BD Images/iStock Editorial via Getty Images

Introduction

This is a very tricky market environment for dividend growth investors. Dividend yields, in general, have fallen off a cliff after the pandemic caused capital gains to outperform dividend growth. Now, a 3% yield puts a stock in the “high yield” basket, which is everything one needs to know about this market. After discussing both lower-yield dividend growth and high yield investment ideas this month, I’m going to focus on a stock that offers a number of things: a high yield, a safe yield, high potential dividend growth, and a good valuation. Phillips 66 (NYSE:PSX) offers all of these things as it’s one of the S&P 500’s highest-yielding companies with a significant yield premium over related high-yield investments. Moreover, and this is key, I foresee growth and sustainable capital gains for its investors.

Allow me to elaborate.

A High Yield In A Tough Market

There’s one debate I’ve never settled with my followers and it’s based on one question: what do you like better, getting a big dividend hike, or collecting a high dividend?

I think it depends on who you ask. Younger investors will almost without a doubt go for a big dividend hike. It means you were right and the company you bought is indeed able to boost its payout. However, collecting a nice dividend is also a lot of fun as it allows investors to buy new shares with dividends, or to pay for expenses in the case of retired investors.

When it comes to high yield, there’s one thing that bothers me: people who go all-in on high yield because collecting dividends is so much fun. For example, people in my age group (<30 y/o) sometimes tend to go overboard on high yield stocks.

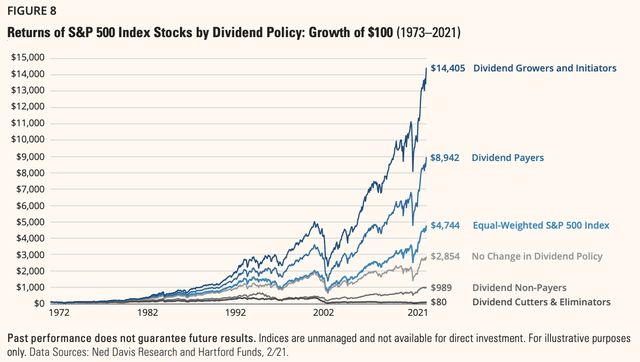

Historically speaking, dividend growth stocks have been the place to get outperformance as the graph below shows. In a lot of cases, a high yield is a trap. Let’s assume there’s one stock with a 1% dividend yield and an 11% annual total return and a stock with a 4% yield and a 6% annual return. The 1% stock would turn a $5K investment into $14,200 in ten years. The 4% yielding stock would turn into $8,950. That’s not bad either, but it’s a difference of $5,200. That’s more than the initial investment. Also, the annual dividend difference is $50 versus $200 in the first year. The first one is a very cheap pair of sneakers, the other is a week worth of groceries. My point is, that it’s a shame to focus on dividends too much. It’s almost always possible to sell fast-growing assets close to retirement and go all-in on high yield. At that point, it makes way more sense.

And don’t get me started on even higher-yielding stuff that’s based on bundled loans like mortgage REITs.

With that said, there’s nothing wrong with buying a high yield. A good balance is what’s important. That’s where I try to focus on high yield as well.

On April 13, I wrote an article titled: A High Yield Play You’ll Like – Bank OZK.

The bank is yielding 3.1%, which technically makes it a high-yield play as I will show you in this article. However, some readers called BS on it as they desired more. I do not disagree as I came very close to “abusing” the high yield definition.

As I said in the title, in this article I’m going to give you high-yield that I believe makes sense for young and retired investors as it allows people to buy high yield without missing long-term upside.

