Umnat Seebuaphan/iStock via Getty Images

Investment Thesis

Workday (NASDAQ:WDAY) has decided to return excess capital to shareholders. Workday will be buying back $500 million worth of shares, in an effort to partially offset share dilution.

At the same time as that announcement, Workday guides for fiscal 2024 (not to be confused with the calendar year).

If we use non-GAAP operating profits as a suitable benchmark, the stock is priced around 30x forward non-GAAP operating profits.

What’s Happened?

This is what’s likely to happen. Today, the Fed is likely to increase by 50 basis points. That shows investors that the Fed is slowing down the pace of rate hikes. And with that in mind, investors won’t have to as aggressively ”fight the Fed”.

So, it’s off to the races then? Well, not quite, there are a few more considerations in mind.

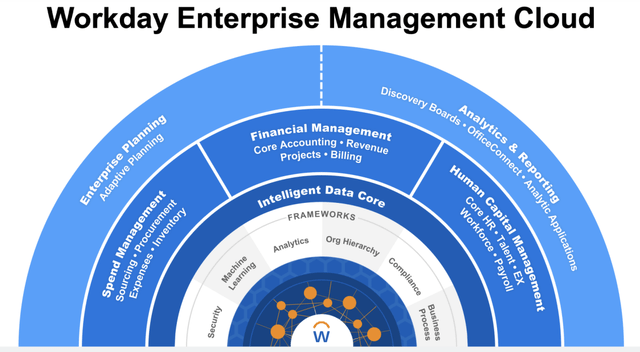

Workday is a leader in Cloud Human Capital Management (”HCM”) & Enterprise resource planning (”ERP”)/Financial Management Resources (often referred to as FINS).

Workday believes that its HCM TAM reaches $52 billion, while its FINS TAM reaches $73 billion. And of both together Workday believes is under 10% penetrated.

The idea here is that Back Office demand won’t be significantly impacted in by the potential recession. As we know, there’s a very tight labor market. And it makes sense for companies to invest in their IT solutions, to drive down Workforce Management, HR-related, Financial costs and Spend Management costs.

Simply put, Workday should not see a significant amount of customer churn.

And this leads me to discuss WDAY’s guidance.

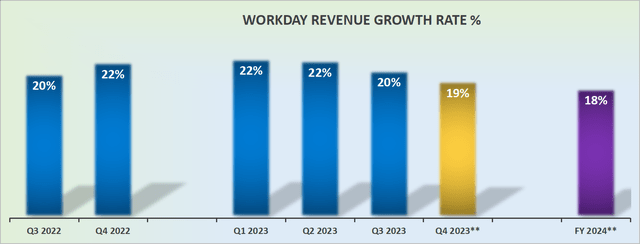

Revenue Growth Rates Are Highly Stable

Workday guides for fiscal 2024 to grow by approximately 18%. What this means for investors is that unlike countless other SaaS business models that turn out to have been substantially cyclical, Workday may actually be a true approximation of a long-term secular growth company.

Margin Expansion Leads The Way

Workday expects to see its non-GAAP profit margins expand by 200 basis points compared with fiscal 2023. That points to around 21% non-GAAP operating margins.

I would obviously point out that this figure is before management gets paid. Management’s stock-based compensation is expected to drag around 23% lower than non-GAAP operating margins.

Put another way, Workday will remain GAAP unprofitable for a while. But I don’t see that the Street is unduly perturbed by this.

Thus, I believe that investors should expect around $1.7 billion of non-GAAP operating profits.

WDAY Stock Valuation — 30x Forward Non-GAAP Operating Profits

Being a purist, I struggle to consider investing in companies that are highlighting their non-GAAP operating profits, as reflective of their fundamental profitability.

On the other hand, if I don’t play this singsong dance, I’ll be left behind a huge portion of the market.

Along these lines, this is what Workday said on their earnings call,

We remain confident in our ability to capitalize on the opportunity ahead and are pleased to announce our first ever share repurchase program and up to $500 million under authorization.

This program will help reduce the rate of our share dilution going forward and is driven by our belief that our share price is undervalued given the long-term growth opportunity ahead. […] know that we feel confident that we reach a scale where we can roll-out this repurchase program, while continuing to prioritize investing for long-term profitable growth.

Indeed, Workday carries approximately $2.5 billion of net cash. So, if Workday continues to deploy its excess cash flows towards buybacks, like the $500 million announced for share repurchases a few weeks ago, a portion of its share dilution will be offset.

The Bottom Line

To sum up my point of view on why I’m now bullish, consider this quote from Workday’s CFO Barbara Larson,

We will continue to prioritize allocating capital towards organic innovation, followed by targeted M&A, but given our strong balance sheet and free cash flow, we intend to use a portion of our capital towards the repurchase of shares, enabling us to partially offset future dilution from employee stock programs.

This repurchase program is a direct reflection of our confidence in the business and our view that our shares are currently undervalued.

At its core, is two aspects. Firstly, the business has enough cash that they can buyback their shares. Secondly, that Workday believes that its shares are undervalued.

I would rapidly counter this by declaring that management is more likely to repurchase shares at the highs than when things slow down and become uncertain.

That being said, I could then deflect this away and acquiesce that the business is clearly generating substantial cash flows and that it has a net cash position. And if they didn’t buyback shares at this junction, then when would be a better time?

Be the first to comment