marchmeena29

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on December 17th, 2022.

We ended the week in a fairly volatile way heading into the latest options expiration. We had a CPI announcement and the Fed meeting earlier in the week. The Fed raised 50 basis points, as expected. However, they were a bit more hawkish, anticipating a higher terminal rate. At first, the reaction was rather muted, but Thursday and Friday, the broader indexes slid lower.

Despite this, the put options we sold ended up expiring worthless. That included Realty Income (O) and STAG Industrial (STAG). We also had a covered call trade on Paramount Global (PARA) that also expired worthless.

Stanford Chemist had a couple of his trade ideas also expire worthless. That includes a covered calls trade on KraneShares CSI China Internet ETF (KWEB) and puts that were sold on British American Tobacco (BTI).

Two Rolls

Earlier in the week, I had alerted members I was rolling the covered calls on Starbucks (SBUX) because it was getting too close to the $105 strike. In hindsight, that move wasn’t necessary as shares slid down with the broader indexes. However, it still locked in a significant amount of premium that increased the potential annualized return or PAR. It also kicked up the strike price to $110.

Stanford Chemist also rolled a trade out and down. That was Meta Platforms (META) that was getting a bit too close to the $120 strike for comfort-rolling that position out to June 16th, 2023 and bringing the strike down to $90 brought in a bunch of option premium. It also moved the potential buying price down dramatically.

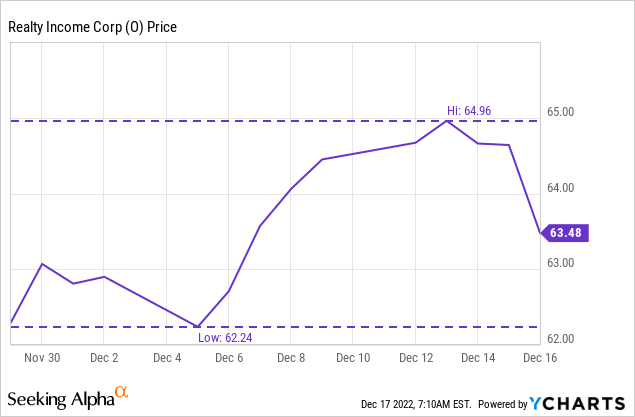

Realty Income

This was a relatively shorter-term trade. We entered into this trade at the end of November for the expiration of December 16th. This trade also adds to our streak of collecting ‘income’ from Realty shares that isn’t just from the dividend.

All said it was 16 days, and we netted $0.55. When writing the puts, we wrote them with only a small cushion because, for me, taking shares of O at $60 is completely fine. Collecting the premium also pushed down the breakeven to $59.45 if assigned. During the duration of the trade, it never breached the strike price.

YCharts

Essentially, we netted 2.22x the monthly dividend in half a month. That opportunity doesn’t happen all the time, but we’ll take it when it presents itself.

We get a more elevated PAR by writing puts with only a small buffer to the strike. In this case, it was 20.91%. Of course, the ‘risk’ of assignment is also materially increased. That’s why it’s only a good strategy to write close to the money if it’s something you really don’t mind holding.

While it was only a short period, O had announced another dividend increase for shareholders. They aren’t large, and this was no different this time at an increase of 0.2% to $0.2485. However, they all add up, and since I’m long shares already, it’s always a good announcement to see.

What’s Next For O?

In the future, O remains a REIT that I don’t mind picking up around these levels. If the latest weakness continues, then we get more opportunities to write puts at $60. Even $57.50 is attractive for the more conservative investors or if we see things tumble a bit further from here.

Here are a couple of ideas I would consider as of the market close of December 16th, 2022. Ideally, I wouldn’t mind being patient to see if shares drop a bit more to juice up the return potential.

- January 20th, 2023, expiration at the $60 strike netting $0.51 (last trade) for a PAR of 9.12%.

- February 17th, 2023, expiration at a $60 strike collecting $1.05 (last trade) brings in a PAR of 10.3%

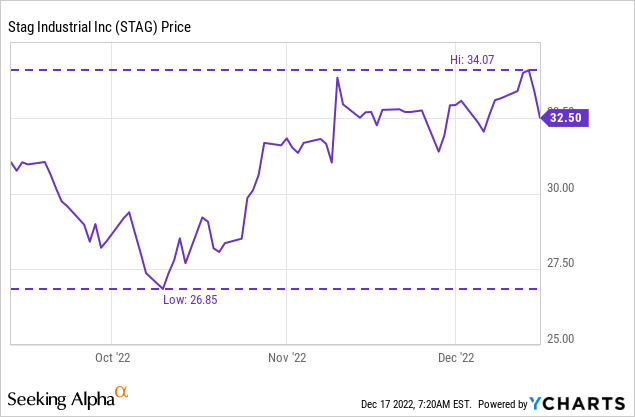

STAG Industrial

STAG was a bit different because this was the conclusion of a roll trade. We had originally sold puts on STAG on September 14th, 2022. That was at a $30 strike, and it was originally planned to expire on October 21st, 2022. Heading into that expiration, shares were incredibly weak, falling below $27 per share at one time.

In that trade, we collected $0.76. When we rolled the trade on October 19th, 2022, we had to close the trade, and that cost us $1.87. That would have left us with -$1.11.

Instead of just taking the loss, I turned around and sold more puts at the same strike but pushed the trade out to December 16th. For selling that put, we collected another $2.57. That brought us back into the positive territory of netting $1.46. If assigned, it would have been beneficial in bringing the breakeven down from $29.27 to $28.54.