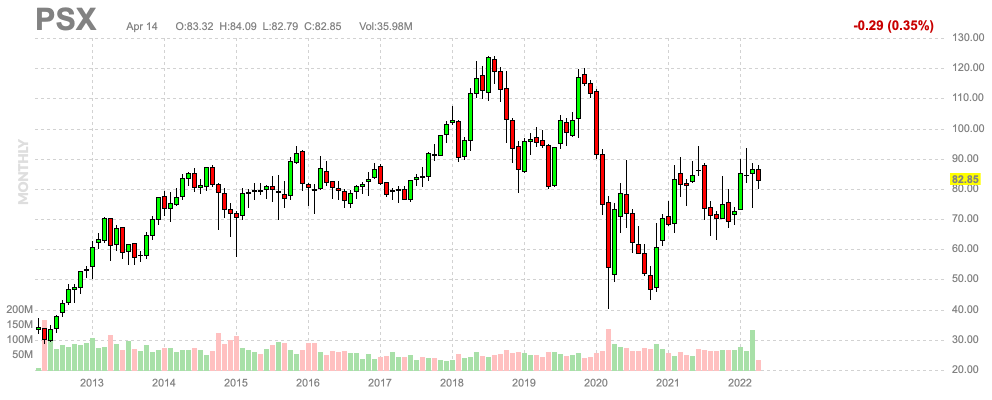

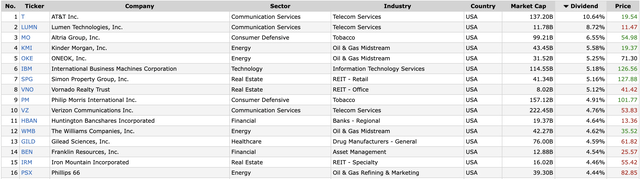

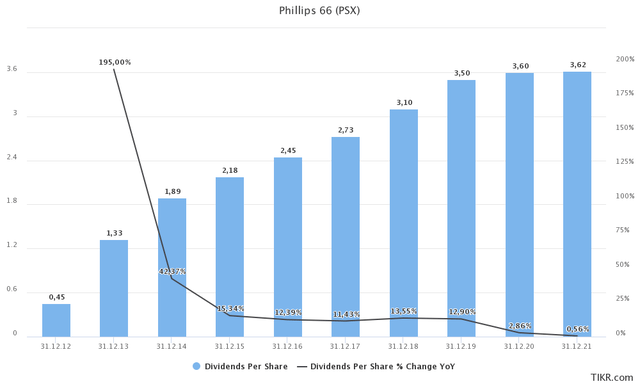

Right now, the Phillips 66 company is paying $0.92 per quarter. That’s $3.68 per year per share. Using the company’s $82.85 share price, we’re dealing with a 4.44% yield. This makes it the 16th-highest dividend yield in the S&P 500 as the table below shows.

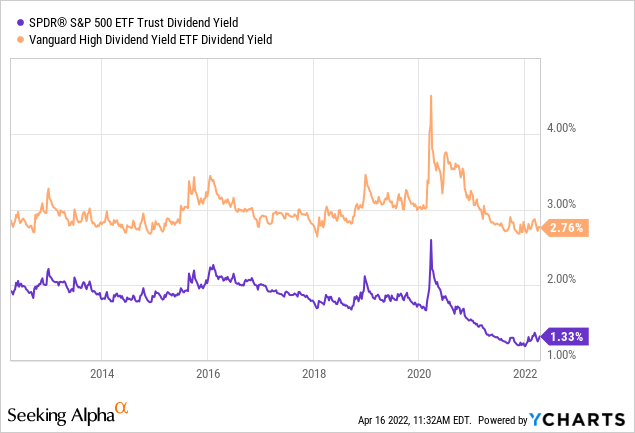

Now, with that said, the graph below shows why it’s such an incredibly tough task to invest in high yield without going all-in on high-risk stuff like energy or structured debt products. The S&P 500 is yielding just 1.3%. Since the pandemic, capital gains have outperformed dividend growth. Prior to the pandemic, the S&P 500 used to yield 2.0% fairly consistently. Now, it’s more than 60 basis points lower. The Vanguard High Yield ETF (VYM) is yielding just 2.8%. That’s just 80 basis points above the S&P 500’s pre-pandemic yield.

I already briefly highlighted it, but it’s absolutely devastating as this means one thing: investors need to take higher risks to get the same yield they got prior to the pandemic. And if there’s one thing I like to avoid, it’s exactly that.

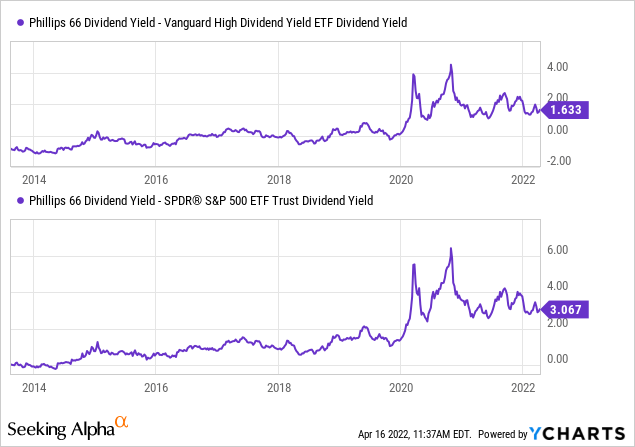

In this case, Phillips 66 is yielding more than 300 basis points above the S&P 500 and 160 basis points above the high-yield ETF. Both numbers are well-above pre-pandemic levels.

