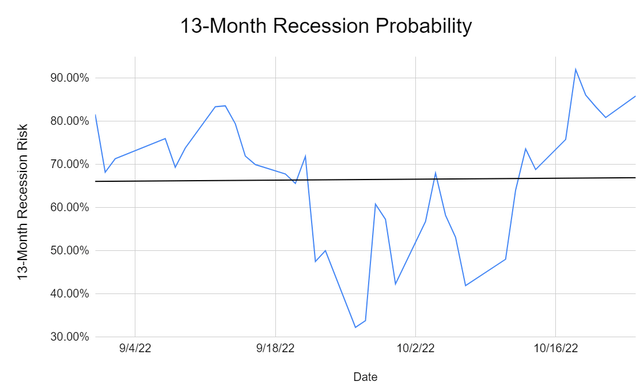

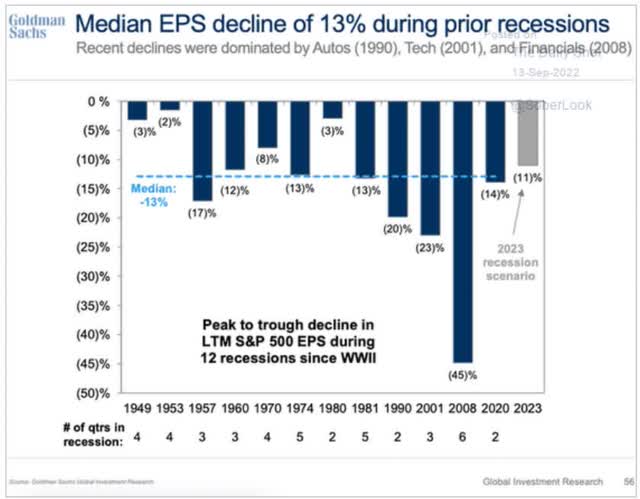

The #1 question on the minds of investors right now is will we get a recession next year, and how bad will it be.

Historically S&P earnings fall 13% during recessions and Goldman’s current base-case is a 11% decline. That’s far worse than the FactSet consensus which is still showing a 7.6% increase in EPS next year.

How likely is a recession in 2023?

- Bloomberg’s model says 100%

- Ned Davis Research’s model says 98%

- the Conference Board’s survey of CEOs shows 96% expect a recession (with 2/3 expecting a mild recession)

- the Bloomberg Survey of CEOs shows 80% expect a recession

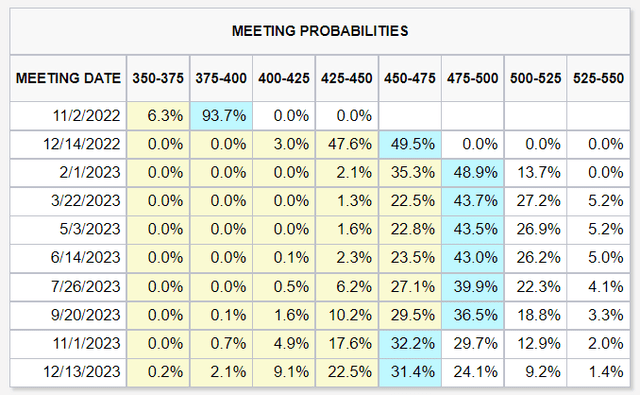

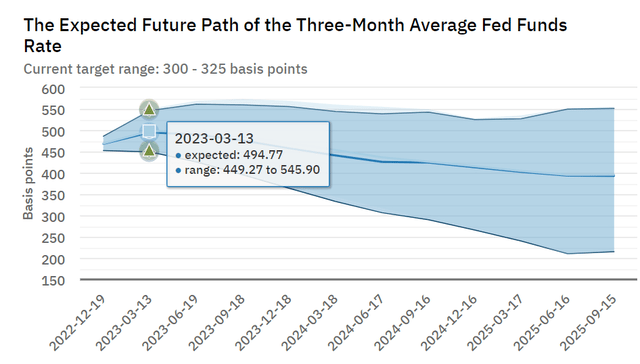

What does the bond market, the “smart money” on Wall Street think?

