Kevin Dietsch/Getty Images News

I recently wrote an article predicting a sharp oil move higher into 2023. Warren Buffett knows this is coming and is snapping up more stock in the latest pullback. In this article, I urge investors to join him and explain why some analysts are missing the bigger picture.

Warren Buffett has used the latest oil dip to add more OXY

Seeking Alpha reported over the weekend that Warren Buffett had snapped up another 9.9 million in Occidental Petroleum (NYSE:OXY).

The cost of the transaction was $584 million with an average price of $58.98 and Berkshire Hathaway now owns 163.4 million shares, for a total stake of 17.4%.

Buffett began purchasing the stock in 2019 and has been convinced to keep buying. The first reason is that he has been impressed with the company’s CEO, Vicki Hollub, whom he said is “running the company the right way.” Berkshire has always made strong management one of the key tenets of its investment strategy and Buffett has been buoyed by the company’s efforts to focus on the balance sheet and return cash to investors. There are many oil plays available but when the ‘Oracle of Omaha’ has confidence in a management team and company direction, it can help him, and OXY investors, sleep at night.

Talking of the company’s fourth-quarter results in February, Buffett said:

I read every word and said, ‘This is exactly what I would be doing.

The second reason is that Buffett has always shunned technology stocks in favor of more traditional, bricks-and-mortar style firms and his love of stocks like See’s Candy has given him a sharp radar for inflationary trends.

Buffett’s initial purchase was timed well as Hollub had begun selling off international assets in favor of domestic plays. That was a wise move and with turmoil hitting the world’s energy markets, the demand for strong domestic oil plays will continue. Despite the recent pullback in oil prices, the underlying supply and demand problems will persist, and may even get worse.

The medium-term outlook for oil is higher

In my recent oil price article, I said that oil could be heading for $150-200 and that was echoed by Trafigura CEO Jeremy Weir and analysts at Goldman Sachs. Weir had said that prices were primed for a “parabolic” event and there was a similar statement this week from JPMorgan.

The recent G7 meeting has seen leaders discussing a price cap for Russian oil, but analyst Natasha Kaneva says that Russia could cut 5 million barrels of oil production per day without drastic economic effects.

“The most obvious and likely risk with a price cap is that Russia might choose not to participate and instead retaliate by reducing exports,” she wrote.

“It is likely that the government could retaliate by cutting output as a way to inflict pain on the West. The tightness of the global oil market is on Russia’s side.”

“A 3 million-barrel cut to daily supplies would push benchmark London crude prices to $190, while the worst-case scenario of 5 million could mean “stratospheric” $380 crude, the investment bank stated.

The outlook is not much better in the gas market, with European gas prices on the Dutch futures benchmark rising to a four-month high. Norwegian gas field workers are planning strike action and the Yamal-Europe pipeline into Germany saw flows at zero on Tuesday. Gas markets will provide no safe haven from oil as the market tightens further.

There is also no respite coming from OPEC and the country has raised prices in Asia to record highs again this week. That is shooting down the market perception that a potential recessionary environment would drag oil lower.

The energy market problems started in Spring this year and we may see the real problems start as Winter arrives.

Valuation, takeover, debt, hedging, and the outlook for Berkshire and Occidental

With its growing stake in Occidental Petroleum, there is talk of a takeover move from Berkshire. Truist Securities analyst Neal Dingmann has a Buy rating on OXY with a price target of $93, as reported by Seeking Alpha, and he said there was a “good chance” of a takeover once the company becomes investment grade.

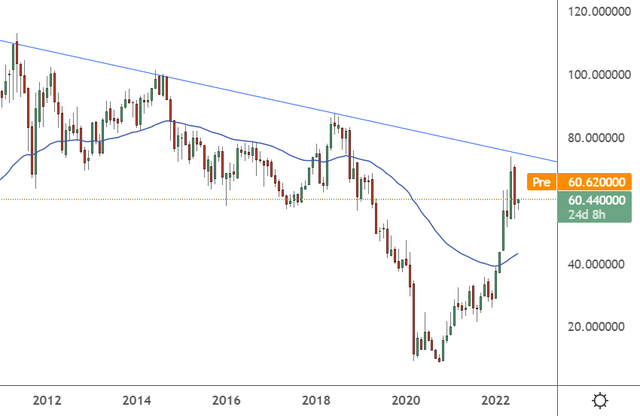

Looking at the technical picture on the stock we can see that a long-term downtrend line from the all-time highs at $113 is now in play. Oxy touched that resistance in the recent oil rally but if the worst-case crude market predictions play out then OXY can easily get above $93.

Going back to the valuation of the company, Dingmann added that the company should be, “quickly on its way to becoming IG as debt could soon go to less than $20B (currently $25B +$10B preferreds),” perhaps even this year, “given the material continued FCF/debt repayment among other positive drivers.”

For Buffett and Berkshire, managing the debt to investment grade means the company is on the right path. But his outlook on this company goes beyond the balance sheet to the outlook for energy prices.

Berkshire Hathaway’s stock portfolio revenue consists of BNSF Railway at 8% and manufacturing at 25%. As the price for energy and raw materials rises, the OXY play is also a hedge for the expenses of his rail and manufacturing businesses. Buffett may even launch a takeover of Occidental for that reason and the company’s debt load would be less important, and on a quicker path to repayment, if oil prices explode higher.

During the 1970s price pressures, Buffett told Fortune magazine:

The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. … If you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker — but not your partner.

That advice holds true for today’s market and Occidental is a stock where you can sit down while others dance around.

Conclusion

Many investors and analysts who are studying the Warren Buffett play on Occidental Petroleum are missing the bigger picture. The company has strong fundamentals and has been on a path to strengthening its balance sheet and returning cash to investors. We may just be getting started on that path with the trouble brewing in the oil market. My own analysis predicted $150-200 oil but that is relatively modest compared to Wall Street talk of $250 or $380 with the current sanctions on Russia and potential for retaliation. OXY is testing long-term resistance with oil prices near $110 and if the higher price scenarios play out, then the price of the company’s shares could well top $100. The resulting effects on the company’s finances would mean a quicker path to debt reduction, less financing costs, and more cash returned to shareholders. There is also potential for a takeover pop in the stock and Warren Buffett is likely less concerned about debt in the near term as this stock also provides a hedge against inflation and expenses for his energy-consuming stocks.

Be the first to comment