In this case, it’s important to explain why it’s a quality yield as buying a high yield isn’t rocket science.

Phillips 66 – It’s A Quality Yield

Most high-yield investments are high-yield investments because companies generate way more cash than they need. In a lot of cases, we’re dealing with older companies that operate in an industry with high (often capital-intensive) entry barriers.

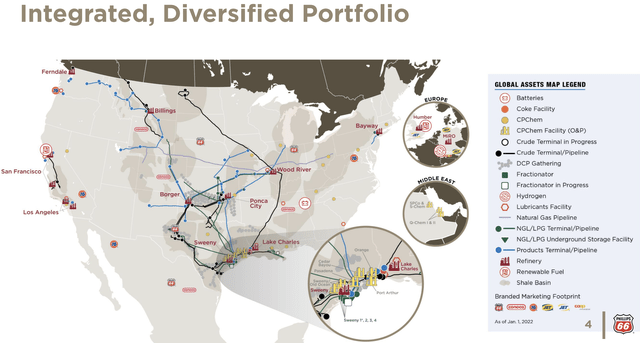

Phillips 66 is very old. While the stock price only goes back to 2012 when the company spun off from ConocoPhillips (COP), the company’s operations go all the way back to 1927 when it was founded in the Lone Star State, Texas.

Fast-forward to 2022, and we’re dealing with a company with a $39.9 billion market cap, which dominates the market with its refinery peers Valero Energy (VLO) and Marathon Petroleum (MPC) as well as major integrated oil and gas companies like Exxon Mobil (XOM) and Chevron (CVX), who have refinery assets as well.

The good and the bad thing about refining is that it’s capital intensive. It means high capital spending is required to maintain operations, but it also means that building a refinery network comes with the benefits of keeping new competitors out. To give you an extreme example, most people with knowledge can start a tech company, but almost nobody in their right mind starts a refinery company from scratch.

This means that this market will continue to be dominated by the players it has now.

Anyway, in the case of Phillips 66, the company needs roughly $1.0 billion to sustain its operations. On top of that, the company uses growth CapEx to (obviously) grow its business and expand its footprint in renewables. This year, the company is expected to spend $1.9 billion on growth and maintenance projects. Roughly $900 million of this is expected to be growth CapEx.

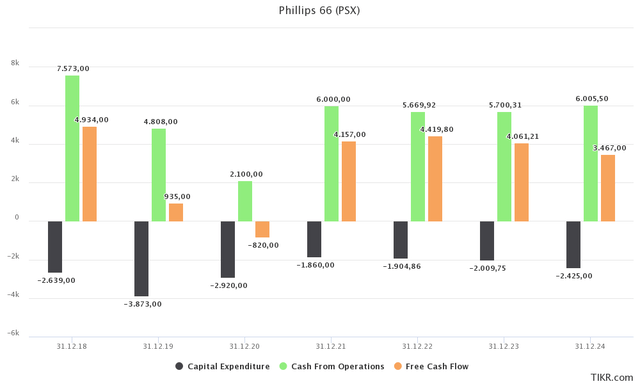

In this case, the company expects $6-7 billion in mid-cycle CFO (cash from operations). Analysts expect close to $6.0 billion going forward, which indicates close to $4-$4.4 billion in annual free cash flow. Free cash flow is cash from operations minus capital expenditures. In good years the company has plenty (>$4 billion) while in weaker years, the company struggles to cover its dividend. 2020 for example saw negative free cash flow, which means there was not enough money to cover both growth and maintenance CapEx. Yet, 2020 was a very unique year as lockdowns killed demand. A “normal” recession won’t have that impact – not even close.

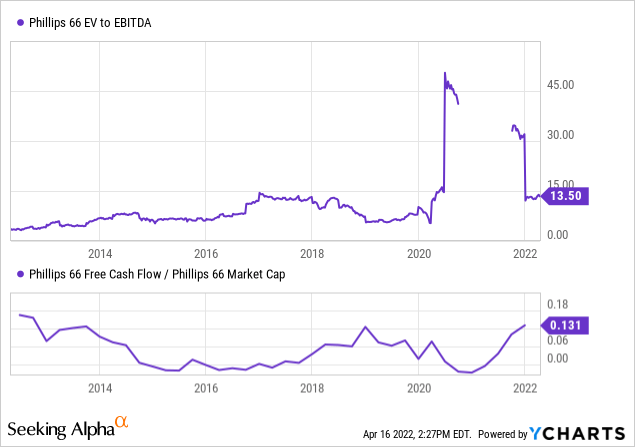

With that said, let’s assume the company can maintain between $4.0 and $4.4 billion in free cash flow in the years ahead. This would translate to a free cash flow yield of 10% to 11% using the $40 billion-ish market cap.