The Bond Market Is Estimating An 86% Probability Of Recession By Late 2023

Dividend Kings S&P 500 Valuation Tool

The bond market agrees with most economists that recession risk is close to 100%, largely due to the Fed’s aggressive rate hiking plan.

The bond market’s base-case terminal Fed funds rate is now 4.75%, though including probabilities of further hikes, the bond market is expecting the Fed funds rate to peak around 4.95%.

The Fed funds futures market has a range of 4.5% to 5.5% for the terminal rate at which the Fed will pause and expects around 4% by the end of 2025.

- when the Fed wants core inflation to return to 2%

Why does this matter? Because according to Moody’s, the 2nd most accurate economist team in the world according to Bloomberg, 4.75% Fed funds rate is the level at which the US economy gets tipped into a recession.

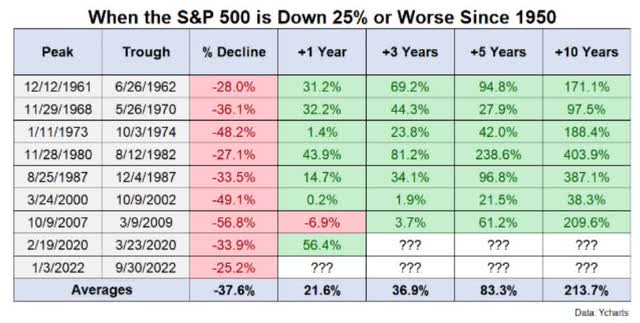

In other words, whether or not we get a recession next year is likely to determine whether the S&P bottoms at around -35% to -40% from record highs, or a much less frightening 30%.

That 5% or 10% difference isn’t going to change your life. In fact, in 5+ years, you won’t even remember where the market bottomed, not as long as you are buying blue-chip bargains right now.

If you buy stocks in a 25+% bear market, you will be happy with the results, that’s a guarantee as long as your time horizon is longer than three years.

If you think that economics can be used to time the stock market you are incorrect. Outside of the Great Depression, perfect economic timing would have still underperformed just buying and holding blue-chip stocks.

But it’s one thing to know all this, and quite another to live through a bear market like this one.

- in bear markets days can feel like weeks

- weeks can feel like months

- months can feel like years

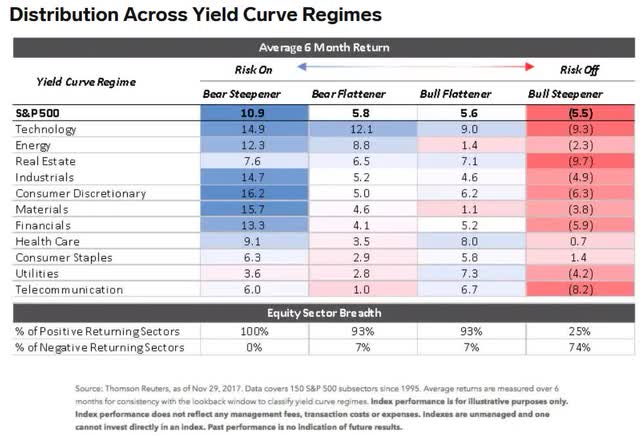

So this is where defensive sectors like healthcare, consumer staples, and utilities can help.

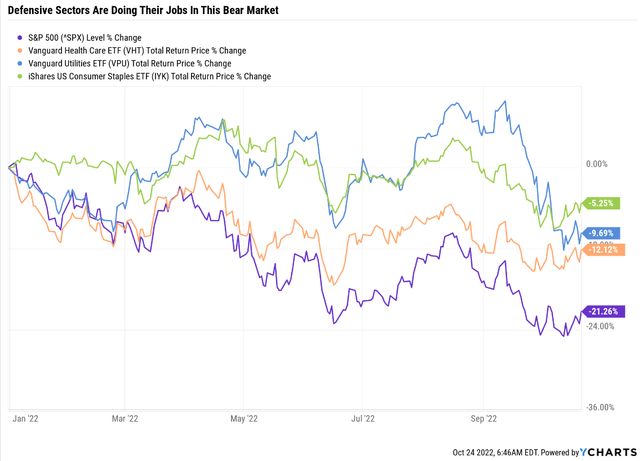

The Power Of Defensive Sectors To Help You Avoid Costly Mistakes In Bear Markets

Defensive sectors like healthcare and consumer staples are the only sectors that historically go up in recessions. They tend to deliver more modest returns when the new economic and market cycle begins.

