Viorika

Shares of personal finance company SoFi (NASDAQ:SOFI) soared last week after mandatory disclosures showed that the firm’s Chief Executive Officer, Anthony Noto, executed three blocks of stock buys totaling $5M. The insider buys are worthy of mentioning because Noto purchased shares near 1-year lows and they come at a time of rock-bottom sentiment for FinTech companies and growing investor concerns about their paths to sustainable profitability. While the extension of the Federal Student Loan Payment Moratorium recently was a negative event for SoFi’s stock (and EBITDA) outlook, as detailed in “SoFi: Tough Blow“, I believe the CEO’s stock buys could help investors regain confidence in the company’s longer term growth prospects!

Insider buys come at a time of increasingly negative attitudes towards FinTechs

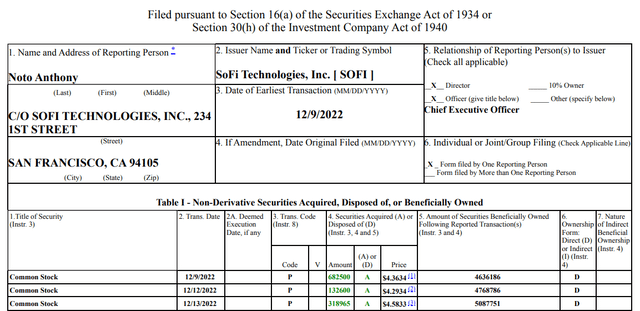

Anthony Noto executed three major stock buys for SoFi on Dec. 9, Dec. 12 and Dec. 13 (disclosure). On each occasion the company’s Chief Executive Officer acquired at least 132,600 shares and he paid as little as $4.29 (for the second batch of transactions) for his SoFi shares.

On Dec. 9, Noto purchased 682,500 shares at an average price of $4.36, followed by an acquisition of 132,600 shares bought at $4.29 on Dec. 12. The last transaction was executed on Dec. 13 which was when Noto purchased another 318,965 shares for a weighted-average price of $4.58… which is about the same level SoFi stock closed on Friday.

In total, Anthony Noto spent about $5M for 1.1M shares of SoFi in December which were also the first buys since June 2022. The CEO owned approximately 5.09M shares of SoFi after the last transaction was executed on Dec. 13 which gives the block holding, based off of a current price of $4.64, a total value of $23.6M. In other words: SoFi’s Chief Executive Officer has skin in the game which is something that investor would want to see in every company they invest in.

Investors demand to see profits

The recent extension of the Federal Student Loan Payment has weighed on SoFi’s valuation and pushed shares to new 1-year lows as the extension is set to impact SoFi’s near term EBITDA potential. I estimated that the continued freeze of student loan repayments could reduce SoFi’s EBITDA possibilities by $50M in FY 2023 to just $150M.

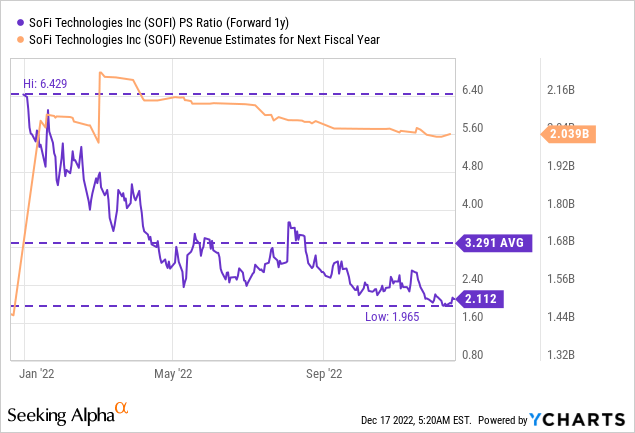

The core problem for SoFi, and which is likely the key reason behind SoFi’s down-ward revaluation in FY 2022, is that the company is not profitable, and its growth prospects traded at too lofty a valuation at the beginning of the year. Investors are increasingly demanding FinTechs show a clear path towards profitability.

Although SoFi is still seeing super-strong member acquisition rates — the FinTech signed on 424 thousand new customers in Q3’22 — driven chiefly by lending and financial services growth, the market is less willing to assign high valuation factors to FinTech companies that don’t generate significant profits.

Unfortunately, SoFi fits into this category because although revenues are still advancing rapidly, the FinTech is not yet achieving a baseline of profitability. SoFi’s earnings were negative to the tune of $74.2M in Q3’22 while the nine months loss (January through September period) reached $280.4M. SoFi, however, is expected to report its first profit in FY 2024, based on Seeking Alpha-provided estimates.

SoFi’s valuation

SoFi is on track to grow its revenues to $1.52B in revenues in FY 2022 (SoFi’s guidance), implying a year over top line growth rate of 50%. Analysts expect $1.53B in revenues, so revenues could be slightly higher than guidance. SoFi is further expected to grow its top line 33% next year to $2.03B, so the FinTech is still projected to see healthy growth in FY 2023.

However, the extended student loan moratorium could hurt SoFi’s prospects for valuation growth in the near term, despite shares trading at a P/S ratio well below the 1-year average of 3.3 X.

Risks with SoFi

One big risk factor for SoFi is the student loan business and the possibility of a continual freeze of student loan repayments in the middle of next year. At the beginning of the pandemic, student loan repayments were frozen in order to give borrowers financial relief. The Federal Student Loan Payment Moratorium has recently been extended to last through June 2023 which delays the reboot of SoFi’s student loan origination business. Since borrowers have more time to make student loan payments, SoFi is not making any money on student loan refinancings either. The moratorium therefore effectively pushes SoFi’s EBITDA growth into the future.

Final thoughts

The insider buys couldn’t come at a better time as the stock is deeply depressed and investors are no longer eager to buy and own FinTech companies. SoFi’s CEO acquired a significant block of shares in the digital personal finance company in December and he did so very close to 1-year lows… which may either be good timing or just a coincidence. I believe SoFi has a lot of potential in the FinTech industry, especially because it keeps growing rapidly, but it may take longer than expected for SoFi to return to the stock highs of 2021!

Be the first to comment