As the current dividend yield is 4.4%, it not only implies that the dividend is safe, but it also implies that there is a lot of room to hike.

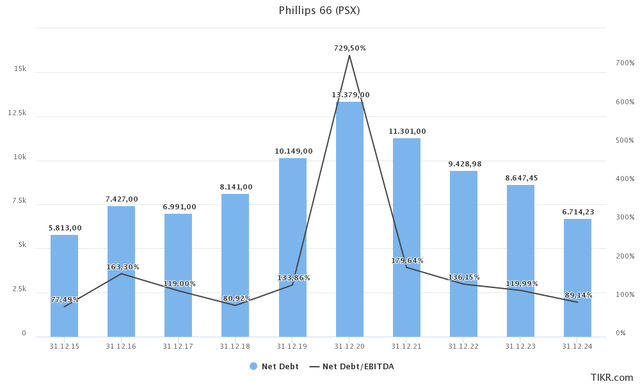

In 2012, investors received $0.45 per share. Now, it’s $3.68 per share after hiking by 2.2% in October of 2021. Prior to the pandemic, the company hiked rather aggressively with strong, double-digit annual hikes. I expect this to continue. Note that the company could have cut the dividend during the pandemic to protect its assets. The company did not and occurs higher net debt as it had to maintain CapEx spending and its dividend. Now dividend growth is weak as the company is prioritizing debt reduction. I think that’s fair and I have zero doubt that dividend growth will come back roaring.

One reason why dividend growth will come back is that net debt is expected to normalize again. As I said, during the pandemic, net debt soared. The company ended 2020 with $13.4 billion in net debt. That was more than 7x EBITDA back then. Now, it’s expected to come down to pre-pandemic levels with a net leverage ratio of less than 1.4x.

With that said, the stock is also cheap.

PSX Stock Valuation And Current Developments

The company has a $39.9 billion market cap. Net debt is expected to fall to $8.6 billion next year. Also, the company has roughly $1.1 billion in pension-related liabilities. This gives us an enterprise value of $49.6 billion, which is 6.9x expected 2023 EBITDA of $7.2 billion.

This valuation is too cheap. The same goes for the implied free cash flow yield of 10-11%. Historically speaking, the stock has traded in high single-digit free cash flow yield territory. This means investors are not overpaying to get access to free cash flow, which is very important.

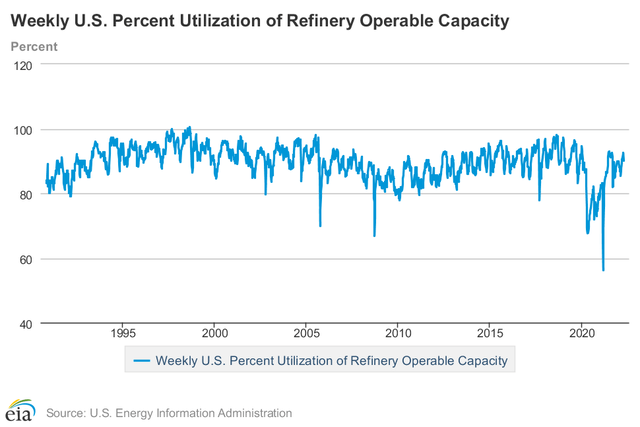

Then, we’re dealing with an economic tailwind. Despite high fuel prices, demand remains strong with refinery operations running at 90% capacity in the US according to EIA data.

Moreover, because of the war in Ukraine, the diesel and fuel market in Europe has gotten extremely tight according to BofA and RBC research published on Seeking Alpha, this is very bullish for PSX.

RBC’s note is more tactical. The analyst writes that Russian crude oil has continued to flow; however, around half of Russian exports come in the form of oil products. Europe has historically been a major importer of Russian and US oil products. With inventories dwindling and Russian supplies facing headwinds, RBC believes Europeans will need to bid diesel and jet fuel away from Latin American and US markets. A process that has already led to effective bidding wars, driving jet fuel and diesel margins to all-time highs.

The war in Ukraine has highlighted many weaknesses in global energy markets. From Riyadh to Wall Street and Washington, stakeholders have been vocal about the need for investment to grow upstream energy production. Though oil production is not growing as fast as stakeholders would like, few have highlighted the fact that refining capacity in the West has actually fallen. It’s fallen significantly in the past two years. As the IEA, EIA and OPEC call for record oil demand in 2022, after the US and Europe shuttered record capacity in 2019-2021, perhaps refiners like Phillips (PSX), Marathon (MPC) and Par Pacific (PARR) are best positioned to benefit from rapidly evolving global energy markets.