In this bear market defensive sectors are doing their jobs with staples down 5%, utilities less than 10% and healthcare 12%. That’s compared to the S&P which is down 21% and has been down as much as 28%.

But healthcare tends to give you the best of both worlds, declining less in bear markets and delivering healthy returns when the new bull market begins.

This is why Bank of America is currently recommending healthcare to its clients, to let them sleep well at night for what’s coming next, but also to profit from whenever the market starts its new bull market.

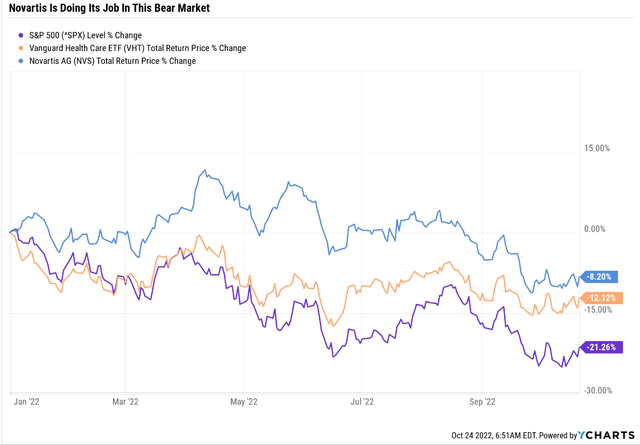

So let me show you why Novartis (NVS), and Vanguard Health Care ETF (VHT) are two of my favorite healthcare dividend blue-chip recommendations for this recession and far beyond.

Novartis: A World-Beater High-Yield Aristocrat You Can Trust In All Economic Conditions

Further Reading

- Novartis Is One Of The Best High-Yield Dividend Aristocrats You Can Buy In 2022

- a deep dive into NVS’s investment thesis, growth outlook, and risk profile

Tax Implications

- NVS is a Swiss company

- 35% dividend tax withholding for non-US investors

- 15% for US investors BUT you have to have your broker file paperwork on your behalf to get the tax treaty rate

- in taxable accounts you can get a tax credit to recoup the rest of the withholding

- own in taxable accounts to get the full yield

NVS has done a fantastic job at being defensive this year, falling just 8%, or nearly 2/3rd less than the broader market.

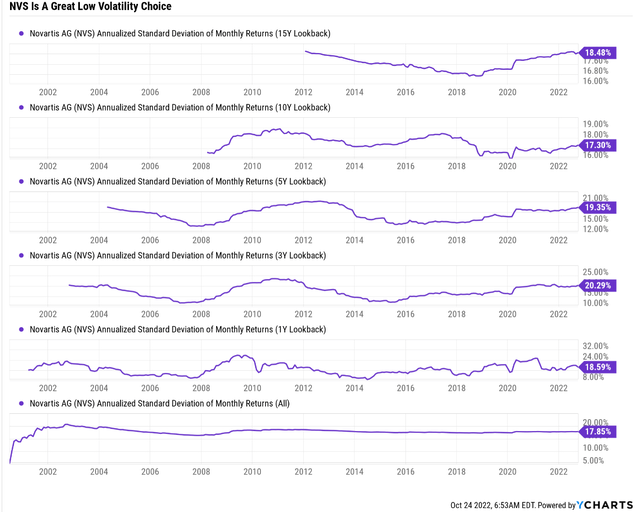

NVS’ historical volatility is about 18% per year, which is much lower than most stocks.

- 28% average volatility for standalone companies

- 24% for dividend aristocrats

NVS is a global aristocrat with a 25-year dividend growth streak, and one of the best drug makers on earth.

