imaginima

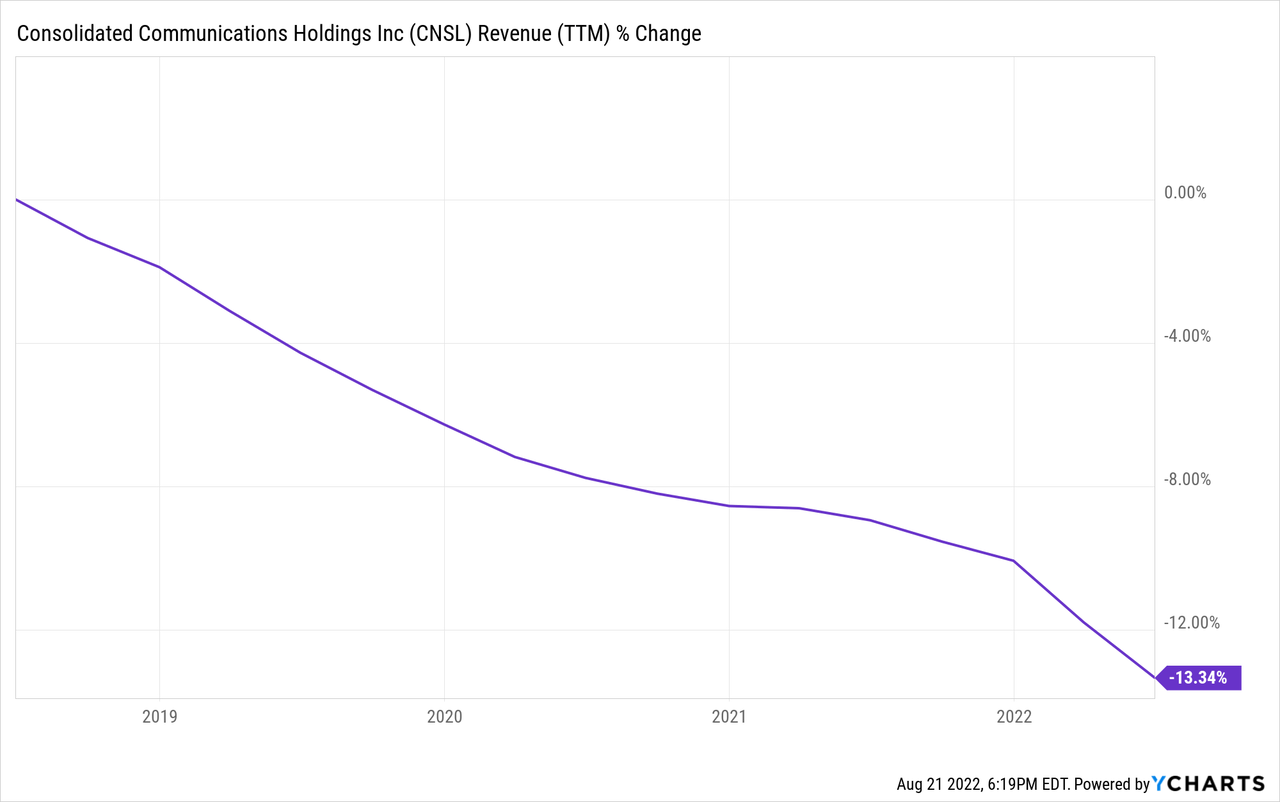

Consolidated Communications Holdings, Inc. (NASDAQ:CNSL) has been struggling with continued erosion in its voice and video services across all of its customer segments. The only category posting growth is broadband internet. Following its last major acquisition, net sales have fallen by about 13% since 2018.

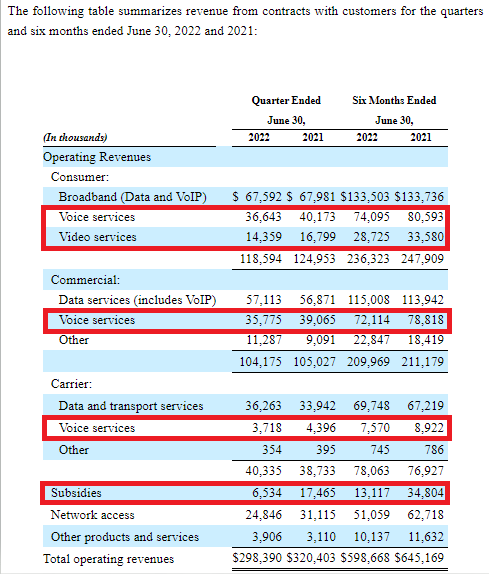

CNSL also disclosed that their subsidy funding was materially reduced this year, which negatively impacts revenue and EBITDA by $10.5 million per quarter or $42 million annualized:

“the annual $48 million in CAF II funding we had received transitioned to $6 million under the Rural Digital Opportunity Fund.”