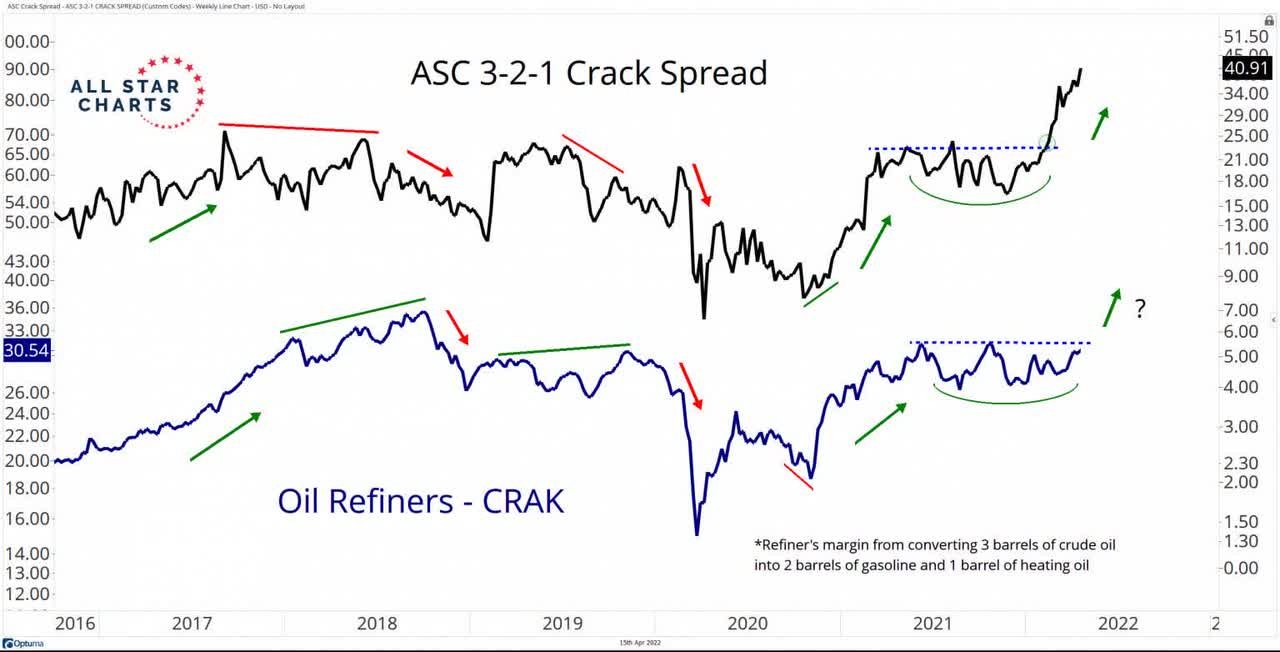

Technical analyst All-Star Charts recently posted this bull case on Twitter showing an accelerating crack spread and oil refineries being on the verge of breaking out.

ALL STAR CHARTS

I think this makes sense as fundamentals and technicals are now overlapping.

Moreover, I think PSX is just too cheap. In a global search for yield, PSX is yielding too high. Hence, I think the (expected) breakout in refinery stocks will push PSX shares to $100-$110.

FINVIZ

So, here’s my takeaway.

Takeaway

It’s not a fun market environment for income-seeking investors. Dividend yields have fallen off a cliff, making it hard to find quality high-yield dividend growth. Phillips 66 is one of the few stocks that’s still an attractive source of both income and growth. This refinery giant is in a terrific spot to not only maintain a 4.4% dividend yield but also to grow this on a long-term basis thanks to very high free cash flow and a healthy balance sheet.

It’s a suitable investment for both income-focused investors and younger dividend growth investors who like to add some yield to their portfolios.

I think by buying Phillips 66, investors are getting yield, but not giving up on long-term gains and growth. Especially now, I believe that the stock is undervalued. The war in Ukraine has created a situation where the “world” is in desperate need of refined products. PSX can deliver.

The valuation is very fair, and I expect the stock to rise to at least $100-$110, followed by a volatile but steady long-term uptrend.

The only thing I need to mention is that PSX is volatile in weak economic times. Only buy PSX if you know that you’re buying a high-yield stock with above-average volatility.

Once investors keep that in mind, I think we’re looking at an almost unbeatable long-term value proposition. The only reason I’m not buying (yet) is because I own its peer, Valero.

(Dis)agree? Let me know in the comments!

Be the first to comment