Reasons To Potentially Buy Novartis Today

| Metric | Novartis |

| Quality | 97% 13/13 Quality Ultra SWAN (Sleep Well At Night) Global Aristocrat |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 21 |

| Quality Percentile | 96% |

| Dividend Growth Streak (Years) | 25 |

| Dividend Yield | 4.4% |

| Dividend Safety Score | 100% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.00% |

| S&P Credit Rating | AA- Stable |

| 30-Year Bankruptcy Risk | 0.51% |

| LT S&P Risk-Management Global Percentile |

97% Exceptional |

| Fair Value | $106.01 |

| Current Price | $77.10 |

| Discount To Fair Value | 27% |

| DK Rating |

Potentially Very Strong Buy |

| PE | 11.9 |

| Cash-Adjusted PE | 9.9 |

| Growth Priced In | 2.8% |

| Historical PE | 15 to 17 |

| LT Growth Consensus/Management Guidance | 5.2% |

| 5-year consensus total return potential |

14% to 19% CAGR |

| Base Case 5-year consensus return potential |

14% CAGR (2X the S&P 500) |

| Consensus 12-month total return forecast | 21% |

| Fundamentally Justified 12-Month Return Potential | 42% |

| LT Consensus Total Return Potential | 9.6% |

| Inflation-Adjusted Consensus LT Return Potential | 7.3% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.02 |

| LT Risk-Adjusted Expected Return | 6.69% |

| LT Risk-And Inflation-Adjusted Return Potential | 4.40% |

| Conservative Years To Double | 16.38 |

(Source: Dividend Kings Zen Research Terminal)

Novartis isn’t just one of the world’s best drug makers, it’s an AA-rated Ultra SWAN quality dividend aristocrat with 97th percentile risk management according to S&P.

- out of 8,000 rated companies just 240 have better long-term risk management than NVS

Like most drug makers, NVS isn’t a growth stock (4% CAGR is the industry growth rate) but it’s a potentially recession-resistant defensive choice that’s 27% historically undervalued.

What does that potentially mean for investors?

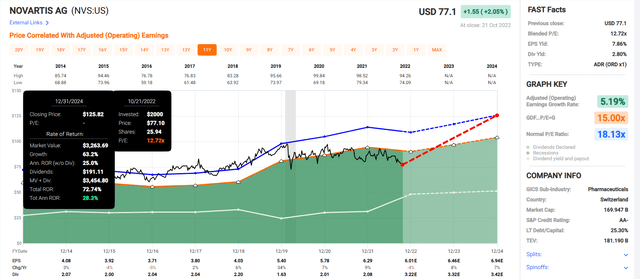

NVS 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If NVS grows as expected and returns to mid-range historical fair value by the end of 2024, investors could see Buffett-like 28% annual returns.

- about 2X more than the S&P 500

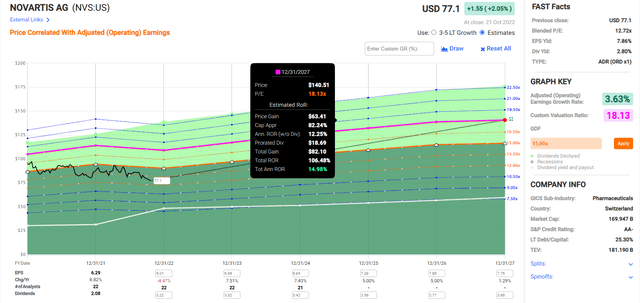

NVS 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If NVS grows as expected and returns to mid-range historical fair value by the end of 2027, investors could more than double their money with 15% annual returns.

- about 2X more than the S&P 500

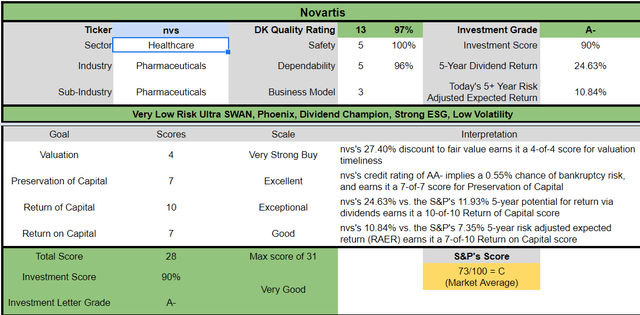

NVS Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

NVS is a potentially very good Ultra SWAN defensive dividend aristocrat opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 27% discount to fair value vs. 7% S&P = 18% better valuation

- 4.4% very safe yield vs. 1.8% S&P (2.5X higher and much safer)