A picture is worth a thousand words, so here’s where the pain points for CNSL are coming from:

CNSL Segments 2Q22 Filing (SEC Filings, Form 10-Q)

The company had some asset diversification with its Verizon partnerships, but sold them for $490 million, or after-tax proceeds of $470 million. These lucrative assets produced solid recurring earnings, but now cash flow will be reduced by $40 million here as well. Their decision was based on the strategy of reinvesting organically to accelerate the buildout of their fiber network. More on that later.

Finally, an analyst on the Q2 2022 conference call questioned CNSL management when top-line erosion will stall. Although CFO Steve Childers gave a rough timeline, the answer was only partially convincing, in my view:

“So I think you will start seeing sequential revenue growth probably — I think revenue and EBITDA growth probably in early 2023. Again, we need to — may continue to work hard on mitigating the voice erosions.”

No doubt. Voice and video erosion have been ongoing for years. I’ve mentioned it before and I’ll say it again, it seems conservative to just view these areas as melting ice cubes. There’s no clear answer as to how they will stabilize, let alone return to growth.

Those are a few headwinds to deal with, and with a sizable debt balance, management has decided to go all in with one potential solution. Fiber.

Some Positives

Fiber is the core business, both from a growth and cash flow perspective. Management is taking a lot of action by monetizing assets and reinvesting in this area. Why is fiber, in general, doing so well? Compared to incumbent cable internet, fiber has very fast upload and download speeds, whereas cable upload speeds can be slower. Directionally, fiber has growth, whereas cable does not. While there’s still debate on the trajectory of market share trends, companies deploying fiber are definitely gaining over time. Management’s strategy also rests on the fact that 80+% of its existing market footprint overlaps with only one cable competitor. Clearly, the company can benefit from this dynamic so long as other competitors don’t expand into its primarily rural, low population density markets. I think this risk is low given the juice wouldn’t be worth the squeeze for another telecom to enter the market given the capex required. However, one newish entrant is Google Fiber, which does have overlap with CNSL in California, Texas, Georgia, and other states.

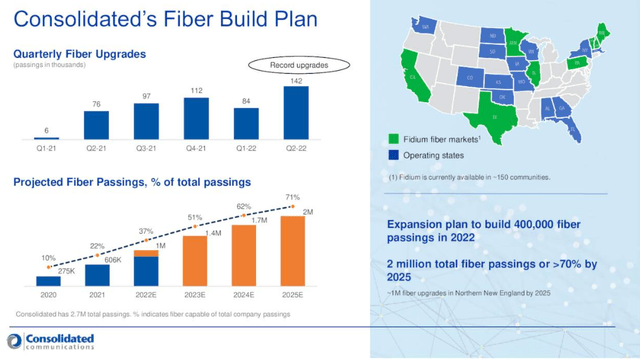

The company featured in its Q2 earnings presentation that it is making good progress with upgrades and is targeting its one million fiber passings milestone by December 2022. It plans to reach two million by 2025.

CNSL Fiber Build Plan (CNSL Q2 Earnings Presentation)

One issue, though, is that housing affordability reached a new low in 2022. That’s discouraging new and existing home sales, which means there will be a slowdown in a key channel of new internet subscribers. Not that CNSL will materially suffer from this trend, but it certainly caps the potential for positive surprises on new residential wins (42% of the broadband mix). The counterargument is that CNSL has been actively marketing its new fiber brand, Fidium. In fact, management claimed that it was taking share from its cable competitor. We can see in the financials that consumer is border lining growth, commercial is slightly growing, and carrier is firmly in growth mode up 6.4% year-over-year and 8.3% sequentially.

Management indicated that their broadband segment should allow them to achieve 3% long-term growth. I think that’s a reasonable expectation, but I’m not sure how that will translate into a positive re-rating on valuation.

Valuation

I think a key development for CNSL will be whether its Fidium brand continues to gain momentum and take market share, despite the challenging industry environment. Presently, CNSL is working with a $2.6 billion total enterprise value after factoring in the cash proceeds from its partnership asset sale. However, management indicated that all of those proceeds would be redirected into the fiber buildout, so the cash isn’t necessarily free and clear. Therefore, I’d pencil in the company’s enterprise value as closer to $3 billion.

