JJ Gouin/iStock via Getty Images

Stress…

Stress is a very fluid word that can be used in different contexts ranging from a very personal level in terms of feelings and medical diagnoses all the way to structural and financial engineering matters. Depending on the context, stress can be the cause of an issue or the end result. It is because of this fluidity that stress lends itself well to being an input and an explanation for the faltering economy and volatile markets we are currently seeing.

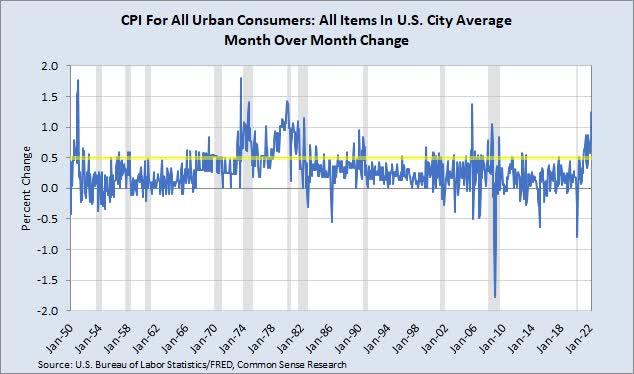

The single largest source of stress in the economy and by default, financial markets, is inflation. While the cause of inflation can and has been debated ad nauseum, it’s unquestionable that it is pervasive in the prices of nearly all goods and services. With the Federal Reserve doing its best to explain and control monetary policy effects on inflation, there still exists the tangible and direct effects that elevated energy prices have had. So, whether one believes that it was excessive Covid related stimulus provided by the government, a rise in energy prices, supply chain issues or a combination of all three that have caused inflation, we still have to deal with the end result. And if we are going to use history as a guide for what may be ahead of us, the chart below shows that we are likely headed for trouble.

FRED

Understanding that the gray areas are recessions, the more time CPI spends above the yellow line, the more likely it is we will enter a recession soon or are already in one. In fact, since 1957 every recession apart from the two months caused by the shutdown has had at least one .5% month over month gain in it with the longest recessions having had the most / largest month over month increases. With the March CPI reading at 1.2%, we are well into the danger zone. The questions now become, how much of this stress will it take before it crushes the economy? Was the weaker than expected March retail sales report which included a 6.4% month over month drop in online sales a harbinger of bad things to come or just a bit of noise? How much relief could easing tensions in Ukraine bring to commodity markets and global inflation? With those questions unanswered, what we actually do know is that wages are trailing inflation by roughly 3% and that the 42% rise (as of April 16th) in gasoline prices since last year are a significant drag on consumption. The bottom line here is that stress in the economy is building and that a tangible source of that stress, energy prices, is not abating.

Old kids on a new bloc…

As a result of the war in Ukraine and sanctions placed on Russia from western governments, new trade relationships have been forming, and they could have significant effects on the role that US dollars (USD) play in global trade, and in turn, inflation. In short, foreign commodity sellers want to be sure that what they are paid in will not lose value before they are able to convert it into their own currency or something else of value to them. The problems with that conversion are known as foreign exchange risk, or FX risk. Because the USD and dollar denominated assets are the most liquid assets in the world, the USD became the default currency for global trade in oil and other commodities in order to minimize FX risk. This default position for the USD is what’s known as “reserve currency” status. Now, due to western governments placing sanctions on Russia which included freezing Russian assets held in western banks, Russia has looked to move away from USD based trade settlements. Already, India is purchasing discounted Russian energy in spite of sanctions and is looking into ways to complete trades in Rupees. Also, other countries like China and Saudi Arabia, who have precarious trading relationships with the US and had already been looking to diversify away from USD trades, are having open dialogues about developing non-USD trading operations. In effect, a new trading bloc consisting of China, Russia, India and Saudi Arabia, or CRIS for short is being established. In order for this new bloc to be successful in avoiding the USD, significant liquidity needs to be established in the Yuan and Ruble. Since a currency is only as strong as its ability to be converted to something else, Saudi Arabia’s significant assets and easy access to western financial markets could play a vital role in fostering the necessary liquidity. Given China’s stated goal of becoming the dominant economy in the world, promoting Yuan-based trade routes are a significant step towards that goal. The implications of this could be enormous for the US in that a move away from USD trade financing would cause a drop in USD value and make the cost of our imports significantly higher thus driving even more inflation. Should the new bloc become the preferred market of other countries and end the USD’s role as a reserve currency, the results could be catastrophic for the US economy.

All is not lost…

Even with all the headwinds the economy and markets are facing today, the economy can still turn things around and maintain sustainable strength into the future. The main driver of this turnaround will be a return to pro-domestic energy production policies.

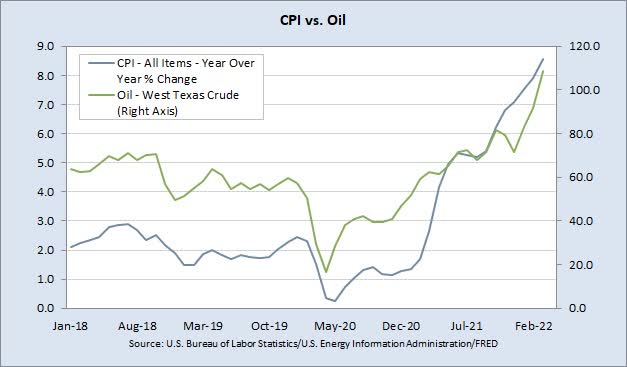

FRED

With inflation acting like a tax on consumers over the last couple of years, a future decline in energy prices will add to consumer discretionary spending and be a very welcomed boost to consumer sentiment. Unfortunately, that return seems dependent on a change in administrations, but if recent polling is accurate, change is on the horizon.

In the short term, markets are still dealing with rising rates and the uncertainty of future Fed rate hikes. The speed and magnitude of the bear steepening that’s taken place in rates has done much of the work for the Fed already. Hopefully, the Fed will realize that additional tightening through rate hikes and balance sheet reduction will not reduce energy prices and could create more stress on consumers and potentially exacerbate a recession should one occur. While quantitative easing needs to end, the instability in the global economy today makes the possibility of a significant policy error through excessive tightening far greater today than at any other time. If the Fed does continue on an aggressive QT path while energy prices remain elevated, the possibility of recession and an equity market correction rises significantly. The good news is that the Fed still has plenty of time to slow down and apply its “data dependent” approach to things.

What will Mr. Market do???

As earnings season gets underway, we have the SPX trading at 21x trailing earnings and 18.8x next twelve months earnings based on the April 15 close and using operating earnings estimates as provided by S&P. Given that we’ve already seen some multiple compression this year, which could continue as rates move higher and / or recession expectation increase, the market is in a tough spot. For example, if the market trades down to 17x forward earnings, a level that’s still expensive by historical standards, we’d get SPX 3967, an almost 10% correction. Additionally, any reduction to earnings would make that correction even worse. At this point, given all the uncertainties there are, raising cash is not a mortal sin and obligatory dip buying should be tempered a bit. Having cash and owning high quality, dividend paying names in an unstable and rising rate environment provides safety and the ability to invest into higher yielding assets as they become available. All of which are things that will do wonders for keeping oneself from being stressed out!

Be the first to comment