- similar annual long-term return potential

- 50% higher risk-adjusted expected returns

- 2X the consensus 5-year income

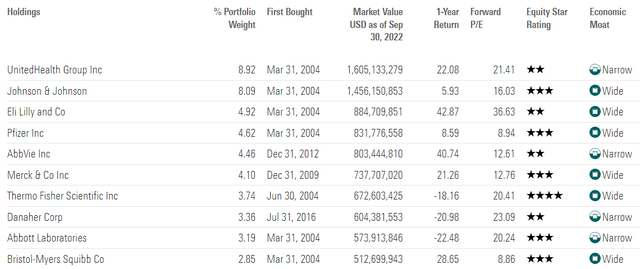

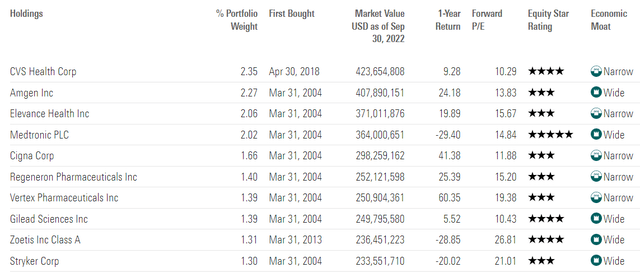

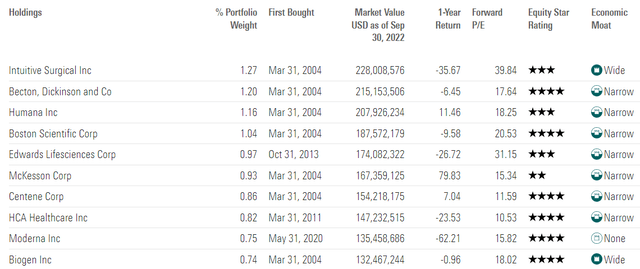

Vanguard Healthcare ETF: The Best Choice For Healthcare Sector Exposure

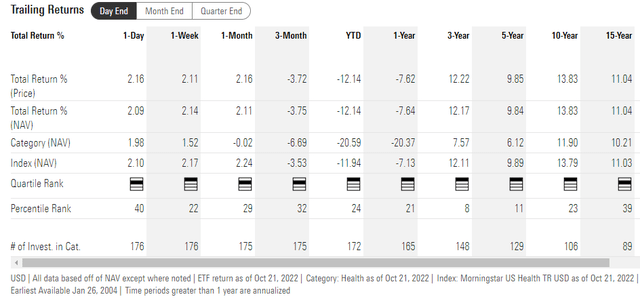

I consider VHT to be the gold standard of healthcare ETFs and Morningstar agrees.

- 5-star gold rated by Morningstar

What makes VHT better than its peers?

Over the last 15 years it’s been in the 61st percentile of healthcare funds, and over the last 10 years the 77th. In the last three and five years it’s been in the top 8% and 11%, respectively, of its peers.

Morningstar Morningstar Morningstar

VHT owns 405 of the world’s best healthcare blue-chips mostly focused on:

- drugs

- medical devises

- health insurance

Morningstar

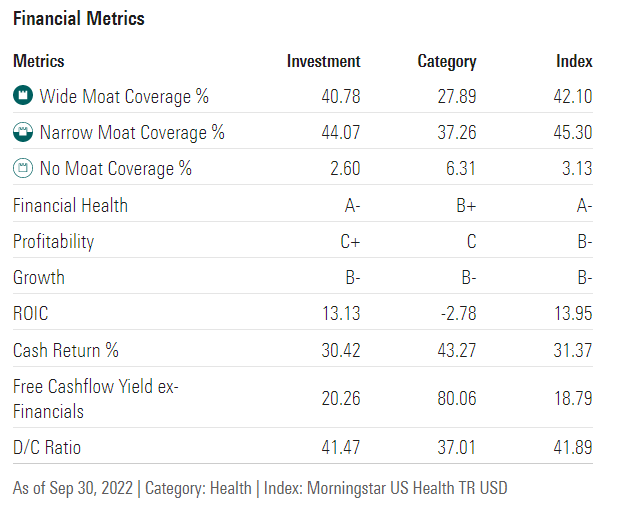

On Morningstar’s moatiness scale, 85% of these companies are wide or narrow moat, with fortress balance sheets, and strong 20% free cash flow margins.