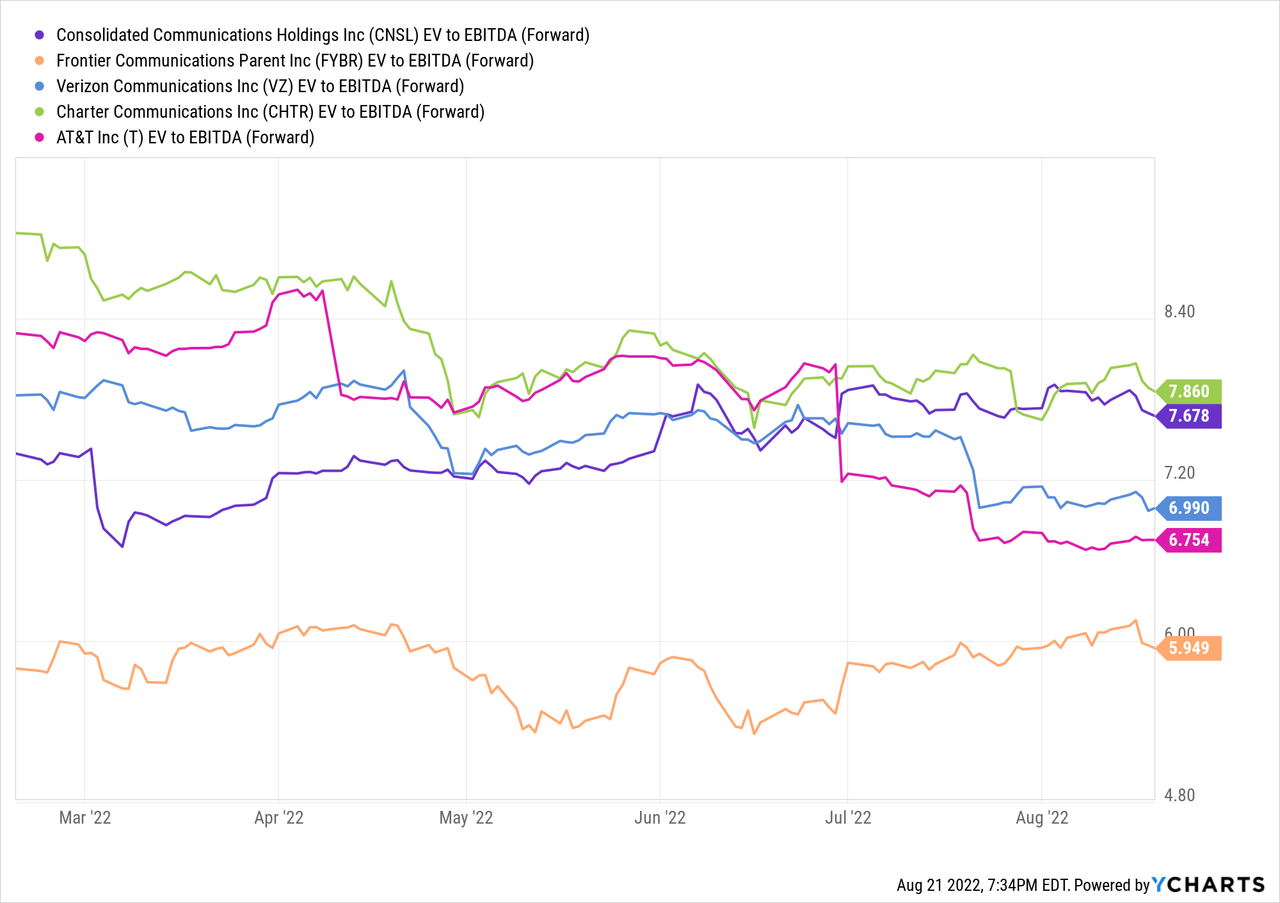

CNSL currently runs a free cash flow deficit because of its capex requirements, and that’s unlikely to ramp down substantially for at least a couple of years. Taking out the guesswork here, let’s stick with the updated 2022 guide of $400-410 million annual adjusted EBITDA. Although it doesn’t move the needle too much, CNSL excludes $10 million in non-cash compensation expenses. For our purposes, we want to add that back in for dilution, which would reduce the EBITDA outlook to $390-400 million.

Therefore, with a $3 billion TEV against a $395 million mid-point EBITDA would provide us with a 7.6x EV/EBITDA ratio. Interestingly, CNSL ranks roughly in line or slightly above its larger-scale industry peers.

Overall, I’m not seeing a visible path for CNSL to re-rate higher. Yes, management is executing where growth matters but I’m not seeing that timeline accelerate in any way other than incremental debt issuance. But there’s no intention to do so. Besides, the company is constrained from a leverage perspective and would not risk a credit downgrade, particularly amid tightening financial conditions.

Bottom Line

CNSL is a small-medium scale operator competing against giants and performance is okay at best. I’ll hand it to management that they understand the competitive landscape well enough and are going all in on fiber, which seems to be the best play. One interesting development to look for is whether broadband growth accelerates and/or video/voice erosion is mitigated, particularly in 2023. If it can achieve one or both of those objectives, that would translate into better EBITDA and investors would quickly take notice. How do you think CNSL will perform? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment