solarseven

This article first appeared in Trend Investing on November 15, 2022 and has been updated for this article.

For a background on Frontier Lithium Inc. (OTCQX:LITOF), investors can read our last article:

Interestingly, the above article was written when Frontier Lithium was trading at C$2.77 and the China spot lithium hydroxide (“LiOH’) price was US$38,850/t. Today Frontier Lithium is trading at C$2.02 and the China spot LiOH price is more than double, at CNY 567,500 (US$81,551).

Frontier Lithium Inc. 5-year stock price chart (source) – Price = CAD 2.02, USD 1.47

Yahoo Finance![Frontier Lithium Inc. [TSXV:FL] 5 year stock price chart](https://static.seekingalpha.com/uploads/2022/12/14/37628986-16709968886319008.png)

Today’s article focuses on the valuation of Frontier Lithium and the potential upside if the company continues to progress well towards production. We also look at the road access risk.

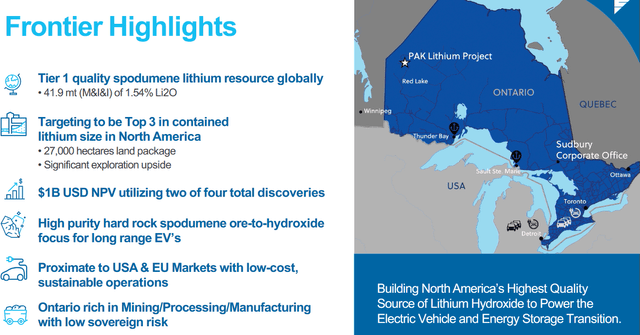

Frontier Lithium Inc. (“Frontier”) is a Canadian company focused on their 100% owned PAK Lithium Project in northwestern Ontario, Canada. Frontier states:

The PAK Lithium Project contains North America’s highest grade lithium resource that is top three in size on the continent and is considered premium quality globally as a result of its rare low-iron spodumene.

It is looking like Frontier’s PAK Lithium Project may potentially soon be the largest and highest grade lithium resource in North America, effectively becoming the “Greenbushes” of North America. Greenbushes is the world’s largest (and highest grade) lithium spodumene mine located in Western Australia. Albemarle (ALB) bought the mine (well before the lithium price boom) when they acquired Rockwood Holdings for US$6.2b in 2014.

During 2022 Frontier has made significant progress including:

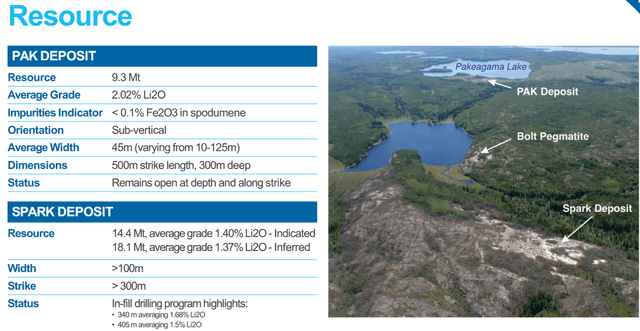

- Substantially increasing the PAK Project resource estimate to the current M&I&I Resource of 41.9 mt @1.54% Li2O.

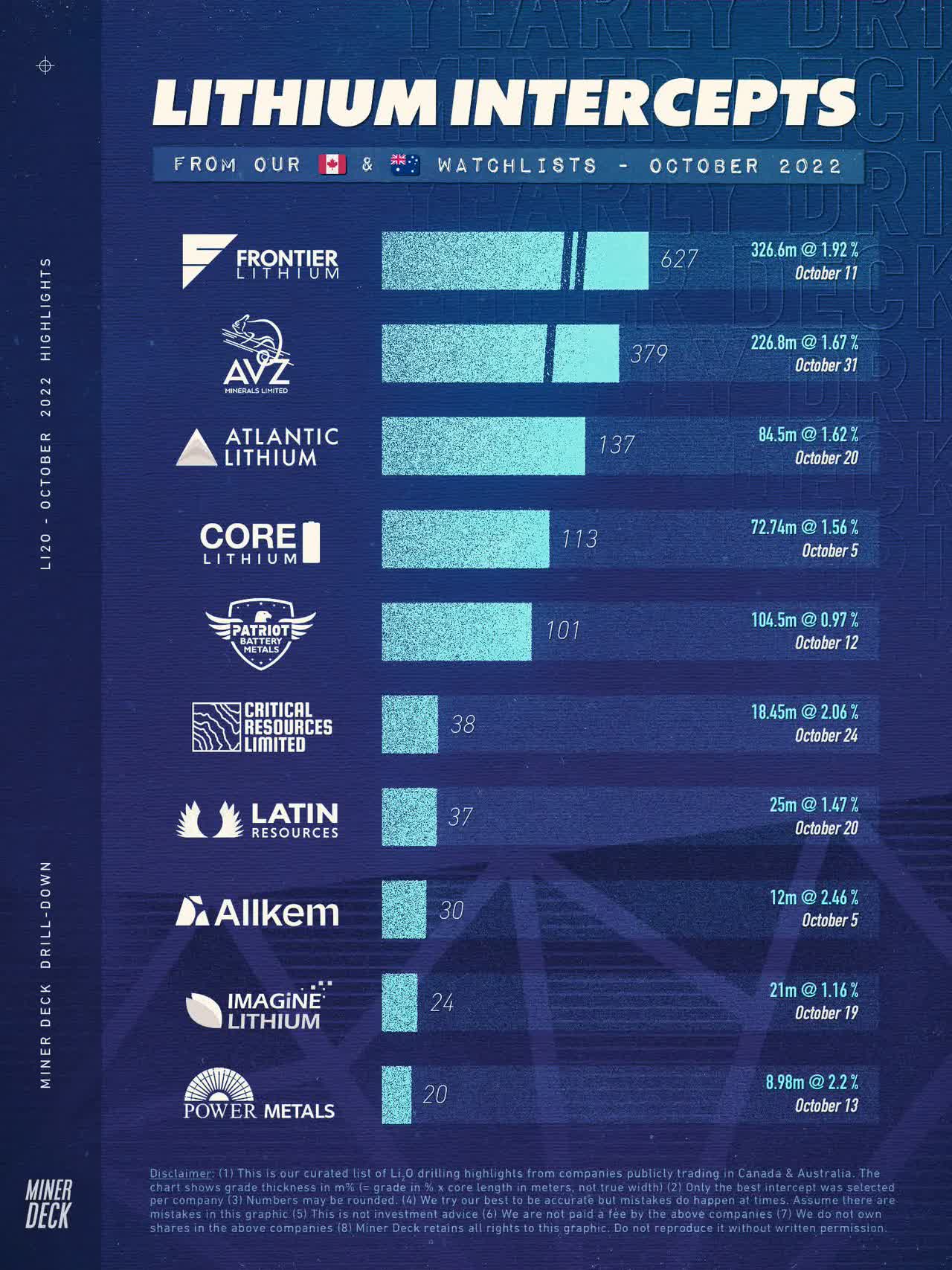

- Several ‘world leading’ and stunning drill results – Oct. 2022 – DDH PL-067-22 intersected 326.6.m of pegmatite averaging 1.92% Li2O. Sept. 2022 – DDH PL-066-22 intersected 338.0m of continuous pegmatite averaging 1.79% Li2O. DDH PL-062-22 Intersected a total of 180.8m of pegmatite averaging 1.55% Li2O. PL-070-22 intersected a total of 181.1m of pegmatite averaging 1.53% Li2O.

Frontier Lithium’s Resource upgrade announced in March 2022 when the Spark deposit resource was significantly improved (source)

Exploration upside

Frontier has further potential exploration upside as they are drilling 15,000m from May 2022 to March 2023, which is equal to the entire drilling done previously (video 13:40 mark).

On May 2, 2022 Frontier Lithium stated:

…..the Company announced its planned exploration program for the fiscal year ended March 31, 2023. Exploration targets for the PAK Lithium project include infill and step out drilling on the Spark deposit and detailed and regional mapping and prospecting in areas proximal to known spodumene-bearing pegmatites and in under-explored areas within its approximately 27,000 hectare land tenure. The Company plans to continue evaluating the Spark pegmatite with a 15,000 metre drill program which began in May 2022 utilizing two diamond drills. It is anticipated that the measured and indicated resource categories of the deposit will be substantially increased.

Note: Bold emphasis by the author.

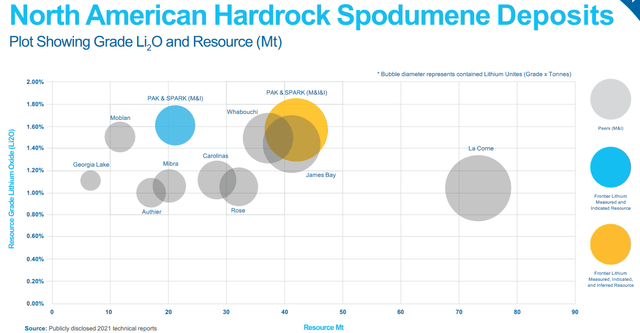

It would not be unreasonable to expect over time that the total PAK Project Resource could potentially grow towards 80m tonnes @ about 1.5% grade. If this occurs it would be the largest and highest grade spodumene project in North America.

Frontier Lithium has the highest grade and is in the top 3 for size, compared to North American peer spodumene projects

A comparison of lithium spodumene drill results globally puts Frontier Lithium well on top (source)

Frontier Lithium Twitter

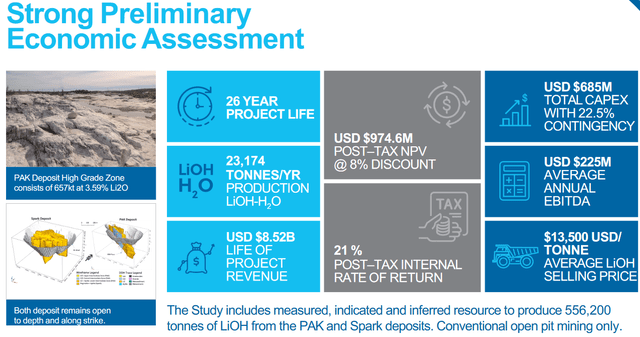

2021 PEA (based on the PAK and Spark deposits) compared to the upcoming PFS due by March-May, 2023

The February 2021 PEA for the PAK Lithium Project resulted in a post-tax NPV8% of US$974.6m and a post-tax IRR of 21%, based on 23,174tpa of lithium hydroxide (“LiOH”) production over a 26 year mine life. The initial CapEx was estimated at US$685m (includes the mine and conversion facility) and AISC of US$4,083/t of LiOH. The PEA was based on a LiOH price of US$13,500/t.

The PAK Lithium Project Feb 2021 PEA summary

The upcoming PFS due by Spring (March-May), 2023

Given the current China spot LiOH price is around US$80,000 as of November 2022, this suggests that there is plenty of upside to the NPV at current spot prices.

We expect the NPV8% for the upcoming PAK Project PFS (integrated project) to be in the range of US$2-4b, depending on what price and production assumptions are used. Over time, this may follow a similar trajectory higher as per Sigma Lithium (see below).

Sigma Lithium (SGML) announced in 2022 a massive increase in their project after-tax NPV8% to US$5.1b based on a 531,000 tpa spodumene production project (selling at US$2,247/t). Incidentally, they recently updated this to include all 3 stages (768,000 tpa spodumene production) with an after-tax NPV8% of US$15.3b. Frontier’s Project size and grade suggests it is potentially capable of following in Sigma Lithium’s footsteps, plus has an advantage of very low iron content and being able to produce highly priced “technical” grade spodumene.

European Metal Holdings [ASX:EMH] updated January 2022 PFS (using LiOH selling at US$17,000/t, 29,386tpa LiOH production, upfront CapEx US$644m) resulted in a jump in their Cinovec Project NPV8% to US$1.938b.

Next steps/catalysts

The next catalysts for Frontier would be further drill assay results, a potential further resource upgrade, and a PFS.

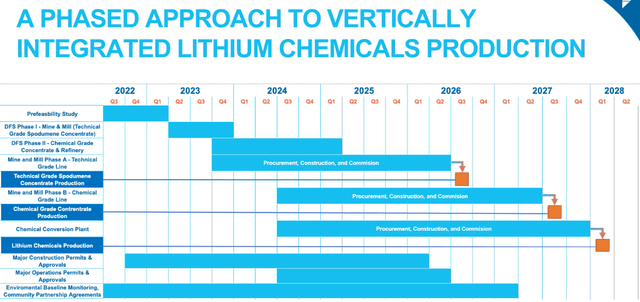

Frontier Lithium targets to release their PAK Project PFS by the Spring (March-May), 2023, a technical grade spodumene DFS by Q4, 2023, and a chemical grade spodumene DFS by Q1, 2025.

Other steps to run concurrently in the next 2 years will be environmental studies, community partnership agreement, and permitting. Also any progress related to the road access issue.

All going well, Frontier anticipates to start technical grade spodumene production in Q3, 2026, chemical grade spodumene production by Q3, 2027, and lithium chemicals production by Q1, 2028.

Frontier Lithium timeline to a targeted 2026 production start

Infrastructure and access problems look solvable

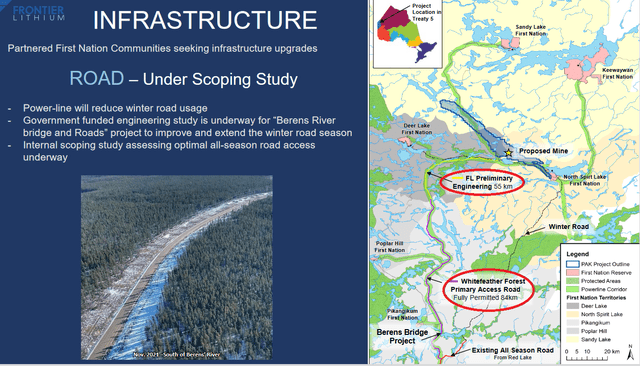

The Watay Power Project is being built (completion by 2024) with a high-voltage transmission line to be located 4km from the PAK resource. The project has sufficient water supply.

As shown on the image below the PAK Lithium project is quite remote and year round road access is the main concern. Currently there is winter road access only.

The government plans to improve the roads so as to extend the winter road season. The map shown below gives more details on Frontier Lithium’s road access issues. It looks like Whitefeather Forest Primary Access Road (84kms, fully permitted) will be built by the government. The final 55kms to the mine site would likely be paid by Frontier and be included in the PAK Project’s CapEx. The cost is expected to be in the range of C$50-100m. We will know more on this topic and costs once the road access scoping study is released or in the upcoming PFS.

Note: The 2022 Canada Federal Budget committed ~C$1.5b to infrastructure for priority critical mineral deposits. (“Dedicates C$1.5B for new infrastructure investments to unlock new mineral projects in critical regions, such as the Ring of Fire.”) (source).

The PAK Project is accessible by winter access road (source) – Red ovals done by the author to show the road access issues

Valuation

Frontier Lithium’s current market cap is C$453m (US$334m). At June 30, 2022, Frontier had cash and cash equivalents of C$16.7m and no debt. Added to this Frontier recently raised ~C$20m in cash.

Yahoo Finance shows an analyst’s price target of C$4.63. Market Screener shows a price target of C$4.20, representing 108% upside.

If the PFS (due by March-May, 2023) delivers an after-tax NPV8% in the order of US$2-4b as we expect due to lithium prices more than doubling since the PEA, then the stock will suddenly look very cheap.

Frontier Lithium’s potential valuation and price uplift after the PFS is delivered (assume a 40% value of the after-tax NPV8%) (in USD)

| Potential PFS NPV outcomes [USD] | FL stock value [USD] | Upside |

| 2 billion | 800 million | 2.39x |

| 3 billion | 1,200 million | 3.59x |

| 4 billion | 1,600 million | 4.79x |

Notes: The above scenario is hypothetical. Stock value is 40% x the ‘potential PFS outcome’. Upside relative to the current market cap of US$334m.

Risks

- Falling lithium prices.

- The usual mining risks – Exploration, permitting, production, partner, environmental, sovereign risks.

- Business risks – Management, liquidity, debt, and currency risk.

- Sovereign risk – Low in Canada.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment, volatility.

- In the case of Frontier Lithium the main challenges looks to be the road access, permitting, and raising the project CapEx. The later should now be easier if they choose to develop the project in stages (technical spodumene, chemical spodumene, lithium chemicals) over several years.

Recent news

We covered the recent news in the article, but here is a link to Frontier Lithium’s news archives.

Further reading

Note: More Frontier Lithium videos here.

Frontier Lithium highlights

Company presentation Company presentation

Conclusion

Frontier Lithium 100% owns the highest grade spodumene project in North America at the PAK Lithium Project in northwestern Ontario, Canada. The Resource is in the top 3 for size and number 1 for grade in North America. 2022 drilling has potential to grow the resource significantly beyond the existing M&I&I Resource of 41.9 mt @1.54% Li2O.

Frontier’s PAK Project looks quite likely to be the “Greenbushes” of North America and potentially become the highest grade, largest lithium spodumene project in North America.

Valuation looks very attractive at the current market cap of C$453m (US$334m) at 34% of the PEA after-tax NPV8% of US$974.6m (C$1.22b). If the PFS (due by March-May, 2023 ) delivers an after-tax NPV8% in the order of US$2-4b, then the stock will suddenly look very cheap. Market Screener shows a price target of C$4.20, representing 108% upside. We see further upside by 2026-27, assuming Frontier makes it to production.

Management is committed with insider ownership very good at ~17%.

Risks are the usual mining risks especially for companies at the development stage. Road access due to the remote location is perhaps the largest concern, but looks solvable with some government assistance.

We rate Frontier Lithium as a very good speculative buy for investors with a 5-year plus time frame.

As usual, all comments are welcome.

Be the first to comment