AsiaVision/E+ via Getty Images

Investment Thesis

We follow up on our pre-earnings article on StoneCo (NASDAQ:STNE) after its recent FQ1’22 earnings card.

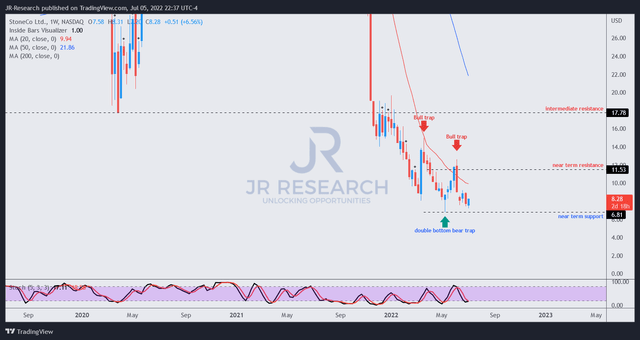

We posited previously that we observed that STNE had formed a potent double bottom bear trap (significant rejection of selling momentum) in early May and was confident of its bottom holding. Accordingly, we also set a near-term $13 price target (PT).

Notably, STNE surged to a post-earnings high of $12.63 before forming another bull trap (significant rejection of buying momentum). The market astutely drew in dip buyers post-earnings before forcing it back to its near-term support. Notwithstanding, STNE demonstrated the resilience of its double bottom as it held firmly, giving investors another opportunity to add exposure.

However, given the lower-high bull trap that formed in June and its bearish bias, we believe it’s prudent to err on the side of caution.

As a result, we revise our near-term PT to $10 while reiterating our Buy rating. It implies a potential upside of 20.8% from July 5’s close. We also rescind our intermediate PT given the change in price action dynamics.

StoneCo Needs to Sustain Its Profitability

As the market formed two lower-high bull traps, despite a double bottom in early May, investors need to pay attention to the market’s signals. Furthermore, STNE traded at a relatively high FCF yield of about 11% when it formed its June bull trap.

Our approach is always to ask why the market rejected buying momentum decisively at such high yields instead of blaming the market for its “myopia.” We learned that it’s better not to argue against the market but try our best to understand its forward intentions through the study of price action.

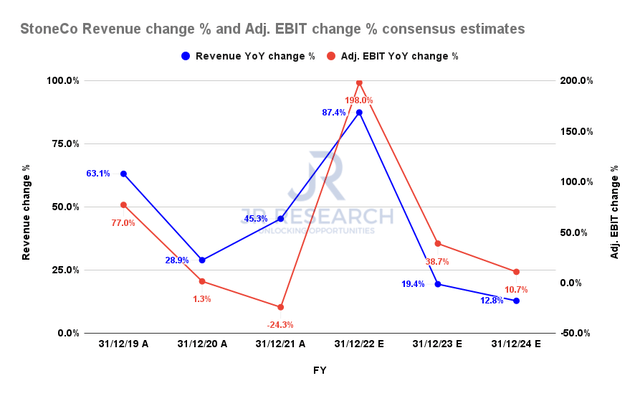

StoneCo revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Therefore, we revisited our fundamental analysis and tried to model the market’s dynamics. The consensus estimates (generally neutral) were upgraded following StoneCo’s better-than-expected Q1 card and Q2 guidance.

The revised Street’s consensus suggests that StoneCo’s revenue and adjusted EBIT are still projected to decelerate markedly through FY24. Therefore, the Street remains unconvinced of the company’s ability to sustain its rapid growth.

Unsurprisingly, analysts on the recent earnings call peppered management with several questions about its pricing leadership while navigating challenging macros. Notwithstanding, management remains confident in its pricing power and competitive leadership. Accordingly, it accentuated (edited):

At the end of the day, I don’t see that competition changes the way we decide to price our products. But given that competition is being much more rational today, it opens more space for this balance to be made with much better room, I would say. So I’m not seeing any change in terms of competition from what we have discussed last quarter. We see players overall taking rational pricing decisions here. In small and medium clients, we see more competition for new players. In large clients, we see more acquire strong incumbent banks. So I think that that’s the take regarding competition. (StoneCo FQ1’22 earnings call)

However, it appears that the Street has decided to remain on the sidelines until StoneCo could prove otherwise.

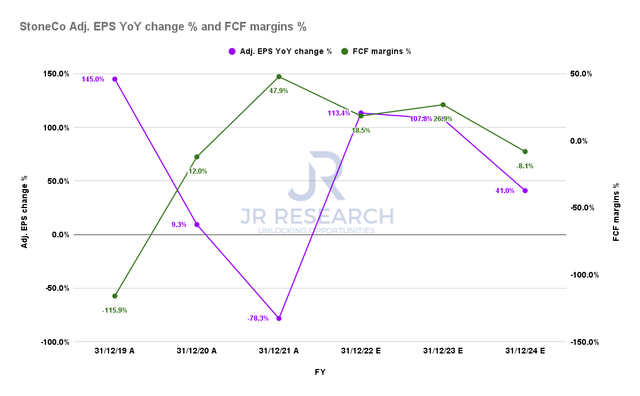

StoneCo adjusted EPS change % and FCF margins % consensus estimates (S&P Cap IQ)

Consequently, its growth deceleration is projected to impact its adjusted EPS growth and free cash flow (FCF) margins through FY24. As seen above, StoneCo’s adjusted EPS growth is estimated to moderate sharply, impacting its FCF profitability.

Notably, StoneCo is estimated to post negative FCF margins in FY24. Therefore, we believe the volatility in its FCF margins could be causing a tremendous level of uncertainty in the market as investors parsed its valuations. Until StoneCo can prove the resilient growth and sustainability of its FCF profitability, it’s better to be nimble on STNE.

STNE – June’s Bull Trap Was Significant

STNE price chart (TradingView)

As seen above, another lower-high bull trap formed in June, lowering its near-term resistance to $11.50. Consequently, we revise our PT to $10 from $13 and rescind our intermediate PT, given the weakening price action dynamics.

Notwithstanding, its May double bottom has held firm despite the rapid liquidation post-earnings. Therefore, we believe that a directionally bullish set-up close to its near-term support is still executable with a reasonable risk/reward profile.

Is STNE A Buy, Sell, Or Hold?

We reiterate our Buy rating on STNE, with a revised near-term PT of $10. It implies more than a 20% potential upside from July 5’s close.

Given the weakening price action dynamics, we urge investors to be nimble on STNE. Notwithstanding, if STNE can continue to hold its May double bottom and consolidate, it could indicate an accumulation phase and, therefore, constructive for its medium-term recovery in its bullish bias. But, until then, STNE remains mired in a bearish bias.

Our fundamental analysis suggests that StoneCo needs to prove that it can sustain its FCF profitability for the market to re-rate its stock confidently.

Be the first to comment