Well, we now know since then that shares came rallying back and that trade now expired worthless. The original PAR of this trade worked out to 25%. By having to roll out the trade, it extended the entire trade out to 93 days. That ultimately reduced the PAR down to 19.10%.

YCharts

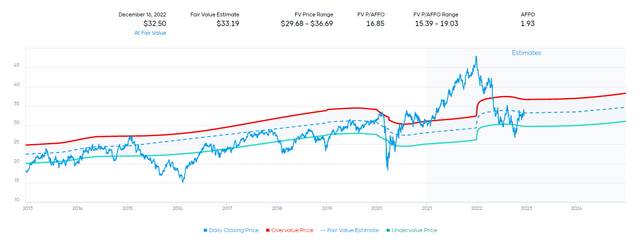

STAG is a position that I continue to hold and reinvest my dividends into. So even without this trade taking assignment, I’m slowly adding to my position over time anyway. Shares aren’t as cheap as they were a short while ago, but they are still fairly attractive. They are essentially trading within the range of fair value based on historical P/AFFO. I covered more on STAG quite recently with a full update.

STAG P/AFFO Fair Value Range (Portfolio Insight)

What’s Next For STAG?

With that, I’d still be looking to get my hands on more shares of STAG. Similar to O, if we get a bit further weakness, that will make a trade selling more puts even more tempting. We once again can look at the $30 strike price. However, for STAG, the options volume is quite limited at most strike prices, and that can narrow down choices.

- January 20th, 2023, expiration at the $30 strike could net $0.31 for a PAR of 11.09%.

- March 17th, 2023, expiration at a strike of $30 could collect $0.88 (midpoint between the bid/ask), working out to a PAR of 11.9%.

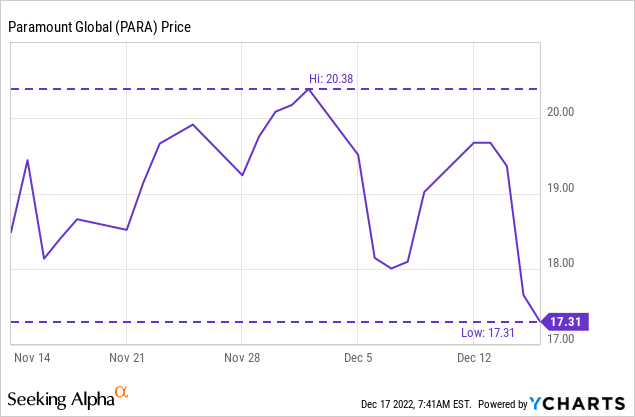

Paramount Global

Finally, we have our PARA-covered calls trade. This was a spur-of-the-moment type of trade. I wasn’t necessarily looking to write calls on PARA because when I took assignment of puts previously, I viewed it as a longer-term play. However, thanks to Warren Buffett, shares got a big pop after it was announced he bought up more shares.

So on November 15th, 2022, we wrote calls at the $25 strike to collect $0.25. That was collecting just over the regular quarterly dividend in 31 days. So basically, it was 3x the normal dividend we collected. I was also comfortable with the December 16th expiration because the ex-dividend date was December 14th, entitling us to that dividend.

We now know that the pop in shares was short-lived, and the trade never was even close to at ‘risk’ of having shares being called away.

YCharts

Shares have since continued to sink back down to much lower levels. This brings up the point that we still have outstanding puts that we sold on PARA too. Those expire on January 20th, 2023 and have a strike price of $15. This trade was a roll itself after shares breached the previous $16 strike we had selected on a trade expiring in November. So that’s something that we need to monitor now that shares are back near this level. Whether to roll or not to roll will be the question as we enter into January.

What’s Next For PARA?

Unlike the other two, there really isn’t a what’s next in terms of selling options at this time. If shares popped back above $20+, I’d look at potentially selling more calls again. We already have puts written at $15 for January 20th, so I’m not too interested in writing more at this point.

PARA trades at quite a low PE, and I think it’s worth holding despite the significant risks inherent in its business. These shares are definitely not for everyone.

With a weaker economy expected next year, advertising revenue that’s already weakening is only expected to be weaker. They’ve been plowing billions into streaming content. Looking at EPS estimates suggests that the next two years are expected to go backward due to that significant spending.

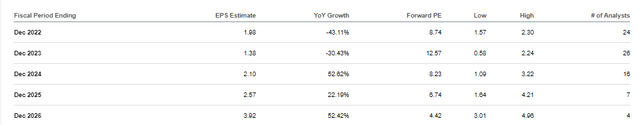

PARA Earnings Estimates (Seeking Alpha)

In fact, the downside is only accelerating. Analysts expect fiscal 2023 to show an EPS of $1.38 now. In September, analysts were calling for an EPS of $1.81, which decreased from the $2.04 just a month before that in August.

This is one way to make a cheap stock more expensive on a forward PE basis. Shares of PARA have slid 25% since the beginning of September, but the forward PE went from around 10 to 8.74 now. For 2023 with earnings expected to be falling yet again, the forward PE comes to 12.57. That makes it less appealing than a deep value play that it might seem at first.

This EPS trajectory really brings up the question of if they are going to be continuing their dividend. Earlier in the year, I was pretty confident in the dividend, but the trend is not moving in the right direction. They could consider a total elimination or a cut; either option would likely see further weakness in shares as income investors get out.

Be the first to comment