Their payout ratio is a very safe 42%, compared to 60% safe for this sector according to rating agencies.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Vanguard Healthcare ETF | 1.4% | 9.3% | 10.7% | 7.5% | 5.2% | 13.7 | 1.67 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.6 | 1.62 |

| Vanguard Utility ETF | 3.1% | 6.5% | 9.6% | 6.7% | 4.5% | 16.2 | 1.55 |

| iShares Consumer Staples ETF | 2.5% | 6.3% | 8.8% | 6.2% | 3.9% | 18.5 | 1.46 |

(Sources: DK Research Terminal, FactSet, YCharts, Morningstar)

Compared to the gold standard utility and consumer staples ETFs, VHT is the only defensive sector ETF that analysts expect to beat the market over the long-term.

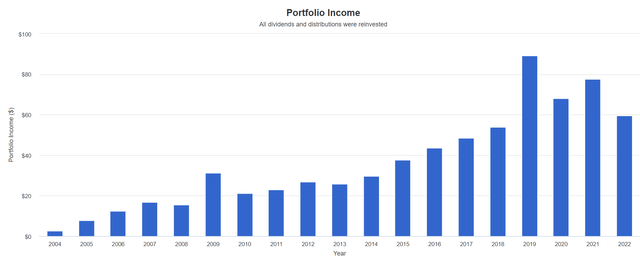

Historical Returns Since 2004

The future doesn’t repeat, but it often rhymes. – Mark Twain

In our case, “past performance is no guarantee of future results.”

Still, studies show that blue chips with relatively stable fundamentals offer predictable returns based on yield, growth, and valuation mean reversion over time.

18 years is a time frame in which 91% of total returns are due to fundamentals, not luck.

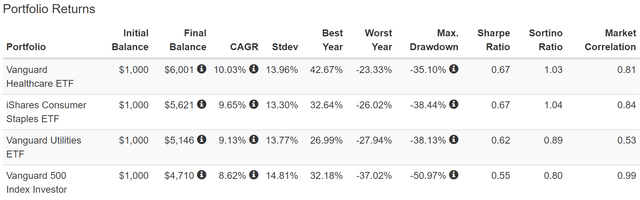

(Source: Portfolio Visualizer Premium)

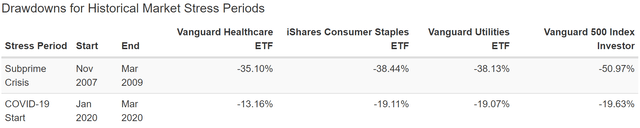

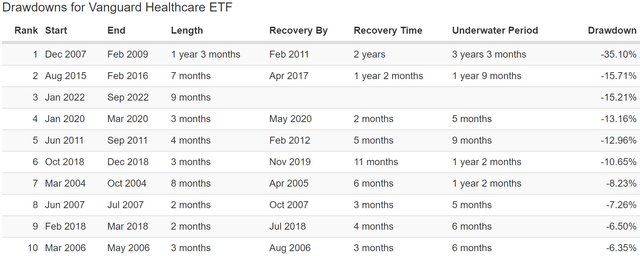

Over the last 18 years all three sectors have outperformed the S&P 500. They fall less in bear markets, with VHT delivering the best Great Recession peak declines of -35%.

- 60/40 fell 42%

- 30% smaller peak decline than the S&P 500 during the 2nd worst market crash in US history

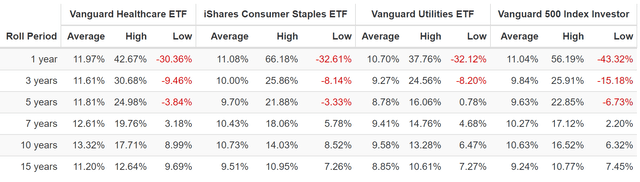

(Source: Portfolio Visualizer Premium)

Very consistent low volatility returns of 12% per year, and 11% to 13% CAGR over the long term.

(Source: Portfolio Visualizer Premium)

In both the Pandemic crash and Great Recession VHT delivered far smaller declines, beating consumer staples and utilities.

(Source: Portfolio Visualizer Premium)

In 2022’s stagflation bear market the peak decline of 15% compares favorably to:

Consistent Income Growth You Can Rely On

(Source: Portfolio Visualizer Premium)

Like most dividend ETFs, the income doesn’t grow every year, due to rebalancing. But overall the dividend growth is consistent and VHT’s income grows at a good clip.

| Portfolio | 2005 Income Per $1000 Investment | 2022 Income Per $1000 Investment | Annual Income Growth | Starting Yield |

2022 Yield On Cost |

| S&P 500 | $19 | $76 | 8.50% | 1.9% | 7.6% |

| iShares Consumer Staples | $18 | $115 | 11.53% | 1.8% | 11.5% |

| Vanguard Utility ETF | $40 | $166 | 8.73% | 4.0% | 16.6% |

| Vanguard Healthcare ETF | $8 | $80 | 14.50% | 0.8% | 8.0% |

(Source: Portfolio Visualizer Premium)

VHT isn’t a high-yielding ETF today, but its historical dividend growth rate is among the best of any sector ETF. 15% annual income growth for 17 years is about 2X that of the S&P 500 and utilities.

Valuation: Wonderful World-Beater Blue-Chips At Attractive Valuations

| Year | PE |

| 2008 | 11.01 |

| 2009 | 14.25 |

| 2010 | 13.59 |

| 2011 | 13.7 |

| 2012 | 15.81 |

| 2013 | 21.35 |

| 2014 | 22.27 |

| 2015 | 18.05 |

| 2016 | 19.75 |

| 2017 | 21.31 |

| 2018 | 19.78 |

| 2019 | 19.07 |

| 2020 | 23.38 |

| 2021 | 20.18 |

| 2022 | 18.7 |

| 2023 | 17.75 |

| 2024 | 15.95 |

| 15-Year Average | 18.15 |

| 15-Year Median | 19.07 |

| 10-Year Average | 20.38 |

| 10-Year Median | 19.98 |

| 5-Year Average | 20.22 |

| 5-Year Median | 19.78 |

| 12-Month Forward | 17.90 |

| Historically Overvalued | -10.43% |

(Source: FactSet Research Terminal)

VHT is historically worth 19 to 20X earnings, and today trades at 17.9X forward earnings.

- 13.2X cash-adjusted earnings

VHT is about 10% historically undervalued and a potential strong buy for anyone looking for a defensive sector ETF to buy ahead of next year’s recession that’s likely to deliver long-term market beating returns.

Bottom Line: NVS And VHT Are Perfect Dividend Blue-Chips For This And Future Recessions

I can’t tell you whether or not the market has fully priced in a 2023 recession yet (though I don’t think it has).

I can’t tell you the exact time the bear market will bottom (though it’s likely to be sometime next year).

What I can tell you is that anyone selling right now is very likely to deeply regret it in 5+ years, when a new bull market is likely to have stocks up historically around 100% to 300%.

Defensive blue-chips like healthcare, utilities, and consumer staples are a great way to ride out market storms like this one, with smaller declines that can help you avoid panic selling.

But while consumer staples and utilities tend to underperform in a recovery, healthcare tends to do well in all economic conditions.

That’s what makes NVS and VHT such potentially attractive long-term dividend growth opportunities right now.

NVS is one of the best high-yield drug makers you can buy right now.

- 4.4% very safe yield

- dividend aristocrat with a 25-year growth streak (in Swiss Francs)

- AA-credit rating (0.51% 30-year bankruptcy risk)

- 97th global risk-management percentile according to S&P

VHT is a great choice for those who want the benefits of healthcare but don’t want to pick individual companies.

- 405 of the world’s best healthcare blue-chips

- 1.4% yield but 15% CAGR long-term dividend growth rate

- fell 30% less than the S&P during the Great Recession (and a lot less in almost every bear market)

- effectively a “risk-free” long-term investment (since 405 of the world’s biggest healthcare blue-chips can’t go to zero outside of the apocalypse)

If you need help staying calm, safe, and sane in this bear market NVS and VHT can help.

If you are yearning to sleep well at night no matter what happens with the economy in 2023 or beyond, NVS and VHT can help.

If you want to make your own luck on Wall Street, then undervalued healthcare blue-chips like NVS and VHT might be just what you’re looking for.

If you’re after strong returns after this bear market bottoms (whenever that finally is) NVS and VHT are near perfect options for these turbulent times.

Be the first to comment